How to Get a Car Title Loan

To get a car title loan, apply with a lender using your vehicle’s title as collateral. Ensure your car is fully paid off and in your name.

Acquiring a car title loan can be a straightforward process for those needing quick cash with clear vehicle ownership. It’s crucial to assess your financial situation to ensure you can repay the loan without risking your transportation. These loans typically require a clear title, which means your car must be completely paid off and not encumbered by any liens.

The lender will assess your car’s value and offer a loan based on a percentage of that value. Keep in mind, though, that title loans often come with high interest rates and fees, making them a costly form of credit. It’s essential to research reputable lenders, understand the terms completely, and have a repayment plan to avoid potential financial pitfalls.

Introduction To Car Title Loans

Facing financial hurdles can be daunting, and sometimes, traditional loans just don’t fit the bill. Car title loans offer a fast and accessible alternative, using your vehicle as collateral. Perfect for those who need capital quickly, this guide will illuminate the ins and outs of car title loans.

What is a Car Title Loan?What Is A Car Title Loan?

Simply put, a car title loan is a short-term loan where the borrower’s car title is used as collateral. The borrower must own the vehicle outright. The lender places a lien on the car’s title. In exchange, the borrower gets cash. Once the loan is repaid, the lien is removed, and the car title is returned.

Key Features And How They Work

- Quick Access to Cash: Borrowers can often receive funds the same day they apply.

- Bad Credit Acceptance: Lenders typically don’t consider credit history, focusing on the vehicle’s value instead.

- Short Loan Terms: These loans often need to be repaid within 15 to 30 days.

- High-Interest Rates: Rates may be higher than traditional loans due to the increased risk to the lender.

To start the process, borrowers must present a clear title, photo ID, proof of insurance, and sometimes a duplicate set of keys. Loan amounts vary depending on the car’s appraisal.

Credit: www.loancenter.com

Eligibility Criteria For Applicants

Eligibility criteria for a car title loan play a critical role in the application process. Understanding what is required upfront can streamline the loan acquisition journey. Let’s dive into the specifics that applicants need to meet.

Basic Requirements For A Title Loan

Securing a title loan involves a few key steps:

- Full ownership of the vehicle with no liens.

- The car title should be in your name.

- State-issued ID matching the name on the title.

- Proof of residency in the state where you’re applying.

- Proof of income to show repayment capability.

- Vehicle inspection may be required to assess value.

Understanding The Role Of Credit

While credit scores might seem important, they don’t always dictate title loan approval. Here’s a closer look:

| Credit Aspect | Role in Title Loans |

|---|---|

| Bad Credit | Possible approval due to loan being secured by car title. |

| No Credit | Often considered, as value of the car is the focus. |

| Credit Checks | Some lenders may still perform them, but they are not always a deciding factor. |

Your vehicle’s worth offers assurance to the lender. This often places more importance on the vehicle than credit history.

The Application Process

The Application Process for a car title loan is straightforward. It lets you borrow money using your car as collateral. Understanding the steps involved will smooth the journey. Here’s how to get started.

