How to Get Out of a Car Loan

To get out of a car loan, consider selling the vehicle or refinancing the loan. You may also negotiate with the lender or find someone to assume the loan.

Exiting a car loan requires careful consideration and a strategic approach. Many individuals find themselves in a financial bind, needing to break free from the constraints of their vehicle financing. Whether it’s due to a change in income, personal circumstances, or simply a change of heart regarding the vehicle, there are ways to relieve oneself from the burden of an unwanted car loan.

The key lies in understanding the terms of your loan agreement, assessing your financial situation, and exploring all available options. It’s critical to approach this challenge with a plan and to communicate openly with your lender. Taking swift and informed action can save you from potential credit damage and additional financial strain.

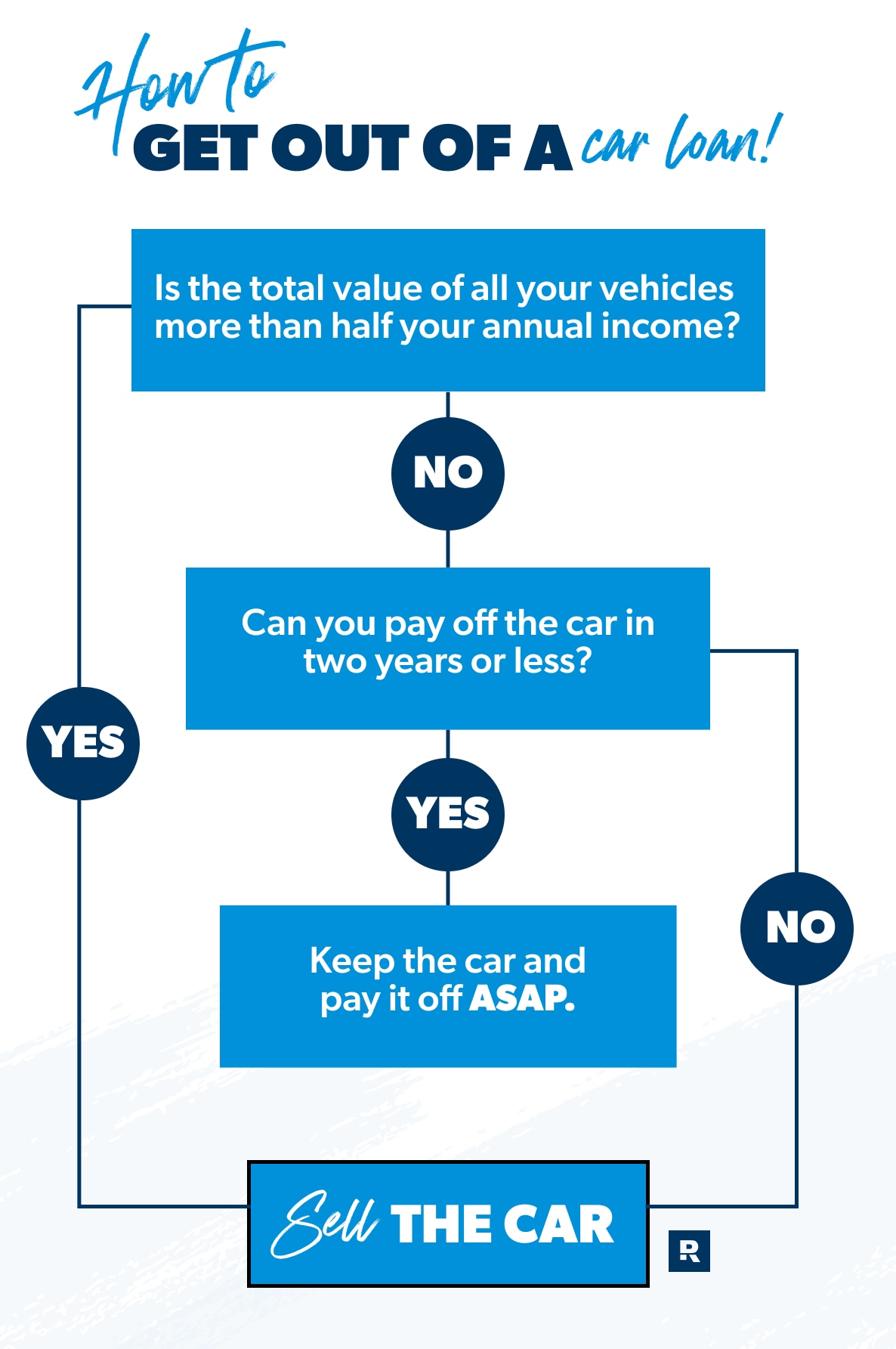

Credit: www.ramseysolutions.com

Recognizing A Burdensome Car Loan

Entering into a car loan agreement is a major financial decision. It’s important to assess whether you can manage the loan in the long term. Let’s dive into the signs that indicate a car loan might be too heavy a burden for your budget.

