How to Get Insurance before Buying a Used Car

To get insurance before buying a used car, first choose the right policy and then contact insurance providers. Compare quotes online or via agent consultation for the best deal.

Buying a used car is a smart financial move, as it often means paying a lot less than the vehicle’s initial sticker price. A vital step in this process, which some may overlook, is securing insurance before finalizing the purchase.

It’s imperative to ensure that you’re fully covered from the moment you drive your new-to-you car off the seller’s lot. Start with a clear idea of the type and level of coverage you need, keeping in mind state laws and your personal circumstances. Engage with reputable insurance companies, either through their websites or directly by phone, to obtain a variety of quotes. By meticulously doing so, you’ll not only protect your investment but also steer clear of any legal complications that could arise from owning an uninsured vehicle.

The Importance Of Insuring A Used Car

Buying a used car is exciting. But don’t forget to secure your purchase. Think about it. You need protection for your car. And not just any protection, insurance matters a lot. Whether it’s a fender bender or a serious accident, being insured means you’re covered. Let’s dive into why insurance for a used car isn’t just an option; it’s a necessity.

Protecting Your Investment

No matter the car’s age, it’s an investment. Insurance keeps your car’s value safe. It’s like a safety net for your wallet. Here’s how:

- Accident repairs can be costly. Insurance covers these.

- Insurance handles theft or damage. You won’t be alone in such events.

- Peace of mind comes with having a backup plan for the unexpected.

In simple terms, you save money, stress, and time. You know you’re protected anytime, anywhere.

Legal Requirements And Liability Coverage

There’s more to insurance than just protecting your car. It’s the law. Driving without it can lead to trouble. Like fines or a suspended license. Liability coverage is what we’re talking about. It’s essential. Here’s why:

| Liability Coverage | Why It’s Important |

|---|---|

| Medical Bills | Covers injuries to others in an accident. |

| Property Damage | Pays for damages to someone else’s property. |

Without liability coverage, you could owe a lot of money. Insurance helps avoid this risk.

Types Of Car Insurance Policies

When you’re in the market for a used car, getting the right insurance is key. There are several types of policies to consider. Each offers different levels of protection and peace of mind. Explore the options to ensure you choose a policy that best fits your needs.

Liability Insurance Explained

Liability insurance is vital for every driver. It covers costs if you cause an accident. These include other people’s medical expenses and car repairs. Liability insurance does not cover your own injuries or car damage. There are two parts:

- Bodily Injury Liability: Covers injury to others in an accident you cause.

- Property Damage Liability: Pays for damage to other people’s property.

Comprehensive And Collision: Pros And Cons

| Comprehensive Insurance | Collision Insurance |

|---|---|

| Covers damages not caused by a collision. Think theft, vandalism, or weather damage. | Pays for your car’s repair after an accident, no matter who’s at fault. |

| Pros: Broad coverage for many incidents. | Pros: Essential for costly repairs after a crash. |

| Cons: Can increase premium costs. | Cons: Usually includes a deductible. |

Uninsured And Underinsured Motorist Protection

Cover yourself against drivers with no or too little insurance. Uninsured Motorist (UM) covers you if the other driver is at fault and lacks insurance. Underinsured Motorist (UIM) helps when the other driver’s insurance can’t cover all costs. These policies protect you from having to pay out of pocket. Essential facts include:

- UM and UIM can pay for medical bills and lost wages.

- They offer peace of mind in hit-and-run incidents.

- Some states require these coverages by law.

Evaluating Your Insurance Needs

Before buying a used car, you need the right insurance. It’s crucial to evaluate your insurance needs to ensure your investment is protected.

Assessing The Car’s Value

Knowing the car’s worth guides your insurance coverage decisions. Research the vehicle’s market value. Use trusted resources like Kelley Blue Book or NADA Guides. Consider the car’s condition, mileage, and age. These factors influence the insurance coverage you should aim for.

