How to Lower Apr on Car Loan

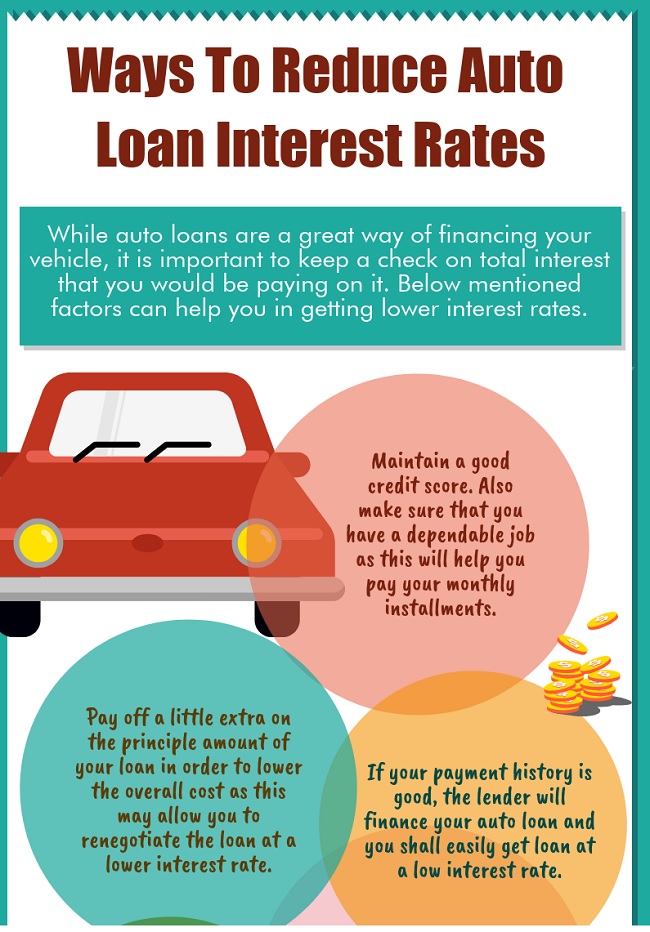

To lower APR on a car loan, refinance with a lower-interest loan or negotiate better terms with the lender. Improving your credit score can also lead to reduced rates.

Navigating the world of car financing can be intimidating, but securing a lower Annual Percentage Rate (APR) on your car loan can save you significant money over time. A high APR can balloon the overall cost of your vehicle, making it crucial to seek ways to bring that interest rate down.

Whether you’re in the midst of a loan or considering a new purchase, understanding the strategies to reduce your APR not only alleviates financial strain but also leads to more manageable repayment terms. Exploring refinancing options, bolstering your credit worthiness, and communicating directly with lenders are actionable steps toward lessening your financial burden. Keep reading to unlock the savvy methods for trimming your car loan’s APR, ensuring your car payments become more affordable and budget-friendly.

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

Credit: www.investopedia.com

Assessing Your Current Car Loan

Understanding your current car loan is the first step to lowering your APR. It involves checking your interest rates and loan duration. This will show you where there’s room for improvement. Let’s dive into evaluating your existing car loan terms.

Evaluating Interest Rates

Interest rates greatly affect how much you pay for a car loan. Compare your rates with the current market trends. Lower rates mean lower monthly payments. Use online tools to check average rates. This info can help you negotiate or refinance.

Reviewing Loan Duration

Your loan’s duration impacts your APR and overall cost. Shorter loans often have higher monthly payments but lower total interest. A longer loan duration has lower monthly payments but you pay more interest over time. Understanding this can guide your refinancing decision.

Here’s what to look at:

- Monthly payment: Can you afford more to shorten the loan duration?

- Total interest: How much will you pay in interest for the life of the loan?

- Remaining term: Do you have many years left on your loan?

Analyze these factors to decide if a refinance could be beneficial for you. Lowering your APR can save you money on your car loan.

Credit: roadloans.com

Credit Score Influence On Apr

Getting a lower APR on a car loan can save you money. Your credit score plays a big role. A better credit score often means a lower APR. Lenders use this score to judge how risky it is to give you a loan. A high credit score shows you’re a safe bet. It can lead to lower interest rates. Now, let’s look at ways to improve your credit score and time your loan application right.

Improving Your Credit Score

To boost your credit score, you must pay bills on time. You should keep debt low. Make sure your credit history is long. Use these tips:

- Check your credit report for errors. Get them fixed.

- Pay down credit card balances. Use less of your limit.

- Leave old accounts open. They help your credit age.

- Limit new credit inquiries. They can drop your score.

Doing these things improves your chances for a low APR. It takes time, so start now.

Timing Of Loan Application

The right timing can affect your APR. Apply when your credit score is strong. Check for deals during the year-end or holiday sales. Rates can be lower. Follow these tips:

- Look for promotional offers. Dealers may offer lower rates.

