Are Sports Cars More Expensive to Insure

Yes, sports cars are typically more expensive to insure. Their high-performance nature often leads to higher premiums.

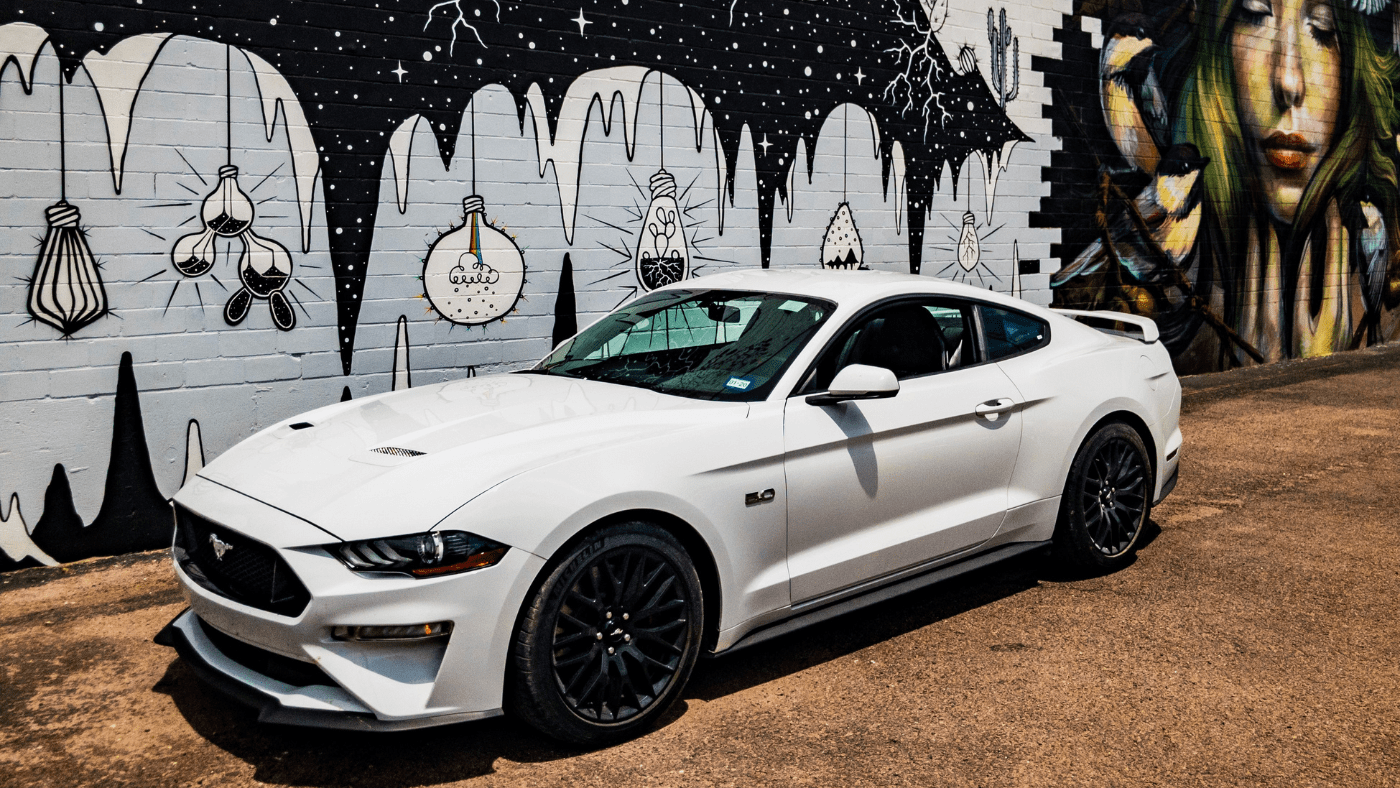

Owning a sports car can be an exhilarating experience, offering speed and style that many drivers dream of. But before you slide into the driver’s seat of a sleek, high-powered vehicle, consider the impact on your insurance costs. Insurers view sports cars as high-risk due to their powerful engines and potential for fast driving, which statistically increase the likelihood of accidents and claims.

