How to Refinance a Car Loan

To refinance a car loan, start by checking your credit score and finding competitive interest rates. Then, apply with a lender and negotiate the terms of your new loan agreement.

Understanding the refinancing process for a car loan is crucial for borrowers seeking to lower their monthly payments or reduce the overall interest paid. This financial move can be an effective way to adjust to changes in your financial situation or benefit from shifts in the market rates.

Before diving into the application process, individuals must assess their current financial standing, credit health, and the potential savings from refinancing. Shopping around for the best loan offers, considering various lenders including banks, credit unions, and online financiers, is key to finding a favorable deal. Additionally, it’s important to be mindful of any fees or penalties associated with refinancing, ensuring the long-term benefits outweigh the initial costs. With diligent research and smart decision-making, refinancing a car loan can lead to significant savings and a more manageable financial portfolio.

Assessing Your Current Car Loan

Assessing Your Current Car Loan is the crucial first step to refinancing. It’s like taking a look under the hood before deciding on a tune-up. To get started, take a detailed look at your current loan agreement. Notice the terms, monthly payments, and the total interest to be paid. Information is power. Knowing the ins and outs of your current loan sets the stage for potential savings.

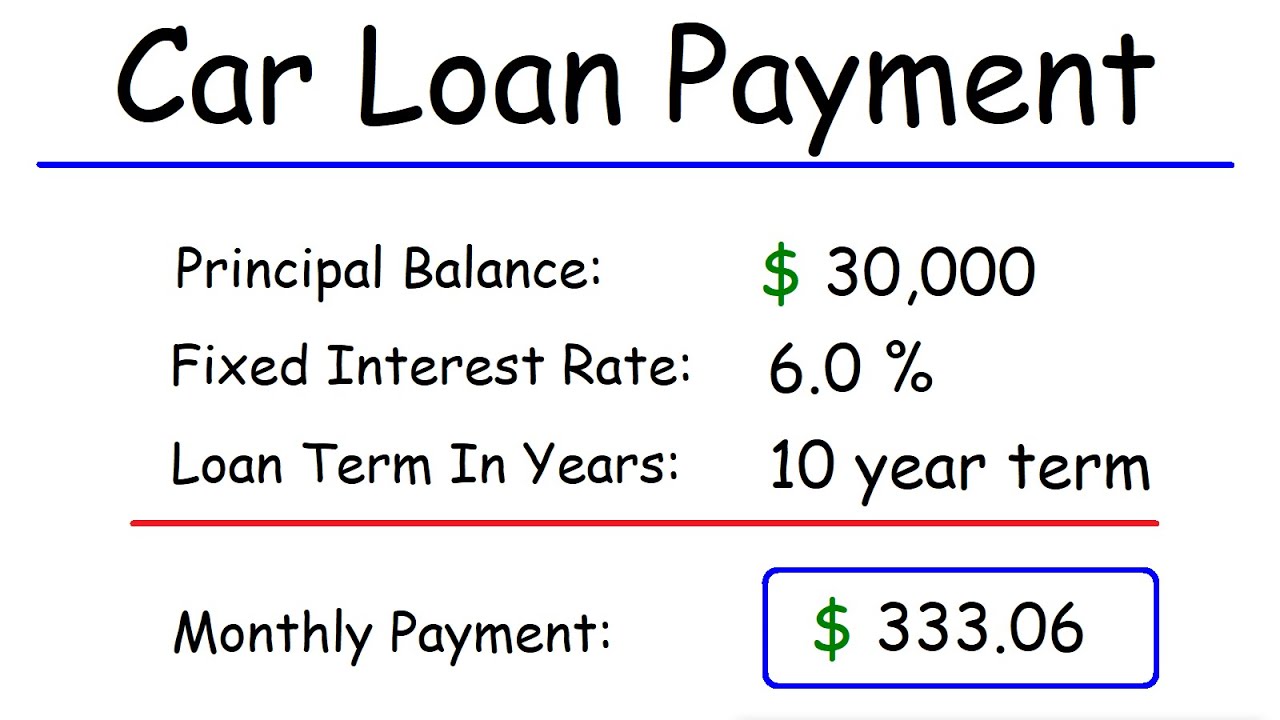

Evaluating Interest Rates And Terms

Interest rates dictate the extra money paid on top of the borrowed amount. Lower rates mean lower overall costs. Here’s what to do:

- Review your existing rate. Is it higher than what lenders offer today?

