How to Privately Sell a Car With a Loan

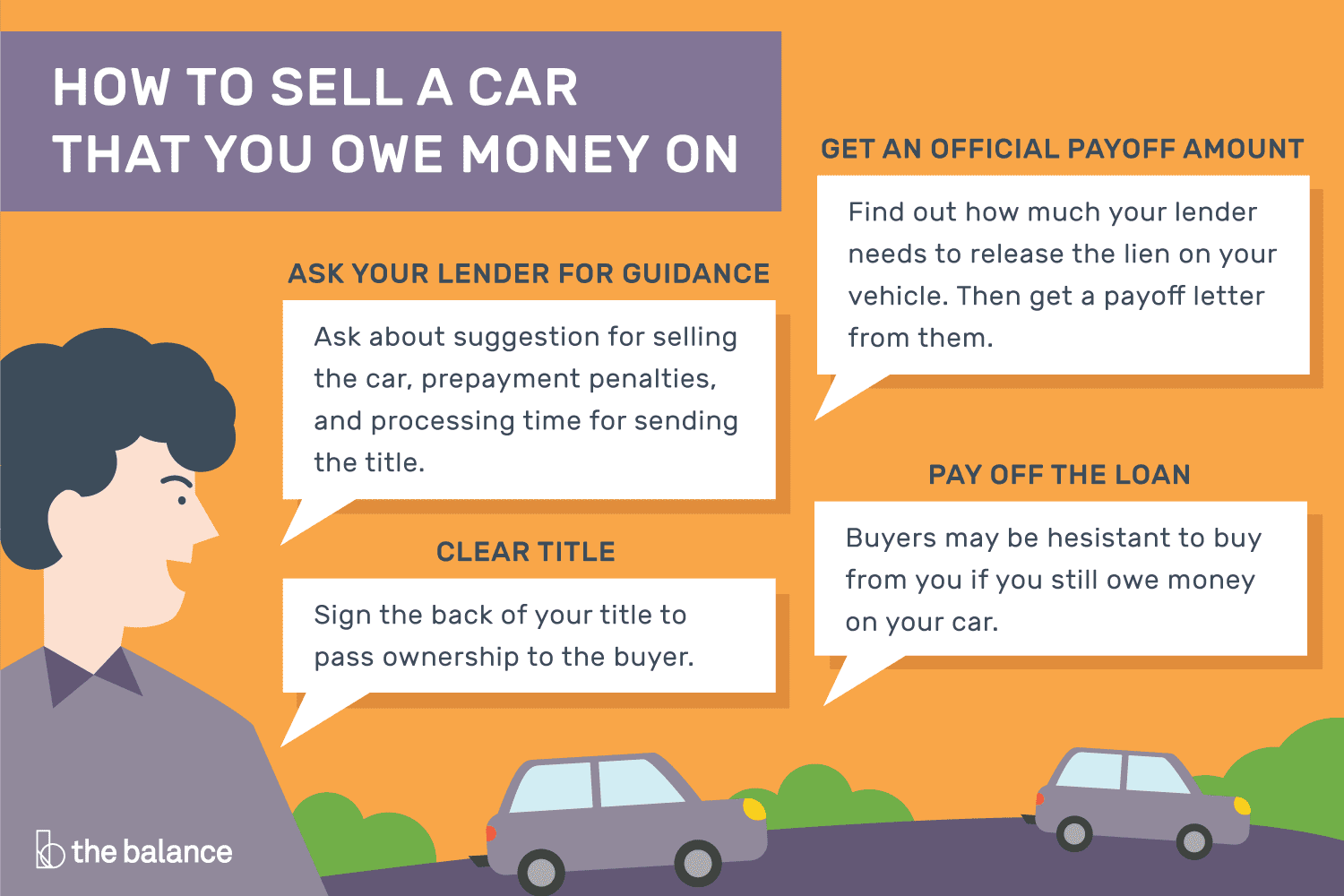

To privately sell a car with a loan, pay off the loan or transfer it to the buyer. Obtain permission from the lender for the sale process.

Selling a car with existing financing requires transparent dealings with the buyer and the lender. Quick communication regarding the loan status ensures trust in the transaction. As a seller, it’s critical to understand your lender’s procedures for transferring title rights.

Most importantly, confirm that all financial obligations are met to avoid legal complications. Navigating through this process might seem daunting, but a concise plan can make it smooth and straightforward. Accurate record-keeping and adherence to state laws protect both parties’ interests. The collaborative effort between the seller, the buyer, and the lender lays the groundwork for a successful private car sale, even with a loan attached.

Pre-sale Preparation

Selling a car privately when you still owe on it can seem tricky. It’s about clear steps and good preparation. Here’s how to lay the groundwork for a smooth, lawful sale.

