How Much to Add a Person to Car Insurance

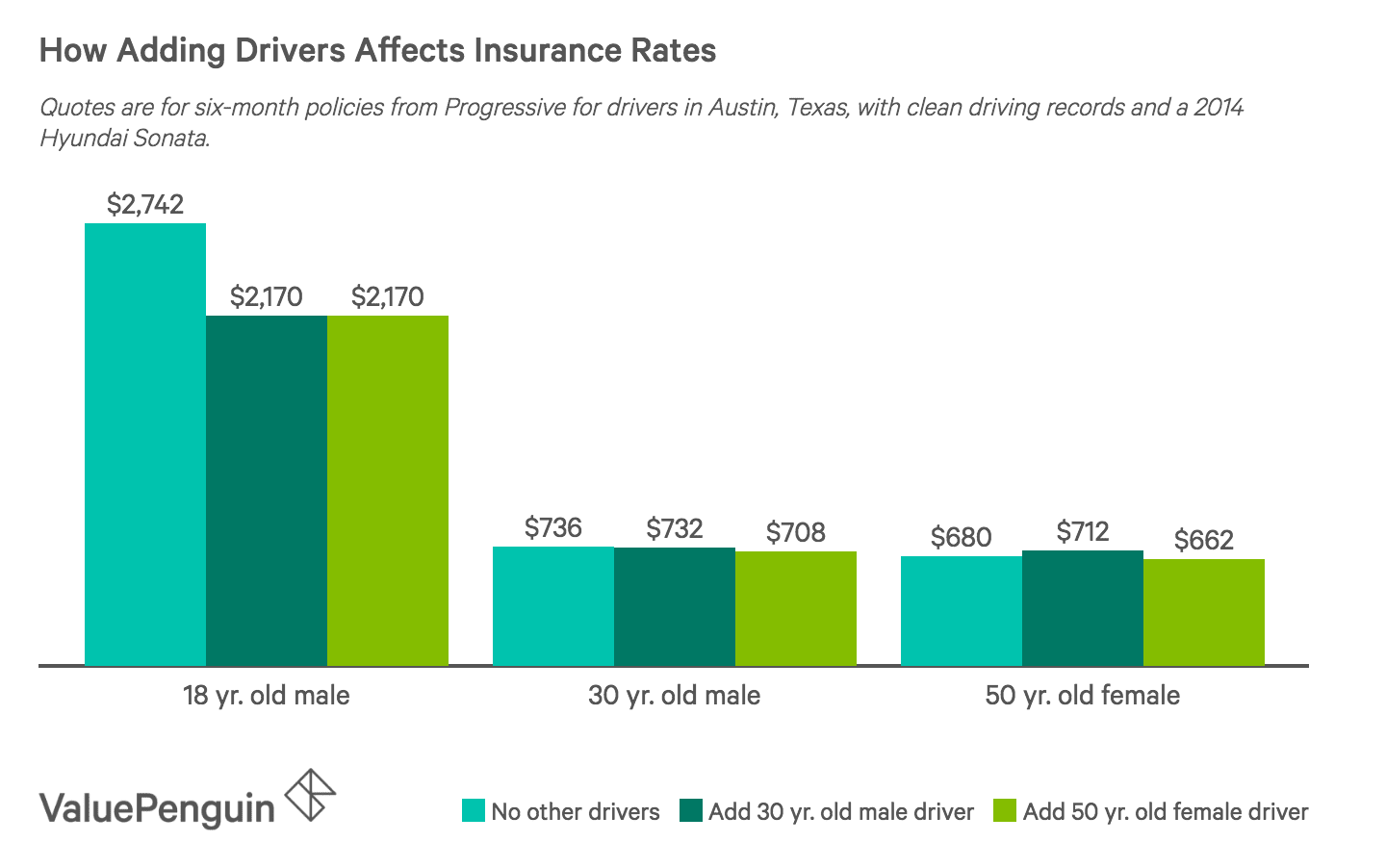

The cost to add a person to car insurance varies, typically ranging from $50 to $500 annually. The exact amount depends on factors like the driver’s age, driving record, and the type of vehicle insured.

