What Should I Pay for a Used Car

The price you should pay for a used car varies based on the vehicle’s make, model, age, mileage, and condition. Researching comparable sales and considering the car’s history are essential steps in determining a fair price.

Embarking on the journey of purchasing a used car can be both exciting and daunting. A smart buyer knows that a car’s value is influenced by several factors, including its overall wear and tear, service record, and the current market demand for that particular make and model.

Prospective buyers should use resources like Kelley Blue Book or Edmunds to gauge the average price for similar vehicles in their area. This due diligence combined with a thorough inspection of the vehicle by a qualified mechanic ensures that you make an informed decision. Remember, negotiating plays a pivotal role in the used car buying process, so arm yourself with knowledge to secure the best deal possible.

Assessing A Fair Price For A Used Car

Entering the used car market might feel like navigating uncharted waters. Determining the right amount to pay for a pre-owned vehicle can be tricky. With a variety of factors at play, one must conduct thorough research to ensure a fair deal. Let’s dive into what constitutes a fair price for a used car and how to pinpoint the exact value of the vehicle you’re eyeing.

- Make and Model: Certain brands and models hold their value longer due to their reputation for durability.

- Vehicle Age: The year of manufacture affects a car’s value; newer models generally cost more.

- Mileage: A car with lower miles often commands a higher price.

- Condition: Expect to pay more for a car in excellent condition. This includes both mechanical and cosmetic aspects.

- Vehicle History: Cars with a clean history report without accidents or major repairs are more valuable.

- Location: Prices can vary based on local market demand and the vehicle’s suitability for the area.

- Options and Features: High-end features like leather seats or advanced technology can increase a car’s worth.

Several reliable resources can help you gauge the market price for a used car. Refer to the following to make an informed decision:

- Kelley Blue Book (KBB): A trusted resource that provides estimated values based on a car’s condition, mileage, and other factors.

- National Automobile Dealers Association (NADA) Guides: NADA offers a look into how dealerships price used cars, taking into account a wide range of market data.

- Edmunds: Thorough pricing tools that include dealer retail and private party sale estimates.

- CARFAX: Beyond vehicle history, CARFAX offers a valuation tool to check how that history impacts price.

- Consumer Reports: Find reviews and reliability ratings which may influence a car’s value.

Armed with knowledge from these sources, you’re ready to strike a fair deal. Remember, due diligence is the key to making a wise investment in a used car. Equip yourself with information, and the negotiation table will feel less daunting.

Credit: www.yourmechanic.com

Pre-purchase Inspections

Pre-purchase inspections are crucial when buying a used car. They ensure value for your money. Discover issues before they become your problems. It’s the step between a good buy and a costly mistake. Let’s dive into what makes these inspections so vital.

Determining The Vehicle’s Condition

Evaluated thoroughly, a car’s condition speaks volumes. A superficial glance won’t reveal hidden issues. By delving deeper, we unearth the true state of the vehicle. Here’s how to assess the used car’s condition effectively:

- Examine the exterior for dents, scratches, and rust.

- Check the interior for wear and tear, functionality.

- Review maintenance records to track the car’s history.

- Look under the hood – engine condition is key.

- Test all electronics – lights, indicators, infotainment.

- Inspect tires for tread life and alignment.

Taking notes during this phase helps in decision-making.

The Role Of Professional Inspections

A professional inspection elevates buyer confidence. Experts reveal what’s beneath the surface. Here’s why they are indispensable:

- Detailed reports provide an inside view of the car’s health.

- Trained eyes identify potential problems easily.

- Specialized equipment gets diagnostics right.

- Verification of documents confirms legal status.

- Negotiation leverage arises from factual findings.

Choose a certified mechanic for reliable results. They have the tools and experience. Expect to pay between $100 and $200 for an inspection. This price is small compared to potential savings from discovered issues.

Understanding Market Trends

When it comes to buying a used car, smart shoppers know that the timing of their purchase can be just as important as the negotiation at the dealership. Understanding market trends is crucial for finding the best deal. Prices for used vehicles can shift based on a variety of factors. From seasonal influences to the broader economic climate, each aspect plays a significant role in determining how much you should pay for a used car.

Seasonal Fluctuations In Used Car Prices

Prices for used cars can wax and wane like the phases of the moon.

In spring and summer, convertibles and sports cars often see higher demand. Families also look for SUVs and minivans for road trips. This desire can drive up prices.

On the other hand, fall and winter months often bring lower prices. Cold weather makes shoppers stay home. Dealers are keen to clear old stock, especially during year-end sales.

- End of the year: Dealers drop prices to meet quotas.

- Early in the year: Tax refund season pushes car sales up.

How Economic Conditions Affect Car Values

Economic shifts can cause ripples across the used car market. A strong economy with high consumer confidence prompts people to buy more, often opting for new cars and trading in their older models.

