How to Get a Car Loan With Bad Credit

To secure a car loan with bad credit, start by finding lenders that specialize in subprime auto loans. Ensure your application stands out by demonstrating stable income and offering a larger down payment.

Securing a car loan when your credit history is less than perfect can seem daunting, but there are strategies to increase your approval odds. Preparation is key; gather all necessary documents before approaching lenders. This shows you’re serious about taking on the responsibility of a car loan.

Research potential lenders, focusing on those who provide options for consumers with varied credit profiles. Credit unions, for instance, often offer more accommodating terms to their members. It’s also beneficial to check your credit report for any errors that may be impacting your score negatively. Correcting these mistakes before applying can give you a slight boost. Lastly, consider a co-signer if possible, as their good credit can lend you credibility, making lenders more likely to approve your loan. Consistently demonstrating financial responsibility will put you on the road to not only obtaining a car loan, but also rebuilding your credit for the future.

:max_bytes(150000):strip_icc()/buying-car-bad-credit-960978-v1-c81d0935b8ff4a66bed520a93a131ad9.png)

Credit: www.thebalancemoney.com

Navigating Bad Credit Challenges

Navigating Bad Credit Challenges can seem daunting when it comes to getting a car loan. A spotty credit history might throw a wrench in the works. But it’s not the end of the road. There are paths to explore and strategies to employ.

The Impact Of Credit Scores On Loan Terms

Your credit score is a big deal. It dictates the terms of your loan, including interest rates and down payments. Higher scores mean lower costs in the long run. A bad credit score doesn’t close all doors,

but it does change the landscape.

| Credit Score Range | Expected APR | Potential Down Payment |

|---|---|---|

| 750+ | Low (<5%) | Minimum |

| 650-749 | Medium (<10%) | Reasonable |

| <649 | High (>15%) | Substantial |

While a score below 649 often means higher costs, it’s not a lost cause.

Common Obstacles In Securing Auto Financing

Bad credit can create roadblocks. Be ready to face challenges:

- Strict Lending Requirements – Lenders view bad credit as a risk.

- High-Interest Rates – Your loans cost more over time.

- Large Down Payments – Lenders may want more money upfront.

- Limited Loan Amounts – You might not get the full amount you need.

- Vehicle Restrictions – Some lenders limit the types of cars you can buy.

Armed with knowledge, you can steer through these obstacles. Show lenders stability in income and job. Display a pattern of recent, responsible credit use. Consider a co-signer with a strong credit background.

Credit: www.cnbc.com

Preparing For Loan Application

Finding a suitable car loan with bad credit can seem daunting. Yet, preparation can help secure the best possible deal. This section delves into the vital steps needed to set the stage for a successful loan application, even with a credit score on the lower end. Let’s get your financial ducks in a row!

Assessing Your Credit Report

Knowledge is power, especially regarding credit health. Before applying for a loan, individuals must:

- Obtain a credit report from all three major credit bureaus.

- Check for errors or discrepancies.

- Dispute any inaccuracies found to improve the score.

Addressing any mistakes on your credit report can positively impact your credit score.

Improving Creditworthiness

To enhance creditworthiness:

- Pay bills on time, showcasing financial responsibility.

- Reduce debt levels to lower your credit utilization.

- Avoid opening new credit accounts before applying for a loan.

These steps won’t fix a credit score overnight, but they signal lenders that you’re a responsible borrower.

Budgeting For A Realistic Loan Payment

Create a budget that reflects your real-world finances. Consider:

| Income | Expenses | Available Amount for Car Payment |

|---|---|---|

| Monthly take-home pay | Total monthly bills and obligations | The sum remaining after expenses |

Stick to a realistic monthly payment that fits this budget. This ensures you seek a loan that won’t strain your finances.

Exploring Alternative Financing Options

Finding the right car loan with bad credit isn’t out of reach. Creative financing solutions exist for those with less than perfect credit. Let’s dive into the options that can pave the way for you to get behind the wheel.

Credit Union and Community Banks

Credit Unions And Community Banks

Credit unions and community banks offer more than standard banking services. They often have flexible loan products designed for members with bad credit. Here’s why you should consider them:

- Typically offer lower interest rates than big banks.

- May provide more personalized service due to smaller size.

- Membership can lead to better loan terms.

Subprime Auto Lenders

Subprime Auto Lenders

Subprime auto lenders specialize in loans for those with bad credit. These lenders understand that life can throw curveballs and assess your situation beyond just your credit score. Keep in mind:

- Interest rates might be higher.

- They offer second-chance financing opportunities.

- Look for reputable lenders to avoid scams.

Online Financing Companies

Online Financing Companies

Online financing companies offer convenient solutions. They provide a quick application process and access to multiple loan offers. Here’s how they can help:

- Compare loan offers from different lenders easily.

- Applications are often free and fast.

- No need to visit a physical branch for the loan process.

Understanding The Terms Of The Loan

Understanding the Terms of the Loan is crucial when seeking a car loan with bad credit. It ensures that borrowers are fully aware of their financial commitment. An informed decision can save you from unexpected charges and long-term debt. So, let’s dive into what you need to know about the terms of your car loan.

