What Fees Should I Pay When Buying a Used Car

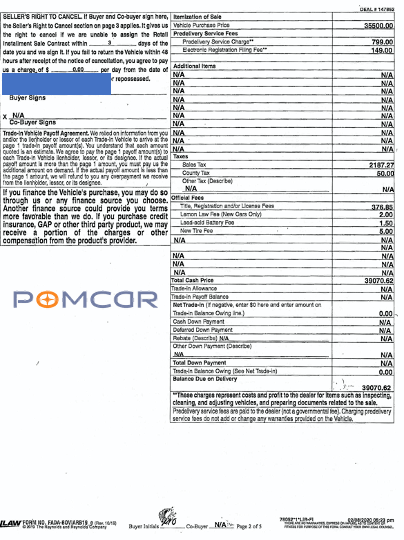

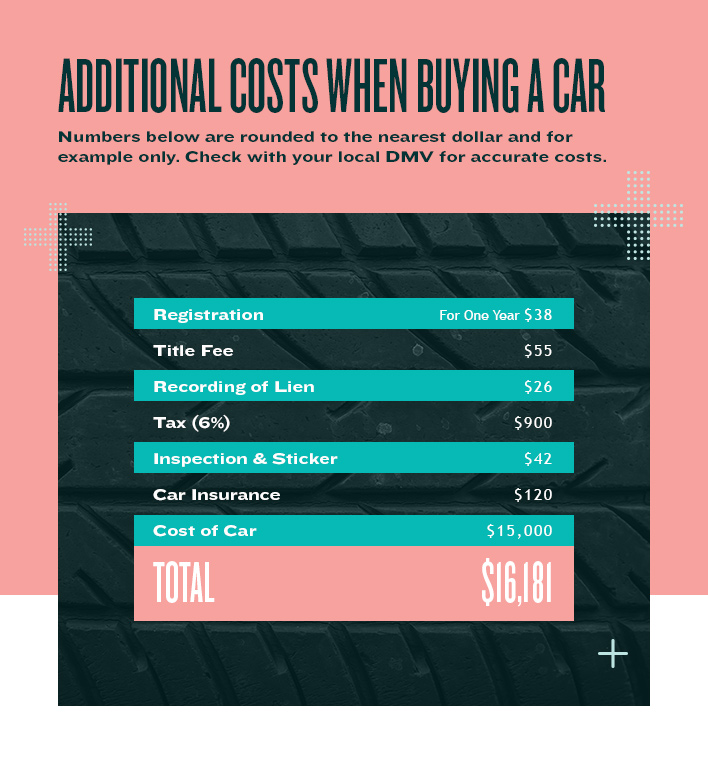

When buying a used car, you should expect to pay for the vehicle price, taxes, registration, and documentation fees. Additional costs may include a dealer fee, and optional extras like extended warranties.

Purchasing a used car involves several fees beyond the sticker price, constituting a significant part of the car-buying process. Buyers should budget for state sales tax, which varies depending on the location, and registration fees that make your new purchase legally drivable on the roads.

The dealership might include documentation or processing fees, covering the cost of paperwork associated with the sale. Recognizing these expenses helps buyers properly plan their finances and negotiate effectively. Secure a transparent purchase by understanding these standard charges, avoiding any unnecessary surprises when closing the deal on a used vehicle.

Credit: www.evansautobrokerage.com

Hidden Costs Of Used Car Purchases

Dealership Fees Explored

Dealership Fees Explored – When venturing into the realm of used cars, buyers often focus on the sticker price. Yet, the final amount you pay extends beyond that initial number. Dealership fees can stack up, quietly inflating the cost of your purchase. It’s crucial to understand these fees, so let’s dive into two common charges you might encounter at the dealership.

Documentation Charges

Documentation charges, sometimes known as the “Doc Fee”, cover the cost of processing your vehicle purchase paperwork. Each state has a cap on these fees. They can range widely:| State | Maximum Doc Fee |

|---|---|

| New York | $75 |

| Florida | No Cap |

Always ask for the exact amount of this fee before finalizing your deal.

Dealership Preparation And Handling

Dealership preparation and handling fees cover the cost to get a car ready for sale. This might include detailing, inspections, and fluid top-ups. Unlike documentation charges, these fees are not regulated and can vary significantly from dealer to dealer.

- Detailing: Cleaning the car inside out

- Inspections: Checking for safety and function

- Fluids: Ensuring all fluids are fresh and filled

Challenge these fees if they seem unreasonable. Some dealers may reduce or waive them with negotiation.