Understanding the nuances of car insurance can be vital for both new and seasoned car owners. Insurers assess the risk associated with additional drivers, and this directly influences premiums. Adding a young or inexperienced driver often leads to a steeper increase compared to an older, more seasoned driver.

Each policy and provider has its own set of rules and rates, so it’s crucial for policyholders to review their coverage and compare quotes. Knowing these details empowers consumers to make informed decisions about their auto insurance, ensuring they get the best possible rate while keeping all drivers adequately covered.

Credit: clearsurance.com

Assessing The Impact On Premiums

When you consider adding a person to your car insurance policy, it’s crucial to assess the impact on your premiums. Whether it’s a new teen driver or a spouse, understanding how this addition affects your rates helps you plan for these changes. Below, we explore the factors and misconceptions influencing premiums for additional drivers on your car insurance policy.

Factors Affecting Additional Driver Rates

A range of elements influences the cost of adding an extra driver to a car insurance policy. These aspects include:

- Age: Younger drivers often lead to higher premiums due to their inexperience.

- Driving Record: A clean record can mean lower rates while a history of violations may increase costs.

- Car Type: High-performance vehicles could bump up the premium more than a standard car.

Insurance companies analyze these factors to determine the risk of insuring the additional driver, which then impacts the premium.

Common Misconceptions

People often encounter myths about car insurance. Let’s clear up some common misconceptions:

| Misconception | Truth |

|---|---|

| All Additional Drivers Raise Premiums | This isn’t always the case. Mature drivers with good records could potentially lower your rates. |

| Gender Doesn’t Affect Rates | Actually, young male drivers may cause higher premiums than female drivers due to statistical risk profiles. |

Understanding these points can save you from surprise costs and help you make informed decisions regarding your car insurance.

Multi-driver Policies Explained

Understanding multi-driver policies is key when considering adding someone to your car insurance. Insurance companies offer the option to include multiple drivers on one policy, streamlining costs and paperwork. This section delves into these policies, highlighting benefits and pinpointing challenges.

Benefits Of Adding Drivers

Adding drivers to a car insurance policy can lead to several advantages:

- Discounts: Insurers may provide discounts for policies with multiple drivers.

- Convenience: It’s easier to manage one policy for all household drivers.

- Continuity: Consistent coverage for everyone driving the vehicle.

It’s important to contact your provider to understand the specific benefits they offer. Each company has unique policies.

Challenges And Limitations

On the other hand, adding drivers can come with challenges:

| Challenge | Explanation |

|---|---|

| Higher Premiums: | Riskier drivers may increase the policy cost. |

| Restrictions: | Some insurers set limits on who can be added. |

| State Laws: | Regulations differ by state and could affect eligibility. |

Weighing these challenges helps in making an informed decision about multi-driver policies. Remember, the final cost can vary based on the drivers’ ages, records, and other factors.

Profile Of The Additional Driver

Understanding who you are adding to your car insurance is key. The cost can vary based on various factors related to the driver. Let’s dive into two crucial aspects: their age and experience and their driving record.

Age And Driving Experience

| Age Group | Experience Level | Insurance Impact |

|---|---|---|

| Under 25 | Novice | Higher Rates |

| 25 to 60 | Intermediate to Expert | Moderate Rates |

| Over 60 | Experienced | Varied Rates |

Younger drivers often pay more due to less road time. Experienced drivers benefit from better rates.

Driving Record And Risk Assessment

- Clean Record: Leads to preferred rates.

- Minor Violations: Could increase premiums slightly.

- Major Violations: Expect significant rate hikes.

Insurers assess the risk of accidents. A good record equals less risk. More violations suggest more risk.

Credit: medium.com

Insurance Company Variation

Insurance Company Variation plays a significant role in determining how much you’ll pay to add a person to your car insurance. Each insurer uses its own formula to set premiums. These calculations consider a host of variables including the new driver’s age, driving history, and even credit score. This means costs can vary greatly from one insurance provider to another. It’s essential to shop around and compare rates for the best deal.

Comparing Different Insurers

Finding the best rate involves comparing different insurance companies. Use the following guidelines:

- Collect quotes from various insurers.

- Make sure each quote is for the same level of coverage.