Signs Of An Unsustainable Loan

Struggling with monthly payments? It could be a red flag. When your car payment hinders your ability to cover essentials, it’s a sign of concern. Let’s look at a few indicators of an unsustainable car loan:

- Budget Strain: Payments exceed a comfortable portion of your income.

- Long Term Commitment: Loan terms extend beyond a typical period.

- Negative Equity: Your car’s value falls below what you owe.

- Recurring Late Payments: You’re consistently paying after the due date.

Impact Of High-interest Rates

High-interest rates can inflate your loan to an overwhelming size. Below is a table that illustrates the impact of different interest rates on a $20,000 car loan over 60 months.

| Interest Rate | Monthly Payment | Total Paid over 60 months |

|---|---|---|

| 3% | $359 | $21,540 |

| 7% | $396 | $23,760 |

| 10% | $424 | $25,440 |

It’s clear that higher interest rates lead to higher overall costs. Understanding these costs is critical when evaluating the sustainability of your car loan.

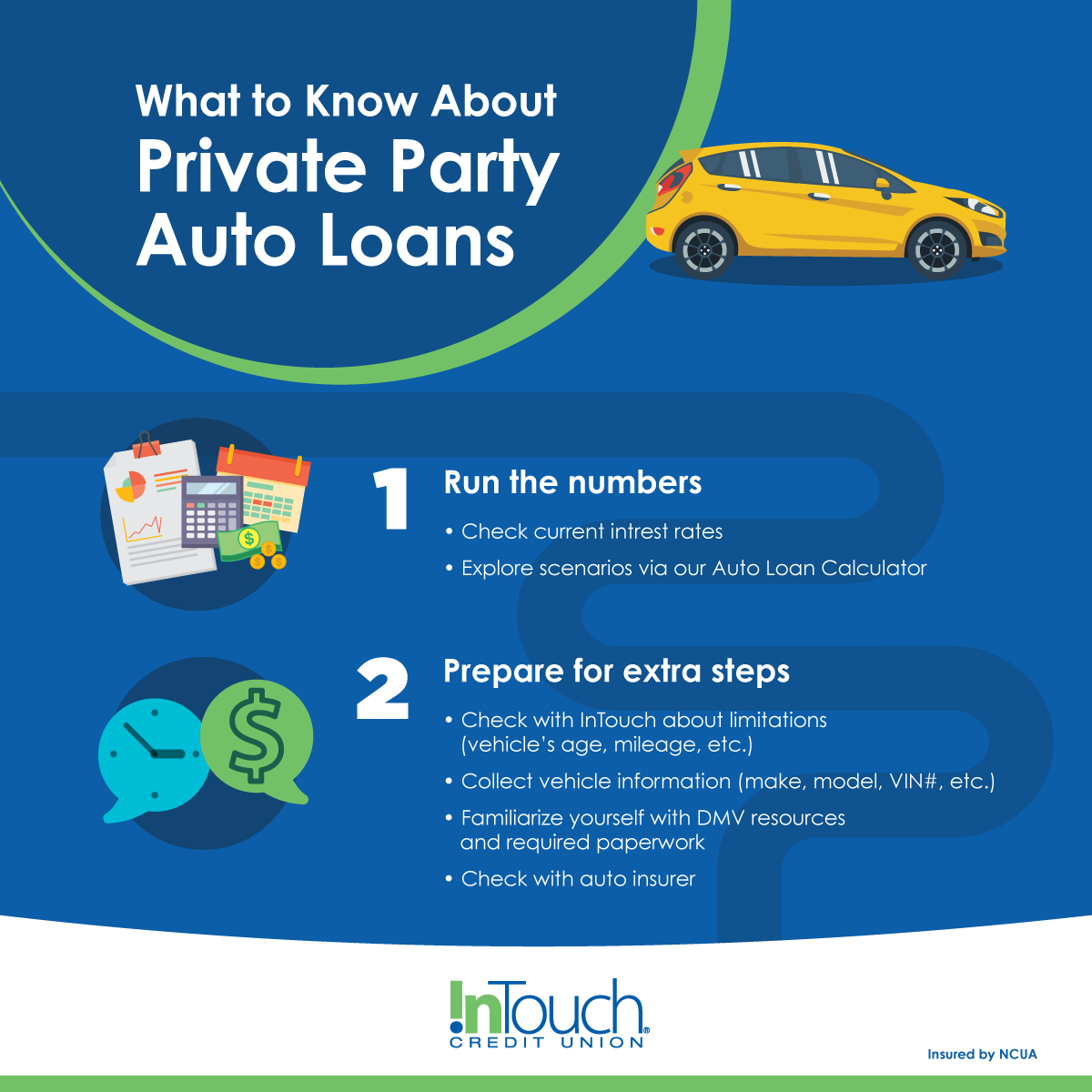

Credit: www.self.inc

Assessing Your Financial Situation

Feeling stuck with a car loan? Don’t worry. First, take a close look at your finances. This is the foundation of finding a way out. Here’s how you can start:

Calculating Total Debt

To see the big picture, list all you owe. Include credit cards, student loans, or other debts. Use simple tools like spreadsheets or an app. Keep it simple and clear.

| Credit Type | Total Owed | Monthly Payment | Interest Rate |

|---|---|---|---|

| Car Loan | $ | $ | % |

| Credit Card | $ | $ | % |

Determining Car Value Vs Loan Balance

Next, find out what your car is worth. Compare it to what you owe. Use online tools for car valuation. Make sure to note both trade-in value and private sale value.

- Trade-in Value: What dealers would offer for your car.

- Private Sale Value: Potential selling price in a private sale.

Compare these numbers to your loan balance. This tells you whether you have equity or if you’re upside down in your loan.

Strategies To Tackle The Debt

