How to Get Your Name off a Car Loan

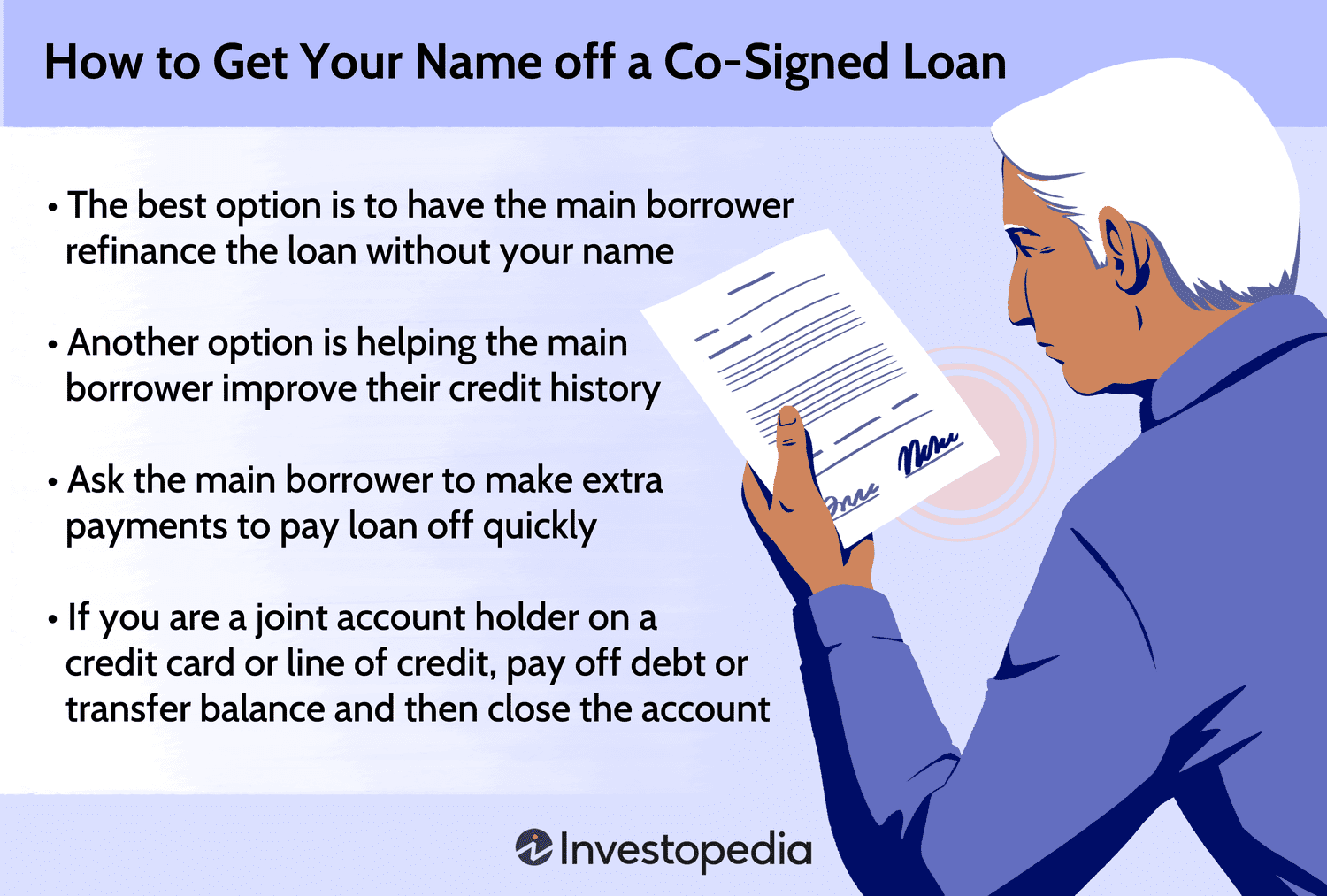

To remove your name from a car loan, you must either pay off the loan, refinance it, or have someone assume it. Selling the vehicle and using the proceeds to clear the debt is another option.