- Check the loan term. This is how long you have to pay back the loan.

- Understand prepayment penalties. Some lenders charge extra for paying off early.

Understanding Your Credit Score Impact

The credit score is a measure of financial trustworthiness. A higher score can unlock lower interest rates. Here’s how it works:

- Get your latest credit score.

- Note changes since getting your current loan.

- Higher scores improve refinancing terms.

| Credit Score Range | Potential APR |

|---|---|

| 750 and above | Lower APR |

| 450 – 749 | Higher APR |

| Below 450 | Highest APR |

Remember, a better credit score since getting your loan means you could qualify for lower rates. It signals lenders that you’re less risky. Those savings can add up over the life of your new loan.

Credit: www.frontwavecu.com

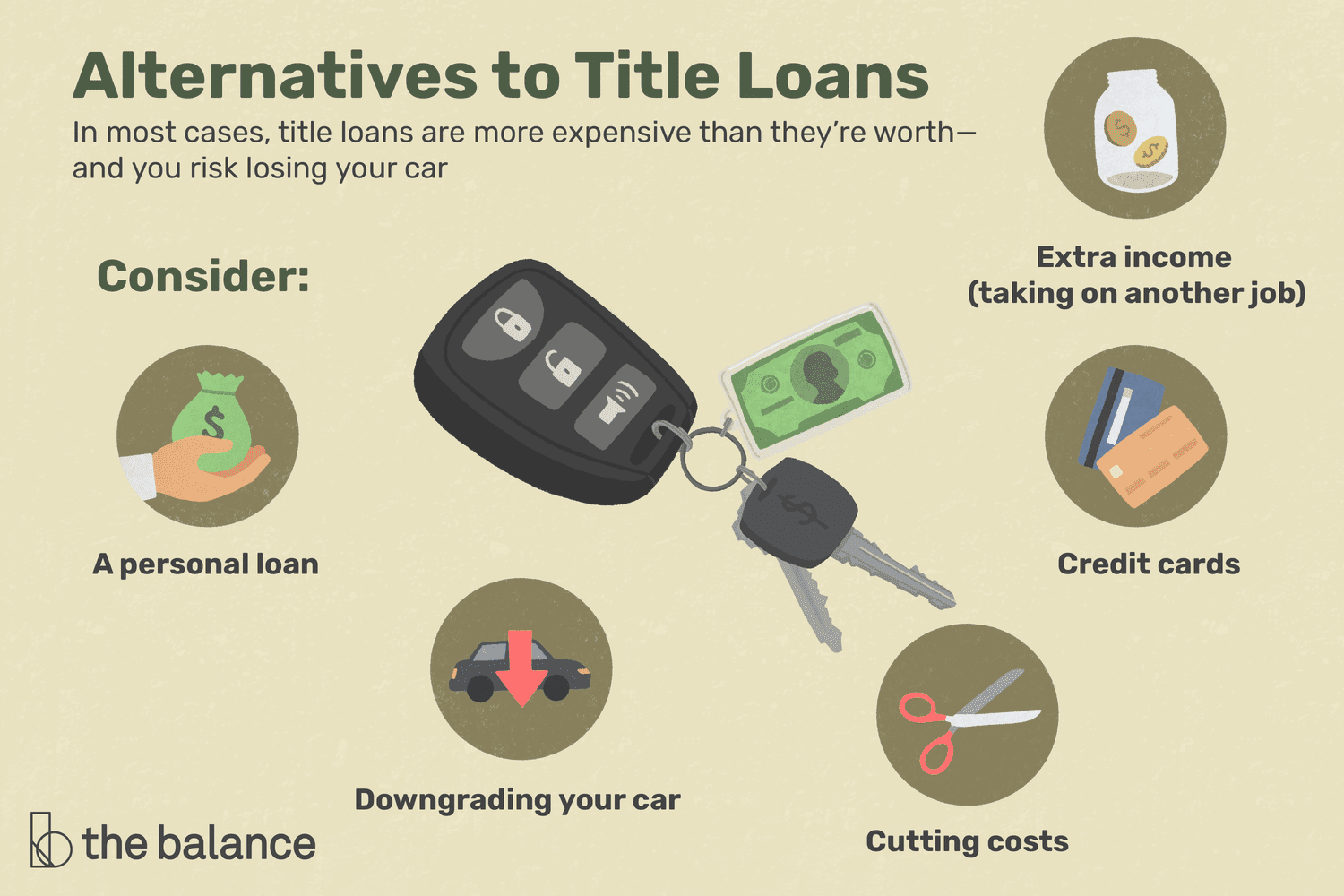

Exploring Your Refinancing Options

Are you aiming to cut down your car loan expenses? Refinancing your car loan can be a bright move. Exploring refinancing options lets you find better terms to match your current financial situation.

Comparing Different Lenders

It’s crucial to weigh the offers from various lenders. Start with these simple steps:

- Gather quotes from multiple financial institutions.

- Check interest rates to find the lowest ones.

- Review terms and conditions for any hidden costs.

- Analyze fees such as prepayment penalties.

Put the information in a table format to compare easily:

| Lender | Interest Rate | Term Length | Fees |

|---|---|---|---|

| Lender A | 3.5% | 60 months | $150 |

| Lender B | 3.7% | 72 months | $0 |