Title, Registration, And Taxation

Welcome to the nitty-gritty world of used car buying! Understanding title, registration, and taxation fees is crucial. These costs can add up and surprise you if not prepared. Let’s ensure you’ll navigate these expenses like a pro.

State Sales Tax Implications

Factor in your state’s sales tax when budgeting for a used car. This tax varies from state to state. It’s a percentage of the car’s purchase price.

- Check your state’s tax rate – Look at the Department of Revenue website.

- Calculate the tax – Multiply the car’s price by the tax rate.

Remember, this step is inevitable. Your wallet will thank you for this prep work.

Title Transfer And Registration Costs

Before hitting the road, transfer the title to your name and register the vehicle.

- Title Transfer Fee: A mandatory one-time fee. Prices differ by state.

- Registration Fee: Usually an annual cost. It can vary based on car type, weight, or age.

These fees make the car legally yours.

| Document | Estimated Cost |

|---|---|

| Title Transfer | $15-$50 |

| Registration | $20-$200 |

Credit: www.edmunds.com

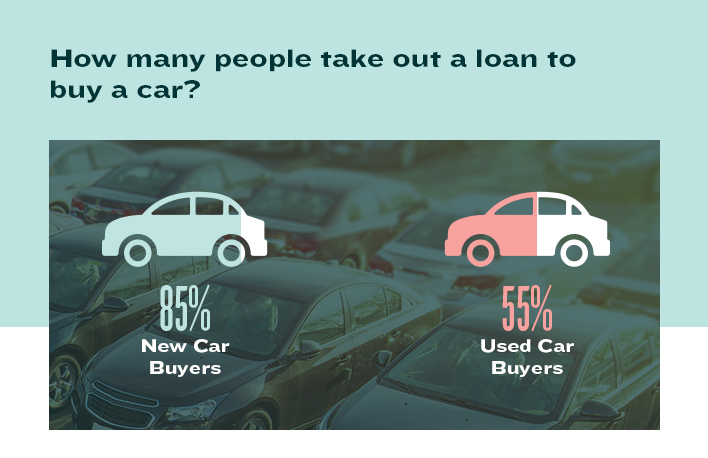

Financing The Deal

Understanding the costs involved in financing your used car purchase is critical. You’ll encounter various fees tied to the loan. It’s not just about the sticker price. Being informed helps you budget wisely. Let’s break down the expenses.

Interest Rates

Interest rates play a big part in financing. They determine how much extra you pay over the loan’s life. Rates vary by lender, credit score, and market conditions. A better credit score often means lower interest rates. Use online calculators to estimate your monthly payments. Remember, a low APR (Annual Percentage Rate) keeps costs down.

Loan Origination Fees

Lenders charge origination fees to process your loan. These are one-time costs at the start. They can be a flat fee or a percentage of the loan amount. Always ask the lender about this fee. Sometimes you can negotiate them or find lenders who don’t charge them at all.

Credit Insurance And Other Financing Add-ons

- Credit insurance protects your loan payments in case of unforeseen events.

- Ask about the total cost and whether it’s factored into your loan.

- Extended warranties and service contracts are other common add-ons.

- Evaluate the benefits versus costs before agreeing to these services.

