How to Pay off Car Loan Faster

To pay off a car loan faster, increase your monthly payments and make extra payments whenever possible. Refinance your loan for a better interest rate or shorter term if you qualify.

Owning a car provides an invaluable sense of freedom, but it often comes with the burden of an auto loan. For many, the goal is to eliminate debt quickly to free up financial resources and reduce the amount paid in interest over time.

Tackling auto debt efficiently requires a clear strategy, from making bi-weekly payments to dedicating tax refunds or bonuses to the loan. By paying more than the minimum amount due and exploring refinancing options, borrowers can accelerate the repayment process and ultimately own their vehicle outright sooner. A decisive plan to pay off a car loan not only saves money but also improves your credit score, providing long-term financial benefits.

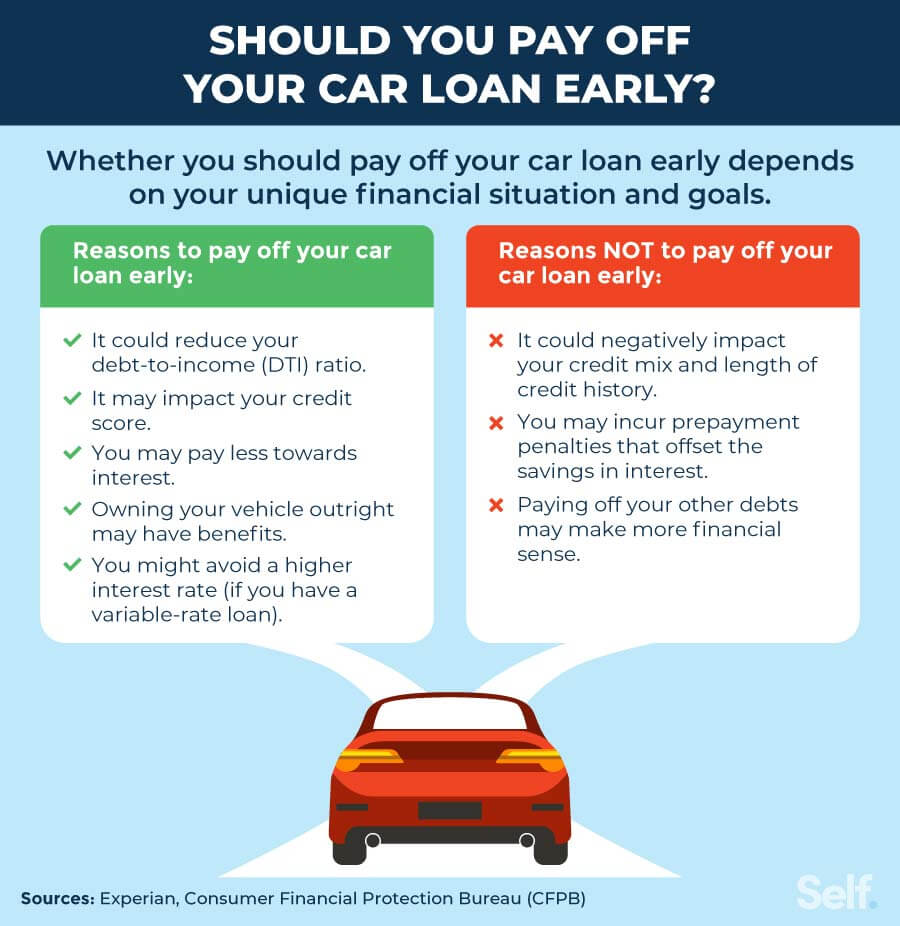

Credit: www.self.inc

Strategies To Accelerate Car Loan Repayment

Thinking about paying off your car loan early? It can save you money in interest. Plus, it’s a fantastic way to free up your monthly budget. Check out these strategies to get that loan balance to zero faster!

Making Extra Payments

Extra payments can shave months, or even years, off your loan. Consider these tips:

- Use tax refunds or bonuses to make one-off additional payments.

- Set aside small amounts weekly to add to your monthly payment.

- Check with your lender for any prepayment penalties first.

Note: Always tell your lender extra payments should go towards the principal. It reduces the total interest paid.

