Do I Need Insurance before I Buy a Used Car

Yes, you need insurance before you drive a used car off the lot. It’s legally required to have at least liability coverage.

Buying a used car can be an exciting venture, but it’s crucial to remember that owning a vehicle comes with responsibilities, including insurance. Securing insurance is not just a legal formality; it’s a critical measure of protection for you and others on the road.

Before you sign the paperwork and get the keys to your pre-owned vehicle, make sure you have a valid insurance policy in place. This step ensures that you comply with state regulations and safeguards your financial well-being in case of an accident. Keep in mind that every state has different insurance requirements, so check the specific laws in your area to understand the minimum coverage necessary. Remember, driving without insurance can lead to severe penalties, including fines and license suspension.

:max_bytes(150000):strip_icc()/7-mistakes-avoid-when-buying-used-car.asp-V1-dbc23496b5164854a581f89b4683a5b5.jpg)

Credit: www.investopedia.com

The Legalities Of Car Insurance And Vehicle Ownership

Understanding car insurance laws is vital before buying a used car. It is a legal necessity in many situations. This section explores these requirements.

State Requirements For Auto Insurance

All states mandate some form of auto insurance or financial responsibility. Coverage types and minimum limits vary. Keep abreast of your state’s laws to avoid legal hassles.

- Liability Insurance: Covers damage you cause to others

- Personal Injury Protection (PIP): Pays for medical expenses

- Uninsured Motorist Coverage: Useful if hit by an uninsured driver

To find specifics, consult state government websites or local DMVs.

Insurance As A Prerequisite For Registration

Many states require proof of insurance to register a vehicle. Ensure you secure coverage promptly after purchase. Registration cannot be completed without it.

Add other states as necessary for more comprehensive data| State | Insurance Needed for Registration |

|---|---|

| New York | Yes |

| California | Yes |

| Florida | Yes |

Without insurance, the registration process comes to a halt. Secure a policy to enjoy your vehicle legally and with peace of mind.

Financial Implications Of Uninsured Driving

The moment you drive a used car off the lot, it’s your responsibility to have insurance coverage. The financial consequences of uninsured driving can be severe and far-reaching. It’s essential to understand the risks and potential costs involved with driving without proper insurance coverage.

Risks Of Driving Without Insurance

Driving without insurance is not only illegal in most states, but it also exposes drivers to significant financial risks. Without insurance, you assume full responsibility for any harm or damage caused while driving. Here’s what could happen:

- Legal penalties, including fines and license suspension

- Personal liability for damage to another vehicle or property

- Responsibility for medical expenses after an accident

- A potential lawsuit and associated legal fees

Potential Costs Of Accidents Without Coverage

If an accident occurs without insurance, your personal assets are at stake.

The price of paying out-of-pocket for damages and injuries can quickly escalate.

Here’s a breakdown of possible costs:

| Cost Type | Possible Expense |

|---|---|

| Vehicle repairs | Thousands of dollars |

| Property damage | Varies widely |

| Medical bills | Often exorbitant |

| Legal fees | Can exceed policy limits |

Remember, these expenses come directly from your pocket, potentially leading to financial ruin.

Purchasing A Used Car: When To Get Insurance

Understanding the right time to secure insurance for a used car is essential. The goal is to ensure protection from the moment of purchase. Timing is crucial, and knowing when to have your policy in place can save you from unforeseen risks. Let’s dive into when and how to time your insurance purchase effectively.

Timing Your Insurance Purchase

Timing Your Insurance Purchase

Getting insurance for a used car starts before signing the sale deed. Contact your insurance provider early. Confirm the details and set the policy start date. This should be the same day you become the car’s new owner. Your policy must activate on this date.

Don’t wait until the last minute. Delays could expose you to risks without coverage. Plan ahead. Secure your policy at least a week in advance. This ensures a smooth transition of coverage from the previous owner to you.

