How to Get a Loan for a Used Car

To get a loan for a used car, start by checking your credit score and evaluating your budget. Compare loan offers from multiple lenders to ensure you get the best rates.

Securing a loan for a used car can be a straightforward process if approached methodically. Begin by analyzing your financial standings and credit health to set realistic expectations for loan terms. With a solid understanding of your credit score, explore various financing options, focusing on those with competitive interest rates and favorable terms.

Engage with banks, credit unions, and online financiers to find the ideal match for your financial situation. It’s essential to pre-qualify and compare loan offers, which could potentially save you hundreds or even thousands in interest over the life of the loan. Don’t forget to account for the total cost of ownership, including insurance, maintenance, and registration, when planning your budget. Thorough research and preparation will position you to negotiate a used car loan that aligns with your financial goals.

Pros And Cons Of Financing A Used Car

When you’re in the market for a vehicle, a used car can be a savvy choice. Financing a used car offers several advantages and disadvantages worth considering. Understanding these can guide you in making an informed decision tailored to your financial situation.

Benefits Of Opting For A Used Car Loan

- Lower purchase price: A used car typically costs less than a new one, meaning smaller loan amounts.

- Less depreciation: Pre-owned cars depreciate slower, protecting your investment over time.

- Potential for better interest rates: With a good credit score, you could secure favorable loan terms.

- Lower insurance rates: Insurance generally costs less for used cars, freeing up more of your budget.

- Wide variety: The used car market offers diversity, increasing your chances of finding the perfect match.

Challenges And Drawbacks To Be Aware Of

- Higher interest rates: Sometimes, lenders charge more for used car loans.

- Shorter loan terms: This might lead to higher monthly payments.

- Vehicle history: Used cars come with a past, so diligent checks are necessary to avoid surprise repairs.

- Mileage concerns: A car with high mileage might need more maintenance, impacting your budget.

- Limited warranty: Fewer warranty options can mean more out-of-pocket expenses.

Determining Your Budget

Embarking on the quest for a used car involves more than just picking a model; it’s crucial to determine your budget. A clear budget acts as your financial compass, ensuring you stay on track and avoid overspending. Let’s navigate the financial aspects step by step.

Assessing Your Financial Landscape

Understanding your current financial status is the first step to setting a budget for a used car. This involves calculating your monthly income and subtracting expenses.

| Income | Expenses | Balance |

|---|---|---|

| $X per month | $Y per month | $Z per month |

The balance, or $Z, is what you might consider for your car payment. But remember, this is not the final number.

- Include savings and emergency funds.

- Factor in existing debts and financial commitments.

- Consider future expenses that may affect your budget.

Setting Realistic Repayment Goals

Once you understand your financial landscape, establish repayment goals that align with your budget.

- Look at the loan amount you can afford.

- Determine the maximum monthly payment that won’t strain your finances.

- Consider the loan’s term; longer terms mean smaller payments but higher overall costs.

Use a loan calculator to play with different scenarios. This will give you a realistic idea of what to expect.

Understanding Your Credit Score

Thinking about buying a used car with a loan? Great! First things first: let’s talk about your credit score. Understanding this number is like holding a map when you’re lost. It guides lenders to say “yes” to your loan. Surprise! It’s not just a number but a story of how you handle money.

Importance Of Credit History In Loan Approval

Credit history acts as your financial report card. Lenders peek at it to decide if they should lend you money. A good score? Thumbs up for loan approval. A not-so-good score? That’s a speed bump. Our tips aim to make your credit history shine.