- Maintain a good payment history. Apply when it looks best.

- Consider refinancing. This works if your credit score goes up.

Timing matters as much as your credit score. Plan carefully to snag a low APR.

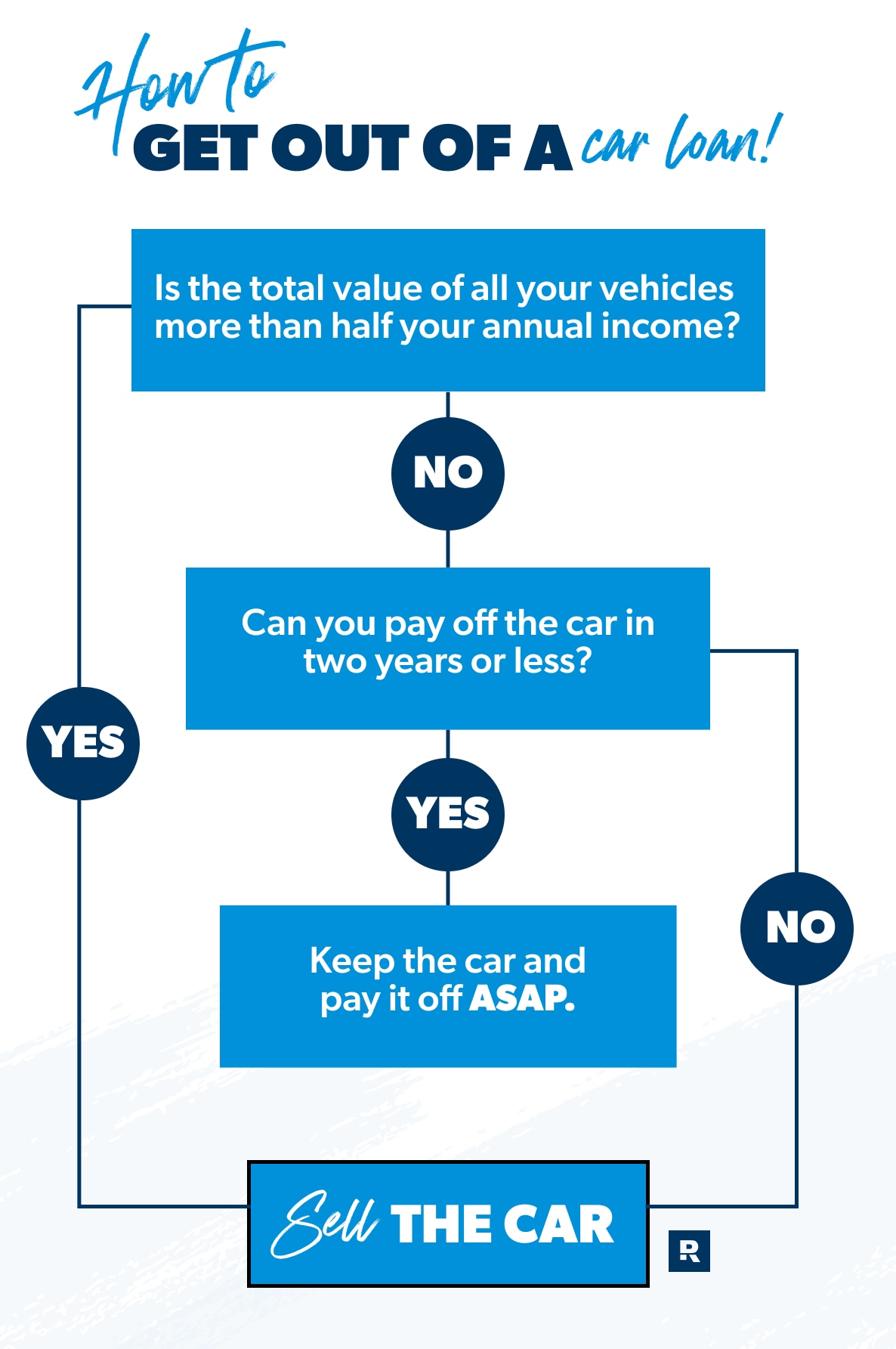

Refinancing As A Strategy

Driving down the APR on a car loan is a win for your wallet. Refinancing your car loan might be the key. This move can offer lower interest rates and better terms. To ensure success, you need to understand the refinancing process.

Choosing The Right Time To Refinance

Timing is crucial when it comes to refinancing. The best time hinges on several factors:

- Credit Score Improvement: A higher score can unlock better rates.

- Market Conditions: Lower market rates mean potential savings.

- Vehicle Equity: Owing less than the car’s worth helps.

- Loan Maturity: A new loan is best when it saves money over time.

