Do You Need Full Coverage on a Used Financed Car

Yes, you need full coverage insurance on a used financed car. Lenders typically require it to protect their investment.

Understanding the ins and outs of auto insurance requirements is crucial when financing a used car. Securing full coverage insurance isn’t just a cautious move—it’s often a mandatory condition set by finance companies. They need assurance that their asset is protected against a host of potential losses, including collisions, theft, and natural disasters.

Full coverage policies typically include liability, collision, and comprehensive insurance, ensuring that almost any incident leading to damage or loss of the vehicle won’t translate into a financial burden for either the lender or you, the borrower. Since used cars are less valuable than new ones, people sometimes mistakenly believe they can skimp on insurance, but the need for full coverage remains as long as the car is financed.

Introduction To Full Coverage On Used Financed Cars

When you finance a used car, the world of insurance can be a little confusing. Knowing what full coverage means and why it’s important is crucial. Let’s dive into the essentials of full coverage for financed used cars and debunk some common misconceptions.

Common Myths About Financing Used Cars

- Myth: “Used cars don’t need full coverage” – This is false. Whether new or used, financed cars often require full coverage.

- Myth: “Liability is enough for an older car” – Lenders usually demand more than liability to protect their investment.

- Myth: “Full coverage is too expensive” – While it’s more than minimum coverage, shopping around can lead to affordable rates.

Why Lenders Insist On Full Coverage

Lenders have a simple reason to require full coverage on a used financed car: risk management. The car is collateral for your loan. If it’s damaged or stolen, the lender still gets paid. Full coverage includes:

| Component | Description |

|---|---|

| Comprehensive | Covers non-collision events like theft and natural disasters. |

| Collision | Pays for damages from accidents with other vehicles or objects. |

| Liability | Protects against costs from injuries or damages you cause to others. |

Insurers view financed cars as high-value items. Full coverage protects the lender and peace of mind for you, the driver.

What Does Full Coverage Insurance Entail

Navigating through the world of car insurance brings up crucial questions. One such question is the need for full coverage on a used financed car. To understand if full coverage is necessary, it’s important to first grasp what it comprises of. Let’s delve into the components that make up full coverage insurance.

Components Of Full Coverage

Full coverage insurance isn’t just a single policy but a blend of several types of insurance. This mix aims to protect drivers financially from a wide range of on- and off-road incidents. Think of it as a safety net that captures potential financial mishaps that could occur with your car.

The essential building blocks of full coverage often include:

- Liability Insurance: Covers costs from damages or injuries you cause to others.

- Uninsured/Underinsured Motorist Protection: Helps when the at-fault driver can’t pay.

- Medical Payments/Personal Injury Protection: Assists with medical expenses regardless of fault.

- Collision and Comprehensive Coverage: They protect your vehicle in different scenarios.

Comprehensive Vs. Collision Coverage

It’s crucial to distinguish between comprehensive and collision coverage. Each serves a unique purpose in safeguarding your car.

Collision coverage kicks in when your car hits another vehicle or object. Comprehensive coverage, on the other hand, covers events that aren’t collisions. These might include theft, vandalism, or weather damage.

| Coverage Type | What It Covers |

|---|---|

| Collision Coverage | Damage from crashes, potholes, or rollovers. |

| Comprehensive Coverage | Non-collision incidents like fire, theft, or hail. |

With these coverages combined, you’re better armed against the unexpected. This is especially meaningful when financing a used car, as lenders often mandate full coverage until the loan is fully repaid.

Assessing Your Need For Full Coverage

Making the right insurance choice for a financed used car is crucial. Full coverage could protect you from unexpected costs. Let’s break down how to assess if it’s the right fit for you.