Being stuck in a car loan with high monthly payments can be tough. Yet, you have several strategies to tackle this debt. With the right approach, you can reduce what you owe and even pay off your loan ahead of schedule. Let’s explore options to help you get back on track financially.

Refinancing Options

If you’re looking for a way to lower your payments, refinancing might be the answer. Refinancing your car loan can lead to better interest rates. This might reduce your monthly payments. Check if you can refinance your loan at a lower interest rate. This can save you money over time. Make sure to shop around. Compare offers from different lenders to find the best deal.

Increasing Monthly Payments

Another effective strategy is to increase your monthly payments. If you can afford it, paying extra each month will cut down the overall interest. Plus, it will help you eliminate that car debt faster. Even small additional amounts can make a big difference. Set a budget and see where you can trim expenses. Use that extra cash to pay off your loan.

Debt Snowball Method

Now let’s talk about the debt snowball method. This method involves focusing on your smallest debt first. Here’s how it works:

- List out all your debts from smallest to largest.

- Make minimum payments on all your debts.

- Focus any extra money on the smallest debt until it’s fully paid.

- Once the smallest debt is paid off, move on to the next smallest.

As each debt disappears, the freed-up money helps tackle the next debt faster. It’s like a snowball rolling downhill, growing bigger and faster. This method can keep you motivated because you see results quickly. Remember, the key to paying off debt is to stay consistent.

Alternative Solutions To Consider

Finding yourself in a tough spot with a car loan can be stressful. Several options can help ease the burden. Explore avenues like selling your car privately. Consider letting go of ownership through voluntary repossession. Or find someone to take over your lease. Let’s dive into these solutions and see which one fits your situation best.

