How to Get Prequalified for a Car Loan

To get prequalified for a car loan, submit your financial information to a lender. The lender assesses your creditworthiness and offers a potential loan amount.

Securing a car loan can be less daunting if you’re prepared. Getting prequalified is a smart move; it gives you an edge when car shopping, showing sellers you’re a serious buyer. It also helps in budgeting, as you know how much you can afford before hitting the dealership.

Start by gathering your financial details—your income, debts, and credit score. Choose a reputable lender or financial institution, and approach them for prequalification. Through this process, you’ll receive insights into the loan terms you might receive, such as the interest rate and loan duration. Prequalification typically requires a soft credit check, which won’t impact your score. This step paves the way for a smoother car buying experience, ensuring you stay within your financial limits.

The Basics Of Prequalification For Car Loans

Navigating the path to a new car involves several steps. One crucial phase is prequalification for a car loan. Understanding this process is like assembling a road map that points toward the best car purchase options.

What Prequalification Means In Auto Financing

Prequalification is a lender’s informal way of assessing your creditworthiness. It reveals how much you might borrow based on your financial background. Prequalification is not a final loan offer.

Benefits Of Getting Prequalified

- Enhances Your Budgeting: It gives a clear picture of how much you can spend.

- Saves Time: Car shopping becomes more efficient as options are narrowed down.

- Safeguards Your Credit Score: Prequalification often uses a soft credit check, which doesn’t impact your score.

- Gives You Negotiation Power: Armed with prequalification, you’re a serious buyer in the eyes of the seller.

.jpg)

Credit: www.3riversfcu.org

Preparing Your Personal Finance Information

Before stepping into a dealership, getting prequalified for a car loan sets the stage. It’s like having a financial blueprint. This journey starts with preparing personal finance information.

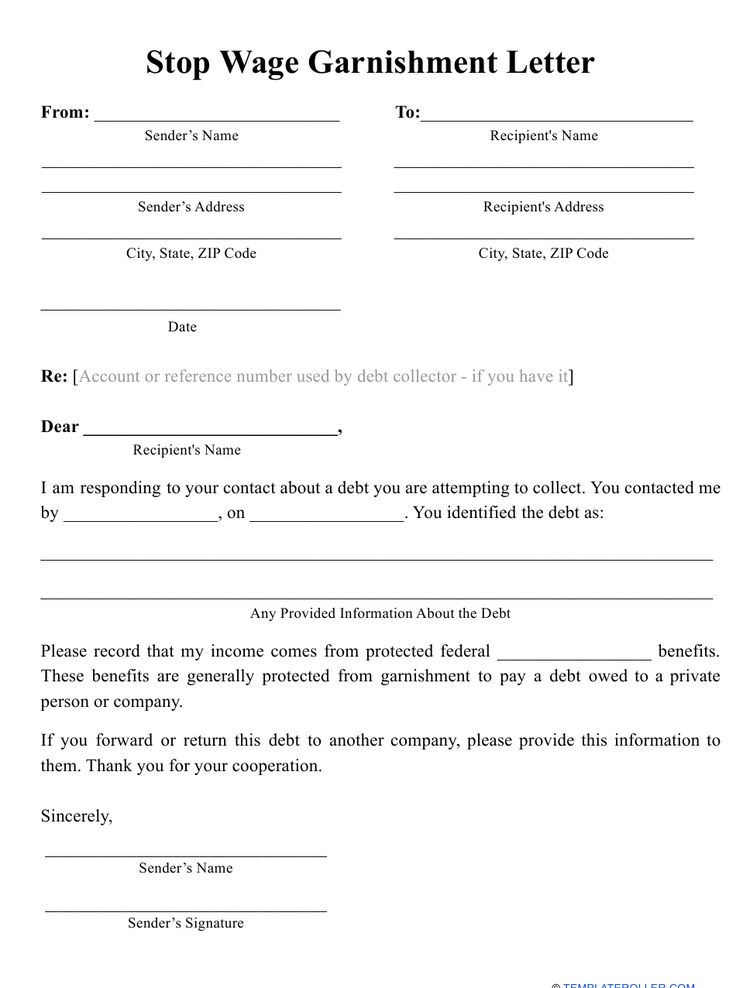

Documents Required For Prequalification

Gathering the right documents is the first vital step. Lenders will ask for specific paperwork to prequalify for a car loan.

| Type of Document | Details |

|---|---|

| Proof of Identity | Driver’s license or ID |

| Proof of Income | Recent pay stubs |

| Proof of Residence | Utility bill or lease agreement |

| Credit and Bank Details | Bank statements and credit card details |

| Vehicle Information | If applicable, details of the car |

Understanding Your Credit Score’s Role

Your credit score is a three-digit number that tells lenders about your credit history. A higher score can mean better loan terms.

