Will Car Insurance Cover Repairs If You are at Fault

Car insurance may cover repairs if you are at fault depending on your coverage. Opting for collision coverage is key for at-fault protection.

Understanding your car insurance policy is crucial to knowing how you’re protected in the event of an accident, especially when you’re the one accountable. Car insurance typically includes several types of coverage, with liability insurance being mandatory in most states.

Liability insurance, however, does not cover your own vehicle’s repairs if you are at fault; it’s designed to protect other drivers from the costs you cause them. This is where collision coverage steps in, as it can help pay for repairs to your vehicle regardless of fault. Choosing the right car insurance plan involves balancing the level of protection you desire with the premium you’re willing to pay. Ensuring you have comprehensive coverage can save you from the financial strains that accidents can impose. Always review your insurance policy details and consult with your insurer to clarify any confusion before finding yourself in need of at-fault repair coverage.

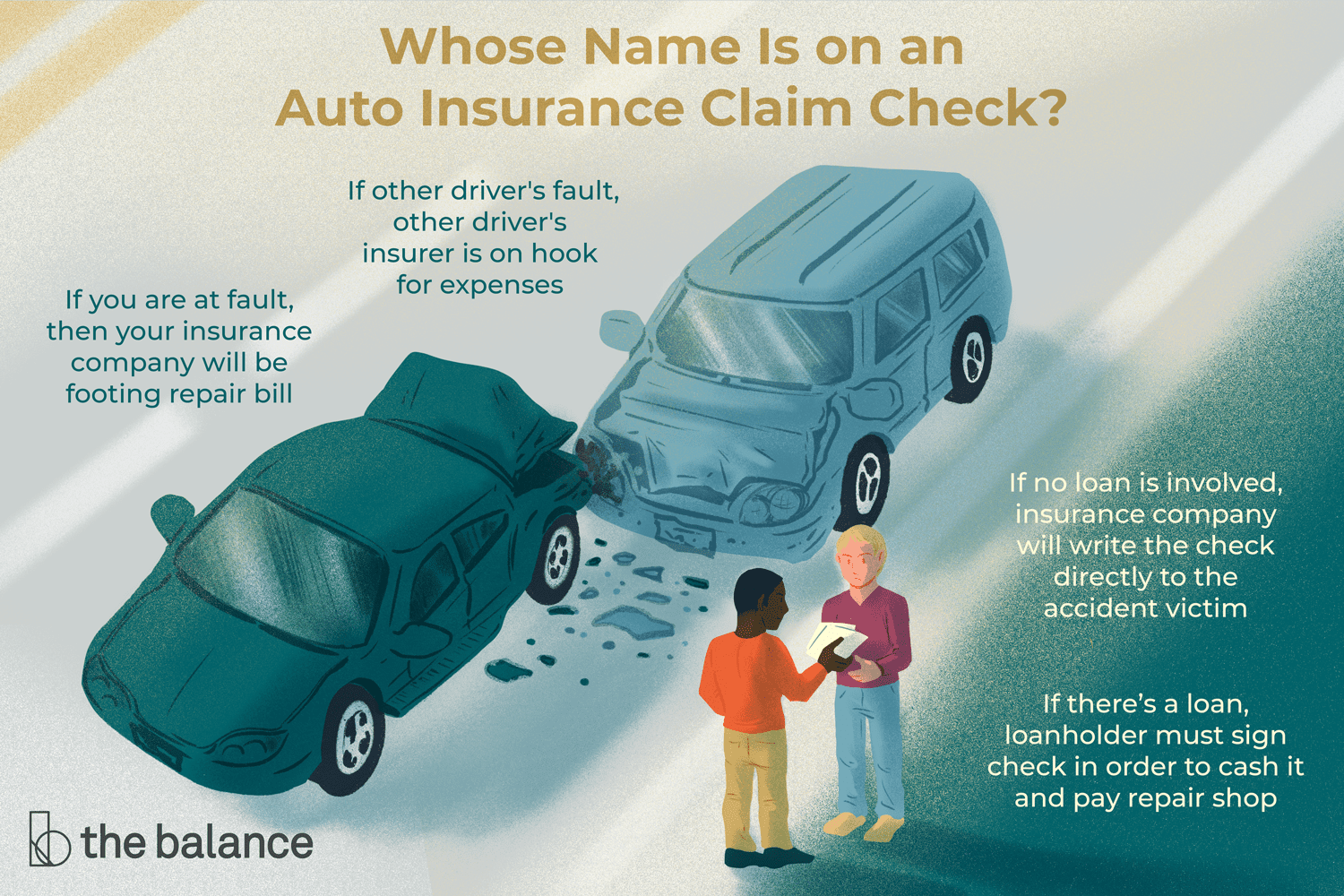

:max_bytes(150000):strip_icc()/Who-will-my-auto-insurance-check-claim-be-made-out-to-527131-v2-f4edb97fee6f488d969226528a1b55d0.png)

Credit: www.thebalancemoney.com

Fault In Car Accidents

Finding out who caused the accident. This step is crucial. It affects your insurance. Sometimes, it’s clear who’s at fault. Other times, it’s complicated. Know this: fault matters.

Determining Fault

Who made the mistake? The answer isn’t always simple. Here’s what happens:

- Police reports help. They often suggest who’s at fault.

- Insurance companies look at everything. They check the accident details.

- State laws differ. Some places have ‘no-fault’ rules. Others don’t.

Facts and evidence matter most. Photos and witness stories can change the game.

Impact On Insurance Claims

Will your insurance pay if you caused the accident? Let’s break it down:

| Type of Coverage | Will It Cover? |

|---|---|

| Liability Insurance | Not for your car. But it covers others’ damages. |

| Collision Coverage | Yes, it covers repairs for your car. |

Important to note: At-fault claims might increase your premiums.

Credit: www.tdi.texas.gov

Types Of Car Insurance Coverage

Navigating through car insurance policies can be as twisty as a mountain road. Understanding the coverage types is crucial, especially if an accident occurs and you’re at fault. It’s vital to know what your insurance shields you from, and what it doesn’t. Let’s buckle up and explore the different types of car insurance coverage available.

Liability Insurance

