How Old Do You Have to Get a Car Loan

To obtain a car loan, you typically need to be at least 18 years old. Age requirements ensure legal contract binding capability.

Navigating the route to car ownership can be thrilling yet complex, especially when it comes to financing. Securing a car loan is a pivotal step, and age plays an integral role in this process. The age of majority, which is 18 in most states, allows individuals to enter into enforceable contracts – including car loan agreements.

This is a safeguard for lenders, guaranteeing that the borrower can legally commit to the loan repayment terms. Younger consumers often face challenges when seeking a loan due to lack of credit history and income stability, which are key factors lenders consider. Before embarking on this financial journey, it’s crucial for potential buyers to understand the requirements and prepare accordingly, ensuring they meet the age criteria and have the necessary documentation and credit health to secure a loan. With proper planning and understanding of the qualifications, obtaining a car loan can be a smooth drive towards car ownership.

Credit: cainandherren.com

Minimum Age Requirement For Car Loans

Thinking about buying a car on loan? Know the age rules first! The Minimum Age Requirement for Car Loans is important. Young drivers, listen up! Here’s what you need to know.

Legal Age For Binding Contracts

To get a car loan, you must be legally able to sign a contract. You need to be at least 18 years old in most places. This is called reaching the “age of majority.” Being 18 means the law sees you as an adult. You can make big decisions, like getting a loan for a car.

Variances In Age Threshold By State Or Country

The age to sign for a loan can change depending on where you live. Different countries and states have their own rules. Let’s break down some examples:

- In the USA, the standard age is 18. But in Alabama and Nebraska, it’s 19.

- In Canada, it’s 18 too. Yet, in Quebec, you need to be 19 years old.

- In the UK, you also must be at least 18.

This age thing matters because it’s about following the law. Check the rules in your area before you plan to get a car loan.

Credit: www.caranddriver.com

Factors Beyond Age Influencing Loan Approval

While age can be a key factor, it’s not the only one that lenders consider when reviewing car loan applications. Elements like your credit history and steady income play pivotal roles, too. Understanding these can help you secure a car loan, irrespective of your age. Let’s delve into the essentials that could make or break your car loan approval chances.

Credit History Essentials

Credit history acts as your financial report card for lenders. It shows them how responsible you are with money. A strong credit score suggests timely bill payments and mature handling of debt. It’s crucial for young adults seeking their first loan. Here’s a breakdown:

- Credit score range: Shows your creditworthiness.

- Payment history: Records of your consistency in paying bills.

- Debt-to-income ratio: How much debt you carry compared to your income.

- Credit length: The age of your oldest credit account.

- Credit mix: Variety of accounts, like cards and loans, you manage.

Income Verification Processes

Your income shows lenders you have the means to pay back the loan. Stable income reduces their risk. Lenders will verify this using different documents:

| Employment Type | Required Documents |

|---|---|

| Employed | Pay stubs, W-2s, employer contact info |

| Self-Employed | Tax returns, bank statements, 1099s |

| Fixed Income | Benefit statements, pension, social security documentation |

Your income helps lenders calculate the debt-to-income ratio. This ratio is key in loan decisions. Show consistent, verifiable income to boost your loan approval chances.

Bold actions like building a solid credit history and proving a stable income can increase your chances of car loan approval at any age. Get your documents in order, and you set the stage for a smoother car loan application process.

Acquiring A Loan As A Young Borrower

Embarking on the journey to buy a car is exciting. For young borrowers, it often starts with the question: How old do you have to get a car loan? Generally, you must be 18 to legally sign a loan contract. Still, age isn’t the only factor lenders consider. As a young buyer, understanding the loan process is crucial. Let’s dig into two key aspects that can help.