- 700 and above is considered good.

- 600 to 699 is fair.

- Scores below 600 might need extra help.

Check your credit score before applying. This way, you know what to expect. You can get a free report once a year from AnnualCreditReport.com.

Choosing The Right Lender

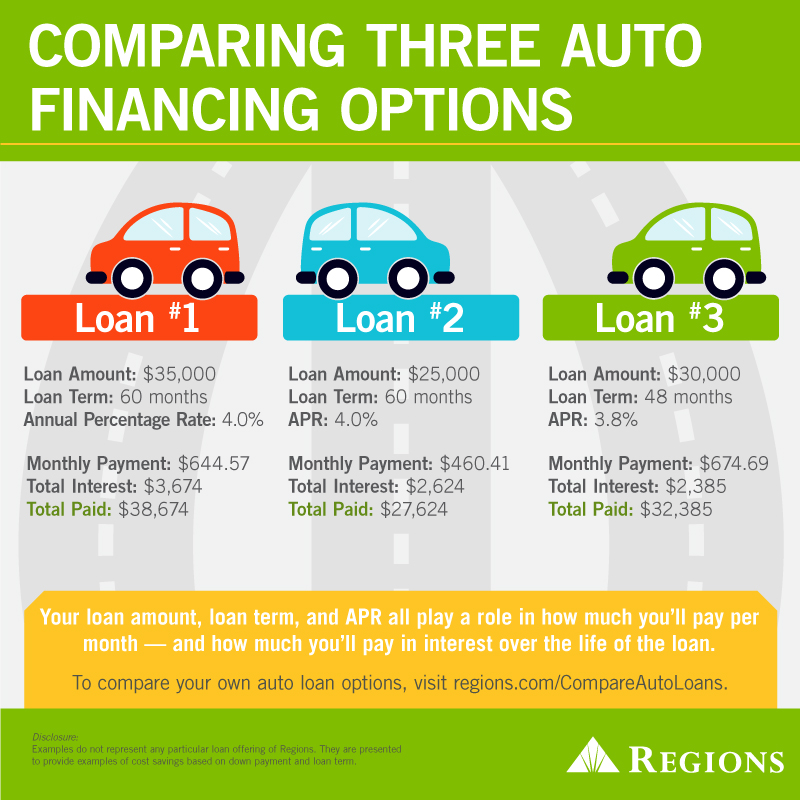

Getting prequalified for a car loan is a smart move. Choosing the right lender is crucial. It affects your interest rates, loan terms, and experience. Let’s dive in to understand your options.

Bank Versus Dealership Financing

Your main options are banks and dealerships. Each has pros and cons.

Banks often offer competitive rates and personalized service. You can build a relationship that extends beyond the car loan.

Dealerships, on the other hand, provide convenience. You can finance on the spot. But, they might have higher rates.

- Banks may offer better rates

- Dealerships enable easy financing

- Research both for the best deal

Online Lenders: A Convenient Option

Online lenders are a game-changer.

They let you shop from home. They are fast and often have great deals. Be sure to read reviews and check terms.

| Online Lender Pros | Online Lender Cons |

|---|---|

| Convenient | Less personalized |

| Quick prequalification | May have hidden fees |

| Potentially lower rates | Limited face-to-face interaction |

Remember to compare. Check rates, terms, and fees. Your perfect lender is out there!

Credit: www.loanry.com

The Prequalification Process Explained

Getting prequalified for a car loan is a first step in buying a new vehicle. It shows how much you may borrow. It also helps budget for a car. Let’s explore this process in detail.

Step-by-step Guide To Applying

To start your car loan prequalification, follow these simple steps:

- Gather Documents: Collect your ID, pay stubs, and bank statements.

- Check Credit Score: Know your credit score, as it impacts your loan terms.

- Choose a Lender: Look for banks, credit unions, or online lenders.

- Fill Out Application: Complete the lender’s prequalification form.

- Review Offers: Compare interest rates, terms, and loan amounts.

Finding out if you’re prequalified usually doesn’t hurt your credit score. Always ask lenders if they do a soft or hard inquiry.

What To Do If You Face Prequalification Rejection

A prequalification rejection isn’t the end. Take these bold steps:

- Analyze Reason: Lenders must tell you why. Understand this first.

