How to Donate a Deceased Person’S Car

To donate a deceased person’s car, obtain the title and death certificate. Contact a charity that accepts vehicle donations and provide the required documents.

Donating a car belonging to someone who has passed away is a generous way to honor their memory and benefit a charitable cause. It’s essential to establish the legal authority to donate the vehicle, usually by having the title transferred to your name.

Charities often make the process seamless, offering tow services and handling paperwork. The donor or the estate may receive a tax deduction, but it’s important to consult with a tax professional. Before proceeding, ensure the car’s papers are in order, clear any personal belongings, and choose a reputable charity that supports a cause the deceased believed in.

The Importance Of Vehicle Donations

Donating a deceased person’s car can be a powerful way to honor their memory. It’s a gesture that extends the usability of their vehicle. This gift can deeply impact various aspects of society.

Impact On Charitable Organizations

Car donations present a significant opportunity for charitable organizations. These donations often become a key source of funding. Here’s how they make a difference:

- Funding charity programs becomes easier with the sale of donated cars.

- Providing transportation for charity workers is another important benefit.

- Donated vehicles may also directly serve those in need, like families without a car.

Supporting Communities Through Donated Cars

When you donate a car from an estate, you’re supporting broader community efforts. Here’s what happens:

- Local services improve as charities bolster their outreach.

- Job opportunities may arise from vehicle donations—like mechanics fixing cars.

- Sustainable practices are promoted as cars are repurposed or recycled.

Credit: www.wheelsforwishes.org

Determining The Eligibility For Car Donation

Donating a car from an estate is a generous act with potential tax benefits. Before proceeding, verify the eligibility for donation. This involves understanding the legalities and preparing required documents.

Assessing The Legal Requirements

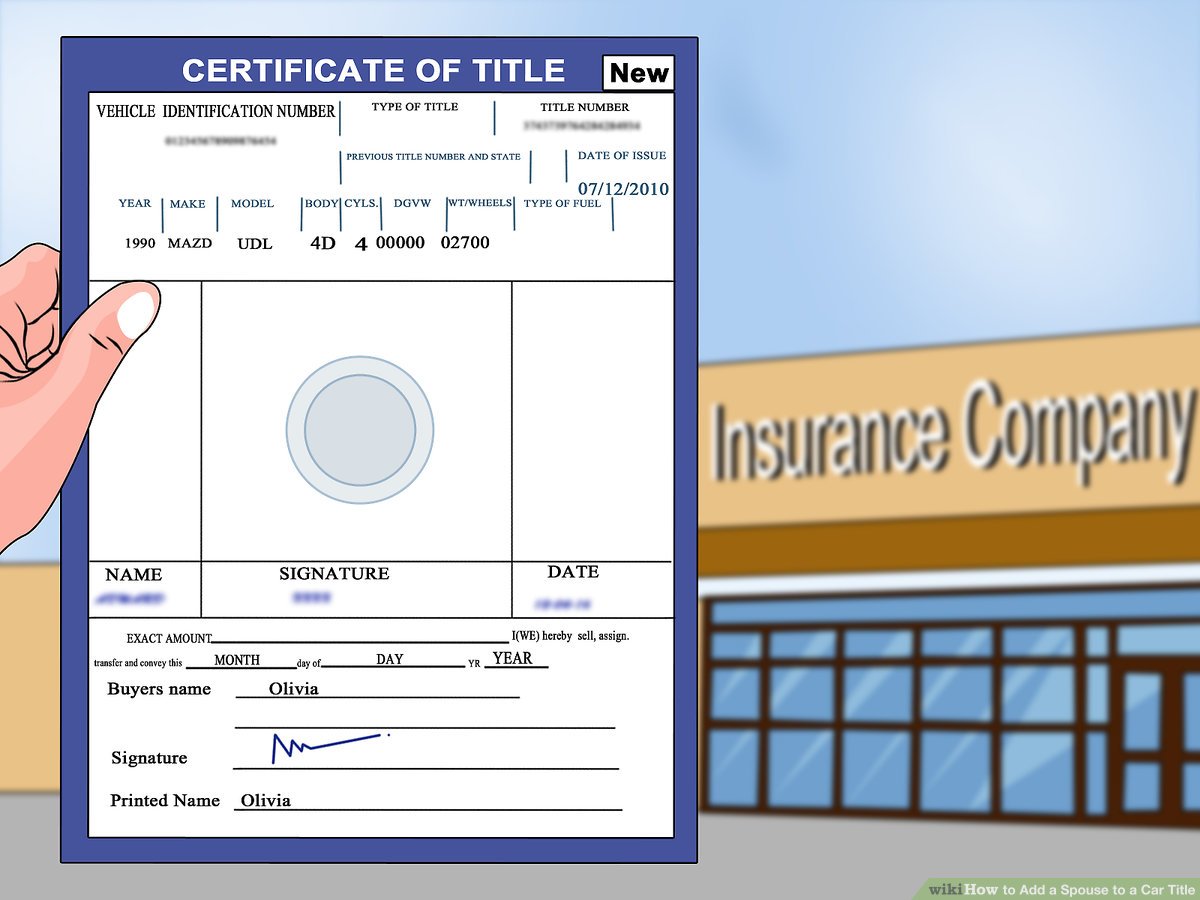

To donate a car of a deceased individual, certain legal requirements must be met. Ownership transfer and approval from the estate executor are key steps. Consult with an estate attorney to navigate local laws.