- Consider the customer service record of each insurer.

- Check for multi-driver or multi-policy discounts.

Remember, the cheapest option isn’t always the best. Look for a balance between cost and the quality of service.

Why Quotes Differ

Why do car insurance quotes vary so much? Several factors could influence the cost:

- Different risk models among insurers.

- Varying costs of doing business.

- State regulations and required coverage minimums.

- Personal factors like driving history of the person added.

Understanding these variables can help navigate why you receive such a range of quotes for adding a person to your car insurance. Be sure to ask insurers why their quotes differ to make an informed decision.

Strategic Considerations

Strategic Considerations play a vital role when adding a person to your car insurance policy. It’s not just about the extra cost. It’s about ensuring everyone enjoys adequate protection without breaking the bank. Assess your needs, and the needs of the new driver, to tailor your policy cost-effectively.

Optimizing Coverage For Multiple Drivers

Ensuring each driver on your policy has adequate coverage is key. Consider the following:

- Driving records: Clean histories might lower premiums.

- Vehicle types: More cars mean adjusted coverage levels.

- Usage frequency: Less driving could equal lower costs.

Review your policy features. Adjust deductibles and limits to fit multiple drivers. Sometimes, bundling policies can unlock discounts.

When To Consider Separate Policies

At times, separate policies make financial sense. Look out for these instances:

- High-risk drivers: Their premiums might spike your policy cost.

- Diverse needs: Different drivers might need different coverages.

- Vehicle ownership: Non-family members should have separate policies.

Compare the costs of a joint policy against individual ones. Your insurance advisor can help decide the best route.

:max_bytes(150000):strip_icc()/GettyImages-1270375826-dd2e5acd89f243de90bccee3ac02ef90.jpg)

Credit: www.thebalancemoney.com

Taking Action

Taking action on your car insurance is essential when life changes. Adding a driver to your policy can affect your rates and coverage. Let’s explore how to navigate this process efficiently.

Steps To Add A Driver

- Collect the driver’s personal information, including full name, date of birth, and driver’s license number.

- Call your insurance agent or log in to your online account.

- Provide the new driver’s details to your insurance company.

- Review the policy changes and any additional costs involved.

- Confirm the addition and update your insurance ID cards.

Follow these steps for a smooth addition to your policy. Your insurance provider will guide you through the process.

Potential Discounts And Savings Opportunities

- Good Driver Discounts: Savings for drivers with clean records.

- Multi-Car Discounts: Lower rates for insuring more than one car.

- Student Discounts: Reduced rates for young drivers with good grades.

- Defensive Driving Courses: Discounts for completing an approved course.

Ask your insurer about these opportunities to save on your premium. Every insurance company offers unique discounts.

Frequently Asked Questions On How Much To Add A Person To Car Insurance

How Does Adding A Driver Affect Insurance Premiums?

Adding a driver to your car insurance typically increases your premiums. The exact amount varies based on factors like the additional driver’s age, driving history, and the relationship to the policyholder. Insurers consider these details to assess the risk level of insuring the additional driver.

What Is The Cost To Add A Teenager To Car Insurance?

Adding a teenage driver to car insurance can be costly, often resulting in a significant premium increase due to their inexperience and higher accident risk. Costs vary widely by insurer and state but expect to see a substantial rise in your insurance rates.

Can Multiple Drivers Share One Car Insurance Policy?

Yes, multiple drivers can share one car insurance policy, often referred to as a multi-driver or joint car insurance policy. This can be a cost-effective solution for households with several drivers, but the premium will reflect the combined risk of all insured drivers.

Will My Car Insurance Go Up For Adding My Spouse?

Adding your spouse to your car insurance policy may result in a higher premium, but it can also lead to discounts for some policyholders. Insurers often provide multi-car or multi-driver discounts, and having a spouse with a good driving record could be favorable for your rates.

Conclusion

Summing up, the cost of adding someone to your car insurance varies widely. Factors like driving history, relationship to the policyholder, and the vehicle itself play crucial roles. Consult with your insurer for the most accurate estimate. Remember, the right coverage can save you money and stress in the long run.

Make the informed choice for your auto insurance needs today.