Online Vs. Traditional Bank Refinancing

Online and traditional bank refinancing both have unique benefits.

Consider online lenders for:

- Convenient applications from home.

- Often lower rates due to less overhead.

- Quick decision process.

Traditional banks might be better if you:

- Prefer face-to-face interactions.

- Have existing relationships that could give you better rates.

- Value the ability to discuss options personally.

Remember, no option fits all. Assess your preferences and needs to choose the perfect lender.

Preparing To Refinance

Refinancing a car loan can be a smooth journey with proper preparation. Get ready to navigate the process and secure potential savings. Start by collecting key documents and assessing financial benefits.

Gathering Necessary Documentation

Before lenders say “yes,” they want to know you better. Essential paperwork helps them see your financial story. Ensure you gather the following:

- Proof of Income: Recent pay stubs or tax returns confirm your earnings.

- Vehicle Information: Your car’s make, model, and VIN are crucial.

- Loan Details: Current loan balance and account number are needed.

- Identification: A driver’s license and Social Security number verify your identity.

- Proof of Residence: A utility bill or lease agreement shows where you live.

- Insurance: Proof of car insurance is mandatory.

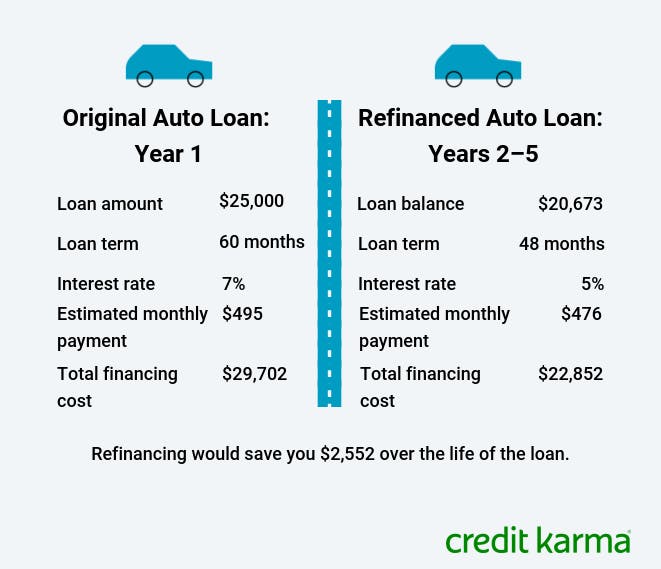

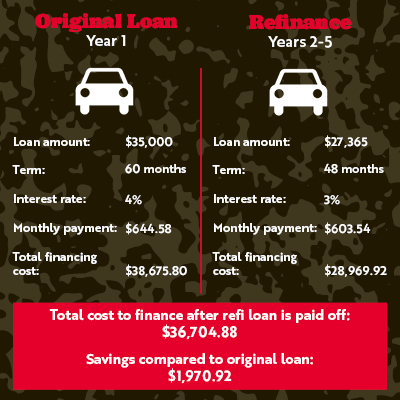

Calculating Potential Savings

Dive into the numbers to reveal the true value of refinancing. Use this simple table to outline potential savings:

