Is It Better to Have a Car Totaled Or Repaired

Whether it’s better to have a car totaled or repaired depends on the cost-effectiveness and safety implications. A car should be repaired if expenses are manageable and safety is not compromised.

Deciding between having a car repaired or considering it a total loss is a common dilemma after a vehicle has suffered significant damage. This choice hinges on various factors, including the extent of the damage, the car’s current value, and the projected repair costs.

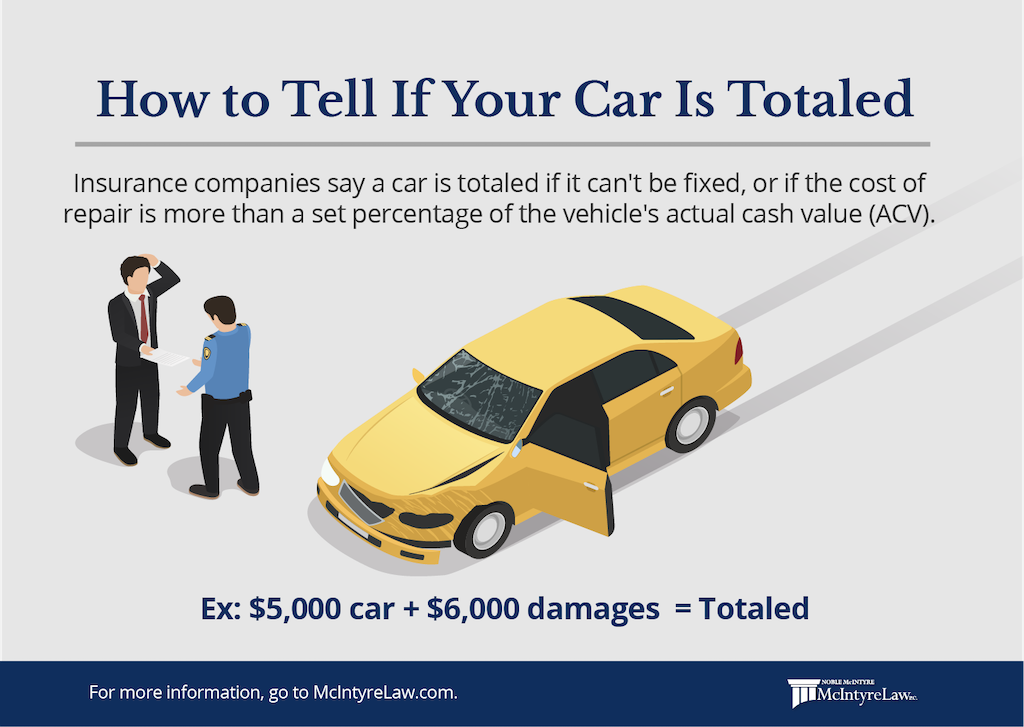

Insurance companies play a crucial role in this decision-making process, as they assess the damage and compare the cost of repairs to the vehicle’s actual cash value (ACV). If repair costs approach or exceed the ACV, the car is often declared a total loss. On the other hand, a car worth repairing should ideally have minor to moderate damage that can be fixed without jeopardizing the vehicle’s integrity or the driver’s safety. Navigating this decision requires careful evaluation of both immediate expenses and long-term financial implications, such as future insurance premiums and vehicle depreciation.

Credit: automotivecollisionspecialists.com

Assessing Damage: Total Loss Vs. Repairable

Picture this: your car just had a rough encounter with fate. You’re standing there, figuring out the next steps. Two paths emerge—repairing your beloved ride or declaring it a total loss. This section sails you through the stormy decision by zeroing in on factors and the insurance company’s pivotal role.

Factors Determining Car’s Status

Multiple elements swing the pendulum between repairing your car or bidding it farewell. The process is not just about damage severity but intertwines with other critical factors.

- Cost of Repairs: Does fixing the car cost more than its current value? If yes, insurers lean towards total loss.

- Vehicular Age: An older car’s value drops fast, pushing it closer to the total loss category.

- Resale Value: What’s the potential sale price post-repair? A plummeting resale value tilts the scale.

- Safety: Can the car be safe again? If not, it’s time to let go.

Insurance Company’s Role

Your insurance company plays detective, crunching numbers and piecing together your car’s future. They employ a total loss threshold, which compares repair costs against your car’s value. They also consider state laws, as these thresholds can vary.

| Insurance Action | Description |

|---|---|

| Evaluation | Examining damage, estimating repair costs. |

| Comparison | Contrasting repair costs with car’s worth. |

| Decision | Declaring total loss or approving repairs. |

If your car’s marked a total loss, you’ll get a cash payout. What’s next? You could invest in a new ride. If your car’s deemed repairable, the insurer will foot the bill up to your coverage limit. Remember, it’s your call to accept or dispute their decision.

