Can You Finance a Used Car

Yes, you can finance a used car through various lenders, including banks, credit unions, and dealerships. Financing options for pre-owned vehicles abound, with competitive rates for qualified buyers.

Buying a used car can be an economical choice for many drivers, offering the advantage of slower depreciation and lower prices compared to new vehicles. When considering a used vehicle, financing is a critical component to think about. Lenders typically provide loans for used cars, but the terms and interest rates might differ from new car loans.

The loan’s interest rate and terms will depend on factors such as the car’s age, your credit score, and the lender’s policies. Most dealerships have relationships with financial institutions and can offer on-the-spot financing, but it’s always wise to shop around. Securing pre-approval from a bank or credit union before heading to the dealership can give you negotiating power and a clear budget. Remember that a solid credit score can help secure a favorable interest rate, making the purchase more affordable over time.

The Viability Of Financing A Pre-owned Vehicle

Many car buyers ponder the possibility of financing a used car. It’s a practical option. Vehicle financing isn’t solely for brand-new models. A pre-owned car offers value, saving potential, and the chance to own a vehicle that fits your budget and needs. Let’s explore the ways financing a used car could be a smart choice.

Benefits Of Choosing To Finance

Financing a used car comes with several perks:

- Lower Overall Cost: Pre-owned vehicles are less expensive, reducing both initial costs and monthly payments.

- Improved Credit Score: Timely loan payments can boost your credit score.

- Ownership Advantage: Eventually, you own the car outright, unlike leasing.

- Warranty Options: Some used cars still carry their original warranty, or you can opt for an extended warranty plan.

Common Misconceptions And Realities

Let’s clear up some myths:

| Misconception | Reality |

|---|---|

| High Interest Rates | Interest rates can be competitive, especially with good credit. |

| Short Loan Terms | Many lenders offer flexible terms, similar to new car loans. |

| Financing Isn’t Available | Financing is widely available for used cars from dealers and banks. |

| Hidden Fees | Transparent deals are common, but always read the contract carefully. |

Assessing Your Eligibility For Financing

Thinking about buying a used car? Exciting times! But first, let’s check if you can get a loan to help pay for it. Lenders look at a few things before they give you money. Your credit score, job, and income matter a lot. Here’s what you need to know before you talk to lenders.

Credit Score Considerations

Your credit score is like your financial report card. It shows if you’re good with money. A high score can lead to better loan terms. A low score may need work or could make loans cost more. Aim for a score above 670 for the best options. Check your score for free once a year.

Income And Employment Verification

Lenders want to know you have a job and earn money to pay the loan. They might ask for recent pay stubs. They could also ask for tax returns. If you’re self-employed, show them how you make money. Having a stable job for a while helps your case.

Here’s a mini checklist for loan prep:

- Know your credit score

- Gather pay stubs or proof of income

- Have tax documents ready

- Stay in your job for consistency

Ready to explore loans for that dream car? Keep this info handy. It gives you a better chance to get the money you need. Now let’s find out what lenders can offer!

Navigating Loan Options For Used Cars

Finding the right financing for a used car can be a puzzle. But it doesn’t have to be. With the right information, you can make a smart choice that fits your budget and car-buying goals. Let’s explore the pathways to financing a pre-owned vehicle.

Bank Loans Vs. Dealership Financing

Deciding between a bank loan and dealership financing is your first step. Both have pros and cons. A bank might offer lower rates and more personalized service. But, a dealership could provide convenience and sometimes promotions for financing on-site. See the differences here:

| Bank Loans | Dealership Financing |

|---|---|

| Personalized customer service | One-stop shopping experience |

| Pre-approval gives leverage in negotiations | Special financing deals for certain cars |

| Potentially lower interest rates | Convenient for quick purchases |

Understanding Interest Rates And Terms

Interest rates and terms dictate the cost of your loan. A lower rate means less money spent over time. Shorter terms can increase monthly payments but save money long-term. Here’s what you should know about each:

- Interest Rates: The percentage the lender charges for your loan. Lower credit scores often mean higher rates.