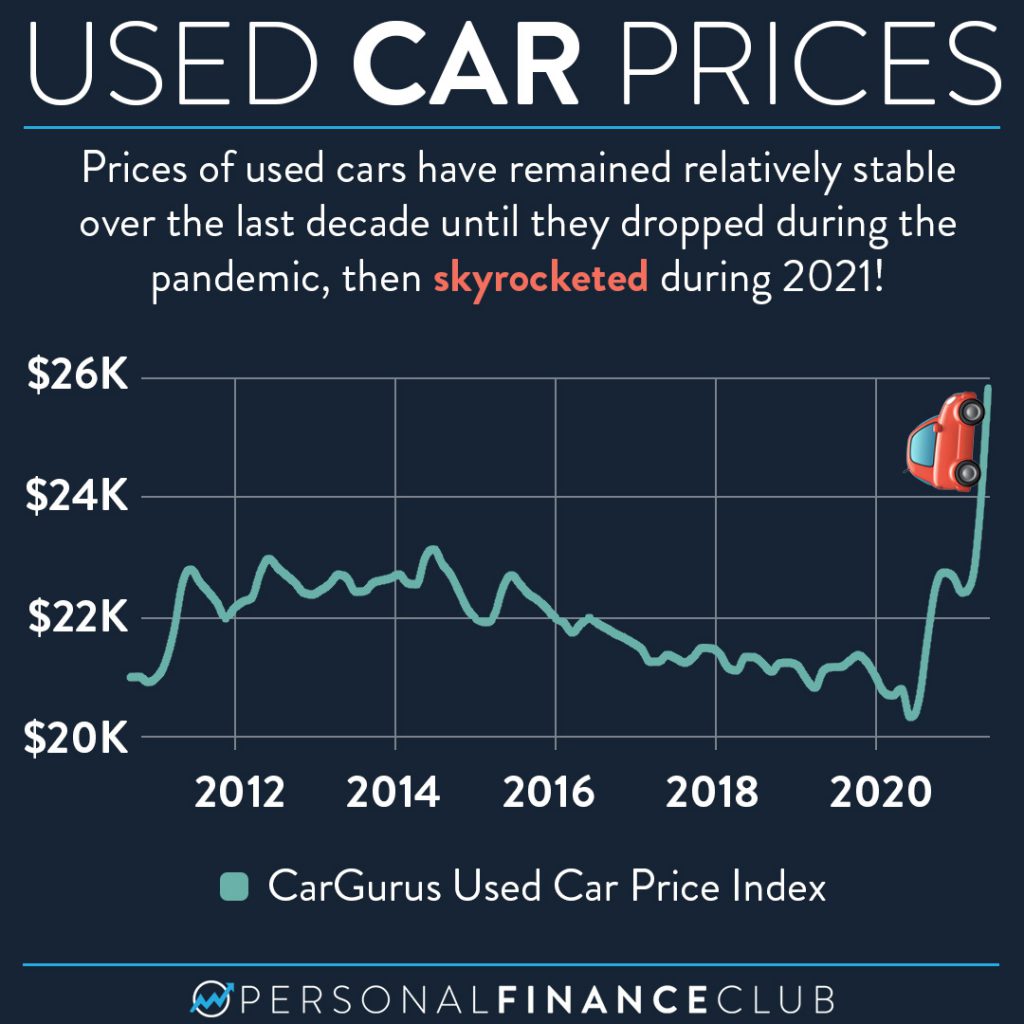

Understanding The Value Of Your Car

Knowing your car’s worth is step one. Cars depreciate, and used ones depreciate faster. Use tools like Kelly Blue Book or NADA Guides to check. This info shapes your insurance decisions.

| Car Age | Depreciation Rate | Estimated Value |

|---|---|---|

| 1 Year | 20-30% | Check Guides |

| 3 Years | 40-50% | Check Guides |

| 5+ Years | 60+% | Check Guides |

Less value might mean less coverage is okay. But consider loan terms because lenders often require full coverage.

Evaluating Risk Factors

Look at what risks you might face. Consider these:

- Accident rates in your area

- Weather conditions

- Your driving history

Risks vary greatly. A safe area with mild weather and a clean driving record might lower your need for full coverage. But, a high-risk area, harsh weather, or a spotty driving history suggest more protection is wise.

Credit: www.dchkayhonda.com

Legal And Lender Requirements

Understanding the legal and lender requirements for full coverage insurance on a financed used car is crucial. States have their own rules, and lenders often add extra demands. This framework ensures both compliance with the law and protection of the lender’s investment. Knowing these criteria is essential for responsible vehicle financing.

State Insurance Mandates

Every state has specific insurance requirements that drivers must meet. These mandates typically include liability insurance to cover third-party injuries and property damage. Some states also require personal injury protection (PIP) and uninsured motorist coverage. Check your state’s minimum insurance laws and compare them with full coverage options.

- Liability coverage: Essential for all drivers

- Personal injury protection: Required in some states

- Uninsured motorist coverage: Mandatory in certain areas

Lender-imposed Insurance Policies

When financing a used car, lenders often require full coverage insurance. This policy goes beyond state mandates. It typically includes both collision and comprehensive coverage. This protects the lender’s investment if the vehicle is damaged, stolen, or totaled.

| Component | Description |

|---|---|

| Collision Coverage | Covers vehicle damage from an accident |

| Comprehensive Coverage | Protects against theft, vandalism, and other risks |

Remember that these policies come at a higher premium. Still, they ensure cars remain covered for all sorts of unexpected incidents. Always review the lender’s insurance policy requirements before finalizing your vehicle financing agreement.

Calculating The Costs

Understanding the costs of full coverage on a used financed car is vital. It helps balance the need for protection with a budget. Let’s dive into calculating these costs and make sure you get the best deal for your needs.

Comparing Insurance Quotes

Start by pulling together quotes from various insurers. Use licensed comparison websites or contact insurers directly. List out the coverage each quote offers. Look for:

- Liability – It pays for damages to others.