Interest Rates And Fees For Bad Credit Loans

Bad credit often leads to higher interest rates. Lenders view low credit scores as a risk. This risk means they will charge more to lend you money. It’s important to shop around for the best rates. This action can make a significant difference in the cost of your loan. Below is a list of fees you might encounter:

- Origination Fee: Charged for processing a new loan

- Late Payment Fee: Added costs for missing a payment deadline

- Prepayment Penalty: Fee for paying off a loan early

Loan Term Considerations

Picking the right loan term is essential. A longer loan term can mean smaller monthly payments. But it also leads to more interest paid over time. A shorter loan term will cost more each month. However, you will pay less in interest and clear your debt faster.

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 5 years | $300 | $2,000 |

| 3 years | $450 | $1,200 |

The Importance Of Reading The Fine Print

Loan agreements are dense and complex. Be sure to read every detail before signing. This step includes all the fine print. Missed or hidden clauses can lead to unexpected costs or obligations. Take your time. Understand every part of the agreement. Talk to a financial advisor if necessary. Being diligent now can prevent problems in the future.

Remember, knowledge is power. Understand the terms of your car loan, and you’ll be in a better position to manage it responsibly.

Strategies To Increase Approval Odds

If you have bad credit, securing a car loan may seem daunting. Yet, with the right approach, you can improve your chances of approval. Below, explore some strategies that could strengthen your loan application and lead to a successful financing arrangement despite a low credit score.

Securing A Co-signer

A reliable co-signer can be a game-changer. If they have good credit, their backing might sway lenders. It’s like getting a vouch for your reliability. Ensure your co-signer understands the responsibility. If you fall behind, they’re on the hook for payments.

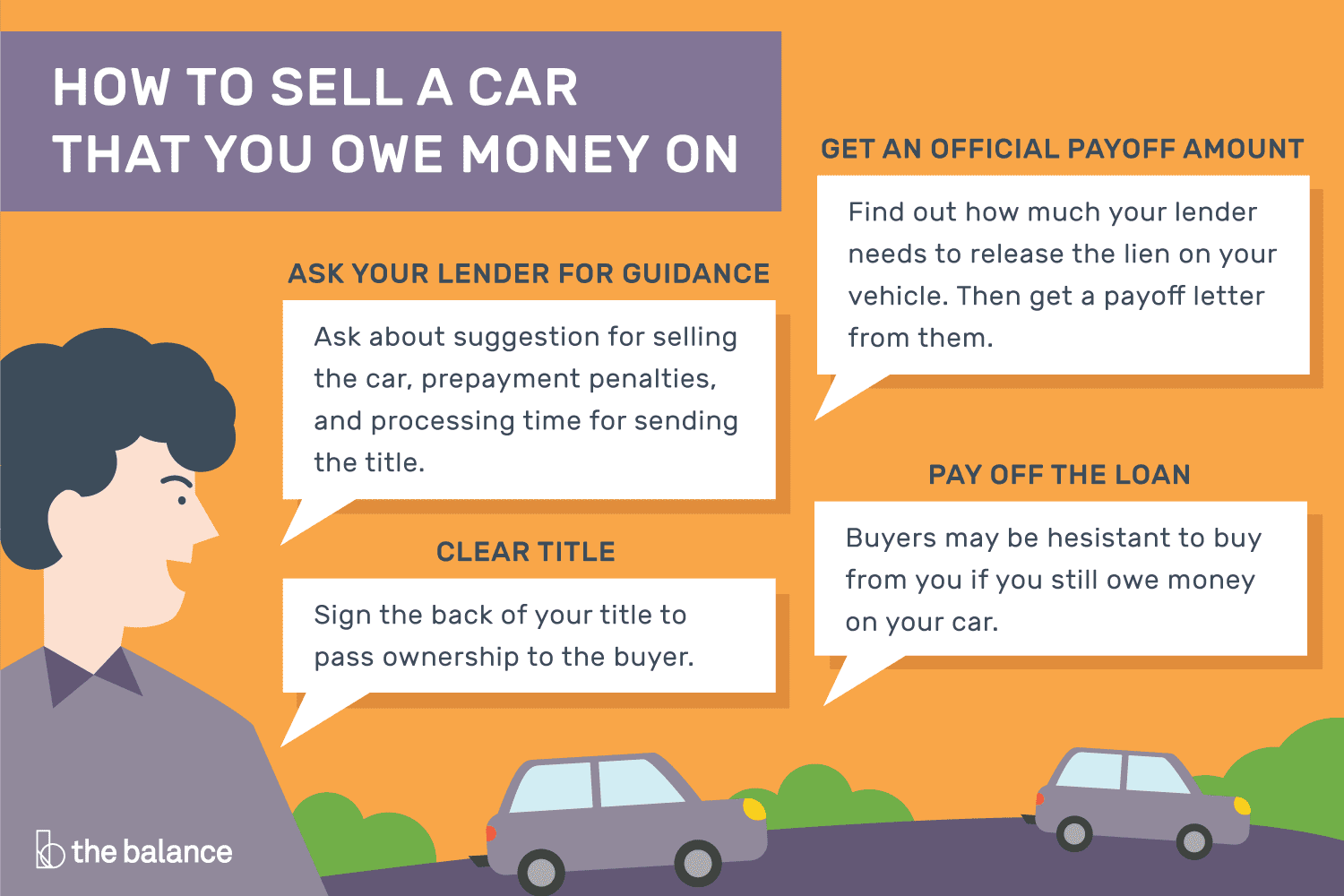

Making A Larger Down Payment

Saving for a larger down payment demonstrates financial commitment. Lenders often see this as a sign of reduced risk. Putting more money down could not only boost approval odds but also shrink monthly bills and total interest paid.