Rounding Up Monthly Installments

Another simple tactic is rounding up your payments. Here’s how it works:

| Current Payment | Rounded Payment | Extra per Year |

|---|---|---|

| $265.50 | $300 | $414 |

Small increases make a big impact over time. They help pay down the loan principal faster.

Refinancing For Better Terms

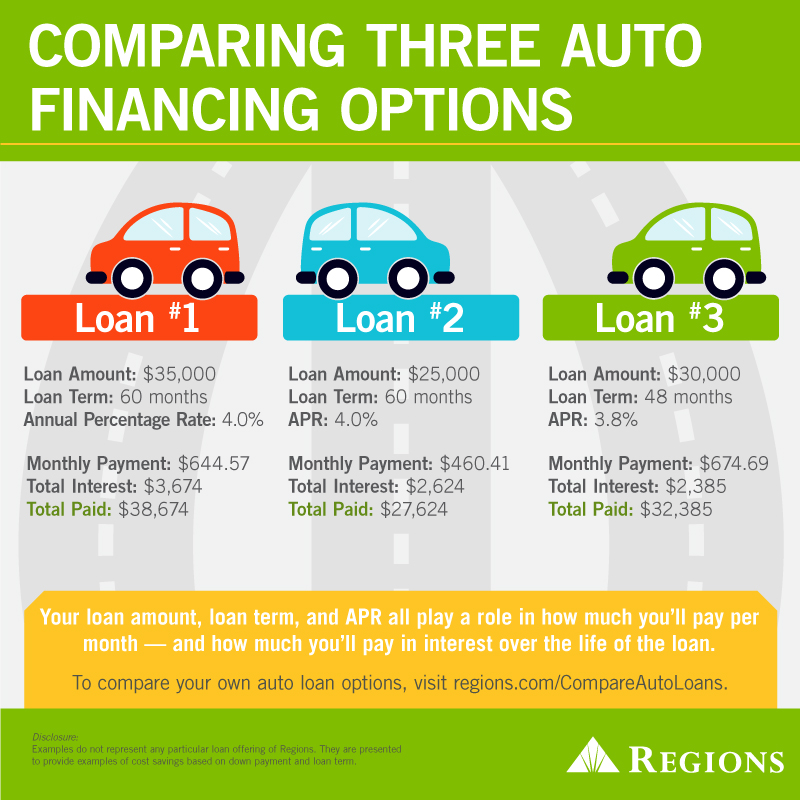

Refinancing for Better Terms could be a smart move to pay off a car loan faster. By refinancing, car owners might find better interest rates and terms. This means more of your payment goes towards the principal balance. Let’s explore the refinancing options to speed up loan repayment.

Identifying Lower Interest Rates

Finding a lower interest rate reduces the overall cost of a loan. It’s essential to shop around and compare offers from different lenders. Use these steps:

- Check your current loan’s interest rate.

- Compare rates from multiple lenders online.

- Consider credit unions for potentially lower rates.

Remember, a credit score impacts interest rates. Work on improving your credit score for even better terms.

Shortening The Loan Term

Shorter loan terms can lead to savings on interest. While monthly payments could be higher, the loan pays off quicker. This table compares different loan terms:

| Original Term | New Term | Interest Savings |

|---|---|---|

| 60 months | 48 months | Potentially Significant |

| 60 months | 36 months | Even Greater |

Always check that the new loan has no prepayment penalties before proceeding.

Budget Adjustments For Quicker Payoff

Want to say goodbye to your car loan faster? Smart budget adjustments can play a huge role. By better managing your money, you can make larger payments on your car loan. This means less interest over time and more savings in your pocket.

Allocating Bonuses And Tax Refunds

Extra money like bonuses and tax refunds can put you miles ahead on your car loan. Instead of spending this money, apply it to your car loan balance. It’s a quick win to slash the interest and the term of your loan.

- Year-end bonuses: A smart place for this unexpected cash.

- Tax refunds: Use this yearly boost to make a dent in your loan.