Focus on the loan terms, not just the APR. Great timing leads to marked savings.

Finding The Best Refinancing Offers

Finding the top refinancing deals means doing your homework:

- Compare Lenders: Look at many lenders for the best rates.

- Check the Fees: Some deals have fees that affect savings.

- Read Reviews: Go for lenders with positive customer feedback.

- Negotiate Terms: Try to get rates and terms that suit your needs.

Use online tools like loan calculators. These help to estimate monthly payments. Opt for offers that bolster your financial position.

Credit: roadloans.com

Negotiating With Lenders

Getting a lower Annual Percentage Rate (APR) on a car loan can save you money. Lenders may seem firm, but APR rates are often negotiable. Before you sign on the dotted line, learn how to effectively communicate with your lender to potentially reduce your interest rates.

Tips For Effective Negotiation

- Know Your Credit Score: Higher scores improve bargaining power.

- Shop Around: Get quotes from multiple lenders for leverage.

- Understand the Rates: Know the going rates for someone with your credit profile.

- Ask for Discounts: Lenders may offer lower rates for certain payment methods.

- Be Confident but Polite: A firm, courteous approach can lead to better rates.

Come well-prepared with information about your financial situation and the current car loan market. This shows lenders that you are serious and ready to negotiate.

Long-term Relationships And Apr

Developing a good relationship with your lender can lead to future perks, such as reduced APRs. Loyalty might be rewarded with better loan conditions.

| Relationship Factor | APR Advantage |

|---|---|

| Previous Loans Paid on Time | Strong Repayment History |

| Multiple Accounts with Lender | Potential for Bundling Discounts |

| Referrals to New Customers | Discounts as Appreciation |

| Negotiation History | Quicker, More Positive Outcomes |

If you have a track record of loyalty to the bank or lender, mention it during negotiation. Remind them of your timely payments and previous business together.

Other Factors Affecting Apr

Understanding the factors that influence your car loan’s APR (Annual Percentage Rate) is key to securing better terms. Beyond credit scores and market rates, specific actions can lead to more favorable APRs. Explore how making larger down payments and selecting shorter loan terms can make a significant difference.

Making Larger Down Payments

The upfront amount you pay influences your loan’s APR. Larger down payments decrease the loan amount, reducing the lender’s risk. Here’s why this matters:

- Lower Interest Rates: Banks often offer lower APRs as the loan risks get smaller.

- Reduced Loan-to-Value Ratio: A lower ratio appeals to lenders, often securing better rates.

- Improved Loan Terms: With a substantial down payment, negotiating the terms becomes easier.

Tip: Aim for at least 20% of the car’s value as a down payment.

Opting For Shorter Loan Terms

Short-term loans can lead to lower APRs. Here’s the rationale:

- Quick Repayment: Lenders favor quicker returns on investment, often rewarding with lower rates.

- Less Interest Accumulation: Over time, short-term loans accumulate less interest.

- Equity Building: Paying off loans faster builds equity in the car, reducing depreciation impacts.

Note: Shorter terms mean higher monthly payments. Ensure they align with your budget.

