How to Transfer a Car Loan to Another Person

To transfer a car loan to another person, you must obtain lender approval and ensure the new borrower qualifies. The transferee must then agree to the terms and complete the transfer paperwork.

Transferring a car loan is not just a financial decision but also a contractual process that can bring multiple benefits or challenges. Navigating the transfer requires understanding the lender’s policies, the creditworthiness of the individual taking over the loan, and the legal implications for both parties.

Though it may seem like a straightforward task, it entails a detailed scrutiny of loan conditions, meticulous document exchange, and compliance with state and local regulations. Before initiating a loan transfer, it’s essential to assess all these factors to ensure a smooth transition and avoid potential complications that could affect your financial standing.

Eligibility Criteria For Car Loan Transfer

Wondering about shifting your car loan to someone else? You’re in the right place! Car loan transfers are not as direct as handing over the keys. The process includes checking if the other person fits the loan transfer mold. Let’s dig into the specifics of eligibility for transferring your car loan.

Creditworthiness Of The New Borrower

Does the new borrower have a good credit score? Lenders look at credit history closely. They need assurance that the new borrower can handle the loan. Here’s what they seek:

- A strong credit score, usually above 700

- Stable income to manage the monthly payments

- A low debt-to-income ratio, showing good balance between earnings and spending

If the interested party meets these criteria, they stand a better chance. The lender might approve the loan transfer.

Lender’s Policies And Requirements

Each lender will have different rules for a car loan transfer. Some may not allow it at all. Always check with the lender first. They might have specific requirements such as:

- A written application for the loan transfer

- Documentation such as proof of income, residence, and identity for the new borrower

- Payment of a transfer fee

- Possible reassessment of the vehicle’s value

Contact the lender to learn more about their policy. They will guide you through their transfer process.

Credit: www.chase.com

Steps To Initiate The Loan Transfer

Is a car loan transfer on your agenda? Follow these measured steps to ensure a smooth process. Each action opens the door to the next, guiding you through the twisty road of transferring your car loan to another person.

Contacting Your Lender

Kick off your journey by reaching out to your current lender. Discover if a loan transfer fits their policies. Some lenders may not allow car loan transfers, while others have detailed conditions. Obtain clear instructions and the initial green light before venturing further.

Completing The Application

A key step is the loan transfer application. Fill it with accurate details about both borrower and the new owner. Consistency with the information is crucial—any discrepancy might cause delays.

Gathering And Submitting Required Documents

Compile essential papers such as proof of income and credit reports. Take the time to double-check each document for accuracy. Submit all together, streamlining the verification process. A swift submission clears the path for quicker approval.

- Credit reports

- Proof of income

- Car insurance documents

- Vehicle registration details

Potential Obstacles In The Transfer Process

Understanding the potential obstacles in transferring a car loan is crucial. While the process might seem straightforward, you could face hurdles.

Prepayment Penalties And Fees

One common obstacle is prepayment penalties and fees that lenders impose. These are costs for paying off a loan early. Before transferring, it’s essential to check the loan agreement carefully.

- Some lenders charge a fixed fee.

- Others calculate a percentage of the remaining balance.

- Penalties can add significantly to the cost of a transfer.

Delays And Loan Transfer Denials

Another roadblock can be delays and loan transfer denials. Not all lenders allow for easy transfers. They may require extensive checks on the new loan holder.

| Reason for Delay/Denial | Impact |

|---|---|

| Creditworthiness of the New Borrower | Lenders assess risk and might deny if not met. |

| Documentation Issues | Lack of proper documents can cause setbacks. |

| Lender’s Policy | Some do not permit transfers, leading to denials. |

It’s best to speak directly with the lender. Seek clarity on policies and requirements. Know that each lender has unique protocols for handling transfers. Prepare in advance to ensure a smooth process.

Credit: www.capitalone.com

Legal And Administrative Considerations

Legal and Administrative Considerations are crucial when transferring a car loan. Understanding the process helps avoid penalties or complications. Get ready to navigate through legalities and paperwork. The journey includes updating documents and notifying all parties.