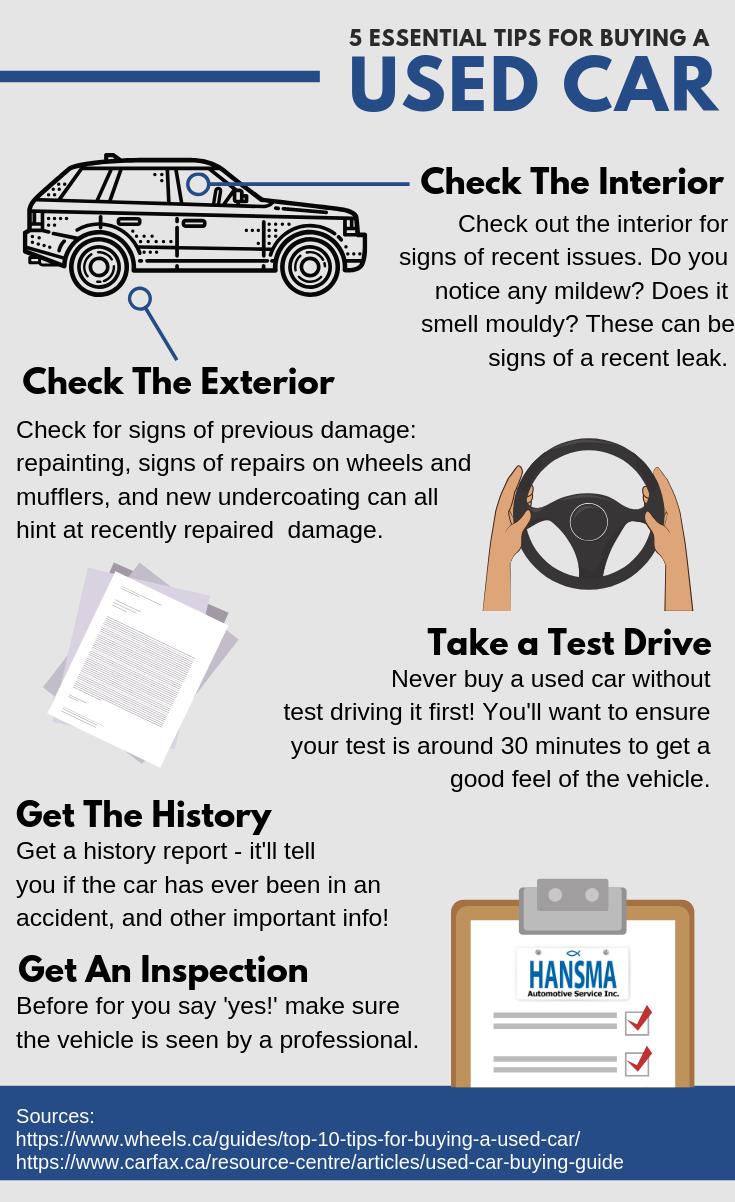

Additional Costs To Consider

When purchasing a pre-owned vehicle, various fees are often straightforward and expected. Nonetheless, it’s key to factor in additional costs that might not be immediately apparent. This section illuminates some of those potential expenses you may encounter to prepare your budget accurately.

