How to Get 0 Apr Car Loan

Securing a 0% APR car loan requires a stellar credit score and shopping during promotional periods. Lenders reserve these deals for models they wish to clear quickly.

Navigating the world of auto financing can be a challenge when in pursuit of a 0% APR car loan. Such an enticing financing option means you pay no interest over the life of your loan, potentially saving you thousands. Achieving this requires excellent credit, which reassures lenders of your ability to pay back the loan.

Timing is also crucial; auto manufacturers often offer these deals to move inventory, especially during end-of-year sales or when new models are about to launch. To snag a 0% APR deal, it’s important to research, prepare your finances, and be ready to negotiate. A keen eye for special promotions and dealer incentives will put you in the driver’s seat for the best possible loan terms.

Decoding 0% Apr Car Loans

Bright banners and bold adverts often shout about 0% APR car loans. They surely catch the eye, but what exactly does 0% APR mean? This friendly guide dives into the nuts and bolts of obtaining a car loan without interest—it sounds appealing, but let’s unpack what it really involves.

What Is 0% Apr?

APR stands for Annual Percentage Rate. It’s the yearly interest rate paid on a loan. So, a 0% APR means:

- No extra charges above the car’s price.

- Every payment goes directly to lowering the balance.

- You pay only what the car costs on the sticker—no hidden fees.

How Do These Loans Work?

Understanding 0% APR car loans is simpler than it sounds:

- Dealers offer these loans to entice buyers.

- They’re usually reserved for those with excellent credit scores.

- Shorter loan terms typically apply, leading to higher monthly payments.

- Not all cars qualify; often, it’s select models or last year’s stock.

Zero-interest deals sound like a steal, but they’re a strategic move by dealers. A 0% APR loan can lead to quicker sales of specific car models. Conversely, they may not always lead to the best savings. Comparing offers remains crucial.

Credit: www.moneylion.com

Eligibility Criteria For 0% Apr Deals

Finding the right car deal is tricky. Sometimes it offers a 0% Annual Percentage Rate (APR). This means you pay no interest. But there are rules. Here we talk about those rules. These rules are called ‘Eligibility Criteria for 0% APR Deals.’ Follow these steps and you might just drive away without paying extra!

Credit Score Requirements

Your credit score is like a report card for your money. It tells lenders if you’re good at paying back. For a 0% APR loan, you need a great score. A top score usually means 740 and above. The better your score, the better your chances. Check your score before you apply.

- 740+ : Excellent

- 670-739: Good

- 580-669: Fair

- Below 580: Poor

Income And Employment Verification

The loan people want to know you have a job. They want to see money coming in regularly. So, they check. They look at your pay slips. They call your job. Sometimes they want bank statements too. Make sure you have this info ready. It shows you can pay for the car over time.

| Document | Purpose | Why It’s Needed |

|---|---|---|

| Pay Stubs | Show your income | To prove regular earnings |

| Employment Verification | Confirm your job | To check job stability |

| Bank Statements | Reveal your savings | To ensure financial health |

Evaluating The Pros And Cons

Evaluating the Pros and Cons of a 0% APR car loan is essential. This type of financing can appear enticing. It promises no interest on your auto loan. But, it’s crucial to understand the details. We must weigh both sides to see if it fits our financial situation.

Potential Savings

A 0% APR loan can lead to significant savings over time. Let’s look at the benefits:

- No interest payments – You pay for the car’s price alone.

- More car for less – Higher-end models become attainable.

- Budget breathing room – Extra cash for other expenses.