| Current Loan | New Loan | Savings |

|---|---|---|

| Interest Rate | Potential Lower Rate | Interest Savings |

| Monthly Payment | New Lower Payment | Monthly Savings |

| Total Loan Cost | New Total Cost | Total Savings |

Remember to factor in any fees. Subtract these from your total savings. Use an online refinance calculator for quick estimates. This helps decide if refinancing is a smart financial step.

Applying For A New Loan

Refinancing your car loan can be a smart move to decrease interest rates or reduce monthly payments. Before you start, understand what’s involved in this process. Ensure you meet the eligibility requirements and gather the needed documents. Let’s dive into each step.

Completing The Refinance Application

Gather personal and vehicle information before applying. You will need your current loan details, income proof, and car’s make, model, and VIN. Online lenders or banks offer quick applications. Fill them out with accurate information for a smooth process. Don’t skip any sections!

- Current loan account number

- Driver’s license and Social Security number

- Proof of income (recent pay stubs)

- Car make, model, and VIN

What To Expect During The Approval Process

After you submit your application, lenders will assess your credit score and debt-to-income ratio. High credit scores often lead to better rates. Lenders may also evaluate car value and your repayment history. Expect a call or email from them within a few days.

- Lender evaluates credit score and history

- Confirmation of car’s value

- Debt-to-income ratio is considered

- Decision typically within a few business days

Finalizing The Refinance Deal

After gathering all the information and shopping around for the best refinance rates, you are now at the doorstep of a potentially brighter financial future. Finalizing your car loan refinance requires a clear understanding of the new loan terms and the handling of your previous loan. Let’s gear up and cross the finish line with confidence.

Understanding The New Loan Terms

Thoroughly review the contract before you sign on the dotted line. Ensure the following key elements align with your expectations and financial goals:

- Interest Rate: Confirm the rate is lower than your current loan.

- Monthly Payment: Check that payments fit comfortably in your budget.

- Loan Duration: A longer term can mean lower payments but more interest.

- Total Cost: Calculate the total amount you will pay over the life of the loan.

Clarify any fees associated with the new loan. Some common fees include:

| Fee Type | Description |

|---|---|

| Origination Fee | A charge by the lender for processing the new loan. |

| Prepayment Penalty | A fee if you pay off the loan early. |

| Documentation Fee | Cost for paperwork processing. |

Be sure to ask questions if anything is unclear.

Handling Your Previous Loan

Settling your old debt is crucial when you refinance. Follow the steps below to ensure a smooth transition:

- Obtain the payoff amount from your current lender. It might differ from your balance due to interest.

- Coordinate with your new lender to pay off the old loan directly.

- Keep proof of payment and ensure the account reflects a zero balance.

Protect yourself against any errors by checking your credit report after a few weeks to verify that the loan is marked as paid.

:max_bytes(150000):strip_icc()/pros-and-cons-of-refinancing-a-car-loan-1a117a027ee14bd583fd1abdef935b9d.gif)

Credit: www.thebalancemoney.com

Post-refinance Considerations

After successfully refinancing your car loan, it’s crucial to keep an eye on what comes next. Smart post-refinance strategies can further improve your financial health. Here’s what to consider:

Maintaining A Strong Credit Score

Keeping your credit score high is essential after refinancing. This ensures you get the best rates on future loans and credit lines. Follow these tips:

- Make payments on time to maintain a positive payment history.

- Avoid taking on excessive new debt that can increase your credit utilization.

- Monitor your credit report for errors or fraud to avoid unjustified score dips.

- Keep old accounts open to preserve the length of your credit history.