Securing a car loan with someone else can initially seem like a great idea, but circumstances change. You might decide that having your name on a car loan is no longer favorable or even sustainable. Perhaps you’re looking to improve your debt-to-income ratio or you’re no longer in possession of the car.

Getting out of a car loan isn’t always straightforward, but it’s possible with the right strategy. This typically involves interacting with lenders, seeking qualification for refinancing, or finding a trustworthy individual to transfer your loan obligations to. A clear understanding of the loan terms and credit implications is critical before making any changes. We’ll outline the steps you need to take for a smooth and efficient removal of your name from a car loan.

Assessing The Car Loan Situation

Are you considering how to remove your name from a car loan? Proper assessment is your first step. This can be complex, but understanding your loan details helps. Let’s navigate how to assess your car loan situation effectively.

Reading The Fine Print

Knowing your loan agreement is vital. Start with the loan contract. Look for details about removing a name. Check for early payoff penalties. Identify obligations and rights.

- Loan Duration: Check how long you have to pay.

- Monthly Payments: Remember these figures.

- Premature Closure Fees: Know if these apply.

Understanding Loan Transferability

Some loans let you transfer responsibility to another person. This is called loan transferability. Here are actions to take:

- Study your loan’s transfer policy.

- Seek approval from your lender.

- Find someone reliable to take over the loan.

Remember, lenders must approve the new borrower. They must meet credit requirements. Without lender approval, a transfer can’t happen.

Credit: www.bankrate.com

Exploring Loan Assumption

Getting out of a car loan can be tricky, but loan assumption may be an option. This method allows someone else to take over the loan under their name. It can save time and avoid early payment penalties. To get started, understanding the eligibility and the process is key. Let’s dive into how to navigate through this path.

Eligibility Criteria For Assumption

Not all lenders allow loan assumptions. To find out if yours does, contact them directly. They will explain the requirements. Criteria often include:

- Credit Score: The new borrower must meet the lender’s credit standards.

- Debt-to-Income Ratio: This shows the new borrower can afford the payments.

- Loan Status: Current and not in default.

- Vehicle Condition: The car must be worth at least as much as the loan balance.

If these points are checked, the next step is the actual process.

Process Of Assuming A Car Loan

- Contact the Lender: Get the assumption process details.

- Application: The new borrower fills out application forms.

- Credit Check: The lender assesses the new borrower’s creditworthiness.

- Transfer Paperwork: If approved, paperwork transfers the loan.

- Release of Liability: The original borrower gets a release document.

The process can take a few weeks. Both old and new borrowers should keep a copy of all documents.

Remember, the goal is a smooth transition for both parties. Clear communication and meeting all lender requirements are paramount. With successful loan assumption, you can move forward without the car loan in your name.

Refinancing The Car Loan

Do you want a better deal for your car loan?

Refinancing could be the key. It can mean lower payments. It could even mean saying goodbye to that loan in your name. Let’s explore how to make this happen!

Requirements For Refinancing

To refinance, you need to check off a few boxes first:

- Good credit score for better rates

- Stable income for reliable payments

- Vehicle value higher than the loan amount

- Timely car payments for at least a year

Meet these? Your next step awaits.

Comparing Refinance Lenders

Finding the right lender is like shopping for the perfect car—it’s got to fit just right.

| Lender Name | Interest Rates | Fees | User Reviews |

|---|---|---|---|

| AutoLoanCo | 3.5% – 5.5% | $0 | ★★★★☆ |

| CarRefiNow | 3.0% – 4.5% | $0 | ★★★★★ |

| EasyDriveRefi | 4.2% – 6.0% | $100 | ★★★☆☆ |

Compare. Choose. And get ready for a brighter financial path.

Credit: www.moneylion.com

Selling The Vehicle To Release Liability

Getting your name off a car loan is no small task. Selling the vehicle to release liability stands as a clear path to freedom. This means, when the car sells, you’re no longer tied to the loan. Let’s explore how to make this happen step by step.

