How to Get a Car Loan from a Bank

To get a car loan from a bank, submit a loan application and provide the necessary financial documents. Ensure you have good credit to boost approval chances.

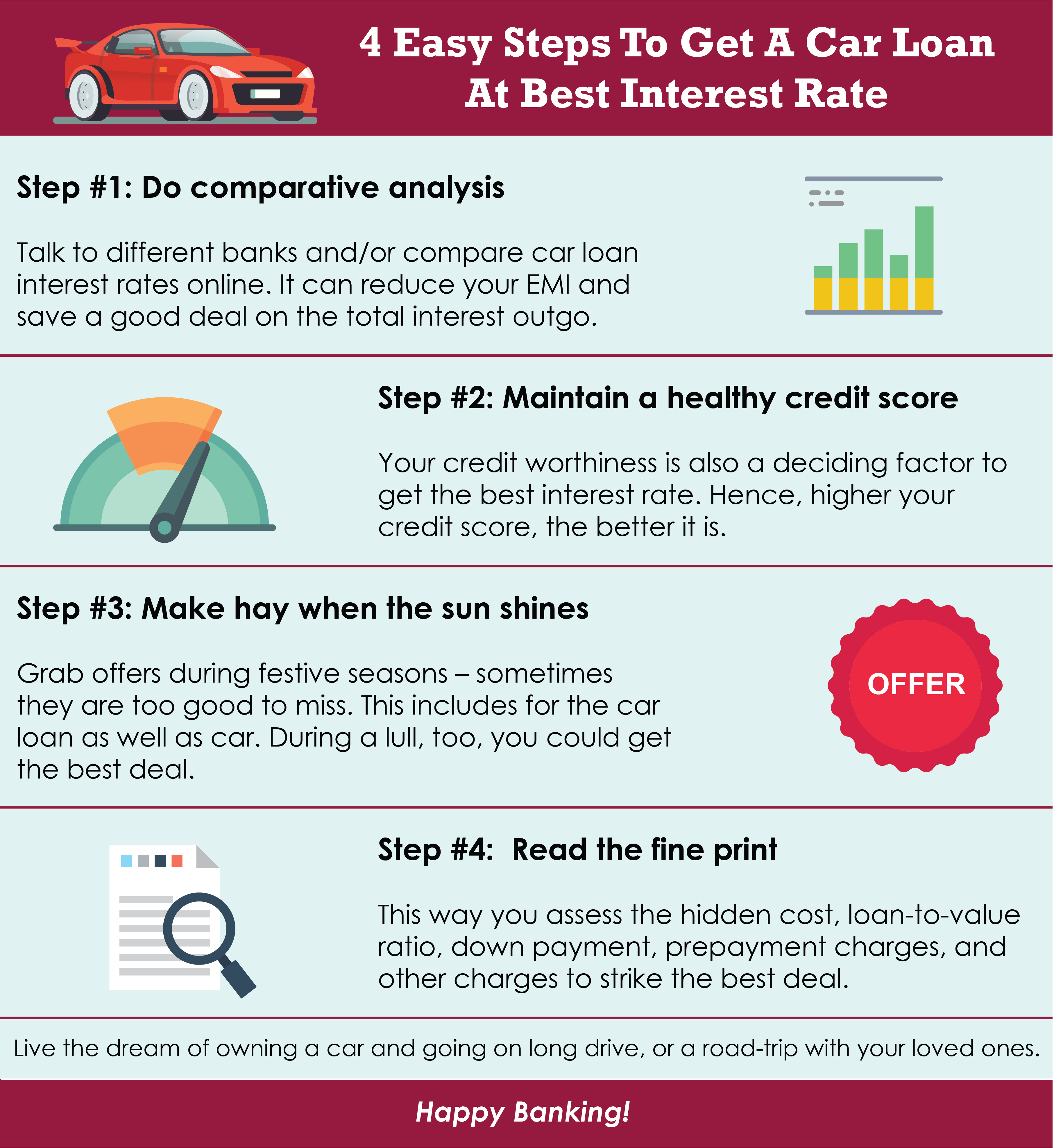

Navigating the road to a car loan can be straightforward if you have the right map. First, you should have a clear understanding of your financial health, as it plays a critical role in the bank’s decision-making process. Taking the wheel entails getting your credit score in check, since a higher score can lead to more favorable loan terms.

You will then need to gather documentation, such as proof of income and residence, to support your application. Remember to shop around; comparing loans from different banks can land you the best interest rate. An eye for detail and a steady hand on your financial documents can put you in the driver’s seat of your new car financing plan.

Evaluating Financial Health Before Applying

Before walking into a bank for a car loan, it’s essential to assess your financial health. A solid financial foundation increases your chances of getting approval. Let’s dive into the key steps to consider.

Checking Your Credit Score

Your credit score is a vital factor banks consider. It reflects your creditworthiness. A high score can lead to better interest rates. Check your credit score through reputable online platforms. Aim for a score above 700 for optimal loan conditions.

Steps to check your credit score:

- Visit a credit bureau website or use a credit score service.

