Can I Use Affirm for Car Repairs

Yes, you can use Affirm for car repairs. Many auto service providers accept Affirm as a payment option.

Affirm offers a flexible and transparent payment alternative for those unexpected car repair expenses. Car troubles often arise without warning, leaving vehicle owners in need of a reliable payment solution. Embedding the concept of ‘buy now, pay later,’ Affirm allows customers to manage the costs of vehicle maintenance and repairs in a more manageable way.

With no hidden fees, the service transforms large out-of-pocket expenses into smaller, structured payments over time. For those prioritizing financial planning without sacrificing necessary vehicle care, Affirm provides an adaptable payment option, enhancing access to quality auto services and ensuring your vehicle stays in top condition. Integrating Affirm for auto repairs could not only streamline your payment process but also help keep your finances on track while taking care of essential vehicle maintenance.

The Basics Of Using Affirm For Payments

Caught off guard by unexpected car repairs? Worry not! Affirm offers a simple solution to manage those costs without the immediate financial strain. Here’s how to navigate the world of flexible payments with Affirm for your automotive needs.

What Is Affirm?

Affirm acts like a credit card without the plastic. It’s a payment method that lets you split the cost of your purchase into manageable chunks. With Affirm, you can repair your car now and pay over time.

How Affirm Works With Retailers And Services

Affirm partners with retailers and service providers to bring you a smooth checkout experience. Here’s a quick breakdown:

- Select Affirm at checkout.

- Complete a quick application.

- Choose your payment plan.

With transparent terms and no hidden fees, Affirm keeps your finances in clear view. Always know what you owe and when it’s due. For car repairs, look for auto shops that accept Affirm. They’ll let you service your vehicle immediately and spread the cost over time.

SEO friendly tip: Ensure Affirm and relevant car repair terms are combined within the content organically, facilitating better search engine rankings.

Credit: www.affirm.com

Affirm For Auto-related Expenses

Maintaining a car can lead to unexpected bills. Whether it’s a regular service or emergency repairs, costs add up. Affirm offers a way to manage these expenses through flexible payments. This can ease the financial burden car owners often face. Let’s explore the role of Affirm in the automotive industry and how to find mechanics that accept this payment option.

Scope Of Affirm In The Automotive Industry

Affirm partners with various auto shops to help customers pay for services over time. This includes a range of automotive needs:

- Oil changes

- Brake repairs

- New tire purchases

- Engine work

Using Affirm, car owners can handle these expenses without paying the full cost upfront. This is possible at participating dealerships and repair shops across the country.

Finding Auto Shops That Accept Affirm

Discovering a mechanic that accepts Affirm is simple. Follow these steps:

- Visit the Affirm website.

- Use the store directory to look up auto-related businesses.

- Select a shop within your area.

Be sure to confirm with the auto shop that they accept Affirm before booking your service. This can save time and ensure a smooth transaction.

| Service Type | Affirm Accepted |

|---|---|

| Oil Change | Yes |

| Brake Repair | Yes |

| Tire Purchase | Yes |

| Engine Work | Yes |

After finding a shop, you can manage your payments over time. Affirm provides a transparent payment plan, often with no hidden fees.

Advantages Of Using Affirm For Car Repairs

The advantages of using Affirm for car repairs can be a lifesaver. Cars break down when it’s least expected. The stress of repair costs adds up quickly. Affirm steps in to help manage these expenses without ruining your budget. Explore options that keep car repairs affordable and stress-free.

Interest-free Financing Options

One of the biggest draws to using Affirm for car repairs is the interest-free financing. Some plans allow you to pay for your repairs without extra cost for a set period. This can be especially helpful for large repairs.

- Pay over time: Spread the cost over weeks or months.

- Saving credit cards: Keep credit lines open for emergencies.

- No hidden fees: Costs are upfront, with no surprises.

Budget-friendly Payment Plans

With Affirm, repair bills don’t hit all at once. Budget-friendly payment plans split the cost into manageable chunks. You pick a schedule that aligns with your payday and budget.

| Payment Flexibility | Financial Control |

|---|---|

| Choose how much to pay. | Take charge of your finances. |

| Set your own pace. | Prevent debt accumulation. |

Assessing The Financial Implications

Finding a smart way to handle car repairs without breaking the bank can be a challenge.