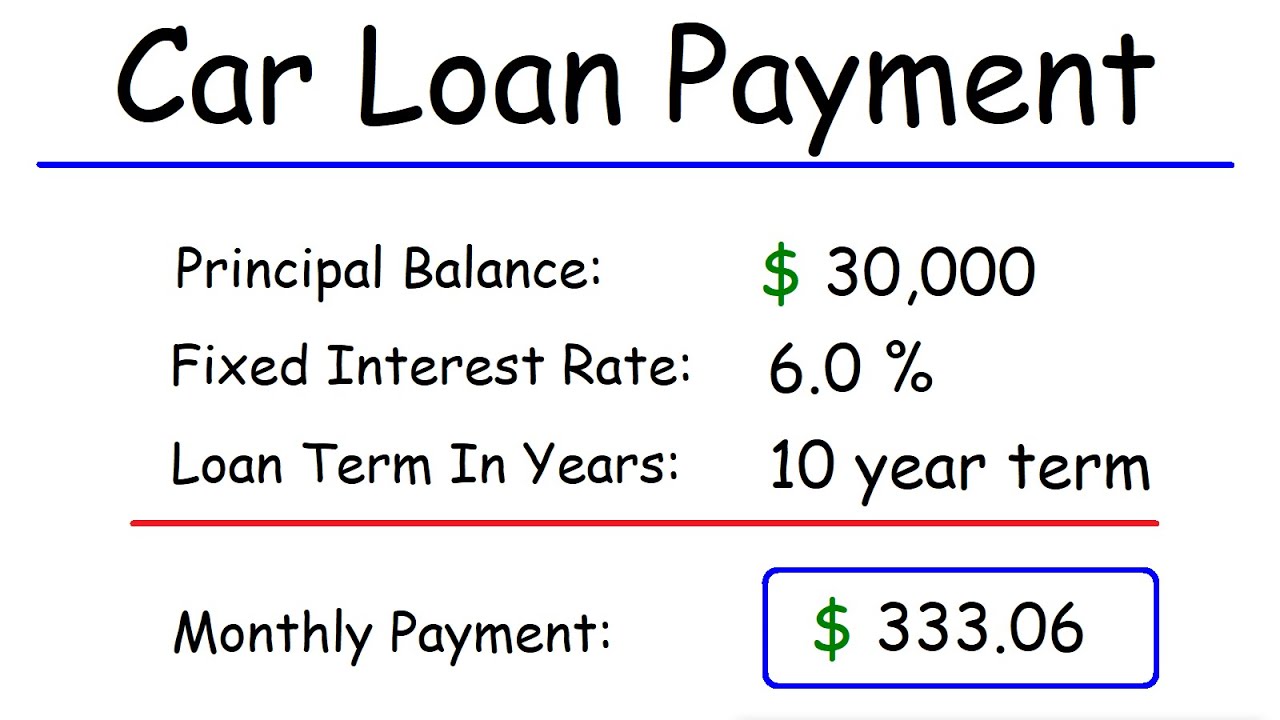

Savings can vary. Use an online calculator to check potential benefits.

Fine Print Pitfalls

The details in the contract matter. Here’s why reading the fine print is vital:

| Pitfall | How It Affects You |

|---|---|

| Eligibility Criteria | Not everyone qualifies. High credit scores are often needed. |

| Short-term Loans | Repayment times can be short. Expect higher monthly payments. |

| Restricted Choices | Car models with 0% APR are limited. Your dream car might not be included. |

Remember, the dealership may substitute a cash rebate with 0% financing. Consider which is more valuable for your situation.

Negotiating The Best Deal

Negotiating the Best Deal on a 0% APR car loan can make a major difference in your finances. First, understand that a car loan with no interest saves you money over time. Next, learn how to get this deal with the right steps. Here’s how to approach the negotiation process for a favorable outcome.

Timing Your Purchase

Finding the best time to buy can lead to great deals. Dealers often offer special promotions at certain times of the year. Aim for:

- End of the month: Sales quotas can motivate dealers to offer better terms.

- Model year-end: New inventory means old models need to go.

- Holiday sales: Look out for Black Friday or New Year discounts.

Tips For Effective Negotiation

Enter negotiations with knowledge and confidence. Use these tips:

- Research fair prices for the model you want. Use car pricing guides.

- Check your credit score. A high score improves approval chances.

