How to Pay off Car Loan in Full

To pay off a car loan in full, contact your lender to get the payoff amount. Then, submit the payment according to their instructions.

Paying off your car loan early can be a smart financial move, freeing you up from monthly payments and saving you on interest. Before you make the final payment, ensure you know the exact payoff amount, which can be slightly different from your current balance due to interest accrued.

You’ll also want to understand the payment methods your lender accepts and whether there are any prepayment penalties involved. Keep in mind that the process for paying off a car loan varies slightly between lenders, so it’s crucial to follow their specific procedures. Once the loan is paid off, request a lien release or a title that reflects the loan’s satisfaction, confirming that you now own the vehicle outright.

Credit: www.self.inc

Rethinking Your Budget

To pay off a car loan quickly, adjusting your budget is crucial. Find new ways to save money and redirect it towards your loan. Take a close look at your expenses. You might uncover funds you never knew you had!

Identifying Extra Savings

Begin by reviewing monthly expenses. Look for services you rarely use. Consider cancelling subscriptions or downgrading plans. Can you skip the coffee shop? Maybe pack a lunch? Small changes add up over time and free up cash for your loan.

- Eat out less often

- Switch to generic brands

- Use public transportation

Allocating Funds To Your Car Loan

With extra savings identified, it’s time to act strategically. Allocate these funds directly to your car loan. Paying more than the minimum can drastically reduce your interest over time. Even small additional payments can lead to big savings.

| Extra Payment Per Month | Interest Saved | Loan Term Reduction |

|---|---|---|

| $50 | $300 | 4 months |

| $100 | $600 | 8 months |

Income Augmentation Strategies

Paying off a car loan quickly requires extra cash. One effective way to gather additional funds is through income augmentation. This simply means finding ways to increase your earnings. Here, we explore practical strategies to boost your income, thus enabling you to pay off your car loan in full.

Taking Up Side Gigs

Side gigs can give your earnings a significant push. Different side gigs suit different skill sets, and many do not require much time. Here are popular side gigs:

- Freelance work: Sites like Upwork or Fiverr connect you with short-term jobs.

- Ride-sharing: Driving for services like Uber can fill pockets in your free time.

- Delivery services: Work for food or parcel delivery companies during your off hours.

Selling Unwanted Items

Clearing out clutter can also clear your debt. Sell items you no longer use:

| Item Type | Platform to Sell | Potential Earnings |

|---|---|---|

| Clothing | Poshmark, eBay | $10-$100 per piece |

| Electronics | Facebook Marketplace, Craigslist | $50-$500 per item |

| Furniture | OfferUp, Local Yard Sales | $20-$2000+ per item |

Remember, consistency is key. Keep pursuing these income augmentation strategies and watch your car loan disappear!