Credit: elmersautobody.com

Financial Implications Of Totaling A Car

When a car accident occurs, owners face a big decision. Fix the car or declare it a total loss? Each option has financial impacts. Understanding these will help in making an informed choice. The insurance company plays a big role. The car’s value and loan status matter too. Let’s explore the money side of a totaled car situation.

Insurance PayoutsInsurance Payouts

Insurance payouts depend on the car’s actual cash value (ACV). Upon totaling a vehicle, insurers pay out this amount. This figure comes from the car’s value before the crash minus the deductible. A key point to note is insurance might not cover aftermarket parts. Work with the adjuster to understand the ACV. Keep in mind premium changes post-claim.

Potential for Underwater LoansPotential For Underwater Loans

An underwater loan occurs when you owe more on the car than its ACV. In such cases, even if an insurance company pays the ACV, you’re still in debt. This scenario is where gap insurance can save the day. It covers the difference between the ACV and the remaining loan balance. Consider this coverage when buying a new vehicle.

| Term | Definition |

|---|---|

| ACV | Actual Cash Value of your car pre-accident |

| Underwater Loan | Owing more than the car’s worth |

| Gap Insurance | Covers the gap between ACV and loan balance |

- Check insurance coverage details.

- Calculate your car’s ACV.

- Understand the insurance payout process.

- Assess the need for gap insurance.

- Review your car loan agreement.

- Compare ACV and loan balance.

- Decide if totaling the car makes financial sense.

Considering Repair Costs

When your car meets with an accident, deciding between repair or declaring it a total loss is tricky. Repair costs mount quickly.

Insurance companies compare these costs with your car’s value.

Is fixing the car worth it? Let’s break down key points to consider.

Assessing Repairability

Not all damage is the same. Some fixes are straightforward, like a dented bumper or fender.

Others, affect your car’s integrity, like a bent frame.

- Ask a trusted mechanic. They can inspect your car thoroughly.

- Evaluate the repair costs against the car’s current value.

- Beware of repairs costing more than half the car’s worth.

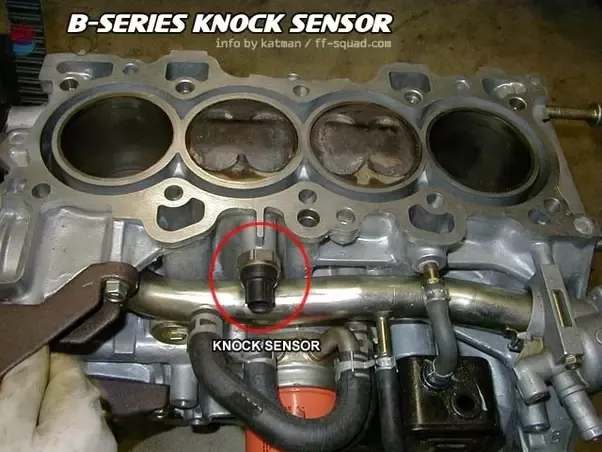

Hidden Damages And Future Issues

Accidents can leave unseen problems.

These hidden damages emerge later, causing new expenses and safety concerns.

Examples include:

| Hidden Damage | Potential Future Issue |

|---|---|

| Electrical system harm | Malfunctions while driving |

| Internal engine damage | Unexpected breakdowns |

| Airbag sensors issues | Failure to deploy in next accident |

Consider long-term reliability. Even after repairs, your vehicle might never be the same.

Credit: mcintyrelaw.com

Impact On Car Value And Insurance

Imagine a vehicle facing an accident. The thought of repair versus total loss can cloud a car owner’s judgment. Understandably, an owner needs to consider not just the car’s usability but its financial viability. The decision affects the car’s future value and insurance costs. Take a closer look at how repairs and total loss scenarios play out in these two areas.

Depreciation After Repairs

A repaired vehicle often suffers depreciation. This is the loss in value from the original price. A car with a history of major repair might have potential buyers skeptical. They often offer lower prices.

Three main factors influence a car’s depreciation after repair:

- The extent of damage

- Quality of repairs

- Vehicle’s make and model

Complex repairs can lead to more significant depreciation. It’s known as diminished value. This is the reduction in resale value post-repair.

Insurance Premium Changes

Post-accident, insurance companies assess the risk attached to a vehicle. Repaired cars might lead to higher insurance premiums. This is due to the potential risk of future claims.

| Condition | Insurance Impact |

|---|---|

| Totaled Car | Policy pay-out, possible premium increase |

| Repaired Car | Potential for higher future premiums |

Insurance premiums can change upon renewal. If claims were made for repairs, expect adjustments. A totaled car might end the current policy’s terms. A new car means a new policy. This could be more or less costly than the previous one.