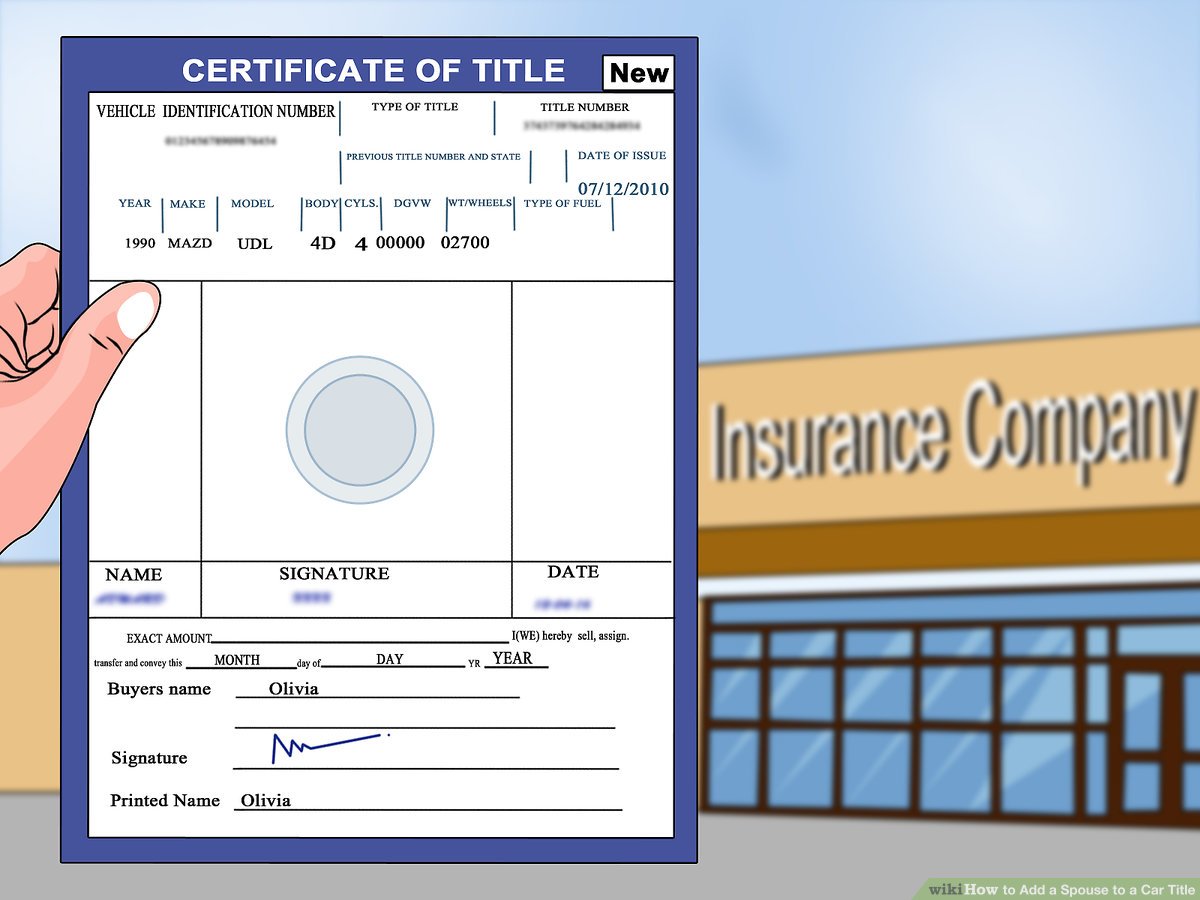

Updating The Title And Registration

To transfer a car loan, update the title and registration first. This step legally transfers ownership. Here’s what to consider:

- Contact your local DMV: Rules vary by location.

- Transfer fees: Be prepared to pay them.

- New owner’s information: Must be accurate on documents.

Remember, the new owner takes on all responsibilities. Double-check details to ensure a smooth transition.

Insurance Policy Adjustments

Adjusting the insurance policy is next. Keep these steps in mind:

- Inform the insurance company: Notify about ownership changes.

- Review coverage: New owners must uphold minimum requirements.

- New policy needed: Often, a fresh policy is best.

Timely updates to your insurance avoid coverage lapses. Check this off your list promptly.

Finalizing The Loan Transfer

You’re almost at the finish line in transferring a car loan to someone else.

Finalizing the loan transfer is a critical step that involves legal documents and financial agreements.

Let’s guide you through the final stages: from signing new contracts to ensuring the transaction wraps up without a hitch.

Signing New Loan Agreements

The most vital step in transferring a car loan is signing new loan agreements.

It marks the official passing of the debt’s baton. Both the original and new borrower should meet with the lender.

Here are the documents you must prepare:

- Car Loan Transfer Documents: Includes the terms and the period of the new loan.

- Consent Forms: Signed by all parties involved, giving legal permission for the loan transfer.

- Registration Papers: Proving the vehicle’s ownership

Ensure all parties read and agree to the new terms.

Once signed, the loan obligations officially move to the new borrower.

Confirming The Completion Of Transfer

After signing the papers, it’s crucial to confirm the completion of the transfer.

Here’s what you should do next:

- Check with the lender that they have everything they need.

- Verify that the old loan account shows a zero balance.

- Ensure the lender updates the credit bureaus with this information.

Keep all paperwork; you will need them for records.

Now you can celebrate, knowing the car loan is officially in someone else’s name!

Alternative Solutions To A Direct Transfer

Transferring a car loan isn’t always straightforward. Here, we explore options if a direct swap isn’t possible.

Private Sale And Loan Payoff

Sell the car privately and use the funds to clear the loan. This simple method is a smart choice. Selling your vehicle can sometimes fetch a higher price than trade-ins. After the sale, the money received can immediately pay off the existing loan. Here’s how you can proceed:

- Assess your car’s market value.

