How to Get a Car Loan for a Private Sale

To get a car loan for a private sale, secure pre-approval from a lender and present proof of income. Gather documentation of the vehicle’s condition and history for the loan application.

Navigating the process of purchasing a vehicle through a private sale can initially seem daunting, especially when it comes to financing. Unlike dealership purchases, private sales require buyers to handle the intricacies of securing a loan without the aid of a dealer’s finance department.

A solid first step involves obtaining pre-approval for a loan, ensuring you know your budget and can demonstrate to the seller that you’re a serious buyer. Providing documentation such as pay stubs or tax returns can verify your income, while a vehicle history report and professional inspection can confirm the car’s worth to your lender. By carefully compiling the necessary financial records and details about the car, you position yourself as a credible buyer, ready to navigate the private car buying landscape with confidence.

Credit: www.nationwide.com

Setting The Stage For A Private Sale Car Loan

Embarking on the journey to secure a private sale car loan can be thrilling yet daunting. Paving the way to a smooth transaction involves preparation and knowledge. Setting the right foundation ensures your success in acquiring a loan for that dream car from a private seller.

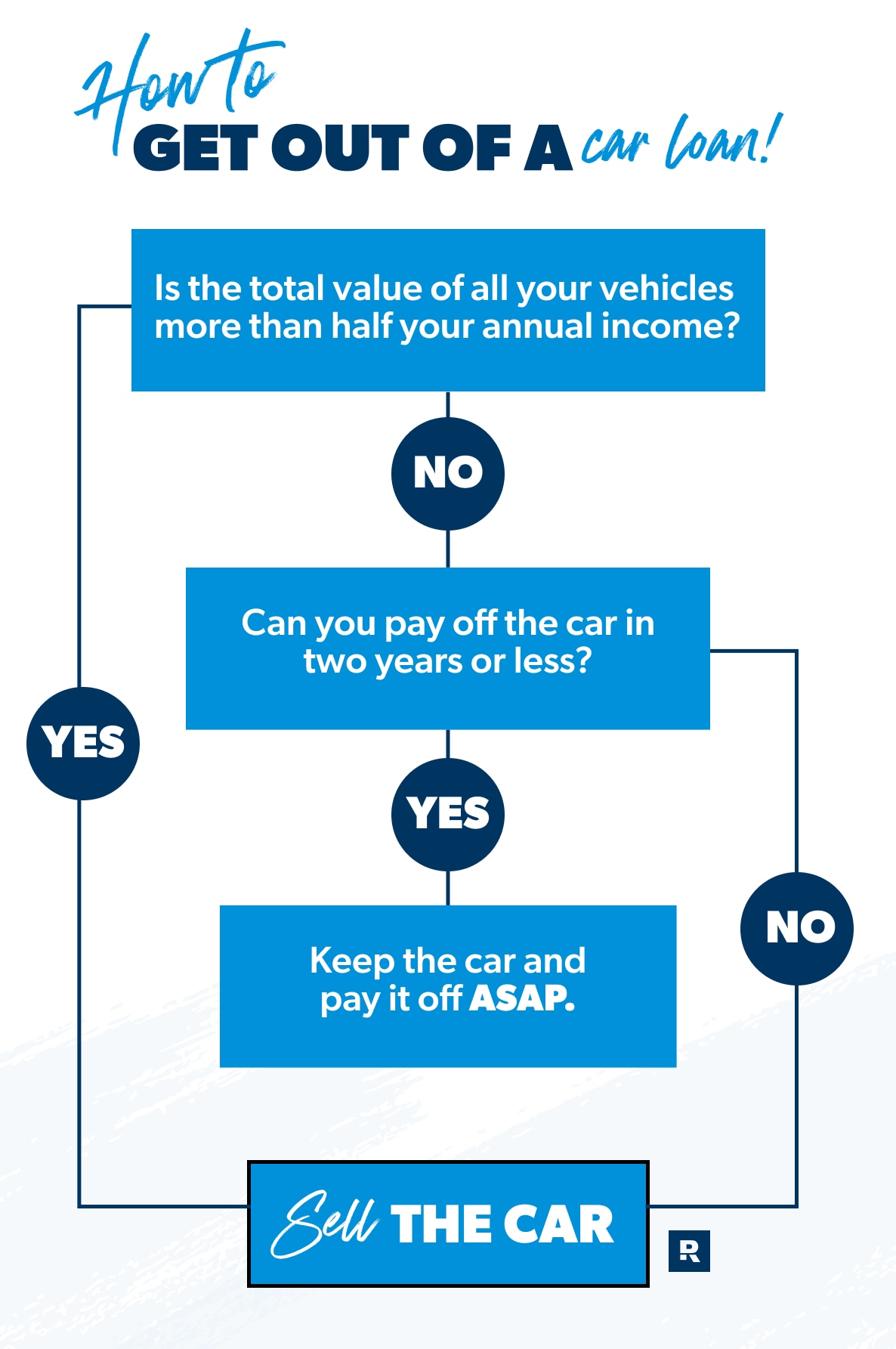

Assessing Your Budget

First, take a close look at your finances. Create a budget plan that outlines all expenses, not just the car payment. Include insurance, maintenance, and fuel costs. Use bullet points to categorize them:

- Car Payment – Determine the monthly amount you can afford.

- Insurance Costs – Estimate the yearly insurance premium divide by 12.

- Maintenance – Set aside funds for regular upkeep.

- Fuel – Estimate your monthly fuel expenses based on usage.

Compare your findings with your steady income. Ensure the numbers align and leave room for unexpected costs. A well-planned budget is your roadmap to confidently securing a loan.