Cutting Non-essential Expenses

Trimming the fat from your budget helps free up cash. Look at monthly subscriptions or dining out. Even small cuts can add up to a significant sum. Put this money toward your loan for faster payoff.

| Expense Category | Monthly Cost | Adjustment | Annual Savings |

|---|---|---|---|

| Cable Subscription | $90 | -$90 | $1,080 |

| Gym Membership | $50 | -$50 | $600 |

| Dining Out | $200 | -$100 | $1,200 |

Credit: walletsquirrel.com

Earning More To Pay More

Paying off a car loan can feel like an uphill battle. Boosting your income is a strategic move. It allows you to make larger payments on your car loan, reducing interest costs and shortening the loan term. Let’s explore practical ways to earn more.

Taking On Side Jobs

Extra jobs can lead to extra cash. Here are common side hustles:

- Ride-sharing driver

- Freelance gigs online

- Pet-sitting or dog walking

- Delivery services for food or packages

Choose something that fits your schedule. Even a few extra dollars can make a difference.

Turning Hobbies Into Income

Your hobby could be a money-maker. Examples of hobbies that can bring in income:

- Crafting and selling items online

- Offering music or art lessons

- Blogging about a passion topic with affiliate links

- Starting a YouTube channel

Profit from what you love. It can help pay down your loan faster.