Understanding Personal Risk Factors

Your driving habits and history affect your insurance needs. For instance, frequent drivers might need more comprehensive coverage. If you live in an area with high theft rates, theft protection becomes vital. Reflect on factors like:

- Driving frequency

- Your location’s crime rate

- Parking conditions (garage or street parking)

Balancing Deductibles And Premiums

Choosing the right balance is key. A higher deductible means lower premiums, but more out-of-pocket cost if an accident occurs. Conversely, a lower deductible results in higher monthly costs. Here’s what to weigh:

- Monthly budget for insurance

- Out-of-pocket payment capacity if damage occurs

- The car’s value versus the cost of full coverage

Credit: www.caranddriver.com

Steps To Secure Insurance Before Purchase

Securing insurance for a used car is a critical step. This guide outlines the necessary steps to ensure you’re covered before driving off. Learn how to get quotes, insure test drives, and arrange final coverage.

Getting Quotes From Multiple Providers

Shopping around is key when looking for car insurance. Start by gathering quotes from various companies. You can compare these quotes to find the best rate and coverage. Use online tools to make the comparison easier. Make sure to get quotes for the same coverage levels to make a fair comparison.

Insurance For Test Driving

Test driving a car is part of the buying process. Ensure you’re insured during this step. Check your current car insurance policy. It might cover you for test drives. If not, ask the seller about their insurance policy. This policy may protect potential buyers during test drives. Otherwise, consider a short-term insurance policy.

Arranging Coverage Before Finalizing The Sale

Finalize your insurance before signing the sale papers. Contact your chosen insurer with the vehicle’s details to start your policy. Always aim to have your new insurance policy begin on or before the purchase date. This way, you’re fully covered the moment the car is yours.

Transferring And Updating Insurance Policies

When buying a used car, it’s crucial to manage the insurance process carefully. Existing policies might need updates or transfer to cover the newly purchased vehicle. Delve into the steps of transferring and updating insurance policies to ensure seamless coverage and legal compliance.

Handling Existing Coverage

Understanding your current insurance status is the first step. Check if the policy allows for an easy car switch. Some insurers offer a grace period, giving you time to inform them about the change in vehicles. Use this grace period wisely and avoid a lapse in coverage.

Notifying Your Insurance Company

Contacting your insurer promptly is essential. Inform them about the purchase. Provide them with the car’s details, such as make, model, year, VIN, and mileage. Ask about potential changes in premium costs and confirm the effective date of coverage for the new vehicle.

Adjusting Policy As Needed

Based on the vehicle’s specifics and your needs, your policy may require adjustments. Consider factors like deductibles, coverage limits, and additional protections. An older car might not need comprehensive coverage; a newer one might. Review your policy details and work with your agent to tailor your coverage effectively.

- Review coverage options: Choose the right balance of protection and cost.

- Update personal information: Ensure all details on your policy are current.

- Read the fine print: Know what’s covered and what’s not in your policy.