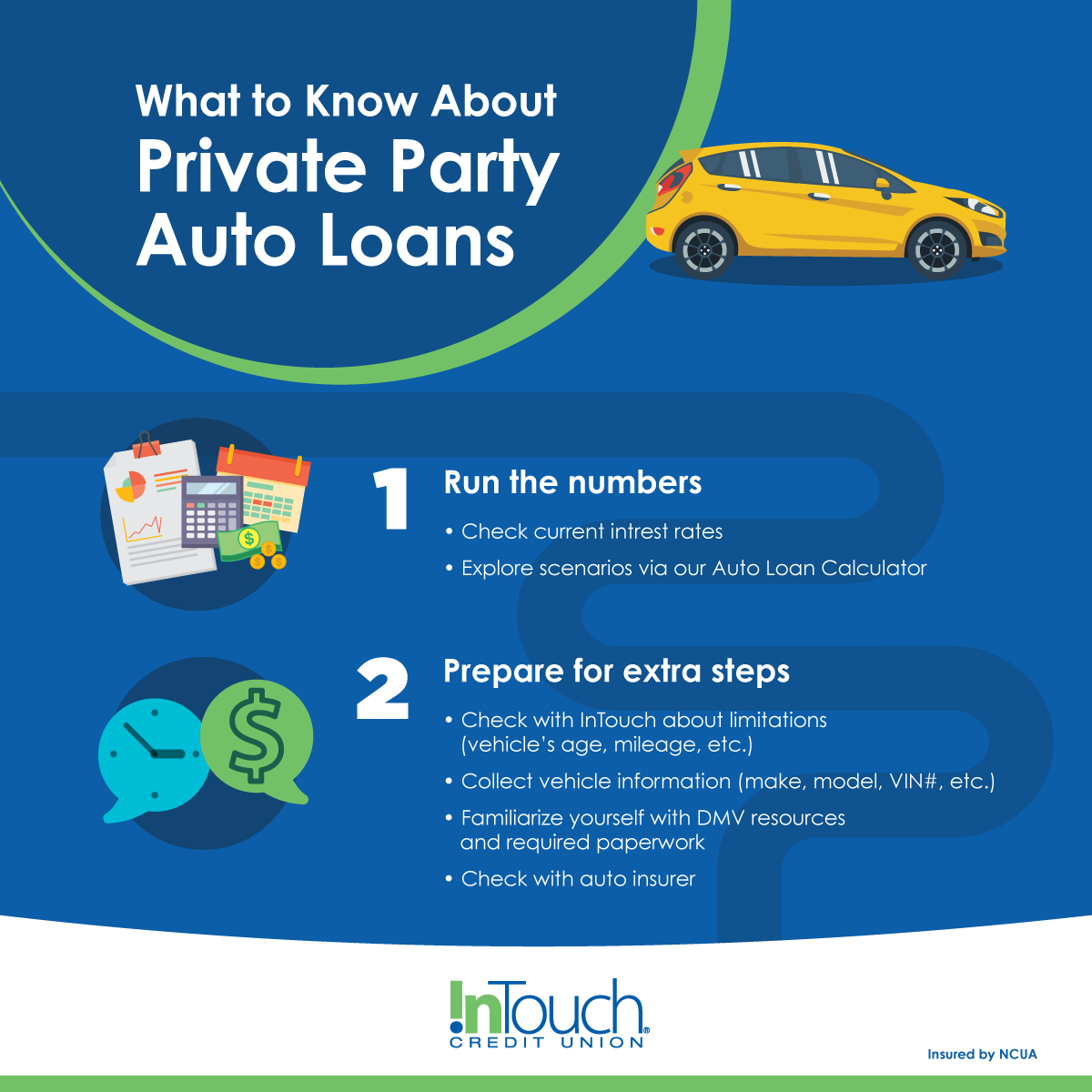

Steps To Apply For A Car Title Loan

- Find a Lender: Search for reputable car title loan providers.

- Car Value Assessment: The provider will examine your car’s value.

- Complete the Application: Fill in the necessary forms with accurate details.

- Submit Required Documents: Provide copies of all requested paperwork.

- Loan Approval: Wait for the loan approval which might take a few hours.

- Get Funds: Once approved, receive the money usually via direct deposit.

Commonly Required Documents

- Title of Your Vehicle: Original document required.

- Government-Issued ID: Such as a driver’s license or passport.

- Proof of Residence: Any utility bill or lease agreement can serve.

- Income Evidence: Recent pay stubs or bank statements.

- Insurance Proof: Showing your vehicle is insured.

- References: Names and contacts of personal or professional references.

The documents ensure the lender can verify both your identity and ownership of the car. Keep copies for your records too.

Credit: www.facethered.com

Evaluating Your Vehicle’s Worth

Evaluating your vehicle’s worth is crucial when considering a car title loan. The loan amount largely depends on your car’s value. Understanding the evaluation process helps you know what to expect.

How Lenders Determine Car ValueHow Lenders Determine Car Value

Lenders use several factors to assess your car’s worth. These include:

- Make and Model: Popular models often fetch higher values.

- Year of Manufacture: Newer cars may lead to larger loans.

- Mileage: Lower mileage indicates less wear and tear.

- Overall Market Demand: High demand increases value.

Lenders may also refer to car valuation guides and check similar vehicle sales.