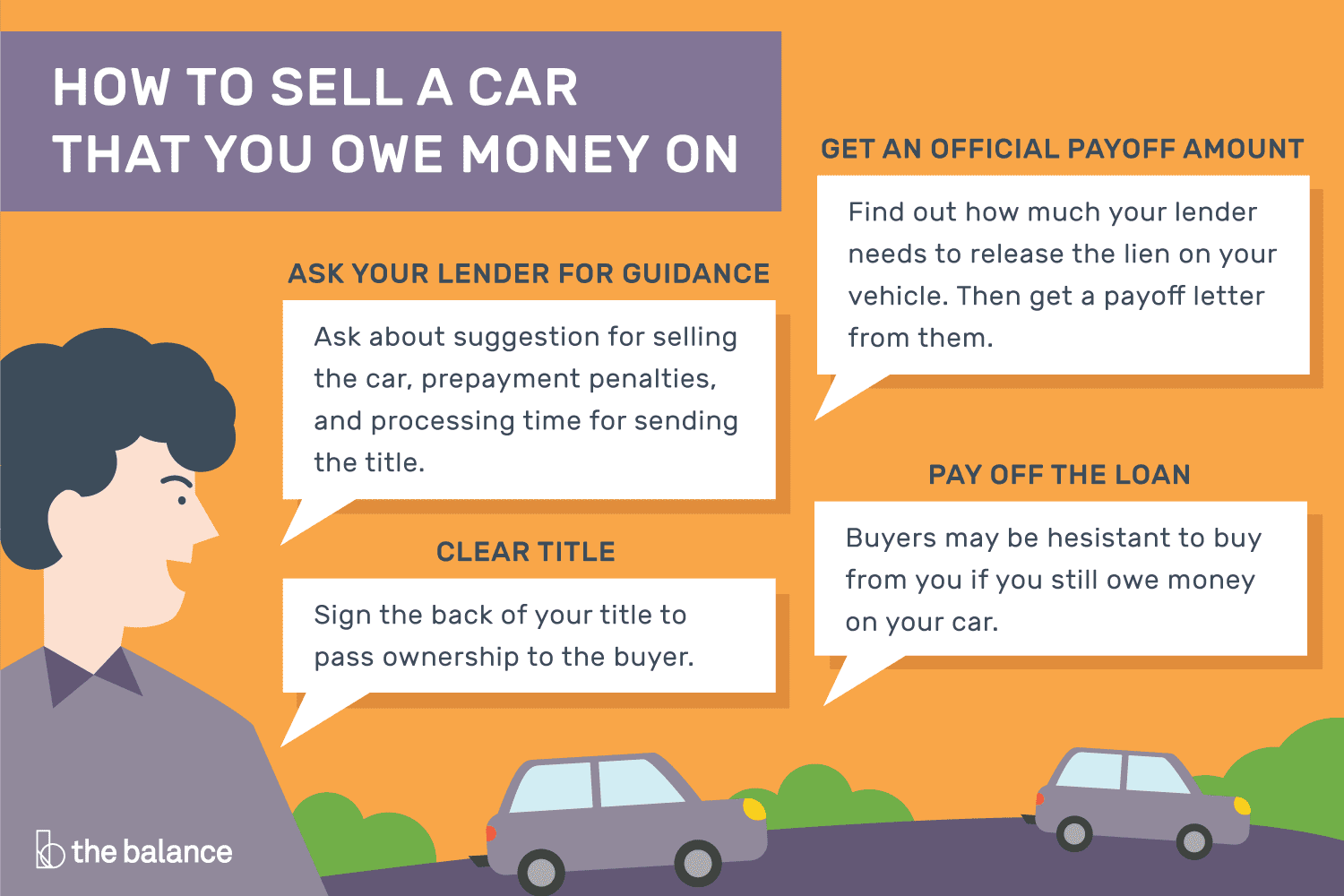

Selling The Car Privately

Selling your car on your own could fetch a higher price than trade-ins. It means more effort but often leads to better payoff.

- Clean and fix your car to look its best.

- Research its value to set a fair price.

- List it online and in local classifieds.

- Show it to potential buyers safely.

The money from the sale can help you pay off the loan.

Voluntary Repossession

Choosing voluntary repossession means you give the car back to the lender. It can avoid the cost and stress of forced repossession.

- Contact your lender to discuss options.

- Understand it will impact your credit score.

- Prepare to pay the difference if the car sells for less than what you owe.

Finding A Lease Takeover

If you’re leasing, a lease takeover could work. Someone else takes over the payments.

This option keeps your credit score intact and relieves you from the lease terms.

- Check if your lease allows a transfer.

- List your lease on takeover websites.

- Screen the interested parties carefully.

The new person steps in, and you step out, free from the lease.

Negotiating With Lenders

Feeling stuck with a car loan can be stressful. But a well-planned negotiation with your lender might help. Let’s dive into how to prepare for negotiation. Understand what outcomes and concessions you can realistically aim for.

Preparing For The Negotiation

Before you reach out to your lender, prepare. Gather all your loan details including balance and interest rates.

Understand your financial situation clearly. Create a budget showing your income and expenses. This helps explain why you seek changes to the loan.

Research alternatives such as refinancing rates from other lenders. This info strengthens your position in negotiations.

Finally, determine what you can afford. Set realistic goals for the negotiation.

Possible Outcomes And Concessions

Several outcomes are possible. You may achieve a reduced interest rate. Lenders might agree to extend your loan term to lower monthly payments.

- Loan modification: Changing the terms of your existing loan.

- Payment deferral: Temporarily pausing payments.

- Settlement offer: Paying less than what you owe as a lump sum.

Remember, each lender is different. The outcomes depend on your loan terms, your history with the lender, and their policies.