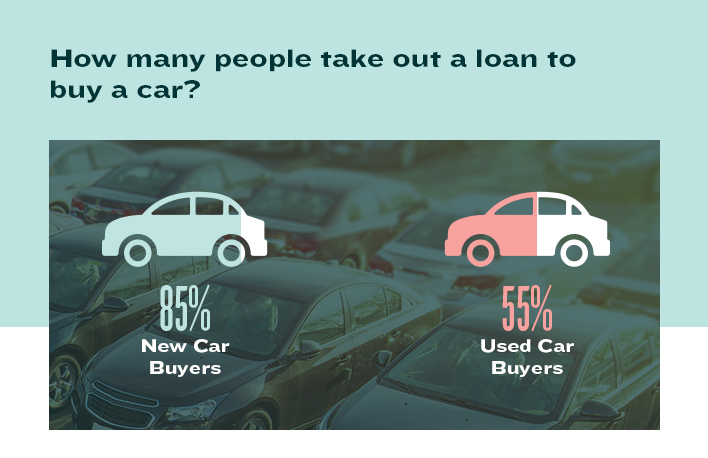

Conversely, in a weak economy, consumers gravitate toward used cars, inflating their prices. Interest rates are also a player. High rates may lead to costly car loans, swaying buyers towards cheaper used options.

| Economic Indicator | Effect on Used Car Values |

|---|---|

| Consumer Confidence | Higher confidence, higher demand for new cars, used car prices may dip |

| Interest Rates | Higher rates, pricier loans, used cars become attractive |

| Gas Prices | High gas prices, less demand for gas-guzzlers, prices for these used cars decrease |

Remember that these trends are mere guides. A personal budget and need should always steer your decision on a used car purchase.

Negotiation Strategies

Entering the used car market feels like preparing for a chess match. A sharp strategy can turn the tides in your favor. Effective negotiation can shave hundreds, if not thousands, off a car’s price. Let’s maneuver through some tactics and counter-tactics to ensure you drive away with a deal that leaves you and your wallet happy.

Starting the Bargain

Starting The Bargain

Know the numbers before you step onto the battlefield. Research fair market values for the car you’re eyeing. Don’t make the first offer; instead, let the dealer set the stage. Your opening bid should be lower than your maximum limit but reasonable enough not to dismiss you as unserious. Aim to meet in the middle somewhere between their asking price and your first offer. A polite, firm approach sets a positive tone.

Common Dealer Tactics and Counter-Tactics

Common Dealer Tactics And Counter-tactics

- Emotional Attachment: Dealers might imply the car suits you perfectly. Counter this by remaining objective. Your need is a good deal, not this particular car.

- Time Pressure: Claims like “it won’t last long” rush you. Take your time, and if it sells, another will come along.

- Last-Minute Fees: Dealers may tack on extra fees late in the game. Insist on a breakdown and validity of additional costs before you agree.

Be prepared to walk away if the numbers don’t add up or the deal feels off. Other cars and deals exist. A prepared buyer is a powerful one.

Finalizing The Deal

Welcome to the critical moment where your used car purchase becomes reality—the deal finalization. Navigate the last stretch with confidence.

Paperwork And Payment Process

Handle the necessary documents smartly. Ensure a smooth payment journey:

- Bill of Sale: This legal document outlines the sale’s specifics. Verify all details.

- Loan Documentation: If applicable, present the approval forms and planned payment schedule.

- Proof of Insurance: Provide evidence of your active policy before you drive away.

Payment: Choose secure methods. Favor bank transfers or certified checks over cash for records.

After Purchase: Taxes, Title, And Registration

Post-purchase steps are as vital as the initial handshake. Here’s what to tackle:

- Sales Tax: Prepare for this one-time payment. The rate varies by state.

- Title Transfer: This confirms you as the new owner. Visit your local DMV.

- Registration: Obtain license plates and a registration card. Comply with time frames.

Expect fees. Some states require smog checks or other inspections. Check your local DMV site.

Credit: www.autoremarketing.com

Frequently Asked Questions Of What Should I Pay For A Used Car

How Much Should You Spend On A Good Used Car?

Typically, a good used car can cost between $5,000 and $20,000, with your budget reflecting your needs and the vehicle’s age, brand, mileage, and condition. Always factor in extra costs for maintenance and insurance.

What Is A Fair Markup On A Used Car?

A fair markup on a used car typically ranges between 20-30%. This markup covers the dealer’s expenses and ensures a profit margin.

What Is A Good Amount To Save For A Used Car?

Aim to save 10-20% of your annual income for a reliable used car. Factor in additional costs like taxes, registration, and initial maintenance.

How Should You Pay For A Car?

Consider paying for a car through a well-planned budget, opting for either a loan, lease, or cash purchase. Assess interest rates, negotiate the final price, and ensure the payment method aligns with your financial stability. Prioritize a down payment to reduce future costs.

Conclusion

Navigating the used car market can be daunting, but with the right strategy, you’re set to make a smart purchase. Determine a fair price by considering a vehicle’s condition, mileage, and market value. Remember, thorough research and negotiation skills are your allies.

Drive home not just a car, but great value.