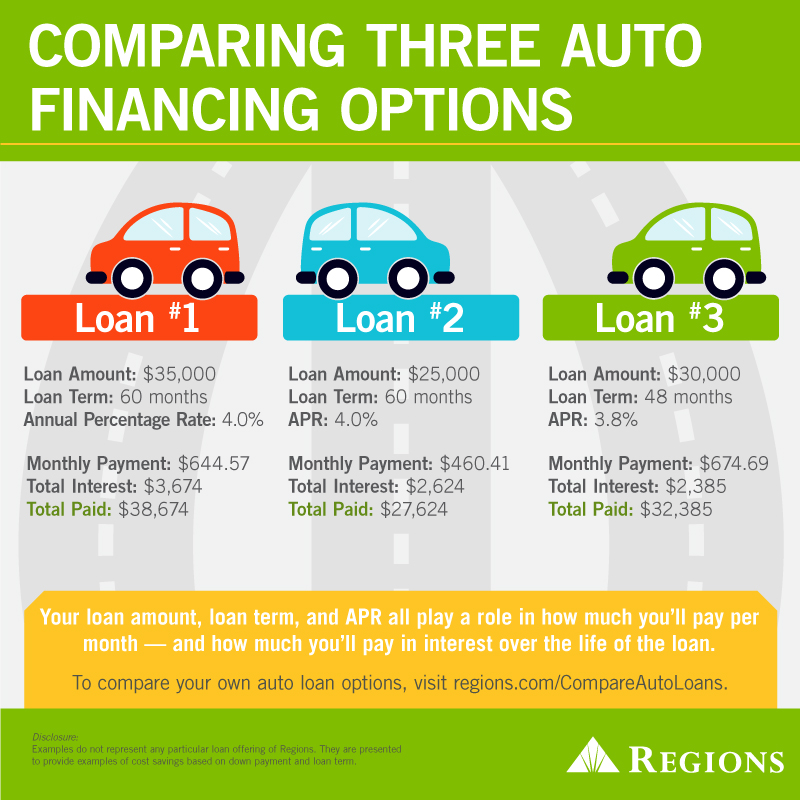

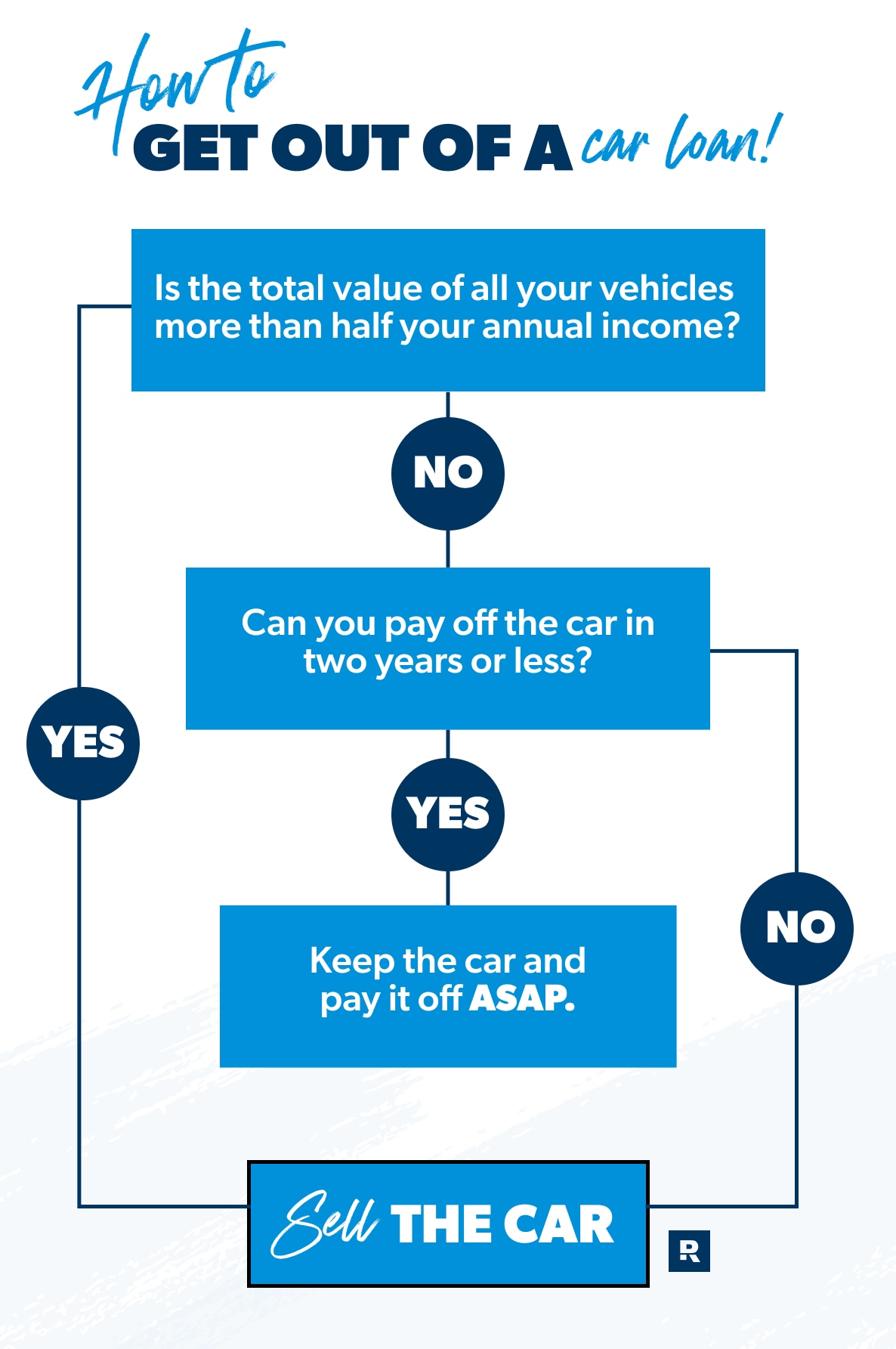

Refinancing Your Car Loan

Want to pay off your car loan in full? Refinancing might be a savvy move. This method involves taking a new loan to pay off the existing one. It can lead to better interest rates and easier payment terms. Let’s dive into the details!

