How to Get a Car Loan With No Credit

To get a car loan with no credit, start by seeking lenders who offer loans for individuals with no or limited credit histories. Consider credit unions or online lenders that specialize in no-credit car loans.

Securing a car loan without an established credit history might seem daunting, but it’s entirely possible with the right approach. Potential car buyers should first focus on lenders willing to accommodate those new to credit, which often include local credit unions and specialized online lenders.

Gathering sufficient documentation to prove your reliability as a borrower, such as employment history and residential stability, can help. A down payment can also be a persuasive factor, as it reduces the lender’s risk. Securing a co-signer with good credit can significantly increase the chances of approval while providing an opportunity to build one’s own credit. It’s essential to compare loan offers to ensure competitive interest rates and favorable terms. Remember, transparent communication with the lender about your financial situation can lead to more tailored solutions for financing your vehicle purchase.

Credit: www.marketwatch.com

Assessing The Challenge

Stepping into the world of auto financing without a credit history can seem like a high hurdle. Let’s explore this journey to understand challenges and solutions. Your credit score is a road map for lenders. Without it, the path is unclear. But it’s not a dead end.

Impact Of Having No Credit History

No credit history means lenders lack information. They cannot see your past borrowing habits. This absence paints an uncertain financial picture. Good credit demonstrates responsibility. It shows that you pay back what you borrow on time. Acquiring a car loan becomes tougher without this evidence.

Risks Lenders Face With New Borrowers

Lenders enjoy security with known risks. Offering loans to new borrowers carries unknown risks. Can these borrowers make consistent payments? What are their financial habits? These questions pose risks to lenders. Strategies to tackle these concerns may include higher interest rates or co-signers.

Lenders look at other areas to offset the lack of credit history:

- Employment stability

- Income level

- Down payment size

- Other assets

Equipped with this knowledge, you’re ready to face the challenge head-on. Build a strong case for yourself as a reliable borrower, despite the lack of credit history.

Building A Financial Foundation

Want to drive your dream car but have no credit history? You still have hope! First, start by building a solid financial foundation. This will show lenders you are responsible with money. Let’s explore the steps to get there.

Opening A Bank Account

Opening a bank account is your first key move. It’s like laying a brick for your financial future. Pick a reliable bank and start a checking or savings account. This step shows lenders that you can manage money smartly.

- Choose a bank with no monthly fees

- Look for good customer service

- Ask about online banking features

Considering A Secured Credit Card

A secured credit card can help build credit. You pay a deposit which acts as your credit limit. Use this card wisely to make small purchases. Then pay it off every month. It helps you show lenders you’re creditworthy.

| Secured Credit Card Features | Benefits |

|---|---|

| Regular reporting to credit bureaus | Builds credit history |

| Low credit limit | Encourages manageable spending |

| Deposit as collateral | Reduces risk for lenders |

Alternative Credit Data

Alternative Credit Data may be your key to securing a car loan without a traditional credit history. Lenders usually check credit scores, but some now consider alternative data. This includes payments you make regularly, like rent and utility bills. Also, non-traditional credit reports can play a part.

Utilizing Rent And Utility Payments

Regular rent and utility payments show how responsible you are with money. Some lenders now use rent and utility payment history to assess your creditworthiness. Here’s how to make these payments count:

- Keep records of your rent payments. Bank statements or receipts work.

- Show your utility payments. Bills in your name prove your reliability.

- Use rent reporting services. These services report payments to credit bureaus.

Exploring Non-traditional Credit Reports

Non-traditional credit reports can highlight your financial reliability in other ways. They consider factors that regular credit reports do not. Below are steps to take advantage of these reports:

- Find lenders that accept alternative data. Do your research to find flexible lenders.

- Check with alternative credit bureaus. They compile reports using non-traditional data.

- Include regular deposits into your savings or investment accounts.

- Gather personal references. Sometimes, a good word goes a long way.

Strategies For Approval

Getting a car loan with no credit can seem tough. But don’t worry; certain strategies can boost your chances of approval. These tactics show lenders you’re capable of handling a loan. Let’s dive into the successful strategies to secure that car loan.

Finding A Co-signer

A co-signer with good credit can be a game-changer. They agree to pay if you cannot, reducing risk for lenders. It’s key to choose someone trustworthy, and who trusts you. Ideally, this person should be a close family member or a friend with a strong credit history.