Determining The Payoff Amount

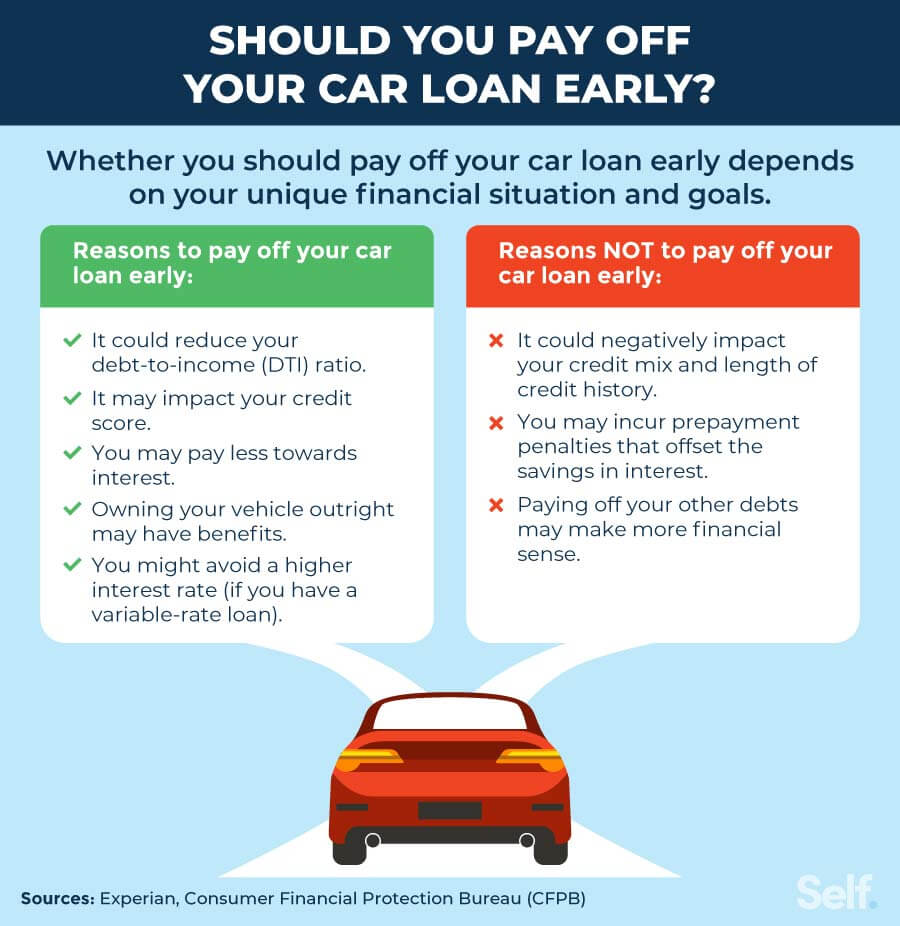

Finding out what you owe is the first task. Contact your lender for the payoff. This number is your loan’s balance.

- Ask for a payoff letter

- Check for prepayment penalties

Gathering Necessary Documents

Documents are crucial for a transparent transaction. Start collecting these right away:

- Title – If not held by the lender

- Loan Account Number – For reference

- Vehicle History Report – Builds buyer trust

- Maintenance Records – Shows care

- Bill of Sale – Template ready for details

Credit: privateauto.com

Advertising Your Car

Advertising Your Car is a critical step in privately selling your vehicle, especially with an outstanding loan. An ad that captures attention and delivers clear, concise information can lead to a quick and profitable sale. Below, discover the keys to crafting an effective ad and where to share it for maximum exposure.

Writing An Effective Advertisement

A standout ad includes detailed info about the car’s condition, features, and history. Use high-quality images from various angles to showcase the car. Highlight key selling points like low mileage, maintenance records, or recent upgrades. Be honest about any issues, as transparency builds trust with potential buyers.

Choosing The Right Platforms

The right platform puts your ad in front of serious buyers. Options include online marketplaces, car selling websites, and social media groups. Consider a mix of free and paid listings to broaden your reach. Always tailor the ad to the platform, keeping its audience and guidelines in mind.

Below are steps and tips for advertising your car effectively:

- Write a catchy title with the make, model, and year.

- Detail the car’s condition, including any repairs needed.

- List upgrades or recent maintenance that adds value.

- Include multiple, clear photos of the interior and exterior.

- Set a fair price by comparing other listings and using valuation tools.

- Mention the loan and your plan for repayment upon sale.

| Platform | Audience | Cost | Best For |

|---|---|---|---|

| Online Marketplaces | Broad | Free / Paid | Quick Exposure |

| Car Selling Sites | Auto Enthusiasts | Subscription / Fees | Targeted Audience |

| Social Media Groups | Local Community | Free | Community Trust |

- Ensure all details in the ad are accurate and up-to-date.

- Refresh your ad regularly to keep it visible.

- Respond promptly to inquiries and be ready to negotiate.

Communicating With Potential Buyers

Communicating with potential buyers is key in the private sale of your car, especially when there’s a loan involved. Transparency and safety during this process not only boost buyer confidence but also pave the way for a smooth transaction.

Handling Questions About The Loan

Be ready for questions on your car’s loan. Prepare clear answers about the loan amount and how you plan to settle it upon sale. This builds trust.

- Mention your lender’s name and contact details.