- Prepare to discuss terms. Know the price, loan length, and monthly payments.

- Be ready to walk away. It shows you’re not desperate.

- Discuss total loan cost, not just monthly payments. It affects the overall deal.

- Bring pre-approval paperwork from a bank. It gives you an edge in negotiation.

- Talk to multiple dealers. Competition can lead to better offers.

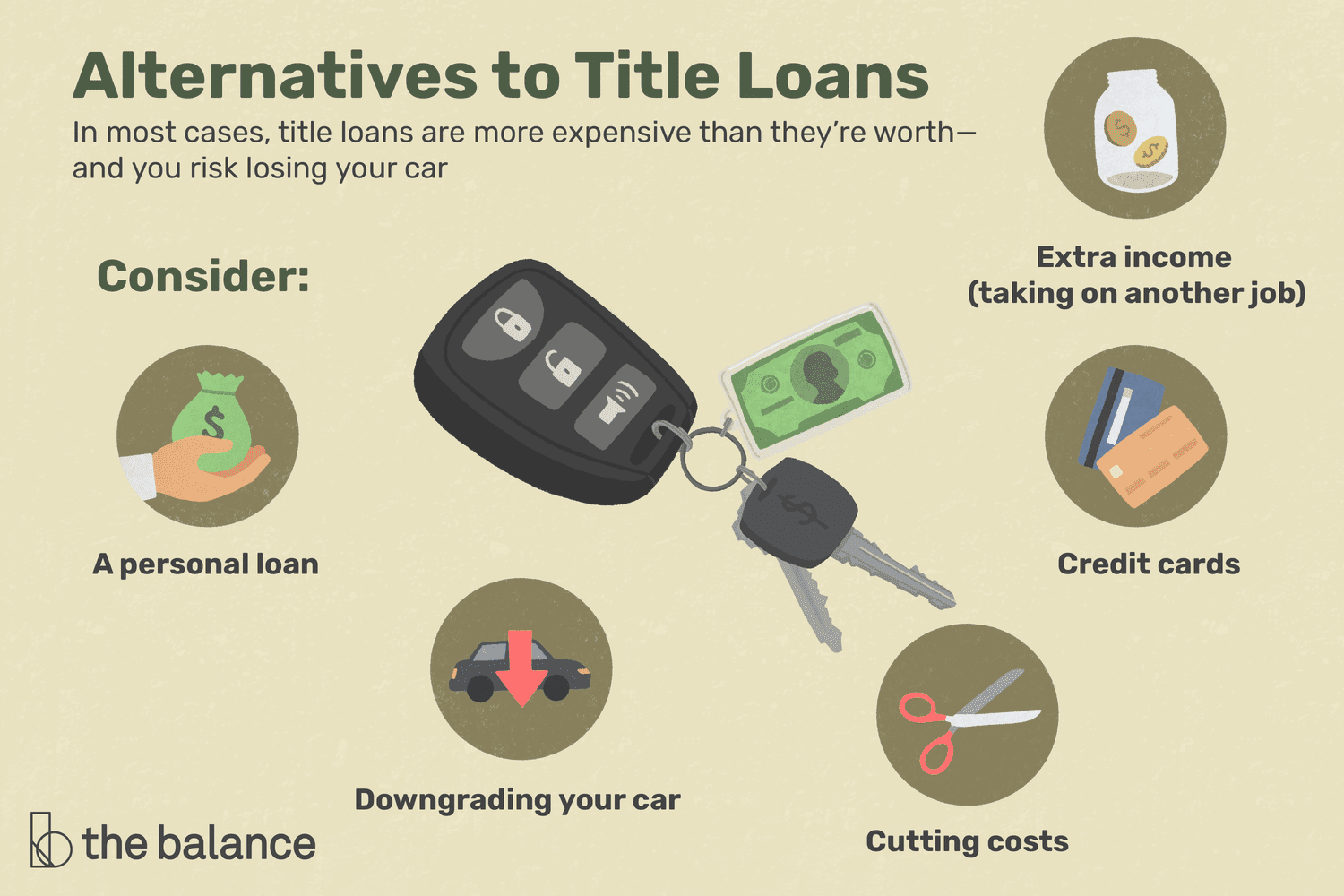

Alternative Financing Options

Exploring alternative financing options for your car can lead to significant savings. Forget being trapped by high-interest rates or unfavorable terms. Many borrowers enjoy the perks of a 0% APR car loan. Let’s delve into how savvy shoppers navigate alternative financing waters.