Ensuring Coverage for Test Drives and Transportation

Ensuring Coverage For Test Drives And Transportation

When test-driving a used car, confirm insurance coverage. Ask the seller about their insurance. Ensure it covers other drivers. Be protected during the test drive.

Once you buy the car, you need to get it home. Your insurance must cover this journey. Without proper insurance, you risk fines and liability. Call your insurer to set this up before you drive away.

- Check the seller’s insurance for test drives

- Arrange for your insurance to start on the purchase day

- Make sure you’re covered for the ride home

Credit: www.psecu.com

Selecting The Right Insurance Policy For A Used Car

Buying a used car is an exciting journey. Yet, securing the right insurance is key before hitting the road. Your choice of insurance can save money and protect your investment. Let’s dive into how to pick the perfect policy!

Comparing Different Types of Coverage

Comparing Different Types Of Coverage

Understanding coverage types is crucial. Here’s a breakdown:

- Liability Insurance: Covers damage and injuries to others if you’re at fault.

- Collision Insurance: Pays for your vehicle’s repairs after an accident.

- Comprehensive Insurance: Handles non-collision events like theft or weather damage.

- Uninsured Motorist Insurance: Helps when the other driver lacks insurance.

Match your needs and budget with the right level of coverage. A table can help you compare.

| Coverage Type | What It Does | Is It Mandatory? |

|---|---|---|

| Liability | Covers others’ property and injuries | Yes |

| Collision | Pays for your car’s repairs | No |

| Comprehensive | Covers non-collision damage | No |

| Uninsured Motorist | Protects against uninsured drivers | Sometimes |

Choose wisely to reduce risks and save money.

Understanding Insurance Rates for Pre-owned Vehicles

Understanding Insurance Rates For Pre-owned Vehicles

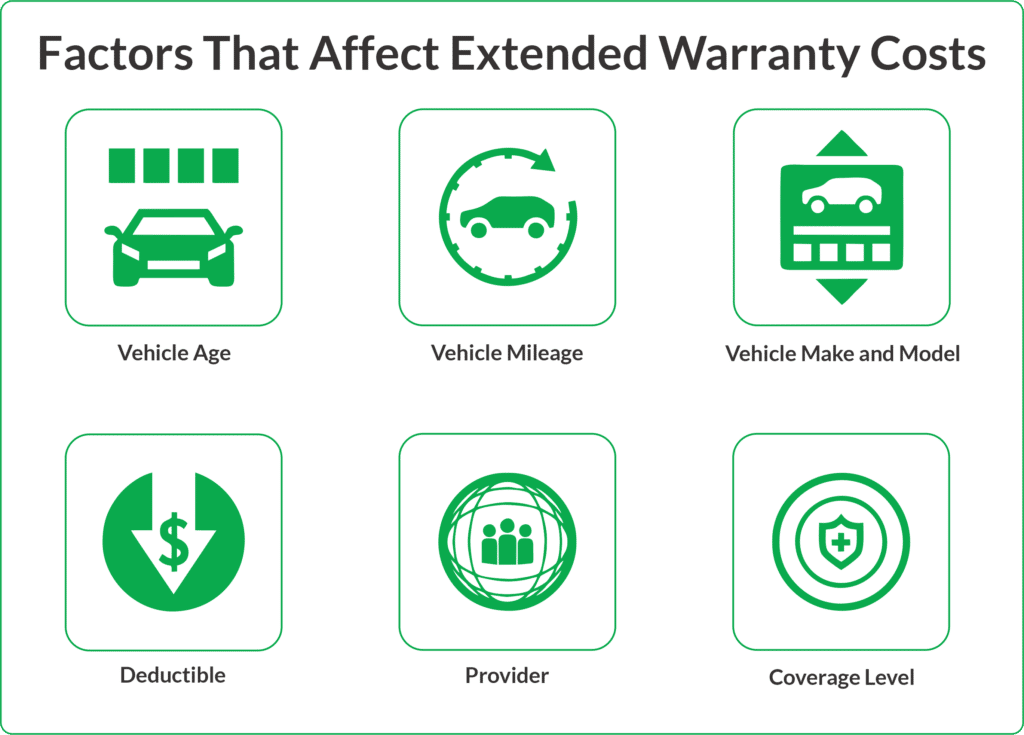

Several factors affect insurance rates for used cars:

- The car’s age and model affect premiums.

