How to Calculate Apr on Car Loan

Calculating APR on a car loan involves dividing the finance charges by the loan amount. Multiply the result by 365, divide by the loan term in days, and multiply by 100.

Understanding the annual percentage rate (APR) on a car loan is crucial for budget-conscious car buyers wishing to minimize costs. APR reflects the total cost of borrowing, including interest and other fees, and it offers a more comprehensive picture than the interest rate alone.

It allows consumers to compare financing options and lenders more effectively. Achieving the best car financing deal requires careful examination of the APR, as it directly impacts the monthly payment and overall cost of the vehicle. With the right approach, calculating and understanding this crucial financial figure helps buyers make informed decisions and potentially save money over the term of their car loan.

What Is Apr?

APR stands for Annual Percentage Rate. It’s the yearly cost you pay to borrow money. When you get a car loan, APR includes interest plus other charges. Think of it as the total price tag for your loan each year. It’s shown as a percentage. Knowing the APR helps you compare different loans to find the best one.

The Role Of Apr In Finance

APR plays a big part in finance. It tells you the actual yearly cost of a loan. This helps you see how much you’ll pay above the borrowed amount. When shopping for a car loan, comparing APRs lets you find the best deal.

- Shows true cost of borrowing

- Helps compare different loans

- Includes interest and fees

Apr Vs. Interest Rate

An APR is not the same as an interest rate. The interest rate is just part of the APR. It’s the cost of borrowing without extra fees. APR includes everything. This makes it higher than the interest rate alone. Think of interest rate as the starting point and APR as the full journey’s cost.

| Interest Rate | APR |

|---|---|

| Cost of borrowing | Total loan cost |

| Doesn’t include fees | Includes interest and other charges |

Elements Impacting Apr On Car Loans

Welcome to the essential guide on the ‘Elements Impacting APR on Car Loans’. Understanding these elements can provide an advantage when negotiating your loan terms. APR, or Annual Percentage Rate, is more than just a number. It’s influenced by several factors that can affect the overall cost of your car loan.

Credit Score Considerations

Your credit score is a critical factor in determining the APR you receive from lenders. A high credit score demonstrates a history of responsible credit management, which can lead to a lower APR on your car loan. In contrast, a lower credit score might mean higher interest rates as you’re considered a riskier borrower.

Check your credit report before applying. Look for errors that could drag your score down and get them corrected. Keep in mind that the better your credit score, the lower the APR you’re likely to receive.

Loan Term Variations

The loan term, or the duration over which you repay the loan, also affects your APR. Generally, a shorter loan term means a lower APR but higher monthly payments. On the other hand, longer loan terms come with higher APRs due to the increased risk for the lender.

Here’s a quick look at how this works:

- Short-term loans usually have lower interest rates.

- Long-term loans spread the cost over more time but cost more in interest.

Dealer Financing Vs. Bank Loans

Where you get your car loan from can greatly impact the APR you’re offered. Dealers may offer financing through partnering lenders or in-house. They might also run promotions with lower rates to attract customers.

Compare these aspects:

| Dealer Financing | Bank Loans |

|---|---|

| Potential promotional APR offers | Standardized rates based on creditworthiness |

| Convenient one-stop shopping | Options to shop around for the best rate |

| May include extra fees | Often no extra fees |

Always compare offers. Whether it’s from a dealer or a bank, shop around to find the best APR. Negotiation is key to securing a favorable deal.

Calculating Apr For Your Car Loan

Understanding the Annual Percentage Rate (APR) on your car loan is crucial. It helps you determine the true cost of borrowing. This cost includes interest rates and other loan fees. APR gives you a comprehensive view of the loan’s cost each year. Let’s break down how to calculate APR on your car loan in simple steps.

Gathering Necessary Information

To calculate APR, you’ll need several pieces of data. Gather your loan amount, interest rate, loan term, and fees. This data is often found on your loan agreement. Be thorough, as missing information may affect accuracy.

- Loan Amount: Total amount borrowed.

- Interest Rate: Yearly rate charged by the lender.

- Loan Term: Duration over which you’ll repay the loan.

- Fees: Any additional costs associated with the loan.

Using Apr Formulas

To calculate APR, you need the right formula. A simple APR formula is:

APR = (Interest + Fees) / Loan Amount / Loan Term 365 100

Here’s how to apply it:

- Add up all the interest you will pay over the life of the loan.

- Add any additional loan fees to the total interest.

- Divide this total by the amount of the loan.

- Divide again by the number of days in your loan term.

- Multiply by 365 to get the annual rate.

- Finally, multiply by 100 to convert to a percentage.