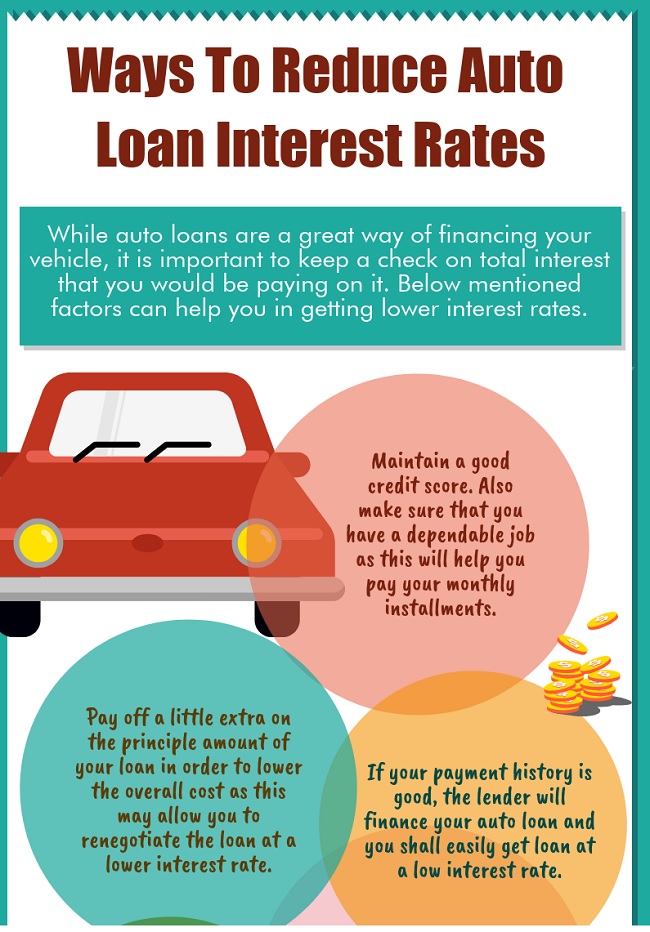

Ways To Improve Your Credit Score Before Applying

To amp up your credit score, focus on paying bills on time. Slash your debt. Swipe your credit card less. Think of it as preparing for a marathon. You want to be in top shape before you hit the starting line, right?

- Check Credit Reports: First, see where you stand. Spot mistakes? Fix them fast.

- Pay Bills Promptly: Late payments are no-nos. Set reminders if needed.

- Reduce Debts: Owe money? Make a plan. Pay a little extra each month.

- Keep Old Accounts Open: Got old credit cards? Keep them. Old credit is good credit.

- Limit New Credit Lines: More credit cards can hurt. Apply only when necessary.

By following these steps, you polish your credit score until it gleams. Your dream car is closer than you think!

Credit: www.spinny.com

Choosing The Right Used Car Loan

Buying a used car often means securing a loan to finance the purchase. Knowing how to pick the right loan is vital. This ensures affordability and a wise financial decision.

Comparing Lenders And Interest Rates

Start by exploring multiple lenders. Both banks and online financial institutions offer used car loans. Compare their interest rates. A lower rate means less interest over the loan’s life.

Consider the following:

- Credit Union: Often provides lower rates.

- Bank: A familiar option with possible customer discounts.

- Online Lenders: Convenient but verify credibility.

A handy comparison table can clarify choices:

| Lender Type | Interest Rate | Customer Reviews |

|---|---|---|

| Credit Union | Low | Positive |

| Bank | Varies | Mixed |

| Online | Competitive | Check Carefully |

Understanding Loan Terms And Conditions

Read all loan details before committing. Know the repayment period, monthly payment amount, and penalties for late payments. Ask questions about anything unclear.

Key aspects to understand:

- Total loan amount

- Annual Percentage Rate (APR)

- Loan duration

Ensure the loan terms align with your financial situation.

Secured Vs. Unsecured Loans

Loans come as secured or unsecured. Secured loans need collateral like the car itself. Unsecured loans don’t need collateral but might have higher interest rates.

Consider:

- A secured loan generally has lower rates.

- An unsecured loan carries more risk to the lender, reflected in the rates.

Choose based on your comfort with the level of risk and your financial capacity.