- Safety features may lower costs.

- Past claims and driving history play a role.

- Higher deductibles can reduce your rate.

Research and compare quotes from different insurers. Use online tools to estimate the best possible rates.

Transferring And Updating Insurance Policies

Buying a used car? Remember, the right insurance is key. Once you’ve selected that perfect ride, transferring and updating your insurance policies is the next step. Ensuring coverage is continuous and reflects your new vehicle is crucial. Step by step, let’s explore how.

Procedure For Transferring Existing Insurance

Transferring your existing insurance to your new car is a must. Here’s the simple process:

- Contact your insurance provider.

- Share details of your new purchase.

- Provide vehicle identification number (VIN).

- Confirm coverage transfer dates.

- Request a new insurance card.

Always carry proof of insurance when driving. Your insurance company needs a few key details to make a smooth transition. Do this promptly to avoid any coverage lapses.

Updating Your Policy To Reflect Vehicle Change

With a different car comes a new policy update. Keep these steps in mind:

- Review your coverage needs. Used cars might need different coverage.

- Adjust your policy limits if necessary.

- Consider the value and features of your new car.

- Include additional protection, like comprehensive, if needed.

- Inform your insurer about any safety features or anti-theft devices.

These updates can impact your premiums. Adjusting your policy ensures that your new car has the right protection. You might even save money.

Insurance Considerations Specific To Used Cars

Buying a used car comes with excitement and some must-do homework. One critical task is sorting out the insurance. Second-hand vehicles have unique needs different from new ones. Understanding these needs ensures a smooth drive ahead. Let’s explore these details.

The Impact Of Vehicle Age On Insurance

Diving into the world of used cars, you discover the age factor. Older cars often cost less to insure. This is due to their lower value. But facts on the ground can vary.

- Rates depend on the car’s safety features and repair costs.

- Discounts may apply if the vehicle has modern security systems.

Checking with insurance providers gets you the best price for your specific model.

Additional Coverage Options For Older Vehicles

When your heart settles on a vintage charm or a simply pre-loved car, insurance tweaks are in order. Specialist coverages are out there for these beauties.

- Consider classic car insurance for vintage finds.

- Comprehensive coverage protects against non-collision events.

- Uninsured motorist protection is a savvy choice for any car age.

Chatting with insurance pros reveals the best mix for your beloved set of wheels.

Frequently Asked Questions For Do I Need Insurance Before I Buy A Used Car

Is Insurance Required To Buy A Used Car?

No, you don’t need insurance to buy a used car. However, to legally drive it, you must have at least the minimum required coverage for your state. Before driving, always secure insurance to avoid legal issues and financial risks.

What Insurance Do I Need For A Used Car?

For a used car, you typically need liability insurance as a bare minimum. Consider comprehensive and collision coverage too, especially if the car has significant value or is financed. Tailor your policy to your needs and state requirements.

How Soon Should I Insure My Used Car?

Insure your used car before you drive it off the lot. Most states require proof of insurance for registration. Plus, immediate coverage protects you against potential accidents or damages as soon as you become the car’s owner.

Can I Transfer My Insurance To The Used Car?

Yes, you can often transfer existing insurance to a new vehicle. Notify your insurance company before the purchase and provide details of the used car to adjust coverage. However, the premium may change based on the car’s specifics.

Conclusion

Embarking on your used car journey requires careful thought, especially about insurance. Securing a policy before purchase protects you immediately from risks. It’s a smart move for financial safety and peace of mind. Remember, driving uninsured is not just risky, it’s often illegal.

Prioritize coverage to ensure your automotive investment is protected from day one.