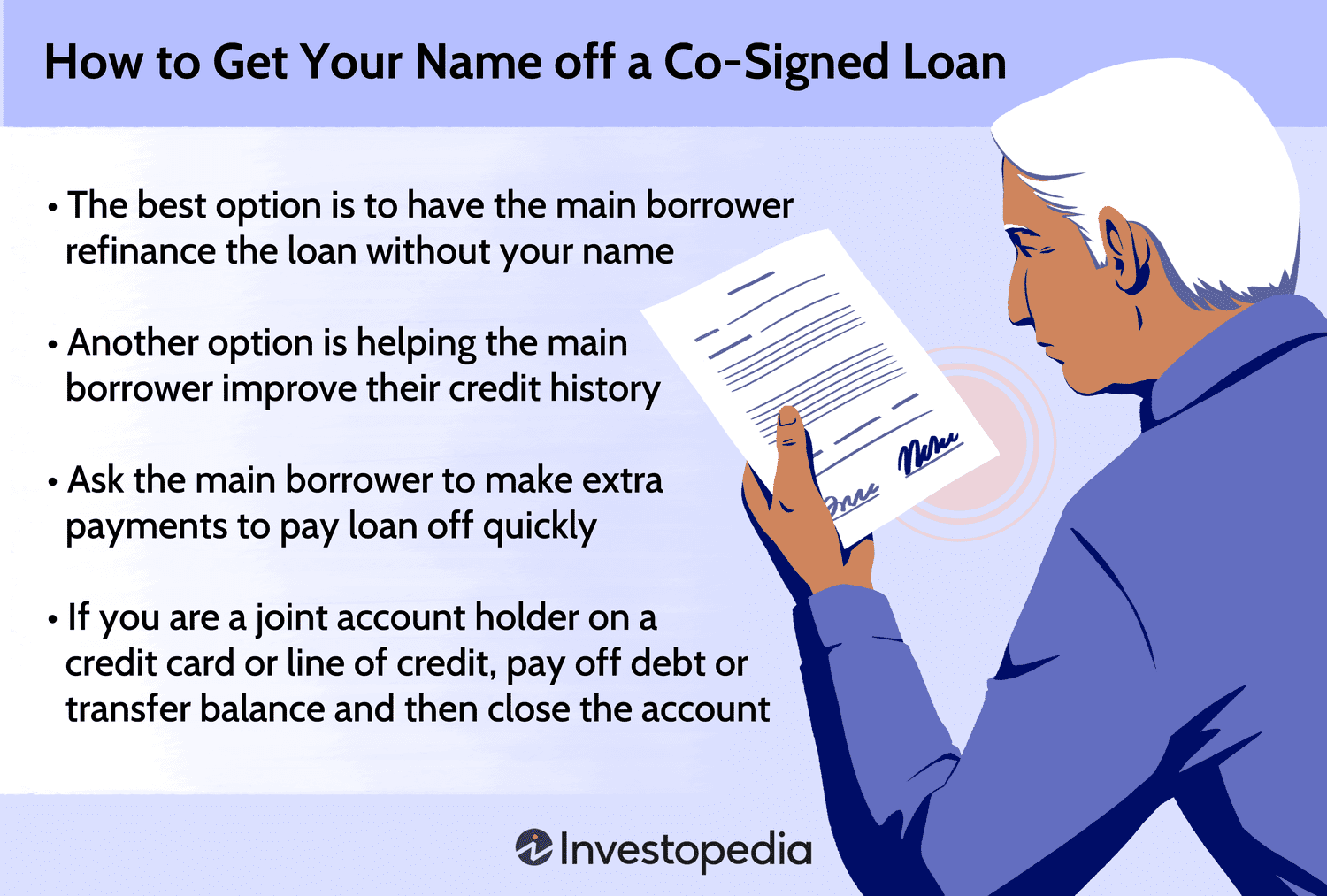

The Role Of Co-signers

Having a co-signer can be your golden ticket to getting a car loan approved. It’s like a trust boost for lenders. A co-signer, often a parent or guardian, promises to pay the loan if you can’t. This shared responsibility can lead to better loan terms. Important points to remember:

- Choose a co-signer with good credit: This improves your chances of approval.

- Responsibility Sharing: Both you and your co-signer need to understand the commitment.

Building Credit Early On

Starting young has its perks. Building good credit early can help you immensely. Lenders always check your credit history. Having a strong credit score can mean lower interest rates and better loan conditions.

Ways to build credit include:

| Method | Description |

|---|---|

| Secured Credit Card | Use a secured card responsibly to start your credit history. |

| Retail and Gas Cards | Often easier to obtain and can help build a credit profile. |

| Student Loans | On-time payments can positively affect your credit score. |

| Authorized User | Being added to someone else’s card can help, if they use credit well. |

Start these habits early to set a solid foundation for your credit score.