Liability Insurance is the basic cover that most states mandate. It comes to the rescue if you cause an accident. This insurance helps pay for the other person’s vehicle repairs and medical bills. But, remember, it doesn’t protect your own car or your injuries.

Collision Coverage

Collision Coverage has your back when your car kisses a pole or hugs another vehicle too closely. This coverage helps to fix or replace your car, even if the accident was your fault. It’s that friend who sticks around regardless of whose mistake it was.

Comprehensive Coverage

Comprehensive Coverage is an all-rounder, protecting your car from non-collision events. This includes theft, fire, hail, vandalism, or a stray baseball. It’s the peace of mind needed for the unexpected incidents that life throws at your vehicle.

Understanding At-fault Claims

If you’re responsible for an accident, you might wonder about insurance coverage for repairs. At-fault claims can be complicated. Let’s explore how insurance helps.

Role Of Collision Coverage

Collision coverage steps in for repairs after an accident. Even if you’re at fault, this part of your policy offers financial help. Check your policy to confirm coverage. Here’s what collision coverage typically handles:

- Vehicle repairs: Fixes your car after an impact.

- Replacement: Covers a car’s value if it’s totaled.

- Tow costs: Pays for towing after a crash.

Policy Limits And Deductibles

Policy limits cap what insurers pay. Your deductible is what you cover out of pocket. If repair costs exceed limits, the rest is on you. Deductibles influence premiums:

| Higher Deductible | Lower Premium |

|---|---|

| Pay more upfront | Save on regular costs |

Choose a balance that suits your financial situation.

Premium Increases Post-claim

Filing a claim might raise your rates. Insurance companies revise premiums based on claim history. A single at-fault claim can lead to:

- Higher premiums: Expect increased rates at renewal.

- Risk assessment: Insurers may view you as higher risk.

Consider all factors before filing a claim for minor damages.

Filing An At-fault Claim

Discovering your level of coverage after an automobile accident can feel overwhelming, especially if you’re found at fault. Understanding how your car insurance policy works is essential.

Steps To Take After An Accident

Immediate action is crucial to ensure safety and document the event properly:

- Check for injuries.

- Move to a safe area if possible.

- Exchange information with the other driver.

- Document the scene with photos.

- Contact your insurance company.

Navigating The Claims Process

Initiating a claim requires a clear understanding of your policy’s terms:

- Report the accident to your insurer quickly.