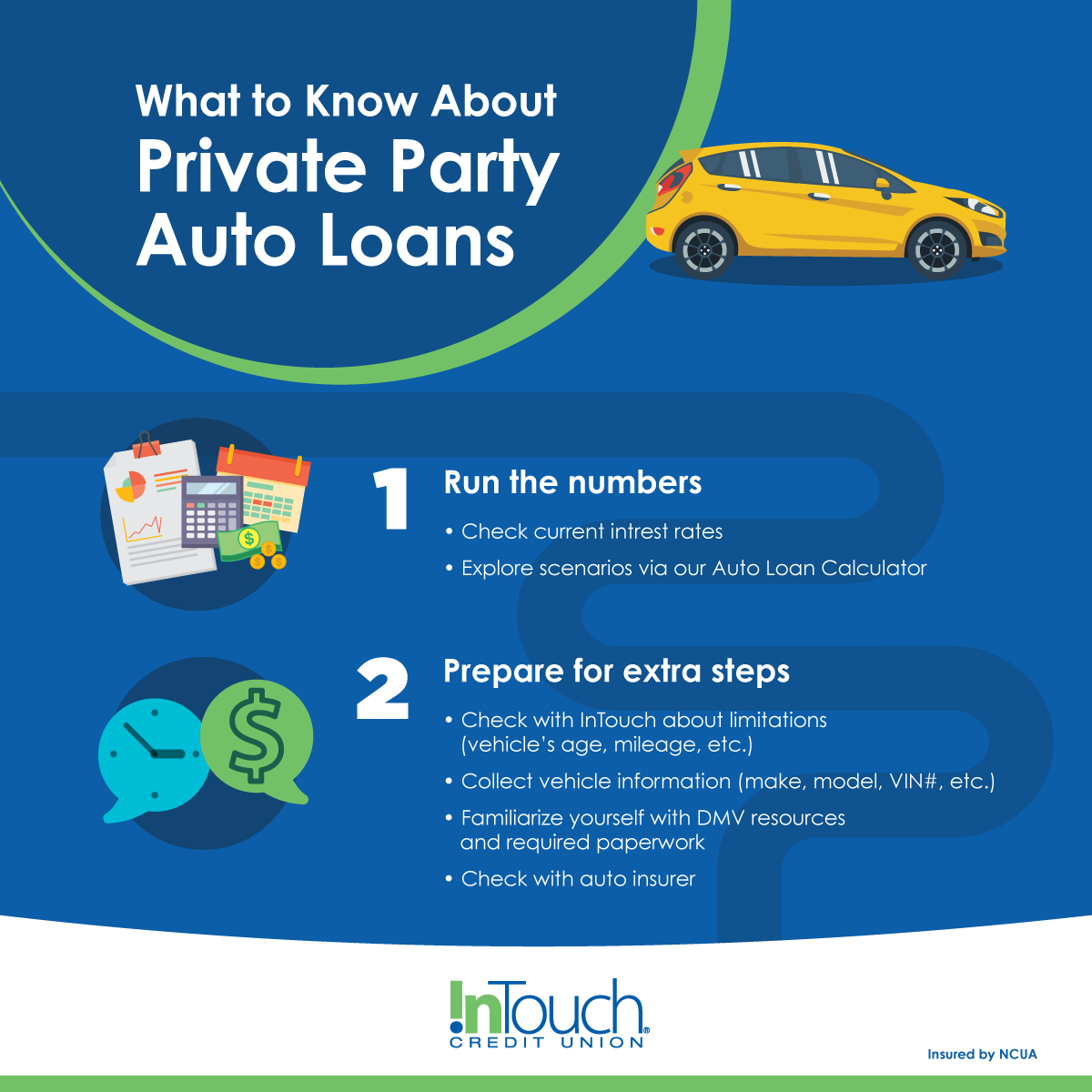

Understanding Private Sale Car Loans

Loans for private sales differ from dealer financing. Banks, credit unions, and online lenders offer these loans. To navigate this terrain, educate yourself on the basics:

| Loan Feature | Description |

|---|---|

| Interest Rates | Check and compare rates from multiple lenders. |

| Loan Term | Select a term that balances monthly payments with total interest costs. |

| Approval Process | Prepare documentation: ID, proof of income, credit report, and car details. |

Some lenders have specific requirements for private sale transactions. Ensure the vehicle meets these standards to avoid last-minute surprises. Start your loan quest equipped with knowledge to make informed decisions.

Preparation Is Key: Getting Your Financials In Order

Embarking on the journey to secure a car loan requires a solid foundation. Financial preparation not only eases the process but also positions you for better loan terms. Before diving into the private car sale market, get a grip on your finances. Anchor this journey with a thorough review of your credit score and a complete set of necessary documents.

Checking Credit Scores

Your credit score is a crucial determinant in loan approvals. Lenders scrutinize this number to assess risk and decide on your loan’s terms. Ensure accuracy and understanding of your credit score beforehand.

- Obtain your credit report from major credit bureaus.

- Scan for errors or discrepancies and address them promptly.

- Understand how your score may affect your loan options.

Assembling Necessary Documents

Gather essential paperwork early to avoid delays. Proper documentation confirms your identity, income, and stability to lenders. This shows lenders you’re a responsible borrower.

| Document Type | Description | Why It’s Needed |

|---|---|---|

| ID | License or Passport | To verify your identity |

| Proof of Income | Pay stubs or tax returns | To confirm your earnings |

| Proof of Residence | Utility bill or lease agreement | To establish your living situation |

| Insurance | Policy documents | To prove vehicle coverage |

When these steps are in place, the path to obtaining a car loan for a private sale becomes clear. Preparation boosts confidence in borrowers and lenders alike, leading to a smoother transaction for your dream car purchase.

Choosing The Right Loan: Options And Considerations

Finding the right car loan for a private sale involves research and understanding different financing options. This section will cover important factors to consider when choosing a loan that aligns with your budget and needs.