This translates to steeper insurance rates for owners of these eye-catching machines. As a prospective buyer or a current owner, it’s essential to factor in this significant cost. Remember, the thrill of driving a sports car comes with financial responsibilities, especially when it’s time to pay your insurance premium.

The High Cost Of Speed

The dream of owning a sports car often comes with the reality of higher insurance costs. Speed thrills, but it also comes at a price. Insurers see fast cars as high-risk investments. This can result in steeper premiums for the owner.

The Thrill Factor And Insurance Rates

Adrenaline and fast cars go hand-in-hand. Drivers buy sports cars for the excitement they deliver. However, this thrill comes with increased danger. Insurers take note of this risk.

- Faster cars attract higher speeds, leading to costly claims.

- They also tend to be driven more aggressively, raising accident risks.

These factors together mean drivers can expect to pay more. Insurance companies charge more to cover potential losses. So, those flashy speeds come with a weighty price tag.

Sports Car Specifications Impacting Premiums

It’s not just about speed. Specific features of sports cars affect insurance rates.

| Feature | Impact on Insurance |

|---|---|

| Engine Size | Larger engines mean more power and higher premiums. |

| Body Style | Sleek designs can be costly to repair, increasing costs. |

| Repair Costs | Specialized parts for sports cars are expensive to replace. |

| Theft Rates | Sports cars can be targets for theft, impacting premiums. |

Modern technology and customization also play a role. Custom parts and tech upgrades can escalate repair costs. Insurance companies reflect these expenses in your premium. Therefore, expect to budget more for that sleek, high-performance machine.

Risk Assessment And Sports Cars

Sports cars raise eyebrows not just for their speed but also for their insurance premiums. Insurers view them through a risk-tinted lens.

The Role Of Crash Statistics

Crash statistics play a major part in insurance decisions. Insurers use this data to determine how likely a sports car will be in an accident. Sports cars often have higher crash rates than family vehicles. This is due to their high-speed capabilities.

Higher crash rates mean insurance companies often charge more to cover potential losses. They assess each model’s accident history. Then they use this to set their rates.

Theft Rates Among High-performance Vehicles

Sports cars are not just fast on the road. They catch the eye of thieves too. High-performance vehicles report higher theft rates compared to average cars. Here’s what insurers consider:

- Popularity with thieves: Some sports cars are targets due to their value and demand for parts.

- Cost of replacement: Insurance companies may increase premiums since replacing stolen sports cars costs more.

These factors lead to higher insurance rates for sports car owners. Insurers aim to cover the greater risk associated with these high-value targets.

Insurance Premium Determinants

Understanding the reasons behind insurance rates is vital. Sports cars can cost more to insure. Let’s dig into what affects these premiums.

Age And Experience Of The Driver

Your age and driving history play a big role. Young drivers often pay more. Experienced drivers can enjoy lower rates.

- Young drivers tend to face higher premiums.

- Seasoned drivers can benefit from their years on the road.

- Insurance companies view older drivers as less risky.

Geographical Location And Its Influence

Where you live affects your insurance cost. Busy cities might lead to higher rates. Quiet towns could mean cheaper insurance.

| Location Type | Insurance Impact |

|---|---|

| Cities with heavy traffic | Higher risk of accidents increases premiums. |

| Areas with low crime rates | Lower risk often leads to reduced rates. |

Weather conditions also affect premiums. Places with extreme weather may see higher rates.

Reducing Insurance Costs For Sports Cars

Think sports cars and you instantly imagine speed, style, and, often, a hefty insurance bill. But owning a dream machine doesn’t always have to come with a nightmare premium. With the right knowledge, you can rev down the cost of your insurance. This section of our blog zooms into effective methods to reduce insurance costs for those flashy speedsters on your driveway.

Safety Features That Lower Rates

Insurance costs may drop with each added safety feature. Here’s a look at some:

- Anti-lock braking systems (ABS) prevent skidding, reduce accidents.