- Loan Terms: How long you have to pay back the loan. Usually, terms range from 36 to 72 months. Choose what best suits your budget.

Check your credit score before you shop. Your score greatly affects your rate. A higher score can help you get a lower rate. Also, compare rates from different lenders. Don’t settle for the first offer you get.

Credit: www.caranddriver.com

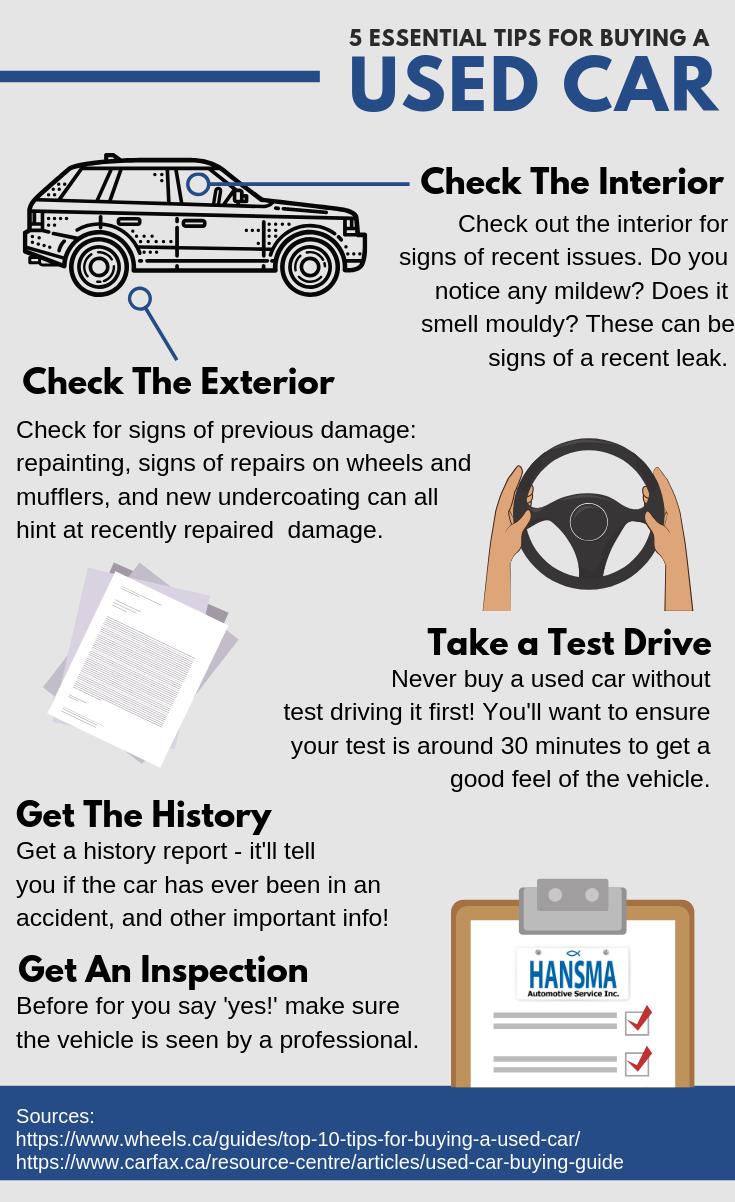

The Importance Of A Thorough Vehicle Inspection

The Importance of a Thorough Vehicle Inspection cannot be overstated when considering financing for a used car. A detailed inspection safeguards buyers from unforeseen expenses. Lenders also prefer financing vehicles in good condition. A thorough check ensures both reliability and value retention.

Pre-purchase Evaluation

Every smart purchase starts with a pre-purchase evaluation. Here are key points a buyer should inspect:

- Vehicle History Report: Reveals past accidents and maintenance records.

- Professional Mechanic Assessment: Uncovers issues not evident to untrained eyes.

- Test Drive: Identifies any operational problems.

Completing these steps can save money and headaches in the future.