Impact of Vehicle Condition on Loan AmountImpact Of Vehicle Condition On Loan Amount

The state of your car plays a significant role in determining loan size. Here’s how:

| Vehicle Part | Condition | Impact on Value |

|---|---|---|

| Body | No damage | High value |

| Engine | Good running | Positive impact |

| Interior | Clean and intact | Better valuation |

| Tires | New or well-maintained | Enhances worth |

Regular maintenance, a clean history report, and documented repairs can increase loan offers.

Understanding The Terms And Conditions

Understanding the Terms and Conditions is a critical step before securing a car title loan. It ensures that you fully grasp what you’re signing up for. Detailed knowledge can prevent unforeseen complications and financial strain. Let’s focus on two crucial aspects: Reading the Fine Print and Interest Rates and Repayment Plans.

Reading The Fine Print

Every car title loan agreement comes with its own set of rules and requirements. It’s essential to read every detail before agreeing. Look for terms about loan duration, hidden fees, and collateral specifics.

- Loan Duration: Check how long you have to pay back the loan.

- Hidden Fees: Identify any additional charges not discussed upfront.

- Collateral Specifics: Understand how your car’s value affects the loan.

Interest Rates And Repayment Plans

Understanding your loan’s interest rates and repayment schedule is crucial. These factors will dictate your financial commitment over the life of the loan.

| Component | Description |

|---|---|

| Interest Rates | Determine the cost of borrowing and can vary widely. |

| Repayment Schedule | Includes frequency and amount of payments. |

Be sure to shop around for the best rates and plan for your financial situation. Use an online calculator to estimate monthly payments and total interest.

Remember, missing payments can result in higher costs or loss of your car. Choose a plan that fits your budget to avoid these risks.

:max_bytes(150000):strip_icc()/car-title-loan-requirements.asp-final-733928ccd9004905b36ed58e2d029ecc.png)

