How to Calculate Finance Charge on Car Loan

To calculate the finance charge on a car loan, multiply the outstanding loan balance by the annual interest rate and divide by 12. This provides the monthly finance charge.

Navigating the ins and outs of car financing is crucial for buyers aiming to make informed decisions. A finance charge on a car loan is essentially the cost of borrowing money from the lender. It encompasses the interest you must pay over the life of your loan.

Understanding this concept allows for clearer financial planning and can lead to more strategic loan management. It’s not just about knowing what you pay monthly; it’s about grasping the long-term cost implications of your vehicle purchase. A calculated approach to assessing these charges helps buyers to streamline their budgets accordingly. Transparent calculation of finance charges promotes a well-informed purchase decision, ensuring that individuals can maintain their financial health while enjoying the benefits of a new vehicle.

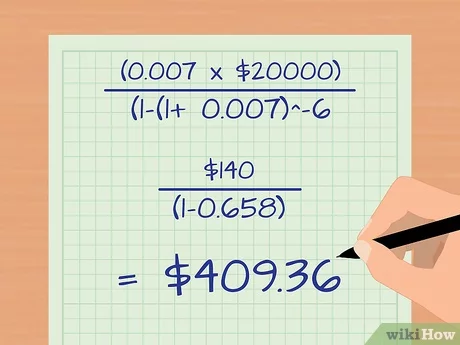

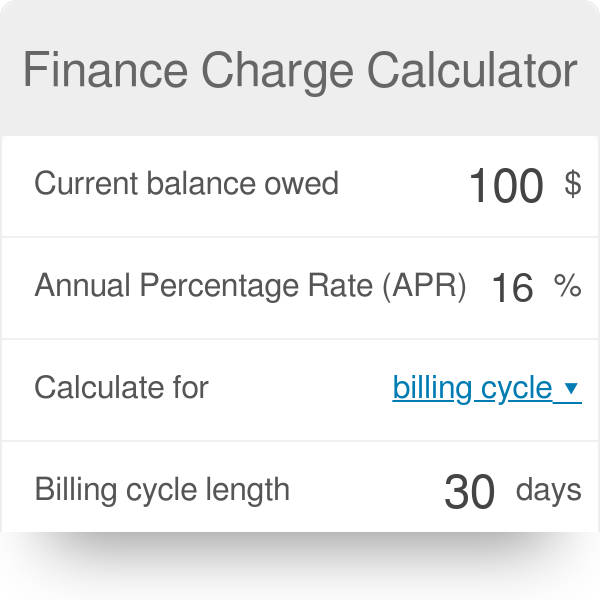

Credit: www.omnicalculator.com

Introduction To Finance Charges

Understanding finance charges is crucial when financing a car purchase. This part of your loan is the cost of borrowing money, and it affects your monthly payments. Finance charges can seem complex, but breaking them down makes them easier to grasp.

The Role Of Finance Charges In Car Loans

Finance charges are the total interest and fees you pay over the life of your car loan. They are a key element in the cost of your loan. When you borrow money, lenders charge interest as compensation for providing you with credit. The finance charge tells you exactly how much extra you’ll pay, aside from the borrowed amount.

Key Factors Affecting Finance Charge

Different elements come into play when calculating your finance charge. Your loan’s interest rate, term length, and the principal amount are among the most influential factors. Here’s a quick overview:

- Interest Rate: This percentage of your loan amount is the primary driver of finance charges.

- Loan Term: Longer loans often mean more finance charges, as interest accrues over a more extended period.

- Principal Amount: A higher principal leads to higher finance charges, as the base for calculating interest is greater.

Awareness of these factors offers better control over the finance charges you’ll incur.

Principles Of Car Loan Financing

Understanding car loan financing is crucial for any potential car buyer. This section will explore the basics of interest rates and the importance of amortization schedules. Grasping these concepts can lead to more informed decisions and potential savings over the life of a car loan.

Interest Rate Basics

The interest rate on a car loan is the cost you pay to borrow money. It’s expressed as a percentage of the loan amount. Here’s what you should know:

- Fixed rates stay the same throughout the loan term.

- Variable rates can change, affecting your monthly payment.

- Lenders determine rates based on your credit score and market conditions.

- A lower rate means lower overall costs.

Amortization Schedules Explained

An amortization schedule breaks down your loan payments over time. It’s a tool that shows how much of each payment goes toward interest and principal.

| Payment Number | Principal | Interest | Total Payment | Remaining Balance |

|---|---|---|---|---|

| 1 | $200 | $150 | $350 | $9,650 |

With each payment, you pay more towards the principal and less towards interest. This schedule helps you see the end date of your loan and how quickly you’re reducing the balance.

Calculating Finance Charges Step By Step

Understanding how to calculate finance charges on a car loan can save you from unexpected expenses. Follow this step-by-step guide to gain clarity on what you’re paying in interest and why.

Determining The Principal Amount

The principal amount is the initial sum you borrow for your car purchase. It’s essential to know this value because it’s the basis for your finance charges. To find it:

- Look at your loan agreement for the amount financed.

- Subtract any down payment from the car’s sale price to find the principal.

Figuring Out The Annual Percentage Rate (apr)

The Annual Percentage Rate (APR) represents the yearly cost of your loan. To determine the APR:

- Check your loan documents; they should clearly state the APR.

- Remember, APR includes interest and other costs associated with the loan.