Navigating The Application Process

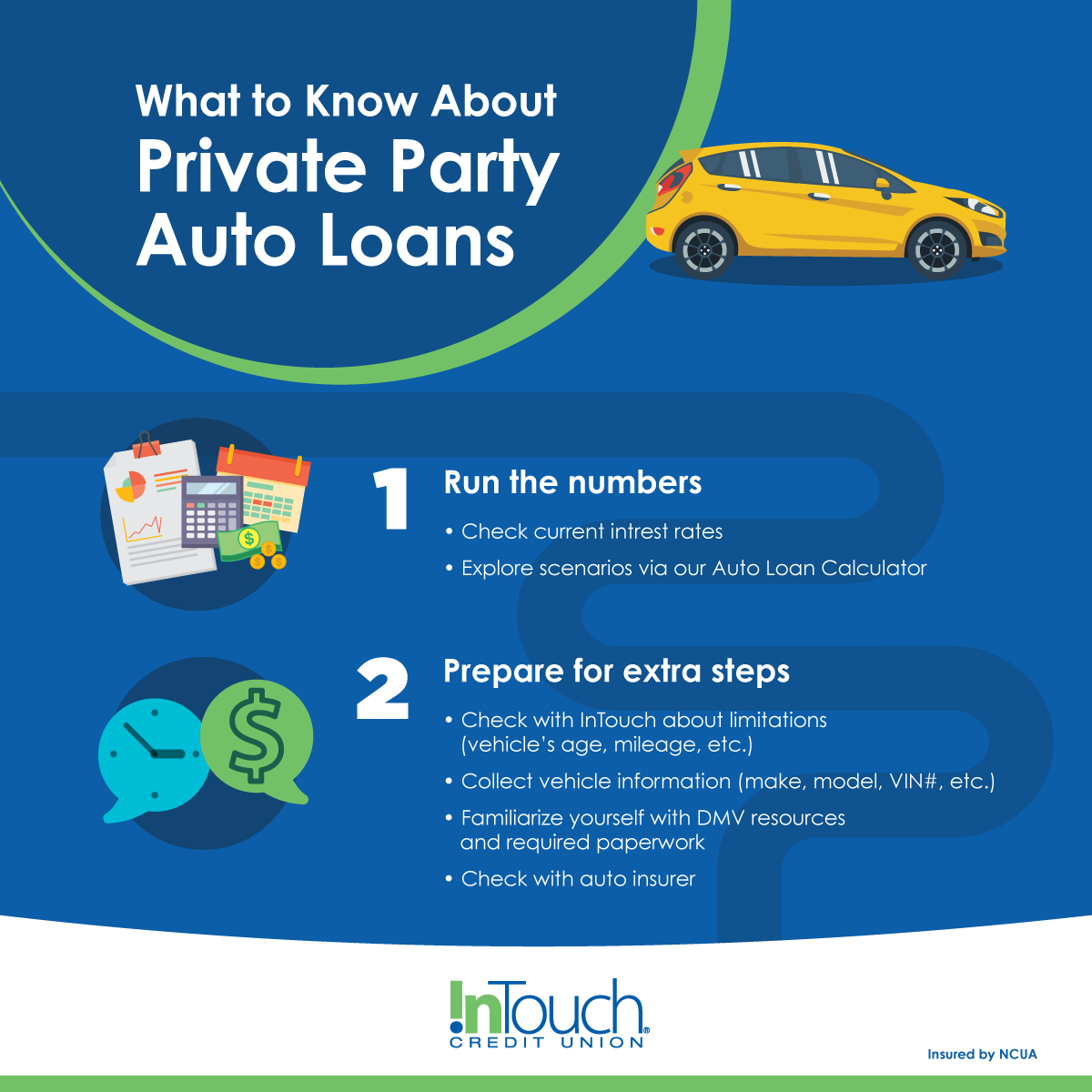

Understanding the application process for a used car loan is crucial. It can seem daunting, but don’t worry. We’ll guide you through each step. Prepare the right documents and follow a straightforward path towards approval.