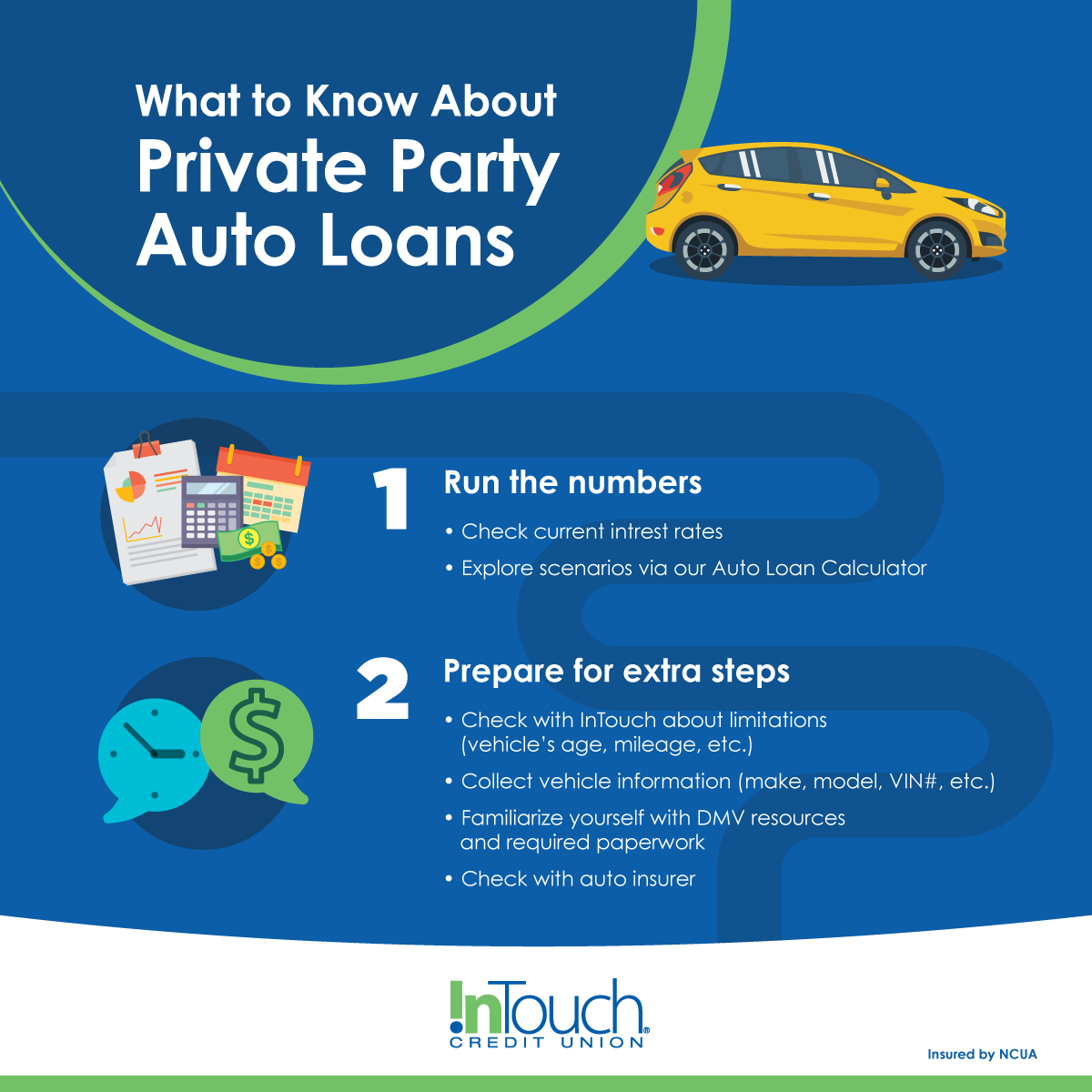

Utilizing Online Tools And Resources

Paying off a car loan faster can save you money on interest and free up your budget.

Thanks to the internet, a multitude of tools and resources are at your fingertips. They

can simplify the process and keep your payoff goals on track.

Loan Calculators For Planning

Loan calculators can play a crucial part in your repayment strategy. By entering

your loan amount, term, and interest rate, you can see a clear breakdown of your payments.

You can adjust the numbers to see how paying more each month reduces your loan term

and total interest paid. Here are key benefits of loan calculators:

- Visualize your loan timeline based on different payment scenarios.

- Calculate the impact of extra payments on your loan’s interest.

- Gain insight into how soon you can be debt-free with adjusted payments.

Apps To Track Progress

Tracking your loan repayment progress keeps you motivated. Many apps sync with

your bank accounts to monitor your car loan balance. They provide visuals like graphs

and charts showing how far you’ve come and what’s left to pay. Consider these advantages:

| App Feature | Benefits |

|---|---|

| Payment Reminders | Never miss a payment, avoid late fees. |

| Extra Payment Option | Easily make extra payments and track savings. |

| Progress Reports | Visualize your journey to a zero balance. |

With the right tools, you’re well on your way to paying off your car loan faster and

saving money in the process. Start using these online resources and see the difference they make!