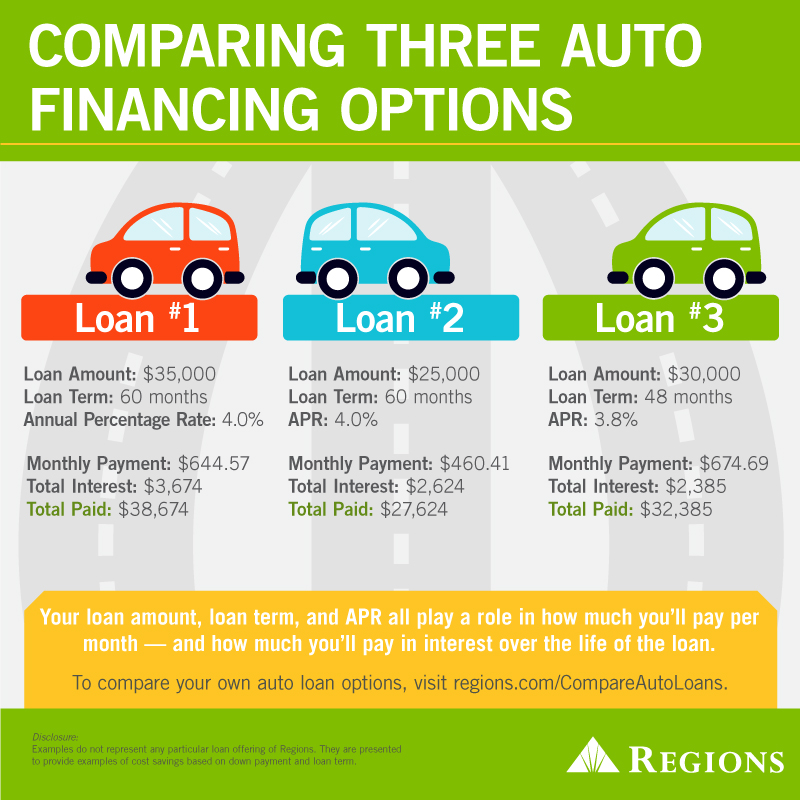

Credit: www.pridechevy.com

Long-term Financial Health

Securing your long-term financial health is crucial after getting out of a car loan.

Clearing a car loan lifts a weight off your shoulders. It’s important to not only get back on stable ground but also build a buffer against future financial challenges. With the right financial moves, individuals can enjoy freedom and security, avoiding the pitfalls of debt in the future.

Budgeting After The Loan

Creating a budget post-loan is a step towards solid financial ground. Align your expenses with your income. Put money aside for savings. This will ensure you stay clear of unnecessary debt.

| Step | Action |

|---|---|

| 1. | Assess monthly income |

| 2. | Outline essential expenses |

| 3. | Set aside savings |

| 4. | Monitor and adjust budget |

List needs versus wants. Stick to the essentials. Review and adjust your budget monthly.

Preventing Future Loan Burdens

To avoid future loan burdens, scrutinize potential loans carefully. Consider your ability to pay without strain.

- Evaluate the necessity of the loan

- Research for the best interest rates

- Save for larger down payments to reduce borrowed amounts

- Build an emergency fund to cushion financial shocks

Focus on strengthening your credit score. This can lead to better loan terms if borrowing becomes essential. Remember, patience and disciplined saving can prevent future financial strain. Choose to purchase only when you can comfortably afford it.

Frequently Asked Questions Of How To Get Out Of A Car Loan

Can You Refinance A Car Loan?

Absolutely, refinancing a car loan is a common strategy to lower your interest rate, reduce monthly payments, or change the loan term. It can save you money and help you get out of your current car loan more favorably.

What Are Options To End A Car Loan Early?

Options to end a car loan early include paying off the loan in full, selling the vehicle to cover the loan balance, or trading it in. It’s essential to weigh the costs against the loan benefits before deciding.

How Does Voluntary Repossession Affect Credit?

Voluntary repossession does negatively impact your credit, but less than involuntary repossession. It results in a derogatory mark on your credit reports and can substantially decrease your credit score, affecting future borrowing potential.

Is Transferring A Car Loan To Another Person Possible?

Yes, transferring a car loan to another person is possible but requires approval from your lender. The new borrower must qualify for the loan according to the lender’s criteria. However, not all lenders allow loan transferability.

Conclusion

Navigating the maze of car loan termination can be daunting. But with the strategies outlined, relief is within reach. Embrace financial freedom by harnessing these tips to break free from your auto debt. Take control now and drive towards a debt-free future.

Remember, a calculated approach can pave the path to your financial liberation.