How Vehicle Condition Affects Loan Approval

Lenders view a well-maintained vehicle as a safeguard for their investment. Here is why:

| Vehicle Condition | Loan Implication |

|---|---|

| Excellent Condition | Easier loan approval and potentially lower interest rates. |

| Good Condition | Approval likely, with reasonable rates. |

| Poor Condition | May lead to denied applications or high-interest rates. |

Securing financing for a used car necessitates evidence of a vehicle’s good standing. Inspect thoroughly, secure a better loan agreement, and ensure long-term satisfaction.

Finalizing The Deal: Steps To Take

Ready to drive off in your chosen used car? Perfect! But before you do, there’s a critical phase: Finalizing the Deal. This stage requires attention to detail and a bit of know-how. Follow these steps to ensure a smooth ride through the last stretch of your car buying journey.

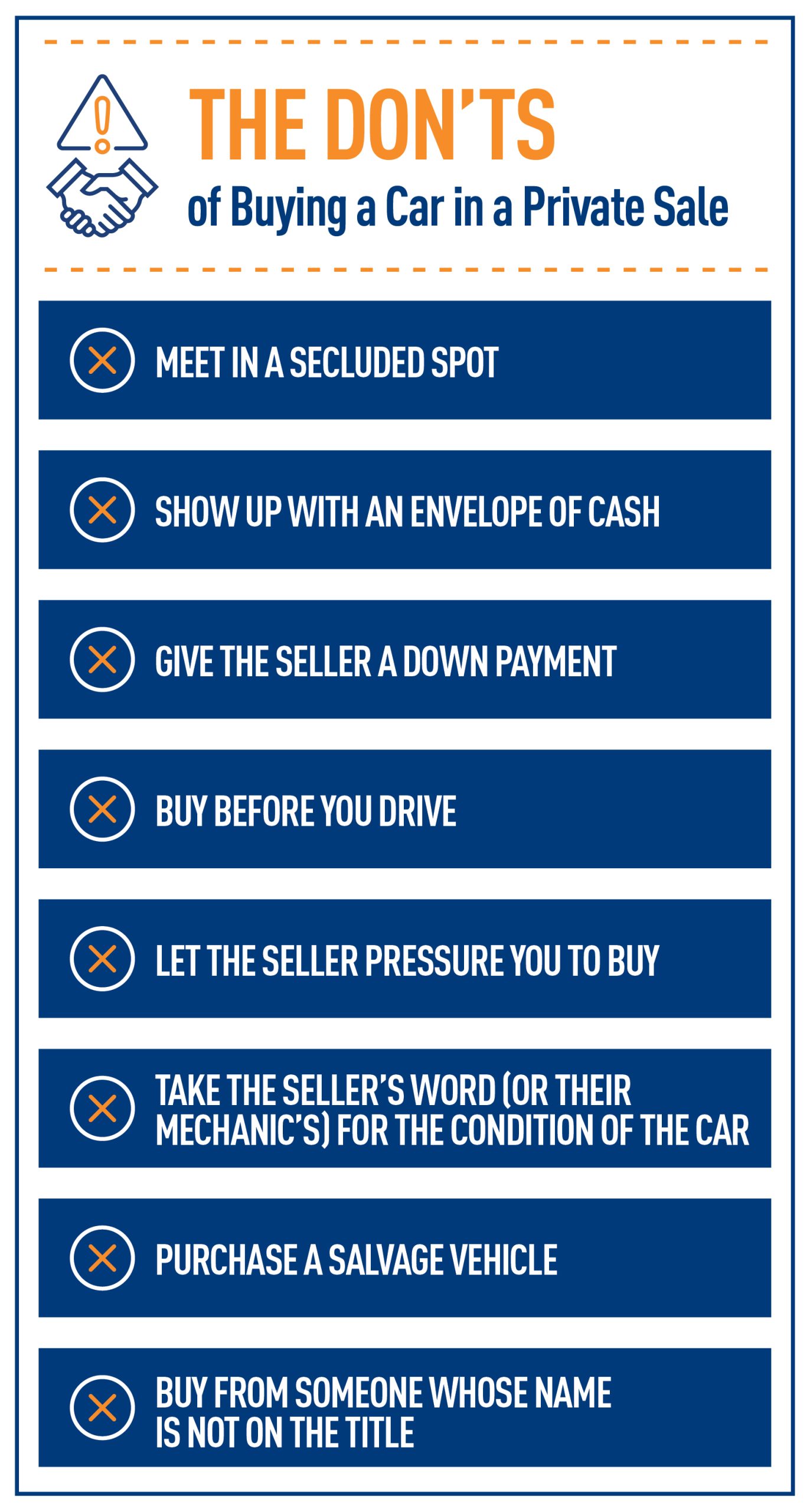

Negotiating The Purchase Price

Entering negotiations can be daunting, but it’s essential for a fair deal. Your goal is to reach a price that works for both. Do your homework. Know the car’s value before discussing numbers. Remember, staying calm and ready to walk away gives you the upper hand.

Here’s a quick checklist for effective price negotiation:

- Research the car’s market value

- Inspect the car’s condition thoroughly

- State your opening offer clearly but politely

- Discuss terms and conditions confidently

- Be prepared with facts to support your offer

- Always keep your budget in mind

Completing The Paperwork

Once you agree on a price, the next step is paperwork. It can be tedious, but it’s vital for a legit transaction. The dealer or seller will provide the important documents. Make sure everything is in order. Check all documents for accuracy to avoid future issues. It’s okay to take your time. You’re making a big investment, so every detail matters.

The paperwork typically includes:

- The bill of sale

- A title that’s free of liens

- The registration

- Proof of insurance

- Warranty documents or service records, if applicable

Tip: It’s wise to ask a professional to review the paperwork with you. This might be a lawyer or a trusted advisor. Safety first!

Credit: www.moneylion.com

Protecting Your Investment And Finance Agreement

Buying a used car is smart. Financing it makes sense for many. But remember, a finance agreement is a big deal. Protecting your investment is key. Let’s explore how to do just that.