Online Apr Calculators

For a quicker calculation, consider using online APR calculators. These tools are user-friendly and do the math for you. Simply enter your loan details. Ensure accuracy for a reliable APR estimation.

Many financial institutions offer free online calculators. Use them to compare the APR on different loan offers. Finding the best rate is easier with these tools at your disposal.

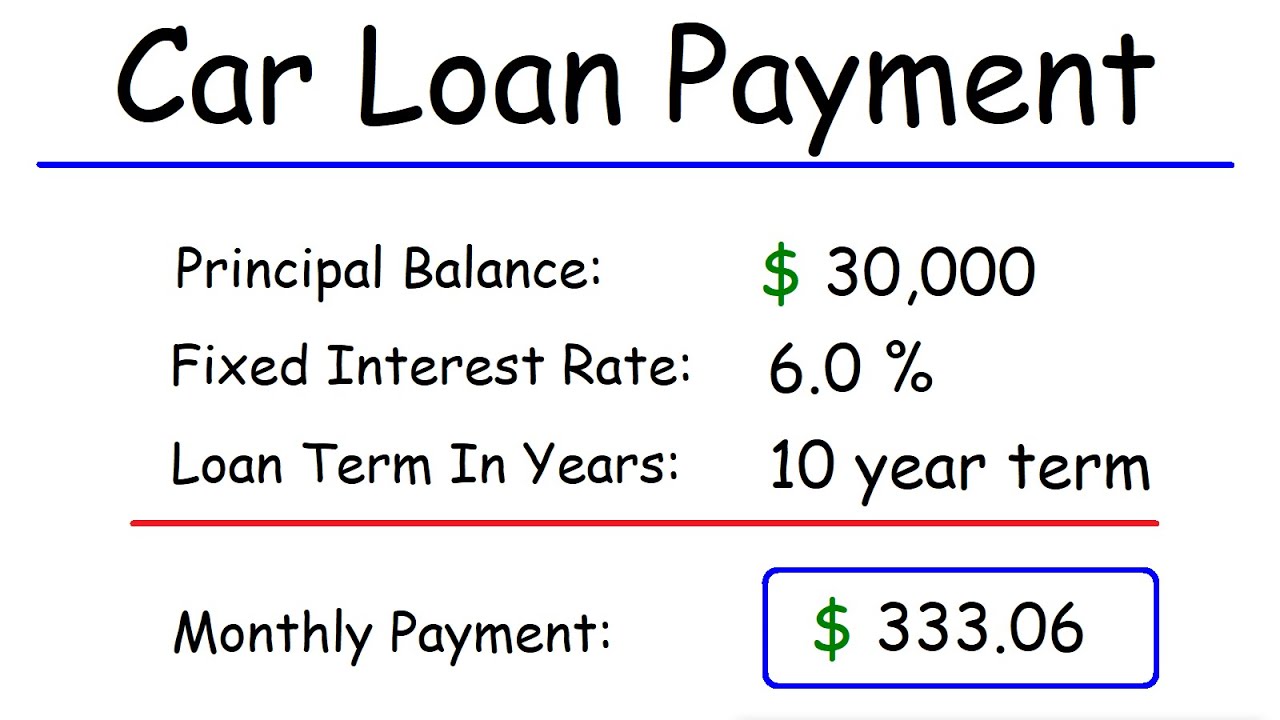

Credit: m.youtube.com

Understanding Your Car Loan Agreement

Understanding Your Car Loan Agreement is crucial when you’re financing your next vehicle. It defines the terms of your loan. Knowing how to calculate the Annual Percentage Rate (APR) on your car loan is vital. This rate affects your monthly payments. We’ll explore the intricacies of your agreement, from reading the fine print to recognizing fees included in the APR.

Reading The Fine Print

Before signing your car loan agreement, it’s important to read every detail. Look for information about the loan’s term, which is how long you’ll be paying for the car. Check the interest rate. Find out if it’s fixed or variable. This can change your APR. Also, check for any prepayment penalties. These could cost you if you pay off your loan early.

Fees Included In Apr

The APR isn’t just the interest rate. It includes other fees too. These can be:

- Loan origination fees: Costs to process your loan application.

- Document fees: Fees for processing paperwork.

- Title and registration fees: Public officials charge these fees.

The APR reflects the total cost of financing. Pay attention to it when comparing loan offers. Sometimes, a low interest rate might have high fees, resulting in a higher APR.

Tips To Secure A Lower Apr

Understanding how to calculate APR on a car loan is crucial. A lower Annual Percentage Rate (APR) means you’ll pay less over the life of your car loan. Here are actionable strategies to secure a competitive APR for your next vehicle purchase.

Improving Your Credit Score

Your credit score plays a key role in securing a low APR. Lenders view higher scores as less risky. Here’s how to improve your score:

- Pay bills on time: Late payments hurt your score.