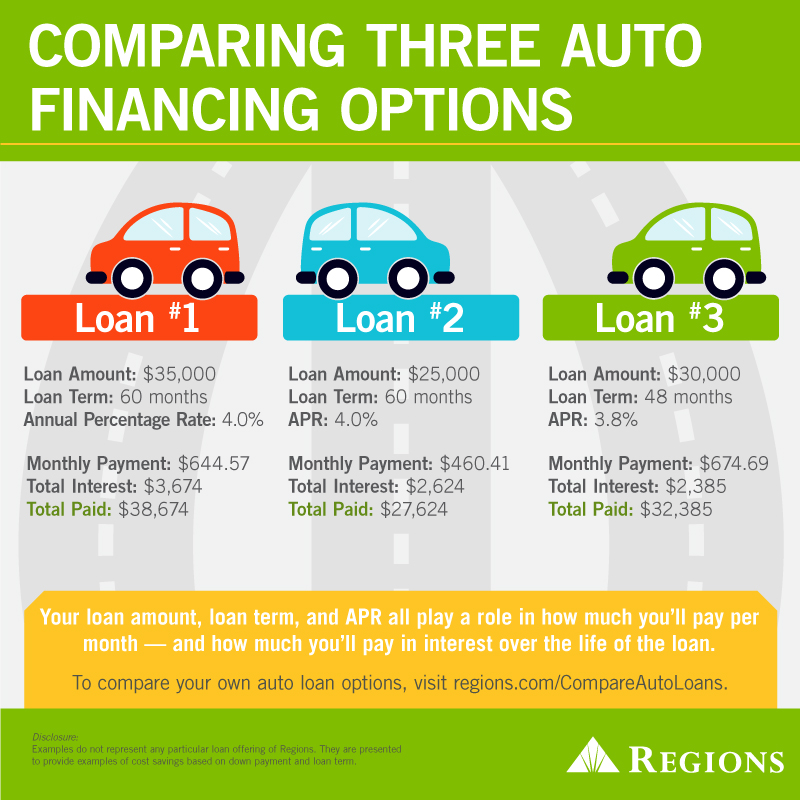

Comparing Loan Terms And Rates

Securing favorable loan terms and rates can save money over the life of your loan. Here are key aspects to compare:

- Annual Percentage Rate (APR): Reflects the total cost of borrowing.

- Loan Term: A longer term may mean lower monthly payments but higher overall costs.

- Monthly Payment: Should fit comfortably within your budget.

- Fees: Look for origination fees, prepayment penalties, or late fees.

Use loan calculators to compare different scenarios and find the best deal.

Deciding Between Banks And Credit Unions

Choosing where to get your car loan is crucial. Consider these points:

| Banks | Credit Unions |

|---|---|

| Often have a wider range of loan products | May offer lower rates and better service |

| Accessible online and in person | Membership could be required |

| May have more stringent credit requirements | Focused on customer satisfaction |

Before deciding, visit both banks and credit unions to discuss loan options. Check their customer reviews and special offers targeted at car buyers.

Credit: www.capitalone.com

The Application Process Simplified

Buying a car through private sale can be exciting. A car loan can help. Knowing how to apply is key. Let’s simplify the process. Begin with the application. Choose online or in-person options. Recognize the approval timeline. A smooth journey awaits, from selecting the car to securing the financing.

Applying Online Or In-person

Apply from home or visit a bank. Both choices work. Consider them:

- Online: Convenience at its best. Fill out forms on your device. Upload needed documents. It’s fast and straightforward.

- In-Person: A personal touch helps some. Visit a branch. Meet a loan officer. Ask questions. Get answers on the spot.

Both methods require the same information. Get your documents ready. This includes ID, income proof, and car details. Start the process once ready.

Understanding The Approval Timeline

Know when to expect a decision. The timeline varies by lender. Yet, understanding the common steps helps manage time.

- Application Review: A day or sometimes hours.

- Credit Check: Instant to a few hours.

- Further Verification: One to three days, if needed.

- Final Approval: Typically, within a week. Some lenders may decide faster.

It’s important to respond quickly to lender requests. Delays can push back the timeline. Planned right, the keys could be in hand soon.

Closing The Deal With Confidence

Approaching the final stretch of a private car sale, you’re almost at the finish line. The last steps are crucial in securing your new vehicle. A clear strategy and understanding of the process will see you closing the deal with confidence. Follow these key steps to ensure you navigate the endgame of your private car purchase smoothly.