Personal Considerations In The Decision

When faced with the decision of totaling a car or repairing it, personal considerations play a key role. Your connection with the car, safety, and reliability are central factors. This complex choice goes beyond just cost. Understand how these elements sway your decision.

Attachment To The Vehicle

Emotional ties can influence your choice significantly. You might own a car passed down through generations or one that marks a significant milestone. For many, a car is not just a tool, but a keeper of memories. Weighing the pros and cons of repairing a cherished vehicle is essential. List out sentiments versus practical aspects. A table might help:

| Emotional Value | Practical Considerations |

|---|---|

| Family heritage | Future maintenance costs |

| First car memories | Reliability of old parts |

Safety And Reliability Concerns

Your well-being is paramount. Even if repairs are possible, a damaged car might no longer be safe. A trustworthy mechanic should assess the damage. Get their professional opinion on the car’s future safety. Consider these points:

- Structural damage: Could impact safety greatly.

- Future reliability: Repairs might not restore the car to its original condition.

- Technological upgrades: Newer models come with advanced safety features.

Bold security features should take precedence. Your loved ones’ safety is irreplaceable. Weigh the car’s sentimental value against the risk factors. An informed decision protects both your heart and safety on the road.

Navigating The Salvage Process

Navigating the salvage process can feel overwhelming. Understanding your options is key. Whether to have your car repaired or declared totaled is a big decision. Here’s how to manage the next steps effectively.

Salvaging Parts

Salvaging parts from a damaged vehicle can offset some costs. Before you agree to have your car scrapped, consider:

- The value of useable parts.

- Market demand for specific components.

- Costs associated with dismantling the car.

Working with an experienced mechanic or salvage expert can maximize returns.

Buying Back A Totaled Vehicle

Buying back your totaled car can be an option. If the insurance company declares your car a total loss, you may:

- Purchase it for a reduced price.

- Restore the vehicle for road use or parts.

- Understand your state’s laws on rebuilt titles.

Consider the costs and benefits before deciding. Consult with your insurance agent and a trusted repair shop.

Legal And Regulatory Factors

Legal and regulatory factors significantly influence the decision between having a car totaled or repaired. Understanding these factors is crucial to making an informed choice. They often dictate the financial viability and legal obligations associated with each option.

State Regulations On Totaled Vehicles

Different states have varying thresholds for declaring a vehicle a total loss. It generally depends on the car’s value relative to the repair cost. To comply, check your state’s specific percentage threshold.

- Some states use a Total Loss Formula (TLF).

- Others have a set percentage, often between 75% to 90%.

After a car is totaled, state agencies require a Salvage Title. This means the car cannot be driven, sold, or registered in its current state. Repairing a vehicle with a salvage title requires meeting stringent inspections.

Re-title And Re-insure A Repaired Car

Post-repair, obtaining a Rebuilt Title is essential. The process involves:

- State-sanctioned vehicle inspection.

- Documenting all repairs.

- Filing paperwork with Department of Motor Vehicles (DMV).

Insurance companies may be reluctant to offer full coverage on a rebuilt title car. Expect higher premiums or the need to shop around for coverage.

Frequently Asked Questions For Is It Better To Have A Car Totaled Or Repaired

What Determines A Car Being Totaled Or Repaired?

When damage exceeds a certain percentage of the car’s value (usually between 60% to 70%), it is considered totaled. Insurers evaluate repair costs versus the car’s actual cash value. If repairs are more expensive, the car is labeled as a total loss.

Is Repairing A Totaled Vehicle A Smart Choice?

It’s usually not advisable to repair a totaled vehicle as it may have hidden damages and safety issues. Moreover, the repaired car could have a significantly lower resale value and potentially higher insurance premiums.

What Are The Cost Implications Of Totaling Versus Repairing?

Totaling a car often results in a payout from the insurance company, which you can use towards a new vehicle. Repairing can lead to costly bills, and in some cases, the repaired car might still not regain its full pre-accident value.

How Does A Totaled Car Affect Insurance Premiums?

After a car is totaled, insurance premiums for a new vehicle may increase. The totaled car’s claim history can affect your risk profile, thereby potentially raising the cost of future insurance policies.

Conclusion

Deciding between totaling your car or repairing it can be tough. It’s crucial to weigh the costs and long-term value. Seek professional advice and consider safety above all. Your choice should align with your financial situation and future needs. Let prudence guide your decision for the best outcome.