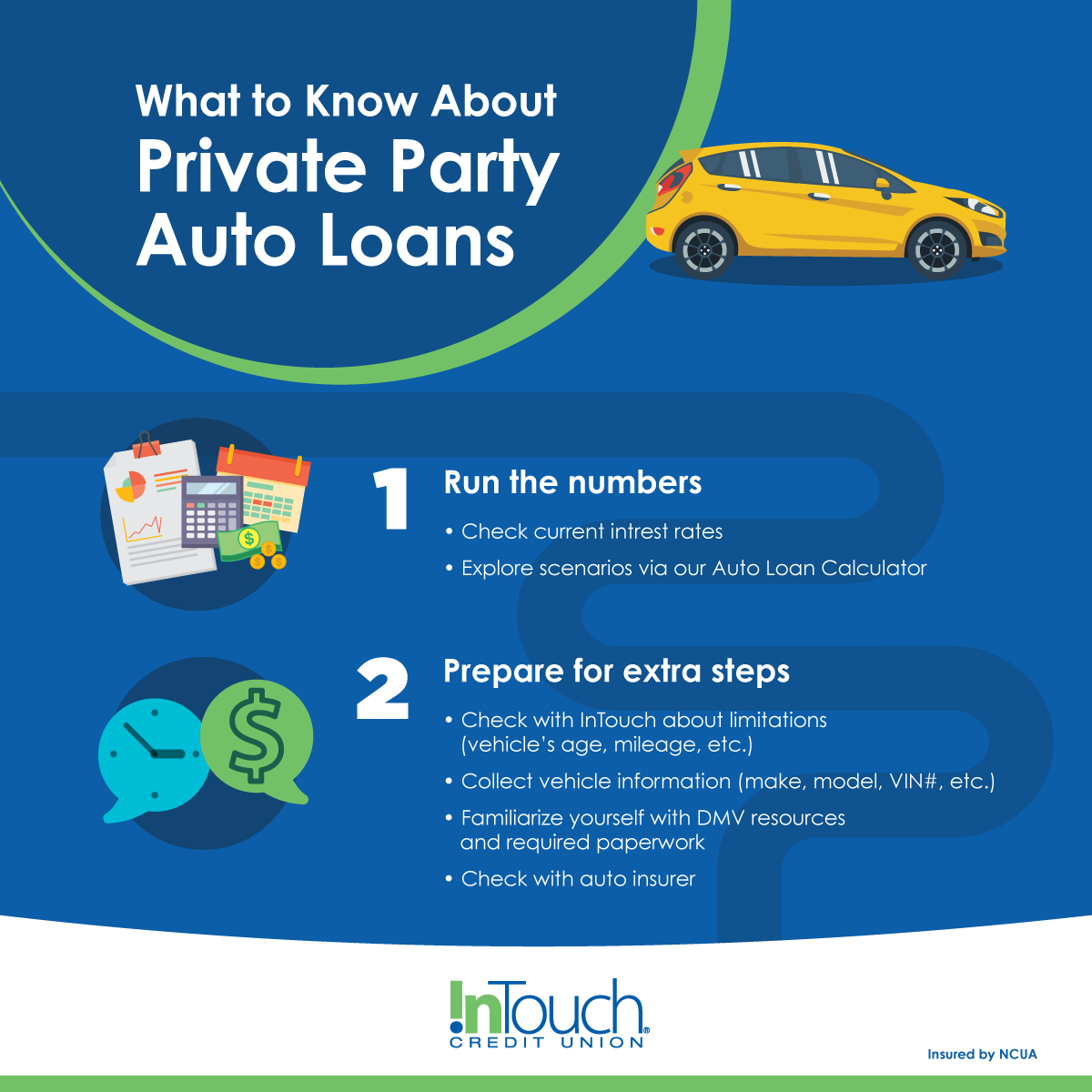

Utilizing Auto Loan Calculators

Auto loan calculators are essential tools for anyone looking to lower their APR on a car loan. They help plan and compare loan options effortlessly. With these calculators, you can input different variables, like the loan amount, term, and interest rates, to understand your potential savings. Now, let’s explore how to make the most of these calculators to secure a more favorable car loan.

Planning Your Repayments

An auto loan calculator simplifies repayment planning. Enter the loan details to see your monthly payment. Adjust the loan amount or term and watch the changes in real-time. This assists in finding a comfortable payment amount, avoiding late fees, and maintaining a budget.

Follow these steps:

- Choose an auto loan calculator online.

- Input your loan amount, interest rate, and term.

- Review the calculated monthly payment.

- Adjust the variables to fit your budget.

Comparing Different Loan Scenarios

Comparing loan options side by side can bring significant savings. Use a calculator to play with different APRs and terms. Notice how even a slight rate reduction can lower your overall cost. This comparison empowers you to negotiate better rates with lenders or choose a deal that aligns with your financial goals.

Try this comparison:

| Loan Option | APR (%) | Term (Years) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| Option 1 | 5 | 4 | $230 | $2,040 |

| Option 2 | 4.5 | 4 | $225 | $1,800 |

| Option 3 | 4 | 4 | $220 | $1,600 |

With these straightforward tools, planning and comparing repayment options becomes a breeze. Embrace auto loan calculators to make informed decisions and save on your car loan.

Frequently Asked Questions On How To Lower Apr On Car Loan

Can Refinancing Lower My Apr?

Refinancing your car loan can potentially lower your APR, especially if your credit score has improved since you took out the original loan. It involves getting a new loan with better terms to pay off your existing one.

What Affects Apr On Car Loans?

APR on car loans is influenced by credit score, loan term, lender policies, and market interest rates. A higher credit score and shorter loan term can result in a lower APR. Shopping around lenders can also help find a lower rate.

How Can I Negotiate A Lower Apr?

To negotiate a lower APR, start by checking your credit score and improving it if necessary. Compare rates from multiple lenders and use these as leverage in negotiations. Don’t be afraid to ask lenders to match or beat competitor rates.

Does A Larger Down Payment Affect Car Loan Apr?

A larger down payment doesn’t directly affect the APR, but it can indirectly lead to better rates. It reduces the lender’s risk and the overall loan amount, which could result in more favorable loan terms, including a lower APR.

Conclusion

Securing a lower APR on your car loan doesn’t have to be daunting. With diligent research, a strong credit score, and the willingness to negotiate, you can potentially save a substantial amount over the lifespan of your loan. Remember, every percentage point counts, so take the steps we’ve covered and drive away with a deal that keeps more money in your pocket.