Meta Description: Discover how young borrowers can secure a car loan, the role of co-signers, and strategies for building credit early on.

Understanding Loan Terms And Responsibilities

Getting a car loan is a significant financial step. Borrowers must be at least 18 years old; this is the age one is legally seen as able to enter into a contract. Understanding the terms and responsibilities attached to a car loan is crucial for financial health and stability. Let’s dive into key aspects like interest rates and the duration of the loan, as well as the repercussions of not keeping up with payments.

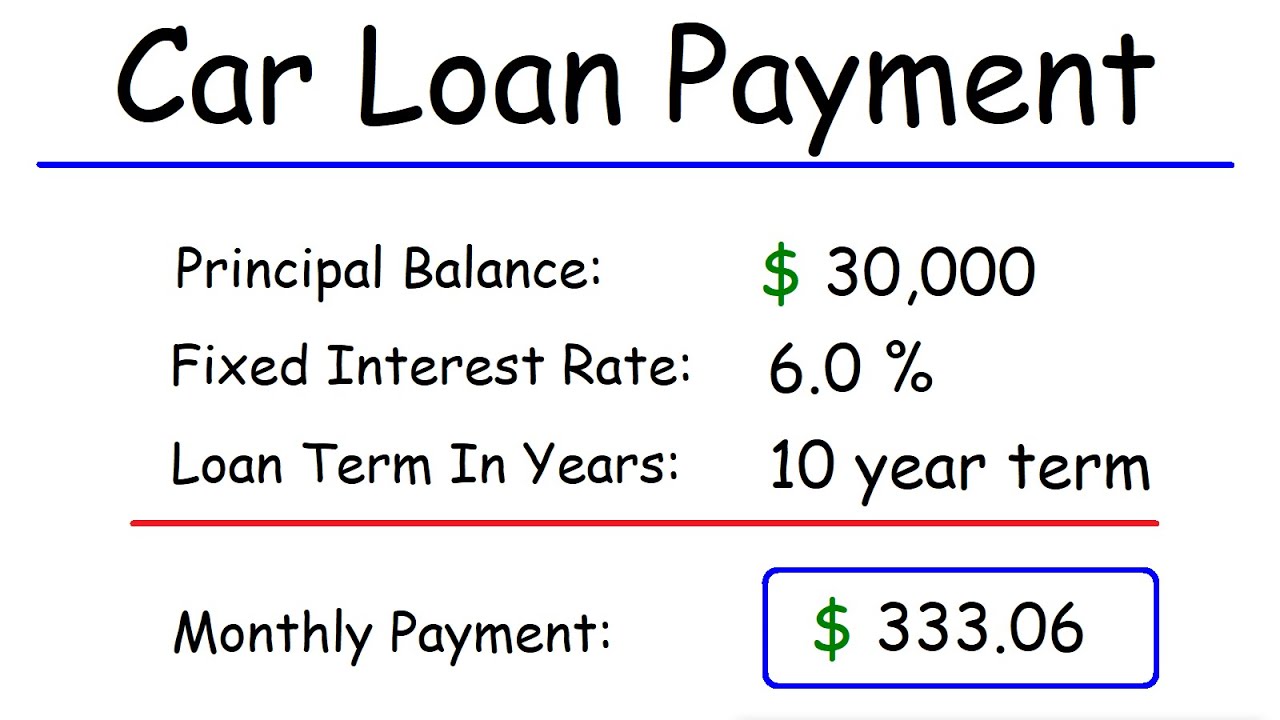

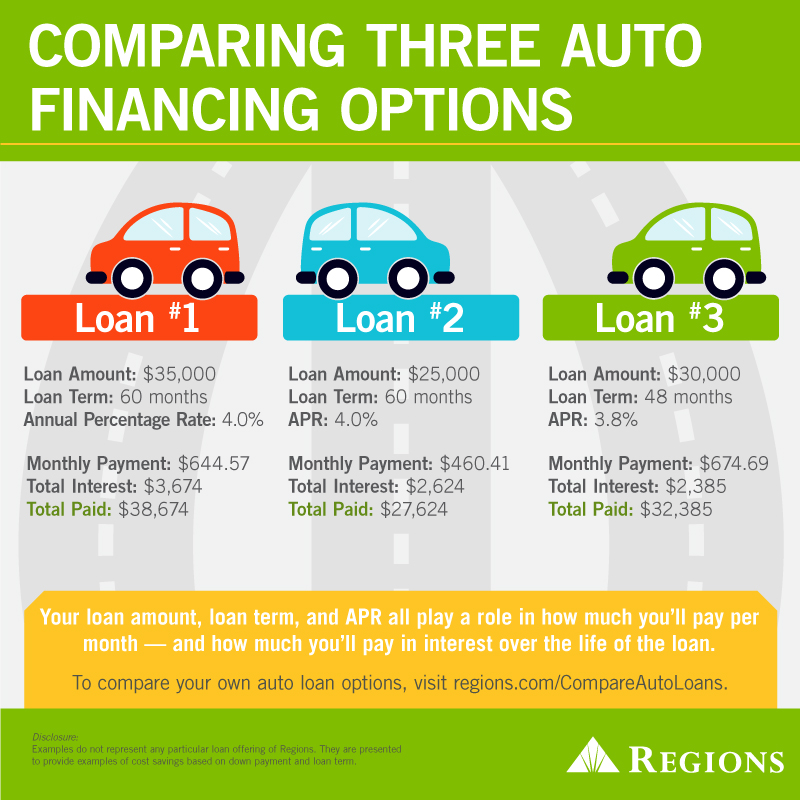

Interest Rates And Loan Duration

Interest rates affect the total cost of your car loan. These rates vary based on credit scores, loan amount, and lenders. A competitive rate keeps payments manageable. It’s crucial to seek the best rate before signing.

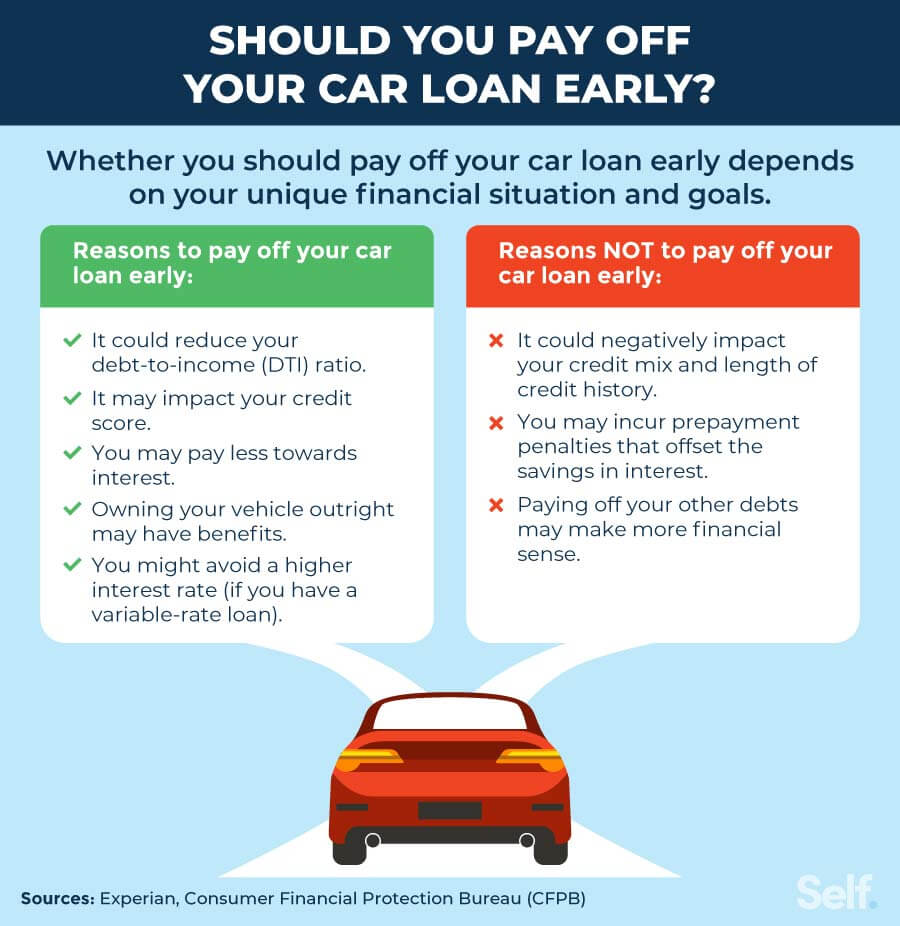

The loan duration, or term, typically spans 3 to 7 years. A longer term reduces monthly payments but increases total interest. A shorter term has higher monthly payments but saves on interest. Consider your budget when choosing.