Credit: www.investopedia.com

Risks And Considerations

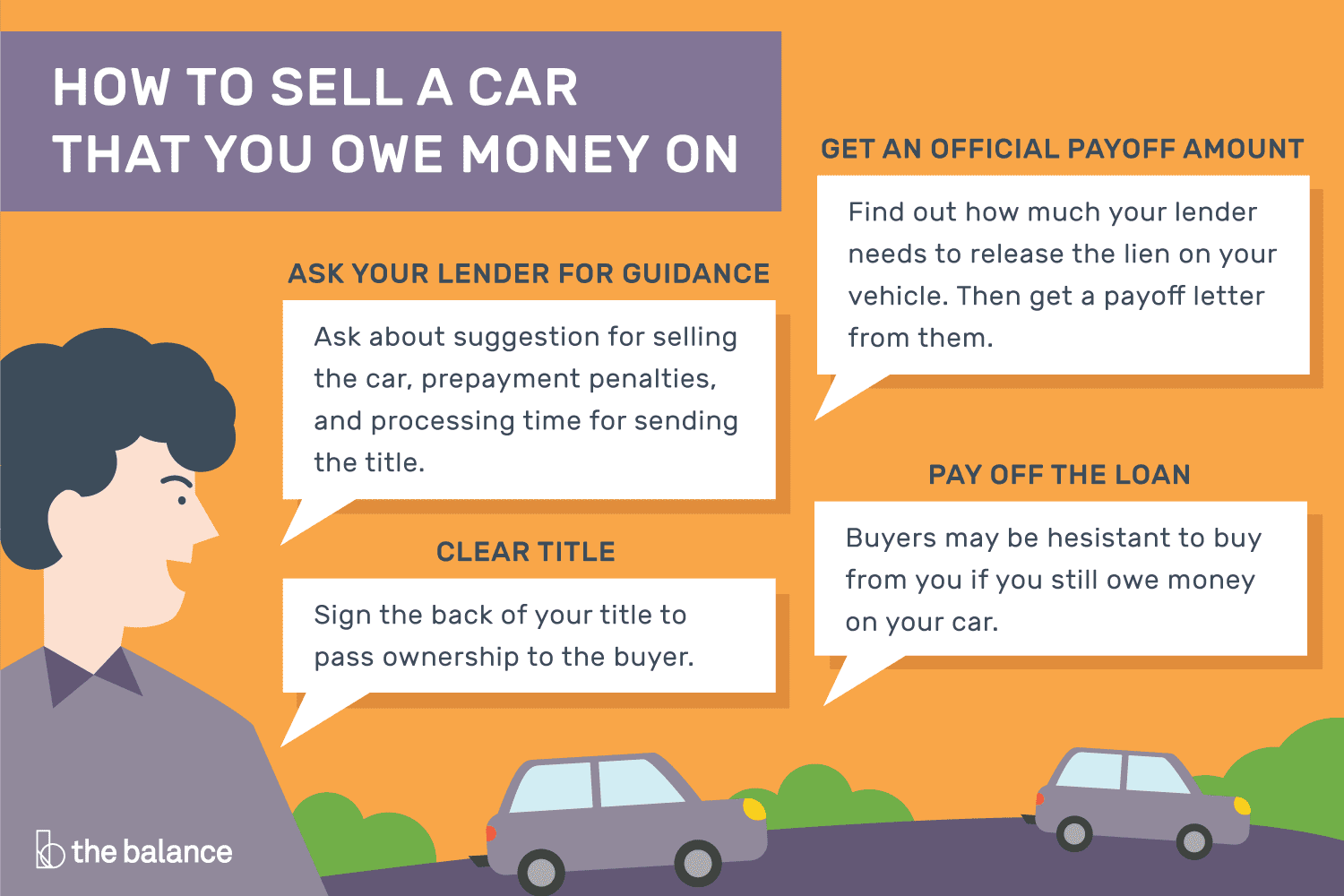

Understanding the risks and considerations before getting a car title loan is essential. This type of loan uses your car as collateral. It means if you fail to pay, you could lose your vehicle. This section highlights the potential pitfalls and key points to ponder.

The Consequences Of Defaulting

Defaulting on a car title loan carries significant risks. Lenders can repossess your vehicle without notice. You could lose not only your mode of transportation but also the money you’ve already paid. It’s vital to understand the lender’s terms. Know the grace periods and repossession policies.

- Immediate repossession: After missing a payment.

- Affected credit score: Your credit could suffer.

- Increase in debt: Possible additional fees and charges.