Offering A Larger Down Payment

Putting down more money up-front demonstrates financial responsibility. It lowers the amount you need to borrow. This reduction in the loan balance can tip the scales in your favor. Saving for a larger down payment prior to applying shows lenders your commitment to the investment.

Highlighting Stable Employment

Lenders love stability. A steady job and a regular income suggest you’re a safe bet. Bring proof of employment and pay stubs when you apply. Showing a history of steady income reassures lenders you have the means to make payments.

Understanding Loan Terms

Getting a car loan without credit sounds hard, doesn’t it? Knowing what the loan terms mean is key. It’s like finding a treasure map. The ‘X’ marks the spot of your new car dream! Let’s read the map together.

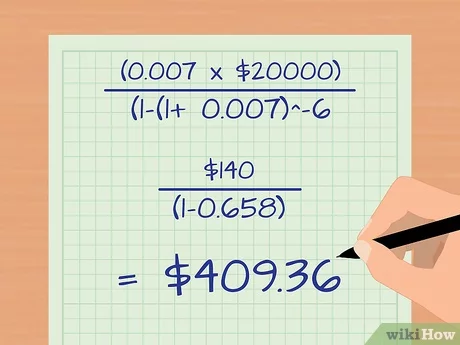

Interest Rates And Their Implications

Interest rates are the extra money you pay on top of the loan. They are like the price tag for borrowing money. A low rate can save cash, while a high rate can cost more.

- Fixed rate – This rate does not change. It’s like a solid promise.

- Variable rate – This rate can go up or down. It’s like a seesaw.

It’s smart to aim for a low, fixed rate. This means your wallet won’t get any surprises.

Deciphering The Fine Print

The fine print holds secrets. It’s like the rules of a game. You must know them to play right!

Some key things to look for:

- Loan term – How long you pay. Shorter means more each time, but less interest in total.

- Penalties – Some loans say ‘no’ to paying off early. Check this before you agree.

- Fees – Things like application and service fees. They add to the total cost.

Understanding these terms can save trouble and money. It’s worth a careful look!

Protecting Your Financial Future

Entering the world of auto financing without a credit history can feel like sailing in uncharted waters.

Protecting your financial future starts the moment you decide to get a car loan with no credit.

It’s about making wise choices today to ensure a stable tomorrow.

Let’s dive into key strategies to safeguard your financial well-being.

Ensuring On-time Payments

Timely repayment is crucial in maintaining a loan.

It reflects financial reliability.

- Set up automatic payments – Automate the process to never miss a due date.

- Use calendar reminders – They’ll prompt you before payments are due.

- Keep a budget – Allot funds for your loan in your monthly budget.

Monitoring And Building Credit

No credit does not mean you cannot start building it now.

Keep tabs on your financial growth and establish good credit.

- Get a credit report – Check your status periodically.

- Consider a secured credit card – It can serve as a credit-building tool.

- Pursue credit-education resources – Understand how to grow your score effectively.

Credit: www.yourmechanic.com

Frequently Asked Questions For How To Get A Car Loan With No Credit

Can You Get A Car Loan With No Credit History?

Yes, it’s possible to get a car loan with no credit history. Lenders may require alternative documentation, such as employment history and income, to assess your loan eligibility. Becoming a co-signer or offering a larger down payment can also help secure a loan.

What Options Exist For No-credit Car Loans?

Options for no-credit car loans include credit unions, banks, and online lenders. Some dealerships offer “buy-here, pay-here” programs specifically for individuals without credit. Additionally, seek out lenders who use alternative credit data for approval decisions.

How Does A Co-signer Help In Securing A Car Loan?

A co-signer with good credit can help you secure a car loan by promising to repay the loan if you default. Their credit history provides assurance to lenders, often resulting in better loan terms such as a lower interest rate or a higher loan amount.

Are There Higher Interest Rates For No-credit Car Loans?

Typically, no-credit car loans come with higher interest rates compared to loans for those with established credit. Lenders view no-credit applicants as higher risk, which is offset by charging more in interest to protect their investment.

Conclusion

Securing a car loan without credit isn’t out of reach. With the right strategy and guidance, you can navigate this challenge successfully. Remember to explore various lenders, consider a reasonable budget, and seek a co-signer if needed. Stay mindful of potential risks and stay informed.

Your journey to car ownership starts now—good luck!