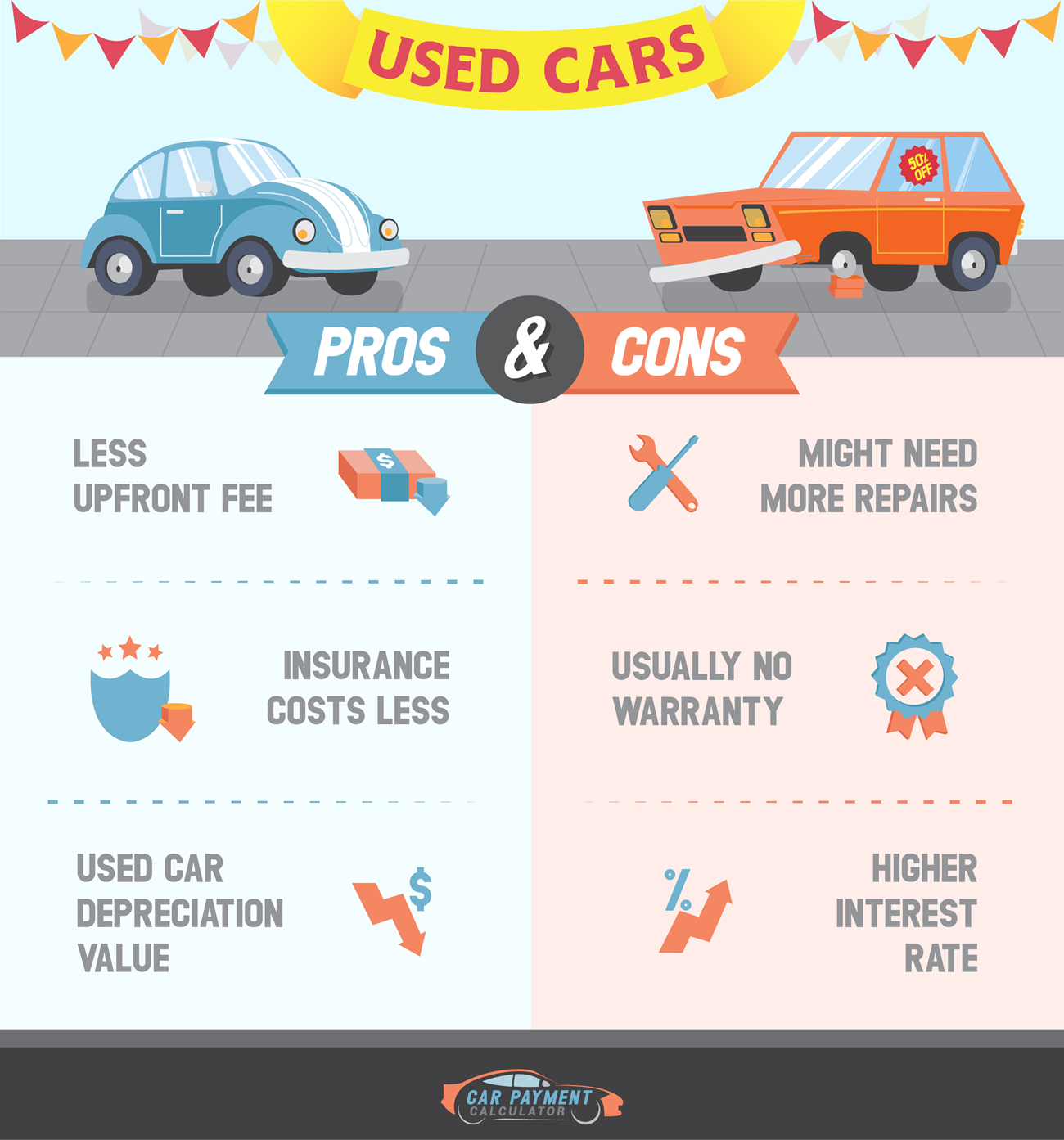

Extended Warranties And Service Contracts

Purchasing a used car means the manufacturer’s warranty might have lapsed. This leads to considering an extended warranty or service contract. These agreements cover repairs and maintenance post-purchase. Here’s a quick glance at what you might expect:

- Service Contract Length: Can range from one to several years.

- Coverage Extent: From basic to comprehensive, depending on the plan.

- Deductibles: Some contracts include them; they can impact overall costs.

Vehicle Customizations And Upgrades

Cars might not match your dream specifications. That’s where customizations and upgrades come in. If you’re considering altering your new-used vehicle, remember these expenses:

| Customization Type | Average Cost |

|---|---|

| Audio System | $100 – $1,000+ |

| Wheel Rims | $400 – $3,000+ |

| Performance Mods | $200 – $4,000+ |

Note: Ensure you factor these into your budget to prevent any surprises.

Credit: www.psecu.com

Negotiation Strategies

Walking into a car dealership to buy a used car can be daunting. But, with the right negotiation strategies, you can ensure you don’t overpay. These tactics will help fight unnecessary fees. They’ll keep more money in your pocket. Let’s delve into specific techniques.

Reducing Dealer Fees

Dealer fees can seem set in stone, but they’re not. We have the power to challenge and lower these costs.

- Examine the fee list. Highlight any that seem high.

- Ask to remove fees that aren’t state-mandated.

- Question processing or documentation fees.

- Compare fees with nearby dealerships for leverage.

These steps can cut down your total cost. Dealers often expect negotiation. They might even drop these fees without a fuss.

Leveraging Competitive Offers

Having offers from other dealers is a strong bargaining chip. Show these offers to your current dealer. It demonstrates that you did your homework.

- Collect offers from several dealerships.

- Ensure they’re for comparable cars.

- Show the best offers to the dealer.

- Negotiate for a price match or better.

Dealers want to close the deal. They often match or beat the competition to make that happen. Use it to your advantage.

Frequently Asked Questions For What Fees Should I Pay When Buying A Used Car

What Are Common Fees For Used Cars?

Common fees when purchasing a used car include state sales tax, registration fees, dealer documentation fees, and potentially a destination charge if the vehicle is being shipped. These fees will vary by location and dealership.

How Much Is The Dealer Documentation Fee?

Dealer documentation fees can vary widely, often ranging from $50 to $400. This fee covers the cost of processing the paperwork involved in a car sale. It’s important to note that some states cap this fee, while others do not.

Do I Pay Sales Tax On A Used Vehicle?

Yes, sales tax is typically required on a used vehicle purchase. The rate is usually based on the state where the car is being registered. It’s calculated as a percentage of the purchase price or the car’s fair market value.

Can I Negotiate Used Car Buying Fees?

Often, certain fees associated with buying a used car, such as dealership fees or preparation fees, can be negotiated. However, official charges like taxes and registration fees are non-negotiable since they’re set by the government.

Conclusion

Navigating the landscape of used car fees can be challenging, yet it’s crucial for a smart purchase. Remember to account for state taxes, registration, dealership costs, and any immediate maintenance. By staying informed, you can ensure your investment remains as cost-effective as intended.

Drive away with confidence, knowing you’ve shopped with diligence.