- Provide necessary personal details.

- Access your score and analyze the report for any errors.

Determining Your Budget For Loan Repayment

Understanding what you can afford is crucial. It prevents financial strain from loan repayments. Calculate your monthly income and expenses. Deduct expenses from income to determine your disposable income. Allocate a portion of this to your car loan repayment.

| Income | Expenses | Disposable Income | Loan Repayment Capability |

|---|---|---|---|

| $ Monthly Income | $ Monthly Expenses | $ Disposable Income | $ Loan Repayment |

Tips to set your repayment budget:

- Keep total loan payments below 20% of your take-home pay.

- Consider the full cost of owning a car, including insurance, maintenance, and fuel.

- Factor in savings for emergency funds.

Note: The HTML entity < represents the “<” character, and > represents the “>” character, in this example, they are used to display the ‘

‘ and ‘

‘ tags within the content for illustrative purposes.

.jpg)

Credit: www.axisbank.com

Choosing The Right Car Loan

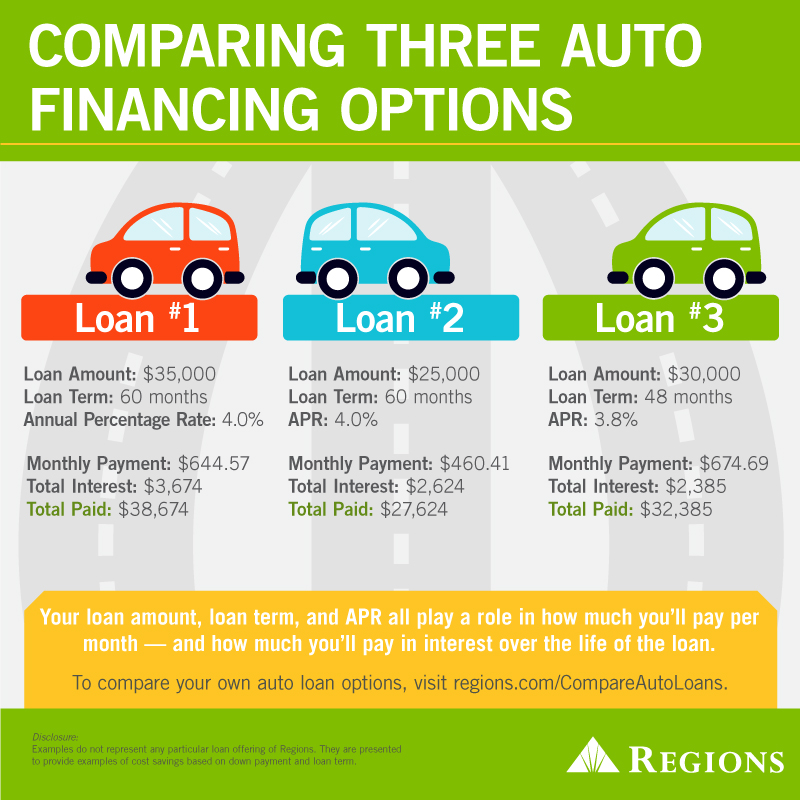

Securing a car loan can feel overwhelming, with so many options available. Key elements, such as interest rates and the loan term, dramatically impact the overall cost. By understanding these variables, you can find a loan that fits your budget and gets you into your new car without financial strain.

Fixed Versus Variable Interest Rates

Interest rates influence your monthly payments. They come in two main types: fixed and variable. A fixed interest rate stays the same throughout the loan term. This consistency allows for predictable payments. Conversely, a variable interest rate can change, based on market conditions. While it could lower costs when rates drop, there’s also a risk of rates going up.

- Fixed rates: Ideal for those who prefer stability and a clear budget.

- Variable rates: Suitable for risk-takers, potentially offering savings.

Loan Term Length Considerations

The length of a car loan affects both the monthly payment size and the total interest paid. Shorter terms usually have higher monthly payments but less interest over time. Longer terms mean lower monthly payments but more interest in total. Choose a term that balances monthly affordability with overall cost effectiveness.

| Loan Term | Monthly Payment | Total Interest |

|---|---|---|

| Short-term | Higher | Lower |

| Long-term | Lower | Higher |

When selecting a car loan, look for a balance. An affordable monthly payment should meet your budget. Yet, strive for the least amount of interest paid over time. This approach secures a loan that makes financial sense both now and in the long run.

Gathering Necessary Documentation

Before you head to the bank for a car loan, prepare the right documents. Don’t let missing paperwork slow you down. Banks need specific papers to process your loan. Get these ready:

Essential Paperwork For Loan Approval

Lenders require key documents to consider your loan. Have these at hand:

- Valid ID – A government-issued photo ID like a driver’s license or a passport.

- Proof of Address – A utility bill, lease, or mortgage statement.

- Car Information – If you’ve picked out a car, bring the sales contract or the car’s title.

- Credit Report Authorization – Allows the lender to check your credit history.

- Loan Application Form – Filled out with your personal details.