- Provide all necessary documentation.

- Follow your insurer’s procedure carefully.

Dealing With Insurance Adjusters

An insurance adjuster assesses the damage and determines the payout:

- Be honest but cautious in your communication.

- Understand that adjusters seek to minimize payouts.

- Review their findings against your policy’s coverage.

Repair coverage depends on policy specifics and the extent of your fault. Always review your insurance terms to prevent surprises.

Protecting Yourself Financially

Protecting Yourself Financially means being savvy about the choices you make with car insurance. It’s not just about finding a policy. It’s about making sure you’re covered, even if you’re at fault in an accident. When it comes to car repairs and liabilities, the right insurance coverage can make all the difference. Let’s explore how to ensure your financial safety net is as strong as it can be.

Choosing The Right Coverage

Selecting car insurance is more than ticking boxes. You must understand what each policy offers and its implications on your finances. Look beyond basic liability. Consider collision and comprehensive coverage. These options cover repair costs for your vehicle, even when the accident is your fault. Below are key points to consider when choosing coverage:

- Collision Insurance: Pays for your vehicle’s repairs.

- Comprehensive Insurance: Covers non-collision incidents like theft or weather damage.

- Liability Insurance: Essential but only covers the other party’s costs.

Benefits Of An Umbrella Policy

An umbrella policy is extra protection. It kicks in when regular coverage reaches its limit. Think of it like a safety net that catches you when your standard policy can’t hold up anymore. It can cover a range of issues, extending well beyond car accidents. Benefits include:

- Additional liability coverage over the basic policy.

- Protection for events like lawsuits that exceed normal insurance limits.

- Peace of mind knowing you have an extra layer of financial security.

The Merit Of Defensive Driving Courses

Defensive driving courses are not just about being a safer driver. They’re a strategic move in protecting your wallet. Many insurance companies offer discounts to drivers who complete these courses. The courses teach accident avoidance techniques. They also show you how to handle emergencies. The benefits are twofold:

| Defensive Driving Benefits | Insurance Perks |

|---|---|

| Reduced risk of accidents | Possible premium discounts |

| Better driving habits | Lower chance of claims |

Credit: american-reia.com

Legal Consequences Of At-fault Accidents

An at-fault accident can have serious legal implications. Understanding these can help drivers manage the aftermath with more confidence. A key question often arises: Will insurance cover repairs if you’re at fault? The answer ties closely to state laws and the specifics of your insurance policy.

State Laws And Insurance

Each state has different rules about at-fault accidents. These laws dictate how insurers handle claims. Some states follow a no-fault system. This means your insurance may pay for your car repairs regardless of who caused the collision. In other states with at-fault or tort systems, the driver who caused the crash is responsible for the damages.

Minimum coverage requirements also vary. It is crucial to know your state’s mandates. Your policy’s collision coverage can be vital. If you have it, your insurer should cover repairs to your car after you pay the deductible.

When to Consult an AttorneyWhen To Consult An Attorney

Seeking legal advice is a smart move post-accident. An attorney can guide you through:

- The claims process

- Potential legal actions against you

- Your rights in an at-fault situation

They ensure you understand every step, including any legal responsibilities. Lawyers protect your interests, especially if there are injuries or disputes about fault.

Frequently Asked Questions On Will Car Insurance Cover Repairs If You Are At Fault

Does At-fault Accident Affect Insurance Coverage?

At-fault accidents typically affect insurance coverage, leading to higher premiums. However, most standard policies include coverage for your repairs minus your deductible.

What Repairs Will My Car Insurance Cover?

Your car insurance will cover repairs related to the accident, such as bodywork and mechanical repairs, after accounting for your policy’s deductible.

Will Insurance Rates Increase After An At-fault Accident?

Yes, insurance rates generally increase after an at-fault accident due to the higher risk associated with the driver.

Can I Choose The Repair Shop After An Accident?

Yes, you can usually choose the repair shop, but it’s recommended to choose one approved by your insurance for seamless claim processing.

Conclusion

Navigating the nuances of car insurance can be daunting. Yet, understanding your policy’s coverage for at-fault repairs is critical. Most standard policies will assist, subject to your deductible. Always verify specifics with your insurer and consider extra protection to ensure peace of mind on the road.

Drive responsibly and stay informed.