- Advanced airbag systems offer better protection, less risk.

- Electronic Stability Control (ESC) helps maintain control, avoid crashes.

- Alarm systems deter theft, reduce comprehensive coverage costs.

Equip your sports car with these technologies and talk to insurers. Mention each feature. Show how your car’s risk is lower. Expect insurance quotes to reflect that.

Insurance Discounts And How To Qualify

Qualifying for insurance discounts takes a few steps:

- Defensive driving courses: Complete one, show your certificate, get a discount.

- Good driving record: Stay ticket and accident-free, enjoy lower rates.

- Bundling policies: Combine car with home insurance, pay less for both.

- Low mileage: Drive less, spend less on insurance.

- Pay annually: Choose a yearly payment, skip the monthly surcharge.

- Student discounts: If you’re under 25 and have good grades, save big.

Stay proactive in seeking out discounts and ensure your insurer is aware of any qualifying factor.

Always compare quotes. Don’t settle for the first offer. Use online comparison tools. Check various insurers. Find the best rate for your sleek road companion. Insurance doesn’t have to be expensive, even for a sports car. Smart choices lead to significant savings.

Comparing Sports Cars And Standard Vehicles

When diving into the world of car insurance, many factors come into play. One key variable is the type of car you drive. Sports cars and standard vehicles sit on different ends of the insurance spectrum. But what makes insuring a sports car potentially more expensive?

Case Studies: Insurance Costs For Different Car Models

Insurance premiums vary depending on the car model. Let’s look at real examples to understand this difference:

| Car Model | Annual Insurance Cost |

|---|---|

| 2023 Sports Car A | $2,500 |

| 2023 Sedan B | $1,200 |

| 2023 SUV C | $1,500 |

Sports Car A has a higher insurance cost than both the Sedan B and SUV C. This shows that insuring sports cars can be pricier than standard vehicles.

Does Brand Reputation Affect Insurance Prices?

The brand of a vehicle can influence insurance rates. Luxury and performance car brands often have a reputation linked to higher costs for repairs and replacements. This can lead to increased insurance premiums.

- High-end sports cars may carry more expensive parts.

- A luxury brand’s market position may result in higher insurance costs.

- Safety ratings and theft rates can affect premiums.

For instance, insuring a renowned sports car brand might be costlier than an economy car with a lower risk profile.

Choosing between a sports car or a standard vehicle involves considering insurance expenses. With sports cars typically costing more to insure due to factors like performance risk, repair costs, and brand reputation, it’s important to assess your priorities and budget accordingly.

Credit: www.quora.com

Frequently Asked Questions Of Are Sports Cars More Expensive To Insure

Why Do Sports Cars Have Higher Insurance Rates?

Sports cars typically have higher insurance rates due to their powerful engines, potential for high-speed driving, and the increased risk of accidents. Their repair costs are usually steep, and they are often targeted for theft, leading insurers to charge more.

Does Car Model Affect Insurance Premiums?

Yes, the car model significantly impacts insurance premiums. Sports cars, considered high-risk vehicles for their speed and performance, often attract higher insurance rates. Additionally, luxury models and cars with expensive parts can also drive up the insurance cost.

What Factors Influence Sports Car Insurance Costs?

Several factors influence sports car insurance costs, including the car’s horsepower, its likelihood to be stolen, repair expenses, and the driver’s age and driving record. Modifications and selected coverage options can further affect the premium.

Can Driving History Affect Sports Car Insurance?

Absolutely, a clean driving history can positively affect sports car insurance rates. Insurers consider a driver’s past behavior on the road as an indicator of future risk, so fewer traffic violations or accidents usually result in lower insurance premiums.

Conclusion

To sum up, owning a sports car does typically carry higher insurance costs. Factors like performance, theft rates, and repair expenses contribute to this trend. Smart shopping and comparing policies can help manage these costs. Remember, your unique driving record and location also play crucial roles in determining your premiums.

Choose wisely and drive safely to possibly offset some of the insurance expenses associated with these exhilarating vehicles.