Pros And Cons Of Refinancing

Refinancing a car loan can be a game-changer.

- Pros:

- Reduced interest rates save money.

- Lower monthly payments improve cash flow.

- Potential to pay off the loan quicker.

- Option to reset loan terms.

- Cons:

- Refinancing fees may apply.

- Longer loan terms could mean more interest over time.

- Not beneficial if the car’s value is less than the loan.

- Possible penalties for early payoff.

Finding The Best Refinancing Deals

Get the best refinancing deal using these steps:

- Check your credit score.

- Shop around for lenders.

- Compare interest rates and terms.

- Calculate potential savings.

- Read the fine print.

- Choose the right offer and apply.

Remember, the goal is to reduce your financial burden, not add to it.

Making Extra Payments

Want to clear that car loan faster? Making extra payments is key. It’s simple – pay more than the monthly due. Every extra dollar goes towards the loan principal, reducing the balance and interest. Ready to speed up your car loan payoff? Let’s dive in.

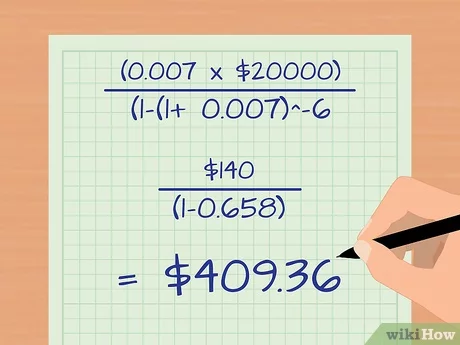

Calculating The Impact Of Extra Payments

Knowing how extra payments shorten your loan term is motivating. Use a loan calculator to see the effects. Input your loan details and extra payment amounts. You’ll see how much you save in interest and time. Try different amounts and frequencies to find the best plan for your budget.

| Extra Payment | Interest Saved | Loan Term Shortened |

|---|---|---|

| $50/month | $300 | 6 months |

| $100/month | $590 | 12 months |

Setting Up Automatic Payment Increases

Consistency beats occasional lump sums. Setup automatic payment increases. Decide an extra amount. Update your online banking to send this along with your regular payment. This way, you won’t forget, and your loan will shrivel up quicker than you’d think.

- Log into online banking.

- Choose your car loan.

- Select ‘Manage Payments’.

- Set the extra amount.

- Save your new payment option.

Watch your loan balance fall each month without lifting another finger.