- Proof of Executorship: Documentation confirming the executor’s authority.

- Title Transfer: The title should be officially transferred to the charity.

- Estate Consent: Obtain consent if the car is part of a larger estate.

Necessary Documents For Donating A Deceased Person’s Car

To ensure a smooth donation process, here’s a list of documents you may need:

- Title Certificate: The car’s title certificate with the deceased’s name.

- Death Certificate: A copy of the death certificate.

- Executorship Documents: Legal papers showing the executor’s right to act.

- DMV Forms: Any forms your local DMV requires for the donation.

Choosing The Right Charity

Deciding to donate a deceased person’s car is a generous act. The next important step is choosing the right charity. This means finding an organization that aligns with the giver’s values and effectively uses the donation.

Researching Non-profit Organizations

Begin by making a list of potential charities that accept car donations. Use reliable sources like the IRS website to confirm they are legitimate.

- Check their status: Look for 501(c)(3) certification.

- Examine their mission: Ensure it matches the deceased’s passions.

- Read reviews: Search for feedback from other donors.

- Study impact reports: Appreciate how they use donations.

Understanding How Donated Cars Are Utilized

Investigate how each charity uses the vehicle donations they receive. Successful charities are transparent about their process.

| Charity | Uses of Cars |

|---|---|

| Charity A | Vehicles sold at auction, proceeds fund programs. |

| Charity B | Cars provided to families in need for transportation. |

| Charity C | Used in charity’s daily operations or vocational training. |

Note the process: Some charities repair and sell cars, others may use them directly to support their work or give them to those in need. Be sure this aligns with your intentions for the donation.

Credit: trustandwill.com

The Donation Process Step By Step

Donating a deceased person’s car is a noble act. It can benefit charities and provide tax deductions for the estate. Understand the process step by step to ensure a seamless experience.

Preparing The Vehicle For Donation

To start, preparing the car is crucial. Gather all necessary documents. The title is vital. Ensure it’s in the estate’s name. Maintenance records and keys need collecting too.

- Clean the car inside and out.

- Record the vehicle’s condition with photos.

- Remove personal items and license plates, if required.

Coordinating With The Chosen Charity

Next, select a reputable charity. Verify their 501(c)(3) status for tax purposes. Communicate clearly with them.

- Contact the charity directly to discuss the donation.

- They may offer a pick-up service, so schedule a convenient time.

- Provide all relevant car information to the charity.

- Keep records of the donation receipt for tax filing.

Tax Considerations And Benefits

Donating a deceased person’s car can bring tax benefits. But it’s important to understand tax rules. This ensures your act of kindness also supports your financial health. Tax deductions can reduce your taxable income. They can sometimes improve your tax situation. We’ll explain how to navigate the IRS guidelines and keep proper documentation.

Navigating The Irs Guidelines

Understanding IRS rules is vital for tax benefits. When you donate a car, the IRS considers this as a charitable contribution. The donor’s tax situation defines the benefit. Here are key points:

- Charity status matters: Only donations to approved nonprofits give tax breaks.

- Itemized deductions: To deduct, you must itemize on your tax return.

- Donation value limits: The deduction may not exceed 50% of your adjusted gross income.

- Deduction amount based on vehicle use: How the charity uses the car affects your deduction. Selling the car often results in a deduction of the sale price.

Retaining Proper Documentation For Tax Deductions

Keep all donation records. This can’t be stressed enough. Solid documentation backs up claims. Essential elements include:

- Acknowledgment: A written statement from the charity is a must.

- Form 8283: If the car’s value exceeds $500, you’ll need this form.

- Valuation evidence: If the car’s value is over $5,000, get an appraisal.

- Market value proof: Resourceful guides can help determine your car’s value.

Remember, these steps are non-negotiable for a smooth tax deduction process. Proper paperwork ensures your generosity pays off on your taxes. By recording every detail, your contribution not only honors the deceased but also supports your charitable spirit with financial wisdom.

Credit: www.kidney.org

Frequently Asked Questions On How To Donate A Deceased Person’s Car

Which Charity Is Best To Donate A Car?

The best charity to donate a car depends on personal preference. Research reputable organizations like Habitat for Humanity, Make-A-Wish, or local charities that offer tax deductions and free towing.

How To Donate A Car In Texas?

Select a charity certified in Texas. Complete the donation form online or call the organization. Arrange a free vehicle pickup. Transfer the car title to the charity. Keep donation receipts for tax deductions.

How To Donate A Car In Louisiana?

To donate a car in Louisiana, choose a charity, transfer the title, remove license plates, and arrange for vehicle pick-up. Notify the DMV and cancel insurance.

Who Organizes Kars For Kids?

Kars4Kids, a New Jersey-based non-profit organization, organizes the “Kars for Kids” car donation program.

Conclusion

Donating a loved one’s car is a heartfelt way to honor their memory. It’s a meaningful gesture that supports charities and provides a sense of closure. Remember to secure the necessary documents and choose a reputable organization. By following these steps, your generous contribution will make a positive impact.

Let their legacy drive forward the change they wished to see in the world.