- Reduce debt: Lower debt-to-income ratios lead to better rates.

- Check your report: Dispute any errors immediately.

Shopping Around For Rates

Never settle for the first offer. Explore diverse options:

- Compare lenders: Banks, credit unions, and online lenders offer different rates.

- Check specials: Dealerships sometimes provide promotional financing rates.

- Use online calculators: They help estimate the APR you qualify for.

Negotiating With Lenders

You have the power to negotiate. Keep these points in mind:

- Know your credit score: Enter negotiations informed about your creditworthiness.

- Discuss terms: Sometimes longer-term loans have lower APRs.

- Be ready to walk away: The best rate sometimes comes from starting to leave.

Remember: Lowering your APR can save you hundreds or even thousands. Use these tips to your advantage.

Apr And Overall Vehicle Cost

Understanding the Annual Percentage Rate (APR) on a car loan is crucial. APR is more than just an interest rate. It reflects the true cost of borrowing over the term of your loan. This includes interest, fees, and other charges. A lower APR can mean significant savings on your overall vehicle cost.

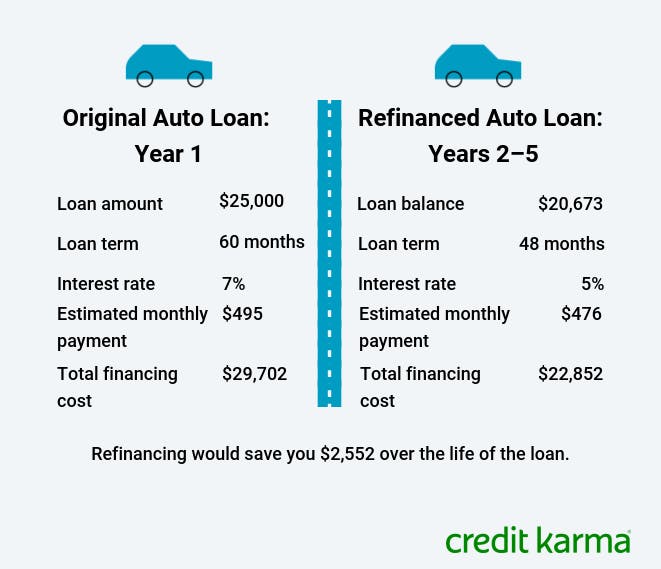

Long-term Financial Implications

The APR impacts the long-term affordability of your car purchase. A seemingly small difference in APR can lead to a big difference in how much you pay over the life of the loan. It’s important to calculate this cost beforehand.

| Loan Amount | Term (Years) | APR (%) | Total Cost Over Term |

|---|---|---|---|

| $20,000 | 4 | 3.5 | $21,680 |

| $20,000 | 4 | 4.5 | $22,080 |

By comparing these figures, it’s clear that a 1% difference in APR amounts to $400 over four years.

Comparing Different Loan Offers

Shopping around for car loans is essential; don’t just accept the first offer. Every lender has different rates and terms. Compare the APRs because this will show you the complete picture.

- Collect loan offers from multiple lenders.

- Look for the lowest APR with the most favorable terms.

- Use an APR calculator to see the actual cost over the life of the loan.

Remember that the lowest APR often means the lowest overall cost for your vehicle. That’s why careful comparison is key to your financial health.

Credit: www.factorywarrantylist.com

Frequently Asked Questions Of How To Calculate Apr On Car Loan

What Is Apr On A Car Loan?

APR, or Annual Percentage Rate, is the cost you pay each year to borrow money for a car loan, including fees, expressed as a percentage. It reflects the full yearly cost and includes the interest rate plus other charges.

How Do You Calculate Apr On Car Loans?

Calculating APR involves summing the total interest payable and any additional costs associated with the loan. Then divide by the amount borrowed, multiply by 365, divide by the loan term in days, and multiply by 100 to get a percentage.

What Factors Affect Car Loan Apr?

Factors impacting car loan APR include credit score, loan amount, loan term, lender policies, and market conditions. A higher credit score can often secure a lower APR, leading to cheaper borrowing costs over time.

Can Apr Vary Between Different Lenders?

Yes, APR can vary widely between lenders due to their unique lending criteria, loan products, and risk assessments. Shopping around and comparing offers is essential to find the most competitive APR for your car loan.

Conclusion

Calculating APR on a car loan is crucial for a smart financial decision. By understanding this interest rate, you’re better equipped to compare loans and save money. Remember to include all costs and fees when calculating. Empowered with this knowledge, you’re on the road to a savvy car purchase.

Drive on with confidence and financial savvy!