Comparing Loan Offers

Start by gathering various loan quotes from different lenders. Look beyond the monthly payments. Focus on the APR, loan terms, and total interest paid.

Use a loan comparison calculator to see the differences. A lower APR can save you more over time. Here’s a quick look at how to compare:

| Lender | APR | Loan Term | Total Interest |

|---|---|---|---|

| Credit Union | 0% | 60 months | $0 |

| Bank | 2.5% | 60 months | $1,250 |

| Dealership Finance | 3.5% | 60 months | $1,750 |

Compare car loan offers diligently to find the best deal for you.

When To Consider Other Loans

Sometimes, a 0% APR loan might not be the best option. Observe the market for other loan types if:

- You find short loan terms with 0% APR unfeasible.

- Hefty down payments with 0% APR offers strain your budget.

- Cash-back deals and rebates present more savings than 0% APR loans.

Assess your financial standing and decide accordingly. Persuasive options like credit unions or online lenders often extend competitive rates.

Explore personal loans for better flexibility or a lower overall cost. Always factor in your credit score, loan length, and total cost against the benefits of a 0% APR.

Securing Your 0% Apr Loan

Driving a new car can be a reality with a 0% APR car loan. This means no interest for the loan duration. Securing such a deal requires knowledge, timing, and a solid credit score. Let’s guide you through the application to finalizing the agreement.

Application Process

The journey to a 0% APR car loan starts with the application process. Follow these simple steps:

- Check your credit score: Lenders prefer high scores for 0% APR deals.

- Gather necessary documentation: This includes ID, income proof, and more.

- Fill out the application form: Complete all required fields with accurate information.

- Submit and wait for approval: Approval times vary with different lenders.

Finalizing The Agreement

Once approved, it’s time to finalize your 0% APR loan. Follow these steps:

- Review the contract: Ensure all terms align with what was offered.

- Understand the fine print: Look for any hidden fees or clauses.

- Sign the agreement: Do this only when you’re comfortable with the terms.

Drive away in your new car with a smile and a sweet deal, knowing you’ve secured a 0% APR loan!

Credit: www.bankrate.com

Frequently Asked Questions On How To Get 0 Apr Car Loan

What Is A 0 Apr Car Loan?

A 0 APR car loan is a financing option where the borrower is not charged any interest on the principal amount. This results in lower monthly payments since interest typically comprises a significant portion of a car loan expense.

How Can I Qualify For A 0 Apr Car Loan?

To qualify for a 0 APR car loan, you generally need an excellent credit score. Lenders are looking for low-risk borrowers, so a strong credit history and a stable financial situation are crucial to secure this type of financing.

What Are The Terms Of 0 Apr Car Loans?

The terms of 0 APR car loans can vary by lender, but they often range from 24 to 60 months. It is important to read the fine print as some offers may include conditions or fees that impact the overall cost of the loan.

Are There Hidden Costs In 0 Apr Car Loans?

While 0 APR car loans mean no interest, there can be hidden costs such as processing fees or penalties for early repayment. Always review the contract thoroughly to avoid unexpected charges.

Conclusion

Securing a 0% APR car loan can transform your auto financing experience. By boosting your credit score, shopping smart, and negotiating terms, you stand a better chance. Remember, the right timing and lender can make all the difference. Drive off with a great deal and peace of mind.

Keep these tips in clutch for your journey to zero-interest financing.