Proof Of Income And Employment

Banks verify your ability to repay the loan. Show them these:

| Document | Details |

|---|---|

| Pay Stubs | Recent ones, usually from the past month or two. |

| Bank Statements | Displays your income and expenditures. |

| Tax Returns | The previous year’s return to prove annual income. |

| Employment Verification | A letter from your employer listing your job and income. |

Understanding The Approval Process

Getting a car loan from a bank may seem daunting, but understanding the approval process can make it much clearer. This process involves several key steps, from assessing your creditworthiness to finalizing the loan terms. Knowing what to expect can help you navigate the journey with confidence.

Pre-approval Versus Direct Lending

Before diving into the world of auto financing, it’s crucial to comprehend the difference between pre-approval and direct lending.

- Pre-approval gives a clear picture of what you can afford. This process involves a bank evaluating your financial background to determine how much they would lend you.

- Direct lending, on the other hand, takes place when you find your dream car and then apply for a loan directly through the bank.

Both methods have their perks. Pre-approval can strengthen your negotiating power, while direct lending may offer convenience when you’re ready to buy.

What Happens After You Apply?

Once you’ve submitted your loan application, the bank’s approval process kicks off.

- The bank reviews your credit to ascertain if you are a risk or a reliable borrower.

- They evaluate the vehicle’s value to ensure it matches the loan amount.

- Income verification is conducted to confirm your ability to repay the loan.

Should the bank approve your application, they’ll lay out the terms of the loan, including interest rates and repayment period. Should they decline, they are obligated to provide reasons why, which can pinpoint areas for financial improvement.

Negotiating Loan Terms

Understanding how to negotiate car loan terms with your bank can lead to better deals and savings. It’s crucial to discuss all aspects including down payments, interest rates, additional fees, and loan conditions before signing the dotted line. Let’s explore how you can successfully negotiate these terms.

Down Payment And Interest Rates

A larger down payment reduces the principal amount which can yield a lower interest rate. Here are the key points to consider:

- Higher down payment means less money borrowed.

- Less interest is paid over time with a reduced loan amount.

- Negotiate for a competitive interest rate based on your credit score.

Utilize a loan calculator to determine how different down payments affect your monthly installments.

Additional Fees And Loan Conditions

Loans come with various fees and conditions that can significantly affect the total cost. Ask for a clear explanation of each fee, including:

Include other relevant fees as necessary| Fee Type | Description |

|---|---|

| Origination Fee | Cost to process your loan application. |

| Documentation Fee | Fee for preparing and filing the loan paperwork. |

Examine the prepayment penalty clause. This fee may apply if you pay off your loan early.

Discuss the loan term. Longer terms can lower monthly payments but increase total interest paid.

- Choose a term that balances monthly payments with total loan cost.

- Review for any hidden conditions that might affect cost or obligations.

Finalizing The Loan And Getting Your Car

Now that you’ve secured your car loan, it’s time to make it official and drive off in your new vehicle. In the “Finalizing the Loan and Getting Your Car” phase, you finalize everything. This is where you sign papers and get keys.

Signing The Loan Agreement

Before you can claim your car, the loan agreement awaits your signature. You need to review and understand the terms. Look for your loan amount, interest rate, payment schedule, and any penalties for early repayment. Be sure to ask questions if anything is unclear.

Assure all blank spaces on the agreement get filled in or crossed out. This prevents future misunderstandings. With every detail in check, sign the dotted line to seal the deal.

Taking Ownership Of Your New Vehicle

With the paperwork complete, taking ownership is next. You’ll receive the keys but also several important documents. These include your registration and proof of insurance. Keep these safe as they’re needed for driving your car legally.

- Bill of Sale: This shows you’ve purchased the vehicle.

- Title: The legal document showing ownership.

- Warranty Documents: If your car is covered by a warranty, keep these handy.

Perform a final inspection of the vehicle before leaving the lot. Check for any pre-existing damage and ensure features work. This is your last chance to address issues before taking full ownership.

Credit: www.axisbank.com

Frequently Asked Questions For How To Get A Car Loan From A Bank

What Are The Car Loan Eligibility Criteria?

Most banks require a stable income, good credit score, and age between 21-65. They also check employment status and debt-to-income ratio. Meeting these criteria is crucial for approval.

How To Apply For A Bank Car Loan?

Visit the bank’s website or branch to submit an application. Provide necessary documents like ID, proof of income, and credit reports. Follow up regularly for updates on your application status.

What Documents Needed For A Car Loan?

Generally, you need a valid ID, proof of income (pay slips or tax returns), proof of residence, credit history, and vehicle information. Always check with the bank for a specific list.

Can I Negotiate My Car Loan Rate?

Yes, loan rates can sometimes be negotiable. Enhance your credit score before applying, make a sizeable down payment, or choose a shorter loan term. Good negotiation can potentially lower your interest rate.

Conclusion

Securing a car loan from a bank boils down to preparation and understanding your credit. Remember, comparing offers ensures you get the best deal, and a solid down payment could tilt the scales in your favor. Drive forward with knowledge, and the road to your new car will be a smooth ride.