Negotiating With The Seller

Negotiation is an art, particularly in a private car sale. Start by reviewing the car’s condition and history. Use your knowledge to discuss price honestly. You’re aiming for a win-win outcome where both parties feel satisfied. Remember, showing respect and keeping a friendly tone can make negotiations smoother.

- Clarify all car details: make, model, year, mileage, and maintenance records

- Check vehicle’s worth using trusted car valuation guides

- Address any concerns or questions openly

- Propose a fair offer based on your research

- Be ready to walk away if the terms don’t meet your expectations

Finalizing Loan Paperwork

With a price set, it’s time to solidify the financial side. Compile all required documents for your car loan approval. These would typically include:

| Document | Reason |

|---|---|

| Proof of Income | Verifies your ability to repay |

| Bank Statements | Shows financial stability |

| Proof of Insurance | Required before closing the deal |

Go over your loan contract with care. Look for the APR (Annual Percentage Rate), term length, and any penalties. Feel empowered to ask questions about any terms that aren’t clear. Once satisfied, sign the paperwork to secure the loan.

- Review and understand all loan terms

- Sign the loan contract to initiate the agreement

- Arrange to pay the seller

- Transfer the title once funds are received

Armed with knowledge and thorough preparation, you can approach the finale of your private car purchase with assurance. Handle the paperwork diligently and soon enough, you’ll be able to enjoy your new ride.

Credit: www.forbes.com

Post-purchase Wisdom: Managing Your Car Loan

Once the excitement of a private car sale settles, it’s time to think about loan management. After buying a car through a private sale, setting up a payment plan is crucial. Well-planned payments lead to financial ease. This section guides new car owners through a smooth loan management journey, emphasizing simple steps and smart decisions.

Setting Up Payment Plans

Creating a reliable payment plan is the first step after securing a car loan. Start by understanding your loan terms. Note the interest rate and payment frequency. Don’t miss any details.

Determine your monthly budget and how the car loan fits into it. Ensure the loan payment aligns with your cash flow.

Options for payment plans include:

- Automatic deductions from a bank account

- Manual online payments

- Check or money orders

Choose the method that suits your lifestyle. Stick to the agreed-upon schedule.

Dealing With Potential Refinancing

Refinancing a car loan involves replacing the current loan with a new one, often with better terms. Consider refinancing if interest rates drop or your credit score improves.

Steps to refinance your car loan include:

- Check your credit score.

- Shop around for the best rates.

- Calculate potential savings.

- Apply with chosen lender.

- Pay off the old loan with the new one.

Remember, refinancing can save money or lower monthly payments. Yet, it’s vital to read all new terms carefully before agreeing.

Frequently Asked Questions Of How To Get A Car Loan For A Private Sale

What Is A Private Sale Car Loan?

A private sale car loan is financing provided by a lender to purchase a vehicle directly from the current owner, rather than a dealership. It involves a credit check, loan agreement, and typically a lien on the vehicle until the loan is repaid.

How Do You Finance A Car Privately?

To finance a car privately, you should get pre-approved for a loan from a bank, credit union, or online lender. Then, agree on a sale price with the seller and have the vehicle inspected. Finally, complete the purchase with your lender’s assistance.

What Credit Score Is Needed For A Private Car Loan?

The required credit score for a private car loan may vary by lender, but generally, a score of 660 or above is preferred. Some lenders may approve lower scores but often with higher interest rates.

Can I Get A Car Loan For A Used Private Sale?

Yes, you can get a car loan for a used private sale. Many lenders offer used car loans with terms similar to new vehicle financing. You’ll need to provide details about the car and seller, and pass a credit check.

Conclusion

Securing a car loan for a private sale doesn’t have to be daunting. By following the steps outlined, you can navigate this path with confidence. Remember, compare loan options, understand the terms, and ensure paperwork is in order. With thorough research and careful preparation, your dream car from a private seller is within reach.

Drive forward, smartly equipped for a successful private car purchase.