- Collision – It covers repairs to your car.

- Comprehensive – It protects against theft or damage not from a collision.

Remember to check the insurer’s reputation and read reviews. Not all policies are the same, even if the prices are similar.

Considering Deductibles And Premiums

A higher deductible usually means a lower premium, and vice versa. But, a higher deductible also means more out-of-pocket after an accident. Weigh your options:

- Risk tolerance – Are you okay paying more later?

- Financial situation – Can you afford a high deductible if needed?

- Car’s value – Is high coverage justified for your car?

Calculate the long-term costs. Multiply the monthly premium by 12 for the annual cost. Add your deductible to understand the potential yearly expense.

Credit: www.galaxytoyota.net

Alternatives To Full Coverage

Exploring your options beyond full coverage on a financed used car? Certain alternatives can provide financial protection, potentially saving money. Understanding these options is crucial. Let’s dive into some popular choices.

Liability-only Coverage

Liability-only insurance is the most basic form of car insurance. It pays for damages and injuries you cause to others. However, it doesn’t cover your own car. This coverage is mandatory in most states. Many drivers consider this option if they own older vehicles with lower value.

- Pros: Often the cheapest option

- Cons: No protection for your car in an accident

Choosing liability-only requires careful consideration of the vehicle’s value and your financial situation. If you can handle potential out-of-pocket costs for car repairs or replacement, this might be for you.

Usage-based Insurance Options

Usage-based insurance (UBI) adjusts your premiums based on your driving behavior and mileage. UBI utilizes technology to monitor habits such as speed, braking, and time of day you drive. This can be ideal for safe drivers or those who drive infrequently.

| Type of UBI | How It Works | Potential Savings |

|---|---|---|

| Pay-As-You-Drive (PAYD) | Premiums based on miles driven | Save if you drive less |

| Pay-How-You-Drive (PHYD) | Rates based on driving behavior | Save if you’re a safe driver |

UBI can significantly reduce insurance costs while still offering substantial coverage. Check with your insurer to see if they offer UBI and if it’s a fit for your driving style.

Making An Informed Decision

Choosing the right insurance for a used financed car is crucial. Many factors come into play. Understand the terms of your loan agreement. Consider the car’s value. Balance this against the risks you face each day. Full coverage isn’t just a requirement; it’s a protection for your investment.

Weighing Costs Against Benefits

Full coverage includes collision and comprehensive insurance. It covers theft, vandalism, and accidents. Lenders usually require it. Yet, the costs can be high. Let’s explore what this means for you.

- Protection Value: Full coverage safeguards against unexpected costs.

- Loan Requirements: Lenders often need full coverage for loan terms.

- Resale Value: Good insurance can keep the car’s value high.

Compare the insurance costs to these benefits. Break down each cover’s pros and cons. Think about your daily routes and parking spots. Are damages likely to occur? Keeping these in mind will help you decide.

When To Drop Full Coverage

Is full coverage always necessary? Not always. As your car ages, its value drops. Here’s when you could consider dropping full coverage:

- Depreciated Asset: When your car’s value falls below a certain point, full coverage might not make financial sense.

- Sizeable Emergency Fund: If you have savings for repairs, you might take a higher deductible or drop part of the coverage.

- High Coverage Cost: If the coverage costs more than the potential benefit, reassess the situation.

Review your situation once a year. Consider mileage, condition, and any changes in your financial situation. Insurance needs can change. Stay ahead of the curve to make sure you are not overpaying.

Credit: www.rallyelexus.com

Frequently Asked Questions For Do You Need Full Coverage On A Used Financed Car

Is Full Coverage Needed On Financed Used Cars?

Yes, lenders typically require full coverage insurance on financed used cars. This ensures the vehicle is protected against all types of damage, as it serves as collateral for the loan until fully paid off.

What Does Full Coverage Include For Financed Vehicles?

Full coverage insurance for financed vehicles generally includes liability, collision, and comprehensive insurance. This combination protects against damages to others and your vehicle, and non-collision incidents like theft or fire.

How Long Should I Keep Full Coverage On My Financed Car?

Maintain full coverage for the entire duration of your auto loan. Failing to keep full coverage can breach your financing agreement, potentially leading to serious financial consequences.

Can I Reduce Coverage After Paying Off My Car Loan?

Once your car loan is paid off, you can reduce your insurance coverage. However, consider your car’s age, value, and your financial situation before opting for lower coverage.

Conclusion

Navigating car insurance options for your financed used vehicle doesn’t have to be daunting. Remember, full coverage safeguards your financial investment and meets lender requirements. Seek a policy that balances protection and affordability. Make an informed decision to drive with confidence and peace of mind.

Your vehicle—and wallet—will thank you.