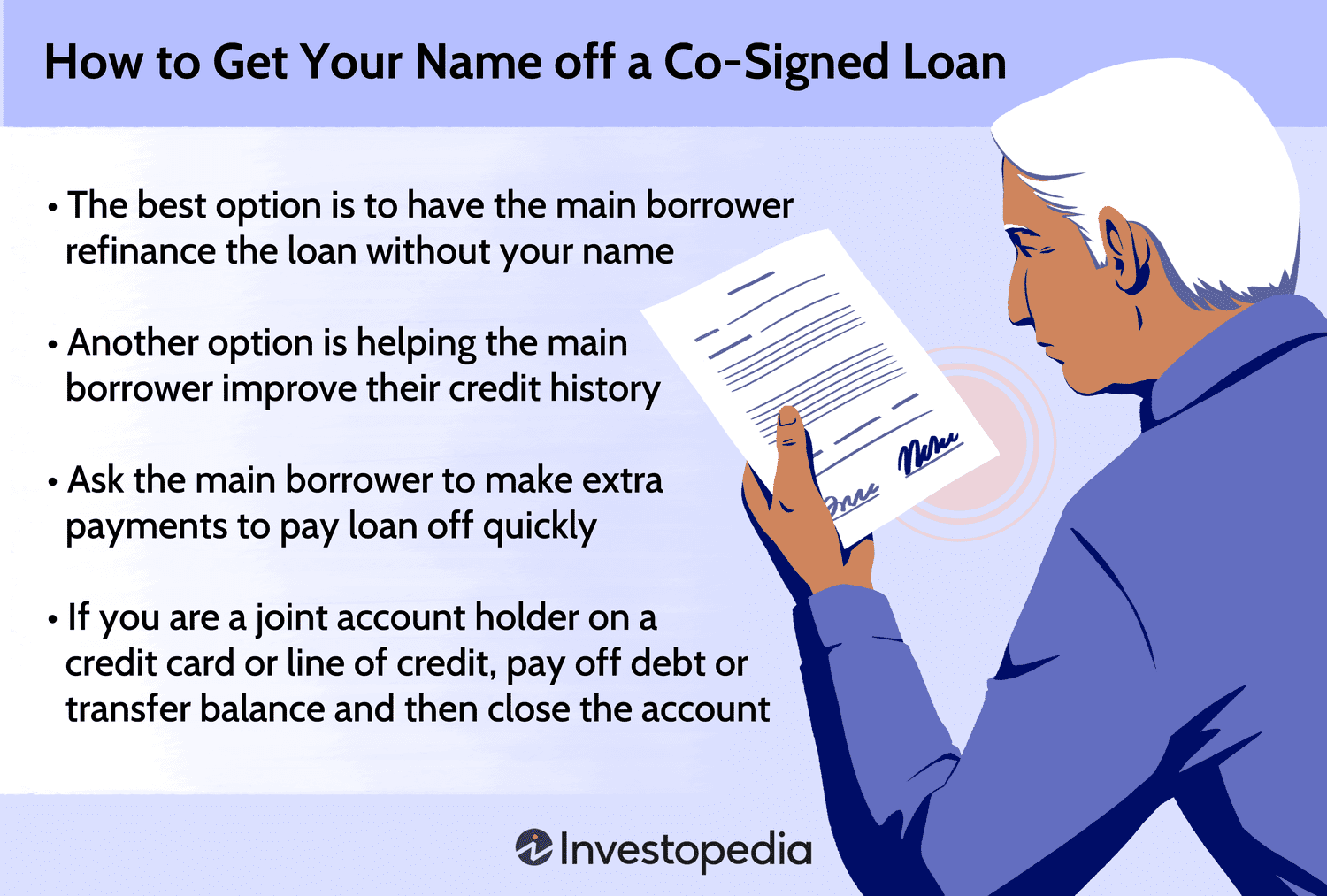

Communication With The Lender

Communication with the Lender plays a pivotal role in the journey to pay off your car loan swiftly. Understanding and negotiating your loan’s terms can lead to more favorable conditions for making extra payments. A strong relationship with your lender may open doors to paying off the principal faster and can result in considerable savings on interest over the life of your loan.

Ensuring Extra Payments Go To Principal

- Contact your lender to clarify how to make extra payments.

- Specify that additional funds should reduce the principal.

- Confirm extra payments reduce repayment time, not just monthly installments.

Always confirm with your lender that your additional payments are processed correctly. Doing so can make a significant impact on your loan balance and interest savings.

Negotiating Loan Terms Directly

- Review your loan agreement to know your current terms.

- Prepare your negotiation points, focusing on paying off the loan early.

- Schedule a meeting or call with your lender to discuss terms.

- Be ready to discuss your payment history and financial stability.

Negotiating directly with your lender may provide opportunities to revise your loan terms. This can include lowering your interest rate or removing prepayment penalties, both strategies that contribute to eliminating the debt faster.

This approach may not apply to every lender or loan agreement, so it’s important to check the specifics of your own situation and seek professional advice if necessary.

Frequently Asked Questions Of How To Pay Off Car Loan Faster

Can Extra Payments Reduce Car Loan Term?

Absolutely. Making additional payments directly to your principal balance can significantly decrease the loan term. This reduces your overall interest and can lead to earlier full repayment.

What’s The Effect Of Biweekly Payments On A Car Loan?

Biweekly payments can shorten your loan duration and save on interest. Paying half of your monthly amount every two weeks results in one extra full payment annually, reducing your loan balance faster.

Is Refinancing A Good Strategy To Pay Off A Car Loan?

Refinancing can be beneficial if you secure a lower interest rate. It reduces your monthly payments and the total interest paid, allowing you to allocate more funds to the principal balance.

How Does A Large Down Payment Impact Car Loan Repayment?

A larger down payment decreases the loan amount, which can reduce both your monthly payments and the total interest paid. This may enable you to pay off the loan more swiftly.

Conclusion

Paying off your car loan early can free up cash and save on interest. Adopt strategies like rounding up payments or making bi-weekly installments. Remember, every extra dollar accelerates your path to a debt-free life with full car ownership. Start implementing these tips today and drive towards financial freedom!