Choosing A Less Expensive Vehicle

Opting for affordability can be wise. A modest car means a smaller loan and a leap towards approval. Lenders are more comfortable when the amount is lower. It’s essential to balance desire with what’s practical for your financial health.

Managing Your Loan Responsibly

Even with bad credit, getting a car loan means new responsibilities. It’s vital to handle this loan with care. Smart management leads to financial health improvement. Learn how you can stay on top of payments, consider refinancing options, and use your auto loan to boost your credit score.

Staying On Top Of Payments

Paying on time is crucial. Late payments mean extra fees and harm your credit. Set up automatic payments if possible. This ensures you never miss a due date. Organize your budget to prioritize your car loan each month.

Extra payments help too. Pay more than the minimum if you can. This reduces interest and the loan’s lifespan.

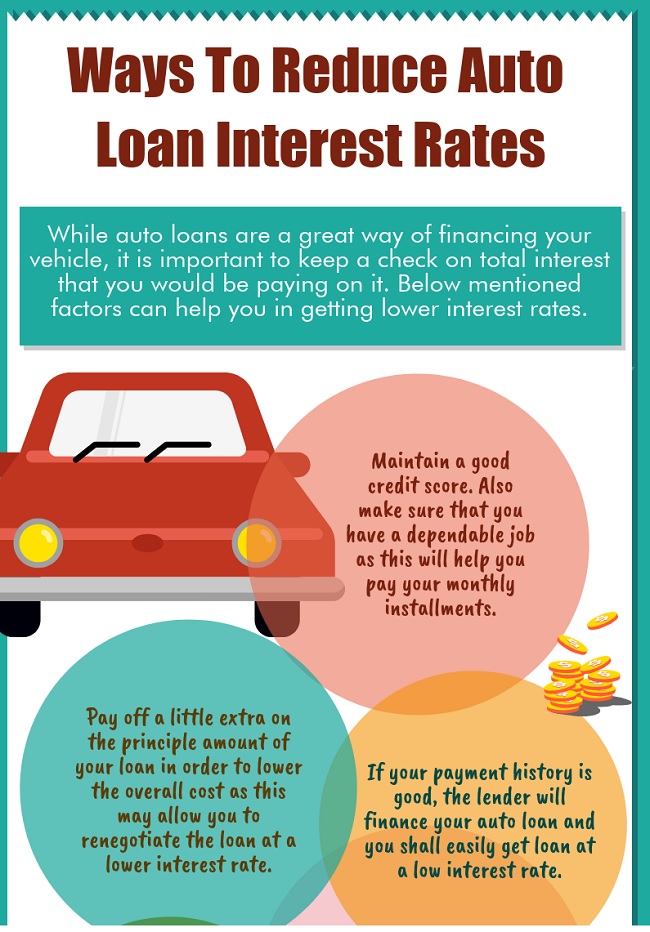

The Role Of Refinancing

Refinancing can lower your interest rate or monthly payments. With improved credit, refinancing becomes an attractive option. Seek better loan terms after some time of consistent payments. Always compare offers and choose the best deal.

Using Your Auto Loan To Rebuild Credit

- See your loan as a credit rebuilding tool.

- Use your loan to prove your creditworthiness.

- Ensure every payment is reported to credit bureaus.

- Monitor your credit score to watch your progress.

On-time payments show lenders you’re reliable. This could help you secure better loans and interest rates in the future.

Frequently Asked Questions For How To Get A Car Loan With Bad Credit

Can Bad Credit Affect Car Loan Approval?

Having a low credit score can impact loan approval, but it’s not the only factor. Lenders also consider your income, employment stability, and down payment size.

What’s The Minimum Credit Score For Auto Loans?

There’s no universal minimum credit score for car loans. While some lenders might accept scores as low as 500, others may require higher. It varies by lender and loan type.

How To Improve Chances Of Car Loan With Poor Credit?

Start by checking your credit report for errors and get them fixed. Offer a higher down payment, and consider a co-signer. Choose a less expensive car and demonstrate steady income.

Are There Special Car Loans For Bad Credit?

Yes, there are auto loans specifically designed for individuals with bad credit. These usually come with higher interest rates and may require larger down payments.

Conclusion

Securing a car loan with bad credit may seem daunting, but it’s far from impossible. By researching lenders, improving credit scores, and considering a co-signer, hopeful borrowers can drive away with a favorable deal. Remember, persistence and informed choices pave the way toward your next set of wheels, regardless of credit history.

Start your journey to approval today and get closer to the car you need.