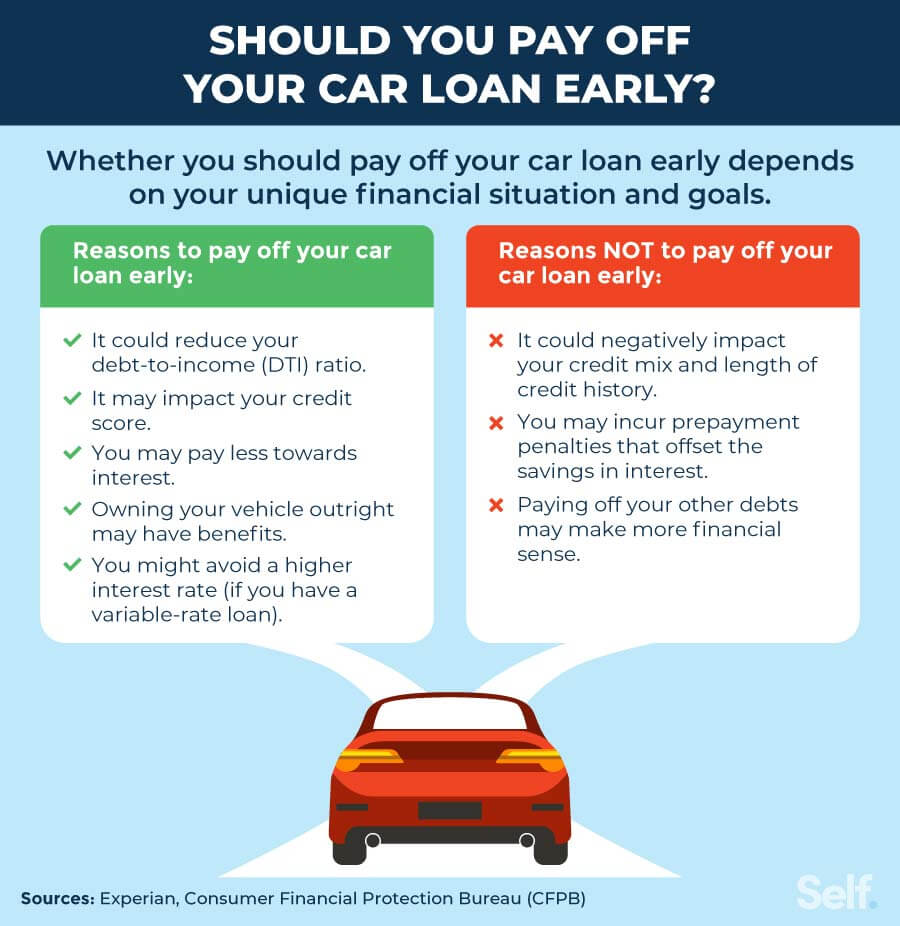

When To Consider Refinancing Again

It might be time to refinance your car loan again if you notice certain changes:

- Falling interest rates in the market could mean a chance for even lower rates.

- A higher credit score than when you last refinanced could unlock better deals.

- Improved financial situation may allow you to shorten the loan term and save on interest.

Keep a yearly check on your loan terms versus market conditions to decide the right time.

Frequently Asked Questions On How To Refinance A Car Loan

Can I Refinance My Car Loan With Bad Credit?

Yes, it’s possible to refinance a car loan with bad credit. However, you may face higher interest rates. Work on improving your credit score, shop around for lenders who offer bad credit refinancing, and compare terms to secure a better deal.

What Documents Do I Need For Car Loan Refinancing?

To refinance your car loan, you’ll need your driver’s license, proof of income (like recent pay stubs), insurance documentation, the car’s registration, and details of your current loan. Prepare these documents in advance to streamline the refinancing process.

How Does Car Loan Refinancing Affect My Credit Score?

Refinancing a car loan can slightly impact your credit score due to a hard inquiry from lenders. However, if refinancing leads to lower payments and you manage them well, it could improve your credit over time through consistent, on-time payments.

When Should I Consider Refinancing My Car Loan?

Consider refinancing when interest rates drop, your credit score improves, your financial situation changes, or you’re not satisfied with your current loan terms. Refinancing can help lower monthly payments or reduce the total interest paid.

Conclusion

Refinancing your car loan can be a strategic move to lower expenses. By doing your homework and comparing lenders, you may snag a better interest rate. Remember, patience and a good credit score are key. Start today and ease your financial journey tomorrow.

Drive forward with confidence and savings!