Applying The Correct Calculation Method

Finance charges on a car loan can be calculated using different methods. The most commonly used are:

| Simple Interest | Precomputed Interest |

|---|---|

| Interest accrues on the principal balance over time. | Interest is calculated at the start and fixed. |

For a simple interest loan:

Interest = Principal × Rate × Time

To calculate, follow these steps:

- Multiply your principal amount by the APR.

- Divide by 12 months to get the monthly rate.

- Multiply this by the number of months on your loan term.

With this comprehensive guide, you’ll confidently understand and calculate your car loan’s finance charges.

Credit: www.yourmechanic.com

Common Calculation Methods For Finance Charges

Understanding how finance charges on a car loan work is crucial for any borrower. Lenders use different methods to calculate the charges you’ll pay over the life of your loan. The two most common methods are the Simple Interest Method and the Precomputed Interest Method. Knowing the difference can help you make an informed decision and possibly save money.

Simple Interest Method

The Simple Interest Method is a widely used approach for calculating finance charges on a car loan. This method involves multiplying the amount of the loan by the interest rate and then by the time period of the loan. Here’s how it works:

- Principal: the initial amount borrowed

- Interest rate: the percentage charged on the principal

- Time: the loan duration in years

The formula for calculating finance charge using this method is:

Finance Charge = Principal x Interest Rate x Time

This method is beneficial as it allows for flexibility. Interest is calculated based on the outstanding balance, so if you pay more than your regular monthly payment, you can reduce your finance charges over time.

Precomputed Interest Method

With the Precomputed Interest Method, the interest is calculated upfront. All the interest for the entire term of the loan is determined at the beginning and is divided into equal monthly payments. Here’s a breakdown of this calculation:

- Determine total interest by multiplying the loan amount by the interest rate and the length of the loan term.

- Add this total interest to the principal to get the total cost of the loan.

- Divide the total cost by the number of months in the loan term for the monthly payment amount.

This method means your monthly payment is fixed and includes a portion of the interest and a portion of the principal. Early payments do not reduce the finance charges, as the interest is precalculated.

Note: Some lenders might charge a penalty for paying off a loan early that uses the precomputed interest method.

Tools And Resources To Simplify The Process

Understanding finance charges on a car loan can be tricky, but the right tools can make it much easier. These resources help break down the complex figures into manageable numbers. Here are some user-friendly ways to calculate finance charges quickly and accurately.

Online Car Loan Calculators

Online car loan calculators are a quick and convenient way to estimate finance charges. They require you to input basic information about your loan:

- Loan amount: The total amount you’ll borrow.

- Interest rate: The annual percentage rate (APR).

- Loan term: The duration over which you’ll repay the loan.

After entering these details, the calculator does the work, presenting an estimated monthly payment that includes finance charges.

Using Excel To Model Finance Charges

Excel can be a robust tool for modeling finance charges on a car loan. With Excel formulas, you can create a detailed amortization schedule that calculates:

- The principal amount paid each month.

- Accrued interest.

- Remaining balance after each payment.

To do this, use the =”PMT”, =”IPMT”, and =”PPMT” functions in Excel:

| Function | Purpose |

|---|---|

PMT |

Determines the monthly payment. |

IPMT |

Calculates the interest portion of each payment. |

PPMT |

Calculates the principal portion of each payment. |

By inputting your specific loan information, Excel provides an accurate picture of your finance charges over time.

Potential Pitfalls And How To Avoid Them

Finding the right car loan requires attention to detail. Minor oversights can lead to paying more than necessary. Stay alert to avoid such traps, especially when calculating finance charges.

Understanding The Fine Print

Every loan agreement has its specifics. It’s important to read and understand the terms before signing.

- Scan for any hidden fees.

- Check for prepayment penalties.

- Confirm the method of interest calculation.

- Validate the loan’s total cost.

Knots in fine print can lead to unexpected costs. Knowledge is your best tool here. Ask questions if anything is unclear.

Dealing With Variable Interest Rates

Variable rates can increase your loan’s cost unpredictably. They adjust with market trends.

| Terms | Fixed Rate | Variable Rate |

|---|---|---|

| Predictability | Stable | Changes with market |

| Risk | Lower | Higher |

Review your budget to see if a variable rate matches your limits. Consider whether potential rate increases are manageable.

- Opt for fixed-rate if stability is key.

- Track market changes to anticipate rate adjustments.

- Secure a rate cap where possible to limit increases.

Credit: www.wikihow.com

Frequently Asked Questions On How To Calculate Finance Charge On Car Loan

What Determines A Car Loan Finance Charge?

Finance charges on a car loan are determined by the loan amount, annual percentage rate (APR), and loan term. They represent the cost of borrowing including interest and any other fees.

Can Finance Charges On Car Loans Vary?

Yes, finance charges can vary based on the lender’s policies, your credit score, and market interest rates. Shopping around for competitive rates can help reduce finance charges.

How Do I Calculate My Car Loan Interest?

To calculate interest on a car loan, multiply the principal balance by the interest rate and the time period. This will give you the total interest you’re expected to pay over the term.

Are Car Loan Finance Charges Avoidable?

No, finance charges are an integral part of most car loans. However, making a larger down payment or opting for shorter loan terms may reduce the overall finance charges.

Conclusion

Understanding your car loan’s finance charge is crucial for smart financial management. By following the steps outlined, you can stay informed and budget accordingly. Take charge of your repayments and save money in the long run. Remember, knowledge is power—use it to drive your financial decisions wisely.