Assessing the financial implications of using a service like Affirm is a crucial step for savvy car owners.

Understanding Interest Rates And Fees

With Affirm, you can spread out your car repair expenses over time. But, remember the price for this convenience. Interest rates vary based on your credit. They can turn a small repair bill into a bigger one. No late fees mean no unexpected costs if a payment slips your mind.

- Competitive rates: Affirm offers rates that might be better than your credit card.

- Prequalification: Check potential rates without hurting your credit score.

- Transparency: Their app shows your total interest, helping you stay informed.

The Impact On Credit Scores

Before you use Affirm, think about your credit score. It matters. Soft inquiries are used at application, keeping your score safe. But, late payments or high debts can hurt it. Good money habits with Affirm mean your credit score stays healthy.

| Action | Credit Impact |

|---|---|

| Consistent payments | Positive effect |

| Missed payments | Negative effect |

| High utilization | Watch out, can be negative |

Navigating The Affirm Application Process

Navigating the Affirm application process can be a smooth sail. With car repairs luring on the horizon, a financing option like Affirm might be the lifebuoy you need. This guide walks through eligibility and the steps to lock in financing, so unexpected repair bills don’t catch you off guard.

Eligibility And Credit Approval

Check eligibility first. Affirm offers a user-friendly platform. They need minimal personal details. Eligibility depends on your credit score. Don’t worry; they run a ‘soft’ credit check. This won’t harm your credit score.

Requirements are straightforward:

- A legal U.S. resident

- At least 18 years old

- A valid U.S. or APO/FPO/DPO home address

- A mobile number for SMS alerts

Credit approval is quick with Affirm. Good or fair credit scores often lead to approval. Remember, on-time payments improve credit. Late payments do the opposite.

Steps To Secure Financing

Follow these steps to get Affirm for car repairs:

- Select Affirm at checkout when you’re at your auto repair shop, if they offer it.

- Enter your details into the Affirm application form.

- Get a decision fast. Affirm confirms your loan amount instantly.

- Choose a payment plan that fits your budget.

- Finish the purchase and get your car fixed!

Making regular payments is easy. Affirm sends email and SMS reminders. You can also set up automatic payments. This keeps you on track and hassle-free.

Credit: www.erienewsnow.com

Real Experiences With Affirm For Car Repairs

Real Experiences with Affirm for Car Repairs shines a light on how this modern financing tool helps drivers get back on the road without the immediate financial burden. People across the country are leveraging Affirm’s flexible payment options when unexpected car issues arise. Let’s dive into personal stories that showcase Affirm’s impact on automotive fixes.

Customer Testimonials

- Jane D. from Texas – “With no savings to cover a transmission overhaul, Affirm let me pay over six months. It was a lifesaver!”