- List the vehicle for sale.

- Find a buyer and agree on a price.

Ensure the loan is paid in full using sale proceeds. Then, transfer the car title to the new owner.

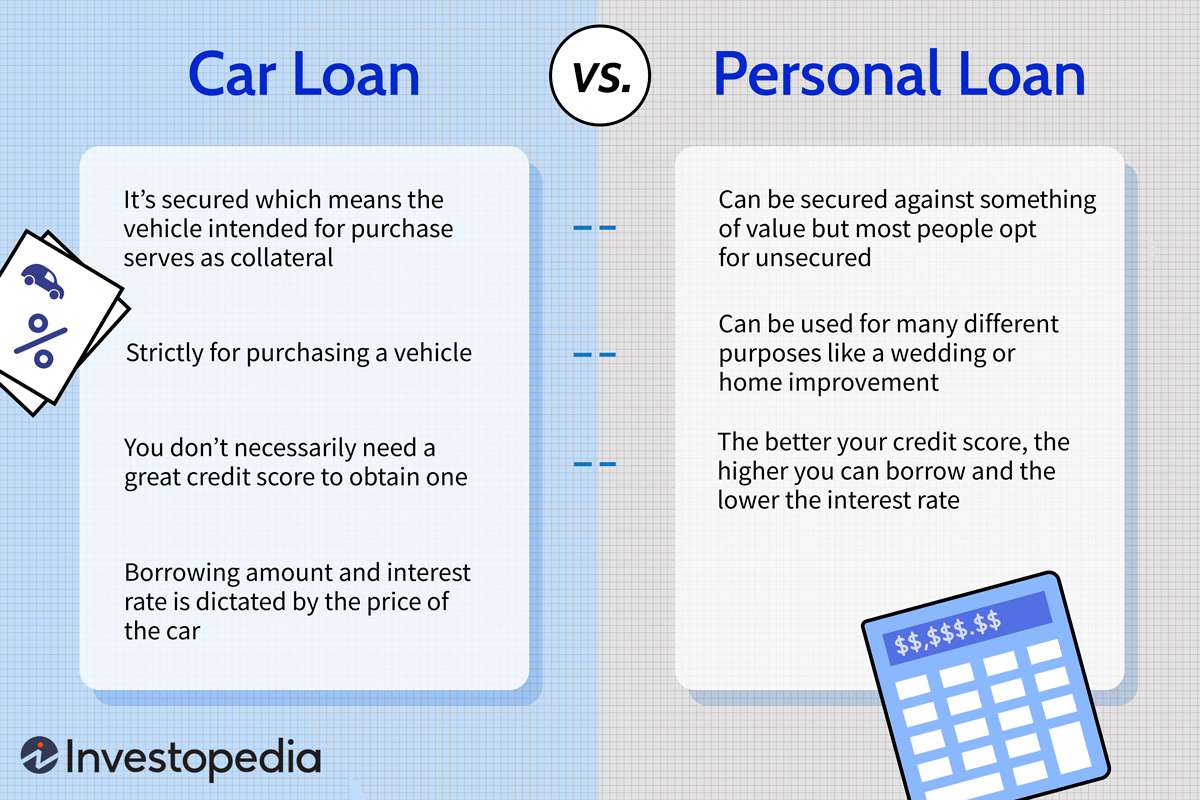

Refinancing Options

Refinancing can be a viable alternative. Refinance the car loan in the new owner’s name. It’s like taking out a fresh loan. The steps include:

- Check credit scores. Yours and the new borrower’s.

- Shop around for the best refinance rates.

- Apply for a refinance loan from a bank or lender.

When approved, the new loan pays off the original. The new borrower becomes responsible for repayment.

Frequently Asked Questions Of How To Transfer A Car Loan To Another Person

Can I Transfer My Auto Loan To Someone Else?

Transferring an auto loan to another person may be possible if your lender approves the transfer and the new borrower meets credit requirements. Check with your loan provider for specific policies.

Is It Easy To Transfer A Loan To Another Person?

Transferring a loan to another person is not typically easy. Lenders often require the new borrower to qualify for the loan under their underwriting criteria, which involves a credit check and other financial assessments. The process can vary significantly between different loan types and lenders.

Can I Refinance My Car To Someone Else?

You cannot directly refinance your car to transfer the loan to another person. Instead, they must apply for a new loan to pay off your existing balance and assume ownership.

Does Selling A Financed Car Hurt Your Credit?

Selling a financed car does not directly hurt your credit, as long as you continue to make loan payments on time and settle any remaining balance after the sale.

Conclusion

Transferring a car loan involves several steps, but it’s achievable with careful planning. Consult lenders, assess creditworthiness, and ensure all parties agree to the terms. Remember to update documents and finalize legally. Seek professional advice for a smooth transition. Success hinges on attention to detail and transparency throughout the process.