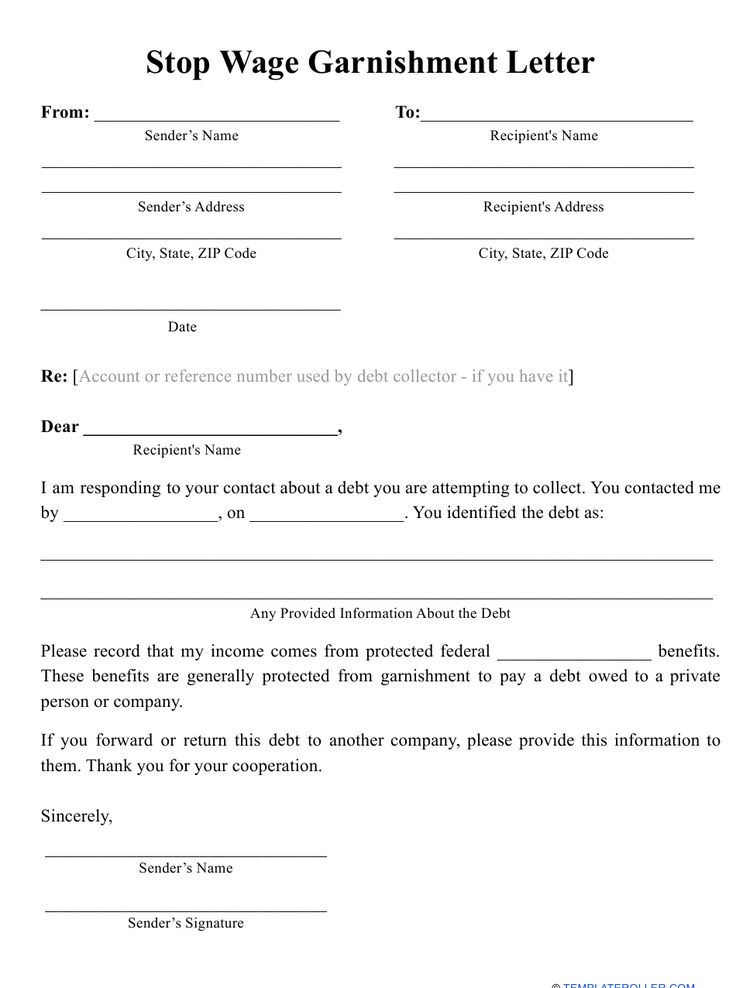

Negotiating With Lenders

Negotiating with lenders offers a potential path to reducing what you owe on a car loan. Crafting a convincing approach may lead to a payoff arrangement that benefits your budget. It requires careful preparation and a strategy.

Preparing To Negotiate

Gather all pertinent information about the loan. Know the balance, interest rate, and terms. Collect documentation such as your payment history. Presenting a complete picture shows you’re serious and informed.

Strategies For Successful Negotiation

- Express willingness to pay. Show you’re proactive about resolving the debt.

- Highlight your payment history. Good previous payments can be leverage.

- Consider timing. Lenders may be more receptive at the end of financial quarters.

-

Propose a lump-sum payment. Offer less than the total balance

- This can be attractive to lenders if it’s a substantial amount.

Demonstrating your understanding of the loan and showing a readiness to resolve it places you in a stronger negotiation position.

Credit: www.self.inc

Exploring Loan Forgiveness And Assistance Programs

Tackling car loans can seem daunting. Yet, loan forgiveness and assistance programs might shine a light at the end of the tunnel. These programs could slash or erase your debt completely. Let’s dive into the options and navigate the journey toward financial freedom.

Qualifying For Loan Assistance Programs

Not all loans or borrowers qualify for assistance. Eligibility criteria are strict. They often target specific groups or areas of employment. For instance, military personnel might have access to unique programs. Professionals in public service might also be eligible. Research is crucial. Identify programs tailored to your situation.

- Check your loan type: Some programs only cater to certain loans.

- Review your employment status: Your job could unlock specific benefits.

- Analyze your financial standing: Hardship can sometimes lead to assistance eligibility.

Steps To Apply For Loan Forgiveness

Securing loan forgiveness is a process. It begins with understanding the application steps.

- Locate the right program: Start with programs designed for your loan type and job field.

- Gather necessary documentation: Proof of income, employment, and loan statements are often required.

- Complete applications meticulously: Fill out all forms with precision to prevent delays or rejections.

- Stay in contact with your lender: Ensure they’re aware of your intent to seek forgiveness.

- Follow up regularly: Persistence helps navigate bureaucracies efficiently.

Adherence to the guidelines is vital. Submit all paperwork on time. Errors can derail the entire effort.

Credit: www.pnc.com

Frequently Asked Questions On How To Pay Off Car Loan In Full

Can You Pay Off A Car Loan All At Once?

Yes, you can usually pay off a car loan in full before the end of its term. Check your loan agreement for any prepayment penalties. Always confirm with your lender before making the final payment.

Is It Smart To Pay Off A Car In Full?

Paying a car off in full can save on interest and reduce debt, but consider your liquidity and emergency fund before doing so. Assess financial stability and other high-interest debts before making a lump-sum payment on an auto loan.

How Do You Fully Pay Off A Car?

To fully pay off a car, send the total outstanding balance to your lender. Check your loan statement or contact the lender for the payoff amount. Ensure you obtain a release of lien upon completion.

What Is The Penalty For Paying Off A Car Loan Early?

The penalty for paying off a car loan early is usually a prepayment fee specified by the lender, but some loans have no penalty.

Conclusion

Paying off your car loan early frees up cash and reduces stress. It’s a financial triumph worth striving for. By following the provided strategies, you can tackle that balance head-on. Remember, every payment above the minimum propels you closer to ownership.

Start today and drive toward a debt-free future.