Consequences Of Defaulting

Defaulting on a car loan bears serious consequences. Lenders may repossess the vehicle. This affects credit scores and borrowing ability in the future. Beyond repossession, lenders could take legal actions to recover their losses.

- Missed payments lead to late fees and could trigger higher interest rates.

- Continued missed payments result in defaulting.

- Credit reports reflect missed payments, lowering credit scores.

- Recovery of the vehicle does not always cover the loan balance; borrowers may owe the difference.

Alternative Paths To Vehicle Ownership

Exploring Alternative Paths to Vehicle Ownership opens up a world of options. Young drivers or those not yet ready to get a loan can still find ways to drive. Let’s dig into smart choices like leasing and programs for new drivers.

Leasing Vs. Buying

Deciding whether to lease or buy a car is a big step. Leasing means you rent the car for a set time. You pay monthly. At the end, return the car or buy it. Buying means the car is yours once you pay off the loan. Here are key points:

- Leasing:

- Lower monthly payments.

- Drive newer models more often.

- No resale hassle when the lease ends.

- Buying:

- Own the car after the loan.

- No mileage limits.

- Modify your car as you want.

Programs For First-time Buyers

Special programs can help new buyers get a car. Dealers and manufacturers offer these perks:

| Program Type | Benefits |

|---|---|

| First-Time Buyer Programs |

|

| College Graduate Programs |

|

These programs build credit and make car ownership easier. Always read the fine print and ask questions. Your dream of driving doesn’t have to wait!

Preparing For A Loan Application

Welcome to your guide on preparing for a car loan application. Navigating the world of auto financing can feel complex at first. The right preparation makes the process smoother. This segment will provide essential information to ready you for your journey to securing a car loan. Let’s ensure you have everything in place to make informed decisions and present a strong loan application.

Documentation Checklist

Organizing your documents is key to a successful car loan application. Lenders will request several items to verify your identity, income, and creditworthiness. Here’s what you need:

- Proof of Identity: A valid driver’s license or passport.

- Proof of Income: Recent pay stubs or tax returns.

- Proof of Residence: A utility bill or lease agreement.

- Credit and Bank Statements: To show your financial history.

- Vehicle Information: Details about the car you wish to purchase.

- Insurance Proof: Verification of at least basic auto insurance.

Budget Planning For Loan Repayment

A solid financial plan is critical for repaying your car loan. Use these steps:

- Calculate your monthly income after taxes.

- List all current monthly expenses to determine your disposable income.

- Decide on an affordable monthly payment for your new car loan.

- Remember to include car-related expenses like insurance, fuel, and maintenance in your budget.

- Use a loan calculator to see how different loan terms affect your monthly payment.

Planning ensures you choose a car and a loan you can comfortably afford.

Frequently Asked Questions Of How Old Do You Have To Get A Car Loan

What Is The Minimum Age For A Car Loan?

The minimum age to qualify for a car loan is typically 18 years. This is because a loan contract is a legal agreement, and one must be of legal adult age to enter into such a contract.

Can Minors Obtain Car Loans With Cosigners?

Minors cannot obtain car loans even with a cosigner, as they are legally unable to enter a binding contract. The cosigner must be the primary borrower if under age 18.

How Does Age Affect Car Loan Approval?

Age itself doesn’t directly affect car loan approval; however, young borrowers may lack credit history, which lenders consider. Demonstrated income and creditworthiness are often more crucial factors than age alone.

What’s The Ideal Age To Finance A Car?

There is no ideal age, but a good credit score and stable income typically make financing easier. This financial stability is often achieved by individuals in their mid-20s and onwards.

Conclusion

Navigating the waters of car financing needn’t be daunting. As we’ve explored, age does play a role in obtaining a car loan, with the typical starting line set at 18 years due to contractual requirements. Remember, credit history and stable income are pivotal in securing favorable loan terms, regardless of age.

Stay informed, and your journey to car ownership will be smooth sailing.