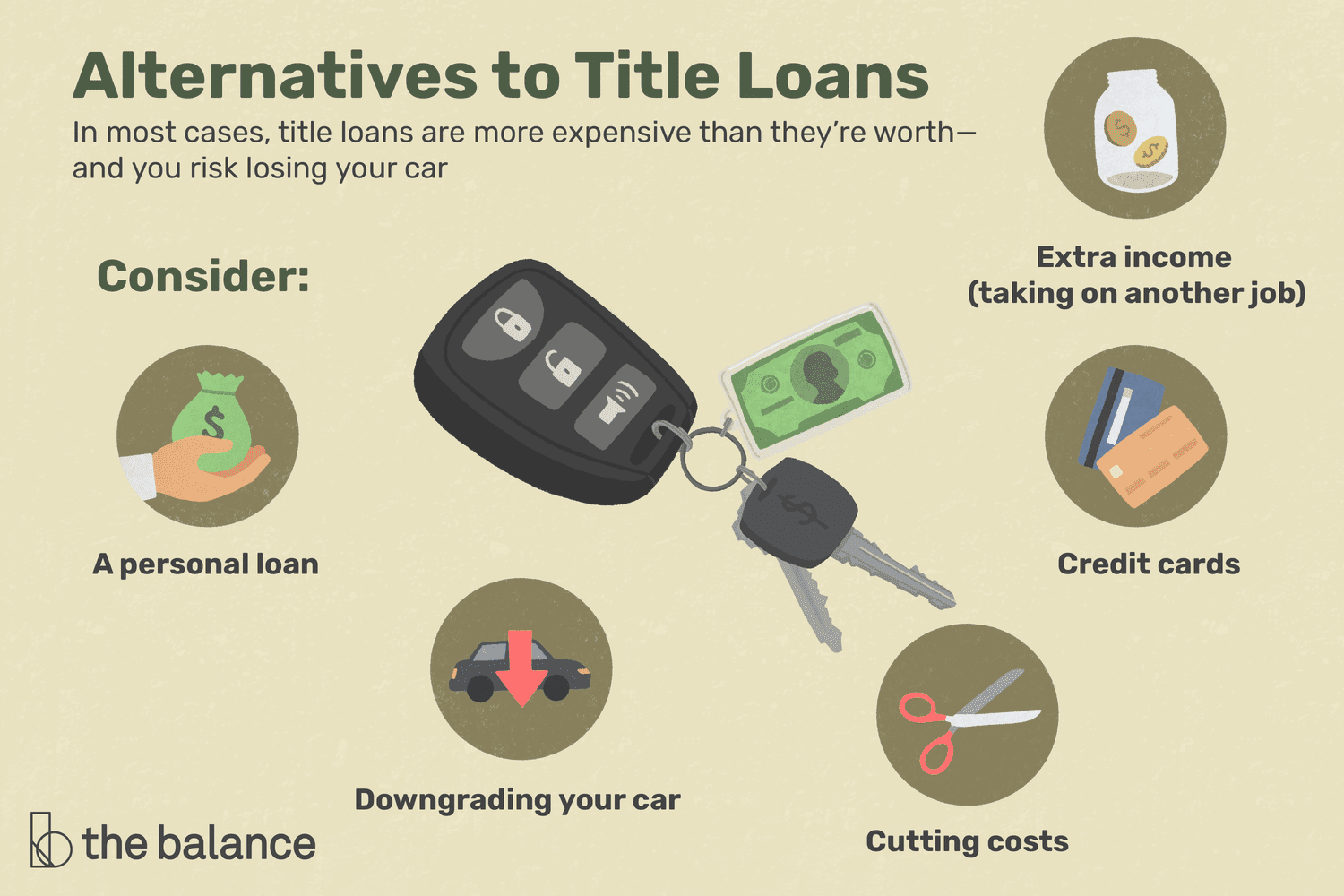

Alternatives To Car Title Loans

Considering alternatives to car title loans could save you from high interest and loss of your vehicle. Explore other options that may offer safer borrowing.

| Alternative | Description | Benefit |

|---|---|---|

| Personal loans | Unsecured loans from banks or credit unions. | No collateral required. |

| Credit cards | Opportunity for cash advances. | Often lower APR than title loans. |

| Payment plans | Arrange payment schedules with creditors. | Avoid borrowing and protect assets. |

| Emergency Funds | Money saved for unplanned expenses. | No need to borrow, no interest charged. |

Tips For A Successful Loan Experience

Getting a car title loan can be a lifeline in a financial pinch. Yet, success lies in the details. Follow these pointers for a smooth borrowing journey.

Negotiating Terms With Lenders

To secure a solid deal, keep these factors front of mind:

- Compare offers. Don’t settle for the first lender.

- Read the fine print. Look for hidden fees and clauses.

- Interest rates matter. Aim for the lowest rate.

- Flexible payment options. Ensure they match your income cycle.

Remember, clear communication with your lender sets the stage for trust.

Managing Loan Repayment Effectively

Stay ahead with these repayment strategies:

- Organize finances. Budget for loan payments ahead of time.

- Extra payments. Reduce interest by paying early or extra.

- Stay in touch with the lender. Inform them of any payment delays.

| Payment Date | Amount | Interest Rate |

|---|---|---|

| 1st of the month | $200 | 5% |

Keep a record of all payments. Avoid missing any due dates.

Frequently Asked Questions For How To Get A Car Title Loan

What Is A Car Title Loan?

A car title loan is a short-term loan where borrowers use their vehicle title as collateral. It allows you to secure funds based on your vehicle’s value, typically without a credit check.

How Quickly Can I Get A Car Title Loan?

You can often receive a car title loan within a day. Many lenders offer quick approval processes, allowing you to access funds almost immediately after approval.

Are Car Title Loans Expensive?

Car Title Loans usually carry high-interest rates. They are considered high-risk loans and consequently have fees and charges that reflect that risk, making them an expensive credit option.

What Do I Need For A Car Title Loan?

To obtain a car title loan, you need a clear vehicle title, government-issued ID, proof of income, and sometimes proof of insurance. Requirements might vary by lender.

Conclusion

Navigating the car title loan process requires careful consideration. Ensure you understand the terms and assess your ability to repay. By choosing a reputable lender and preparing the necessary documents, you can secure the funds you need responsibly. Remember, informed decisions are key to managing your financial health effectively.