- Improve Credit: Pay debts, fix errors, and wait for improvements.

- Consider a Co-signer: A trusted person with good credit can help.

- Explore Other Options: Some lenders specialize in bad credit loans.

- Reapply: After improvements, try the prequalification process again.

Every rejection is a chance to boost your financial profile. Don’t give up, work on it!

Impact On Your Credit Score

When you decide to get prequalified for a car loan, your credit score plays a pivotal role. It affects loan approval and interest rates. It’s vital to understand how prequalification might impact your credit score. This process involves inquiries into your credit report. Knowing the difference between inquiry types is crucial.

Hard Inquiry Vs. Soft Inquiry

Inquiries are credit checks lenders perform to evaluate your creditworthiness. There are two main types: hard inquiries and soft inquiries. Hard inquiries occur when lenders make a complete credit check. They often happen when you apply for a loan or credit card. This type can affect your credit score. Soft inquiries are less intrusive. They might happen when you check your own credit or when lenders pre-screen for offers. Soft inquiries do not affect your credit score.

- Hard Inquiry

- Complete examination of credit

- Triggered by loan applications

- Can lower credit score slightly

- Soft Inquiry

- Basic credit check

- Occurs during prequalification

- No impact on credit score

How Prequalification Affects Your Credit

Prequalification typically involves a soft inquiry. This process gives lenders a quick look at your creditworthiness without a deep dive. Since it’s generally a soft inquiry, prequalification doesn’t harm your credit score. Yet, always confirm with the lender. If they perform a hard inquiry instead, your score might dip slightly. Multiple hard inquiries in a short period can have a greater impact. Therefore, limit the number of applications you fill out.

| Type of Inquiry | Credit Impact | Prequalification Usual Process |

|---|---|---|

| Hard Inquiry | May lower score | Rare in prequalification |

| Soft Inquiry | No effect on score | Common in prequalification |

Next Steps After Prequalification

Once you’ve got your prequalification in hand, it’s time to take the next step in your car-buying journey. You’ll move from a hopeful shopper to a serious buyer. Let’s dive into the process and look at what to do after you’re prequalified for that car loan.

Negotiating A Car Purchase With Prequalification

Armed with prequalification, you enter the dealership with confidence. You know what you can afford. This sets the stage for smart negotiation. Follow these tips:

- Stick to your budget: Don’t let slick sales talk sway you. Stay firm on your pre-set spending limit.

- Show the dealer your prequalification: This shows them you’re serious and ready to buy.

- Discuss total cost, not just monthly payments: Focusing on the total expense avoids long-term, costly loans.

- Don’t forget trade-ins or rebates: These can greatly lower your purchase price.

Remember, with prequalification, you have the upper hand to negotiate terms that work best for you.

Finalizing The Loan: From Prequalification To Approval

The journey from prequalification to approval involves several critical steps. To ensure a smooth transition, consider these key actions:

- Submit all required documents promptly: These include identification, proof of income, and residency documents.

- Choose the right car within your prequalified amount.

- Read and understand the loan terms fully before agreeing.

Once the lender reviews your documents and finalizes the loan, you’re ready to drive away in your new car. Final approval seals the deal, and it’s time to enjoy your vehicle!

Credit: www.loanry.com

Frequently Asked Questions Of How To Get Prequalified For A Car Loan

How Do I Prequalify For Auto Loan?

To prequalify for an auto loan, review your credit score, gather financial documentation, choose a lender, and submit a prequalification application. A lender will assess your creditworthiness and provide potential loan terms.

Where Is The Best Place To Prequalify For A Car Loan?

The best place to prequalify for a car loan is typically through your bank or credit union. Online lenders and dealership financing departments are also viable options. Each offers different advantages, such as competitive rates or convenience.

Does Getting Pre-qualified Car Loan Hurt Credit?

Getting pre-qualified for a car loan typically involves a soft credit inquiry, which does not hurt your credit score.

Do Pre Approvals Affect Your Credit Score?

Getting a pre-approval can result in a hard inquiry on your credit report, which might slightly lower your credit score temporarily. Each inquiry typically affects your score by less than five points.

Conclusion

Embarking on your car-buying journey with a prequalification puts you in the driver’s seat. It streamlines the process, sets a clear budget, and demonstrates to sellers your serious intent. Take the necessary steps, gather documents, and consult with lenders. With prequalification in hand, you can confidently navigate the dealership landscape, assured that the keys to your new car are within reach.