Determining The Car’s Value

First, know what your car is worth. Many online tools can help with this. Look at your car’s make, model, year, and condition. Be honest about its state. Compare prices from multiple sources for a fair estimate.

- Use online valuation tools like Kelley Blue Book or NADA Guides.

- Check local listings for similar vehicles.

- Consider professional appraisals for a precise value.

Finalizing The Sale Process

With the right price set, prepare for the sale. Gather all necessary documents. This includes the title and maintenance records. Clean the car and make small repairs to improve its appeal.

- Advertise the car where buyers look. Think online platforms and local boards.

- Screen potential buyers to secure a genuine sale. Meet in safe locations.

- Provide a test drive and be ready to answer questions about the car.

- Negotiate the price fairly, finalize the payment, and sign over the title. This releases you from the loan.

Remember, once you sign the title, inform the lender. Provide proof of sale to close the loan. Keep copies of all paperwork. This is your proof you’re free from the loan.

Legal Transfer Of Responsibility

Want to remove your name from a car loan? It seems complex, but with the right approach, it’s doable. The key lies in legally transferring the obligation to another party. This safeguard ensures the lender’s approval and keeps your credit score intact. Prepare to navigate through negotiations and legal documentation to achieve your goal.

Negotiating With The Co-signer

Starting the legal responsibility transfer means talking to your co-signer. They have rights and obligations tied to the loan, so their agreement is crucial. Address potential concerns and discuss why shifting the loan entirely to them is beneficial for both parties. Remember, clear communication paves the way for a smooth transition.

- Explain why you want off the loan

- Discuss how the change could help them

- Assure them of the process’s legality

Drafting A Contractual Agreement

A solid contractual agreement is the cornerstone of this process. Hire a lawyer to craft a legally sound contract. This document should detail the transfer and protect all involved parties. Check with your lender if they have specific requirements or forms.

| Step | Action |

|---|---|

| 1 | Consult a legal expert |

| 2 | Create a contract outlining the transfer terms |

| 3 | Get approval from all parties |

| 4 | Submit the contract to the lender for final approval |

Credit: www.bankrate.com

Seeking Professional Advice

Are you wondering how to remove your name from a car loan? Seeking professional advice may be the safest route. Experts can guide you through this financial shift.

Consulting A Financial Advisor

A financial advisor understands complex credit issues. Meet one early on. They’ll explore options to protect your credit score. Potential strategies include:

- Refinancing the loan

- Loan assumption agreements

- Balancing debt-to-income ratio

Advisors tailor plans to your needs. They aim for minimal financial impact.

Understanding Legal Implications

Car loans involve legally binding agreements. Lawyers decode these contracts. They clarify rights and obligations. Key areas they address:

- Contract terms

- State laws

- Transfer procedures

Advice from a lawyer ensures you make law-abiding decisions. It keeps the process smooth.

Frequently Asked Questions For How To Get Your Name Off A Car Loan

Can I Remove My Name From A Car Loan?

Removing your name from a car loan usually requires refinancing. The borrower needs to secure a new loan, solely in their name, to pay off the existing joint loan. Your credit score and payment history influence the success of this process.

What Are The Consequences Of A Joint Car Loan?

Joint car loans imply shared responsibility. If payments are missed, both parties’ credit scores suffer. Conversely, if payments are timely, both parties can see improved credit. Defaulting on the joint loan may lead to serious financial and credit consequences.

How Long Does Refinancing A Car Take?

Refinancing a car loan can take from a few days to a few weeks. It depends on factors such as the lender’s efficiency, your documentation readiness, and the complexity of your financial situation. Quick response times can expedite the process.

Is A Cosigner’s Permission Needed To Refinance?

Yes, you need your cosigner’s permission to refinance a car loan. Both parties must agree to modify the terms of the original contract. The cosigner must be informed and consent prior to applying for refinancing.

Conclusion

Navigating the process of removing your name from a car loan requires diligence. Consulting with lenders and considering refinancing or selling the car are key steps. Remaining informed and proactive ensures your financial freedom. Remember, the right approach can lead to a successful resolution.

Take action to protect your credit score and find peace of mind.