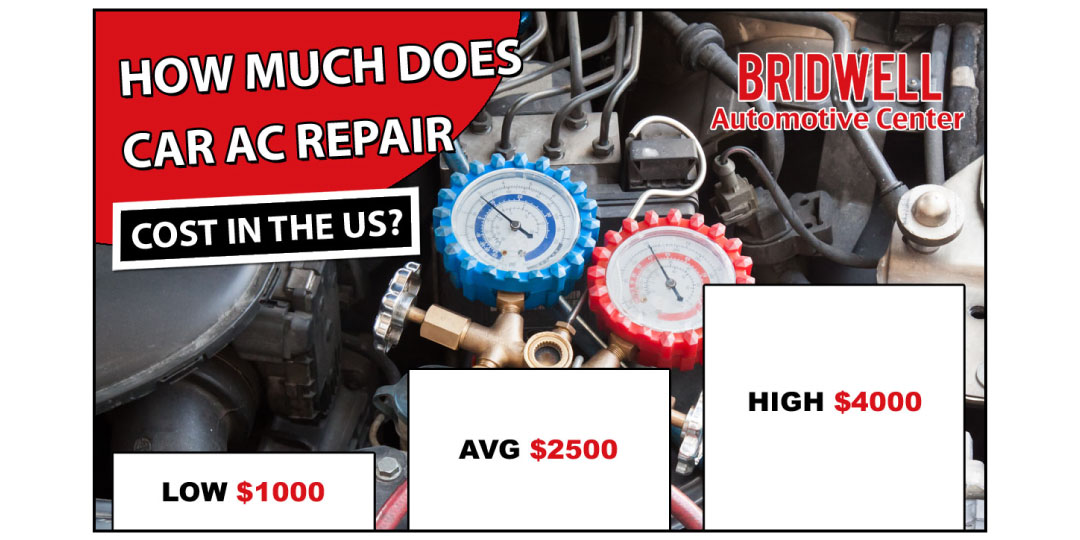

- Mike L. from Florida – “I fixed my AC in the dead of summer thanks to Affirm. Quick approval, zero hassle.”

- Emily R. from California – “After a nasty pothole incident, I was able to use Affirm for new tires and alignment without breaking the bank.”

Case Studies Of Successful Repairs

| Customer | Car Issue | Repair Cost | Affirm Payment Plan |

|---|---|---|---|

| Alan S. | Brake Replacement | $400 | 3 months |

| Beth K. | Engine Repair | $850 | 12 months |

| Carlos G. | Suspension Work | $600 | 6 months |

These case studies depict successful partnerships between afflicted drivers and a financing option that kept them moving. Affirm’s spread of payment options suits different budgets, showcasing a commitment to flexibility.

Alternatives To Using Affirm

Looking for different ways to pay for car repairs? While Affirm offers a handy buy now, pay later service, it’s not your only option. Exploring alternatives to Affirm for auto repair financing could uncover more suitable or cost-effective solutions. Let’s dive into some available options.

Credit Card Usage

Using a credit card might be a straightforward solution. Many cards offer rewards points or cash-back incentives. If you have a card with an introductory 0% APR offer, you could finance repairs interest-free during the promotional period. Remember to manage your balance to avoid high interest rates post-promotion.

Personal Loans For Auto Repairs

Personal loans can provide a lump sum with a fixed interest rate for your auto repair needs. They often feature lower interest rates than credit cards and provide a set repayment schedule. Ensure you compare rates from multiple lenders to secure the best deal.

- Shop around for competitive rates

- Review loan terms carefully

- Evaluate monthly installment impacts on the budget

Direct Payment Plans With Service Providers

Many auto service providers offer payment plans directly to customers. This can be an excellent way to split hefty expenses into manageable installments. Speak with a service advisor to learn what plans are available. They may offer plans with little to no interest, which could be more beneficial than other lending options.

- Ask about service provider financing at the repair shop

- Compare in-house financing terms to other options

- Consider potential benefits like discounts on services or parts

Credit: manuelsbodyshop.com

Frequently Asked Questions Of Can I Use Affirm For Car Repairs

What Is Affirm And Can It Cover Car Repairs?

Affirm is a financing alternative to credit cards and other credit-payment products. It allows users to make immediate purchases and spread the cost over a period of time. Yes, Affirm can be used for car repairs at auto shops that accept it as a payment option.

How Does Financing Car Repairs With Affirm Work?

Using Affirm for car repairs involves choosing Affirm as a payment method at checkout. You’ll be presented with loan terms, showing your monthly payment amount and the interest rate. If approved, you pay off your balance in installments.

Are There Interest Fees With Affirm Car Repair Loans?

Yes, some Affirm loans for car repairs may include interest depending on creditworthiness and the merchant’s policies. However, Affirm does offer 0% APR on select transactions with certain merchants if you qualify.

Can I Use Affirm For Emergency Car Repairs?

Absolutely, if you’re faced with emergency car repairs, you can use Affirm as a payment option, provided that the auto repair shop accepts it. This can help you manage unforeseen expenses without upfront payment.

Conclusion

Affirm offers a flexible method for handling unexpected car repair expenses. It allows for manageable payments, easing financial strain. Before applying, ensure your mechanic accepts Affirm. Always read terms carefully for a smart financial choice. Car maintenance needn’t break the bank with this modern solution.