Documentation Required For Loan Approval

Gather these documents before applying for a used car loan. Lenders need proof of your ability to pay back the loan.

- Identification: Photo ID like a driver’s license or passport.

- Income proof: Recent pay stubs or tax returns.

- Residence proof: A utility bill or lease agreement.

- Insurance: Details of your current car insurance.

- Vehicle Information: The car’s title and registration.

- Credit History: Your credit score will be checked.

Steps To Take When Applying For A Used Car Loan

Follow these steps for a smooth application process. Be meticulous to increase your chances of loan approval.

- Check Credit Score: Know where you stand before lenders do.

- Compare Lenders: Look for the best interest rates and terms.

- Get Pre-Approval: This shows sellers you’re serious.

- Select Your Car: Choose a reliable, budget-friendly vehicle.

- Negotiate Price: Use pre-approval to your advantage.

- Finalize Loan Details: Agree on payment schedule and rates.

- Close the Deal: Sign paperwork and drive your new car home.

Credit: www.experian.com

Closing The Deal

Sealing the deal on your used car purchase is a thrilling moment, but it’s important to handle the last steps with care. You must finalize loan terms, know what to expect at the dealership, and ensure the vehicle transfer is complete. Follow these guidelines to transition smoothly from buyer to proud car owner.

Finalizing The Loan Terms

Understanding your loan terms is key to a successful car purchase. Before you sign any paperwork, review the interest rate, monthly payment, and loan period. Ensure all figures align with your initial discussion. Don’t hesitate to ask questions if anything is unclear. A transparent breakdown of your loan terms can prevent surprises later on.

| Loan Term Component | What to Check |

|---|---|

| Interest Rate | Confirm it’s the agreed-upon rate |

| Monthly Payment | Ensure it fits your budget |

| Loan Period | Know when your loan ends |

What To Expect At The Car Dealership

At the dealership, prepare for paperwork. Sales representatives will guide you through contracts and finance options. Be ready to present your driver’s license, proof of insurance, and any agreed-upon down payment. It’s time to review the car’s history report, confirm its condition, and take one last test drive.

- Personal Identification

- Insurance Proof

- Down Payment

- Vehicle History Report

- Final Test Drive

Ensuring Proper Vehicle Transfer And Registration

You must transfer the title and register your car. The dealer may handle this, but checking is crucial. Verify the Vehicle Identification Number (VIN) and ensure all documents are signed. Pay any applicable sales tax and registration fees. Leave with your proof of ownership and a timeline for receiving your license plates.

- Check VIN on Paperwork Matches Car

- Sign All Required Documents

- Pay Sales Tax and Fees

- Obtain Ownership Proof

- Know Plate Issuance Schedule

Credit: www.debt.org

Frequently Asked Questions For How To Get A Loan For A Used Car

Can I Finance A Used Car?

Yes, you can finance a used car through various lenders like banks, credit unions, and online financial services. Terms and interest rates may vary based on the lender and your creditworthiness.

What’s Needed For A Used Car Loan Approval?

Lenders typically require good credit, stable income, proof of insurance, and a valid driver’s license. Down payment and vehicle information such as make, model, and mileage are also important for loan approval.

How Does Credit Score Affect Used Car Loans?

Your credit score influences the interest rate and loan terms. Higher credit scores generally secure lower interest rates, resulting in lower overall costs for the loan.

Is A Down Payment Necessary For A Used Car Loan?

Most lenders prefer a down payment as it reduces their risk and can help you obtain a lower interest rate. However, there are options available that allow for zero down payment.

Conclusion

Securing financing for a used vehicle need not be daunting. Start by assessing your budget and credit score. Then, explore various lenders and compare rates. With these actionable steps, you’re equipped to navigate the loan process. Remember, the right preparation leads to the best loan terms for your used car purchase.

Drive ahead confidently in your search for financing!