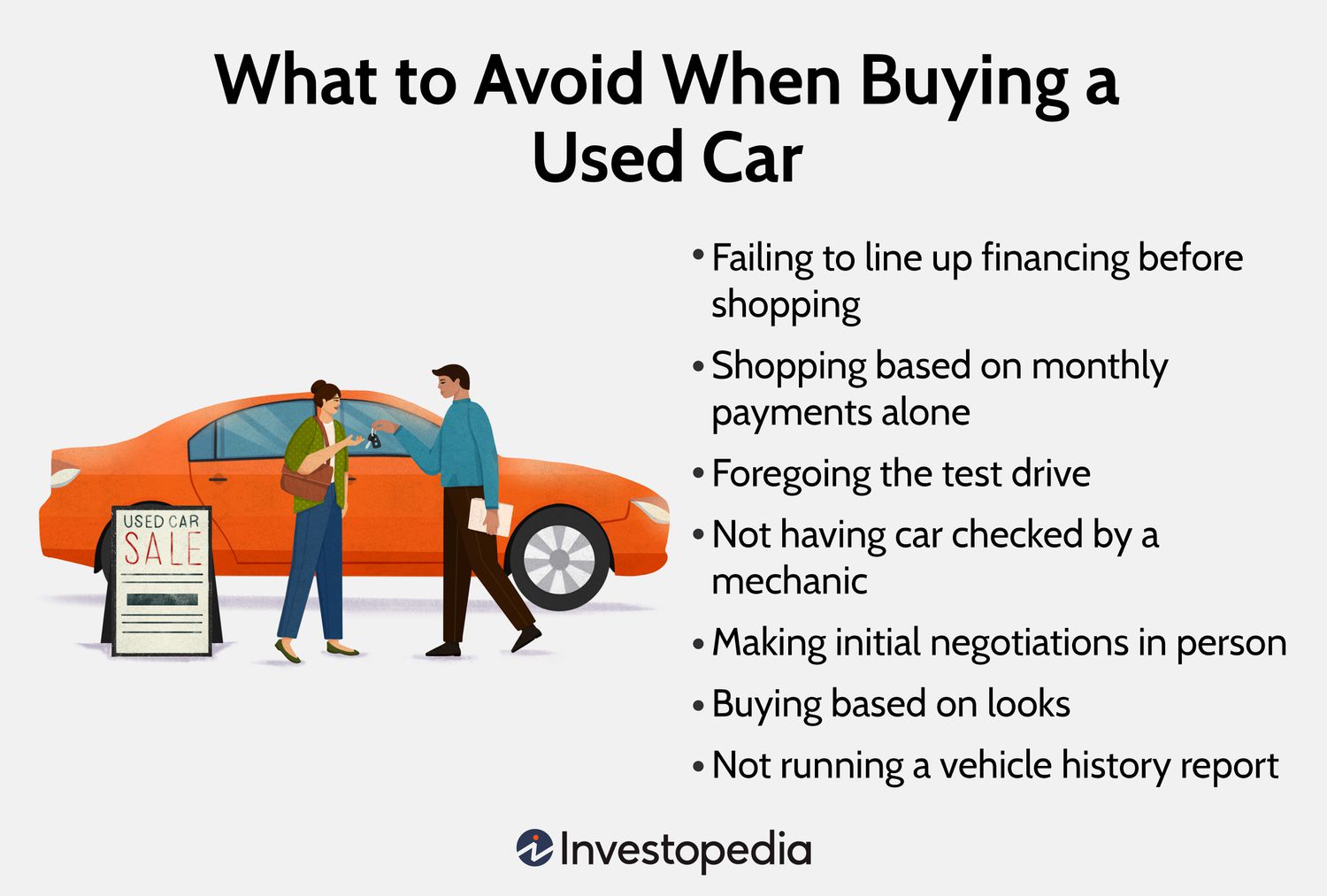

Common Pitfalls To Avoid

Before securing the keys to a used car, insurance is crucial. It’s not just about legality; it’s about peace of mind. Several buyers miss key steps in the pursuit of protection. Recognize and sidestep these traps to ensure a smooth ride ahead.

Ignoring The Need For A Pre-purchase Inspection

Never skip a professional inspection. An overlooked fault could mean costly insurance claims later. A pre-purchase inspection can reveal hidden problems. It can influence your insurance coverage choices, too. Follow these steps:

- Choose a qualified mechanic.

- Check the car’s history and condition.

- Negotiate repairs or coverage needs based on findings.

Skipping Gap Insurance Consideration

Gap insurance covers the ‘gap’ between the car’s value and the amount owed. For a used car, this might not seem vital. But it’s a safety net worth considering, particularly with financed purchases. Look at these factors:

- Depreciation rate of the vehicle.

- Your financing terms.

- Comparison of car’s value against loan balance.

Overlooking Potential Discounts And Savings

In the quest for insurance, don’t leave money on the table. Seek out savings actively. Ask agents about:

- Multi-policy discounts.

- Safety features on the car.

- Defensive driving course credits.

- Good driver rewards.

Every discount makes a difference in the pocket.

Frequently Asked Questions For How To Get Insurance Before Buying A Used Car

Can I Insure A Car Before Purchase?

Yes, you can arrange insurance for a used car before you purchase it. Contact an insurer with vehicle details to have coverage ready for when you become the owner.

What Documents Do I Need For Insuring A Used Car?

For insuring a used car, you require proof of ownership, vehicle registration, your driver’s license, and a history report of the vehicle.

How Do I Transfer Insurance After Buying A Used Car?

After buying a used car, contact the insurance company to update the policy with your details. You may need to provide proof of sale and registration.

Is Immediate Coverage Possible For Used Cars?

Immediate coverage is possible; insurers often provide temporary proof of insurance once you’ve finalized the policy allowing you to drive right away.

Conclusion

Securing insurance for your pre-owned vehicle shields you from unforeseen costs. Start this crucial step before finalizing your purchase to enjoy peace of mind on the road. Remember, the right coverage not only protects your investment but also secures your financial well-being.

Safe driving starts with proper insurance – make it a priority.