- Provide the exact payoff amount and how it affects the purchase price.

- Discuss the timeline for loan clearance after sale.

Setting Up Test Drives Safely

Test drives are critical for a buyer’s decision to purchase. Ensure these are safe and secure for everyone involved.

- Verify the buyer’s driving license before the test drive.

- Plan a safe route in advance.

- Agree on a meeting spot, preferably a public place.

Always accompany the buyer on the test drive. Have a pre-determined plan for the entire test drive process.

Navigating Financial Transactions

Navigating Financial Transactions can seem daunting when you’re looking to privately sell a car that still has a loan outstanding. It’s vital to handle the financial aspects meticulously to ensure a smooth and secure sale. Here’s how to approach the transaction with confidence.

Explaining The Loan Payoff To Buyers

When a car has a lien, the sale calls for clear communication. Outline the process to potential buyers. Make sure they understand that the loan balance will need settling before the title transfer. A forthright discussion about the loan payoff establishes trust and transparency.

- Provide exact loan payoff amount: Base this on your lender’s quote.

- Confirm payment deadlines: Share the timeframe within which the payoff must complete.

- Demonstrate title clearance: Explain how a clean title will be provided post-loan payment.

Using Escrow Services For Secure Payment

An escrow service adds a layer of security to the transaction. It holds the buyer’s money until all parties have met the sale conditions.

- Select a reputable escrow service: Look for services specializing in vehicle transactions.

- Understand the terms and fees: Go over the escrow terms of service and any associated costs.

- Communicate the process: Both seller and buyer should be aware of each step within the escrow procedure.

An escrow ensures the seller pays off the loan and the buyer receives the title securely. It’s a win-win for both parties, facilitating trust and protection.

Transfer Of Ownership

Transferring ownership of a car while it has an ongoing loan requires careful steps. You need the right documents. Also, you must follow legal procedures. This ensures a smooth handover to the new owner. Here’s how to tackle the bill of sale and title transfer during this process.

Completing The Bill Of Sale

First, prepare a bill of sale. This is a written record of the sale. It includes important details. Both seller and buyer need to agree on these details. They include the sale price and the car’s condition.

- Ensure all buyer and seller information is correct.

- Mention the car’s make, model, year, and VIN.

- Declare the sale price and payment terms.

- State if there’s a loan and how you will handle it.

Finalizing The Title Transfer

The title transfer legally changes ownership. You can’t transfer the title with a loan on it. First, plan to pay off the loan. The bank or loan company holds the title. They give you a release document after clearing the loan.

- Confirm loan payoff with your lender.

- Collect the lien release from them.

- Visit the DMV with the buyer for the title transfer.

- Submit all required paperwork, including the release.

Both the seller and the buyer should be present. This makes the process faster and clearer. Make sure you keep copies. You might need these copies for future reference.

Post-sale Considerations

After a car sale, certain steps finalize the process. Key actions include settling the loan and updating your insurance. Understanding these post-sale considerations ensures a smooth transition. Let’s explore how to effectively manage these crucial steps.

Confirming Loan Closure

Once the car sells, it’s essential to close the loan associated with it. Here’s how to proceed:

- Get proof of payment: Secure a document confirming the loan’s full repayment from the buyer or their bank.

- Contact your lender: Send the payment proof to your lender promptly.

- Release of lien: The lender should provide a lien release. This document is crucial for the car’s title transfer.

- Check your credit report: It should reflect the loan closure within a few weeks.

Keep copies of all these documents. They serve as confirmation of the loan settlement.

Notifying The Insurance Company

Insurance updates are next. You must inform your insurance provider of the sale. Proceed with the following:

- Contact your insurance agent or company without delay.

- Provide the sale date and the vehicle’s information.

- Request a cancellation or transfer of the policy, if applicable.

This step prevents future charges. It also removes liability for the sold vehicle.

Frequently Asked Questions On How To Privately Sell A Car With A Loan

Can You Sell A Car With An Outstanding Loan?

Yes, you can sell a car with an outstanding loan. You’ll need to pay off the loan completely, often by using the sale proceeds, before transferring ownership to the buyer.

What Steps Should I Take To Privately Sell A Car With A Loan?

Begin by contacting your lender for the payoff amount. Then, find a buyer who’s willing to work with you through the process. Once agreed, arrange for the loan payment and transfer the title.

How To Determine A Fair Price For A Car With A Loan?

Research similar models online to understand market value. Adjust your selling price based on your car’s condition, mileage, and outstanding loan balance to ensure you can cover the loan payoff.

Is It Possible To Transfer A Car Loan To The Buyer?

Generally, car loans are not transferable. The buyer must secure their own financing to pay you, which you will then use to settle your loan and release the lien on the title.

Conclusion

Selling a car with a loan attached is definitely manageable with the right steps. Prioritize transparent communication with your buyer and lender. Gather all necessary documents and stay informed about the payoff process. By following the advice outlined, you’ll navigate through the sale smoothly, ensuring a win-win for everyone involved.

Remember, preparation is your key to success.