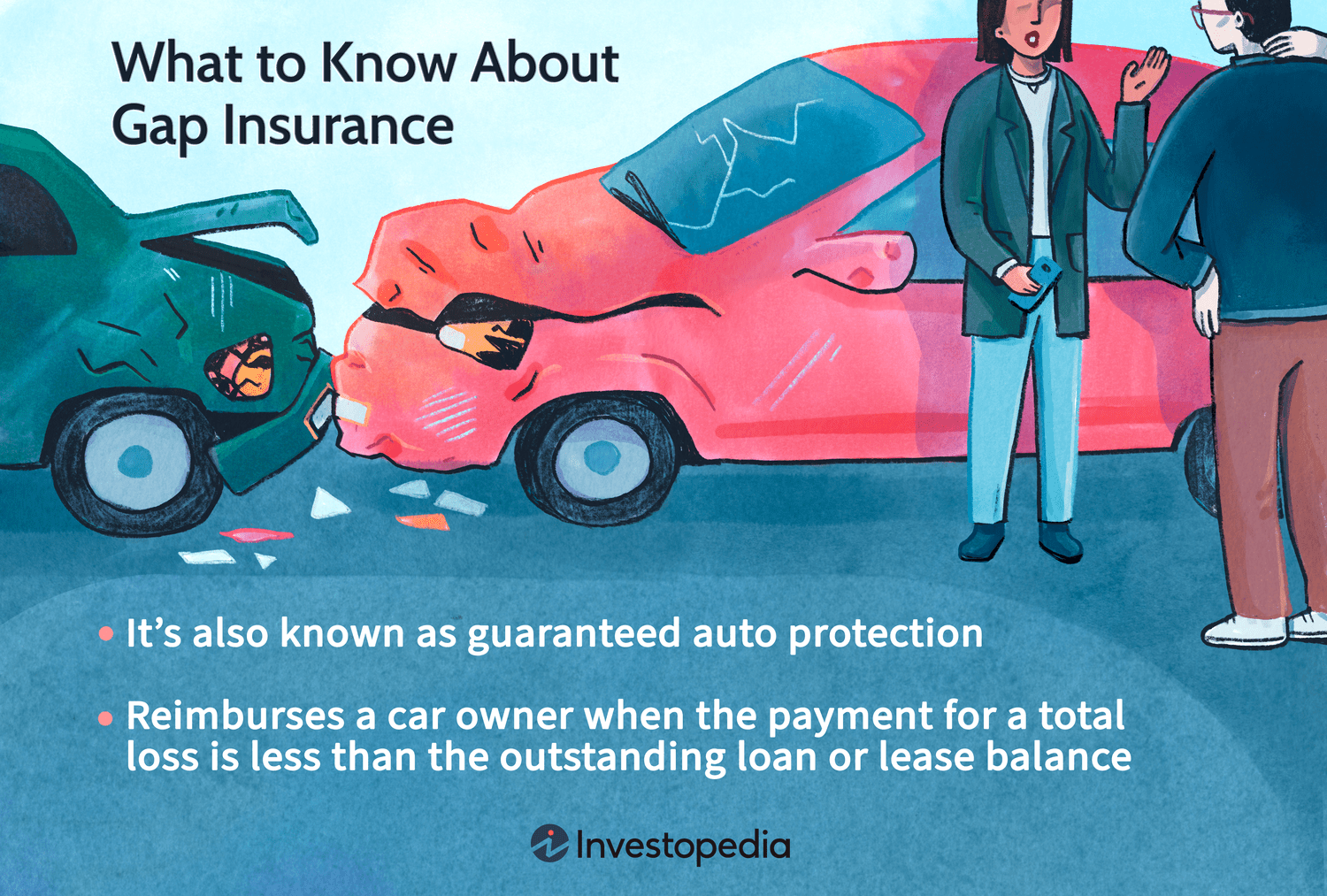

Insurance Requirements

Every financed car needs insurance. It’s not just about obeying the law. It’s about safeguarding your purchase. Should an accident happen, you want no worries about costs. Full coverage insurance is often a must.

- Collision coverage handles repair costs.

- Comprehensive coverage takes care of theft and non-collision damage.

- GAP insurance covers loan balance if your car’s worth less than what you owe.

Maintaining Vehicle Condition

Keep your car in top shape. It’s crucial. Regular maintenance stops small issues from turning big. Preserve your car’s value. Stick to these tips:

- Regular oil changes keep engines healthy.

- Brake checks are vital for safety.

- Inspect tires for wear and tear.

- Timely servicing prevents costly repairs.

:max_bytes(150000):strip_icc()/7-mistakes-avoid-when-buying-used-car.asp-V1-dbc23496b5164854a581f89b4683a5b5.jpg)

Credit: www.investopedia.com

Frequently Asked Questions For Can You Finance A Used Car

Can I Get Financing For An Older Used Car?

Yes, you can secure financing for an older used car. However, lenders may have specific age and mileage limits for financing. It’s best to check with the lender about their specific requirements for older vehicles.

What Credit Score Do I Need To Finance A Used Car?

To finance a used car, lenders typically look for a credit score of 600 or above. A higher score can lead to better loan terms and interest rates, but options exist for those with lower scores.

How Does Down Payment Affect Used Car Financing?

A larger down payment reduces your overall loan amount, which can improve your financing terms, lower monthly payments, and save on interest. Generally, a down payment of 10-20% is recommended for used cars.

Is Financing A Used Car More Expensive?

Financing a used car can have higher interest rates compared to new cars, making it more expensive in the long run. Shop around for the best rates and negotiate the price before financing.

Conclusion

Securing financing for a used car is indeed possible, offering cost savings and flexibility. From credit unions to online lenders, various options cater to different financial situations. Remember, a good interest rate and favorable terms can make your investment even more worthwhile.

Do your research, shop around, and drive away with a deal that suits your budget and needs.