How to Pay Towards Principal on Car Loan

To pay towards the principal on a car loan, make extra payments and specify that they go toward the principal balance. Contact your lender to arrange principal-only payments.

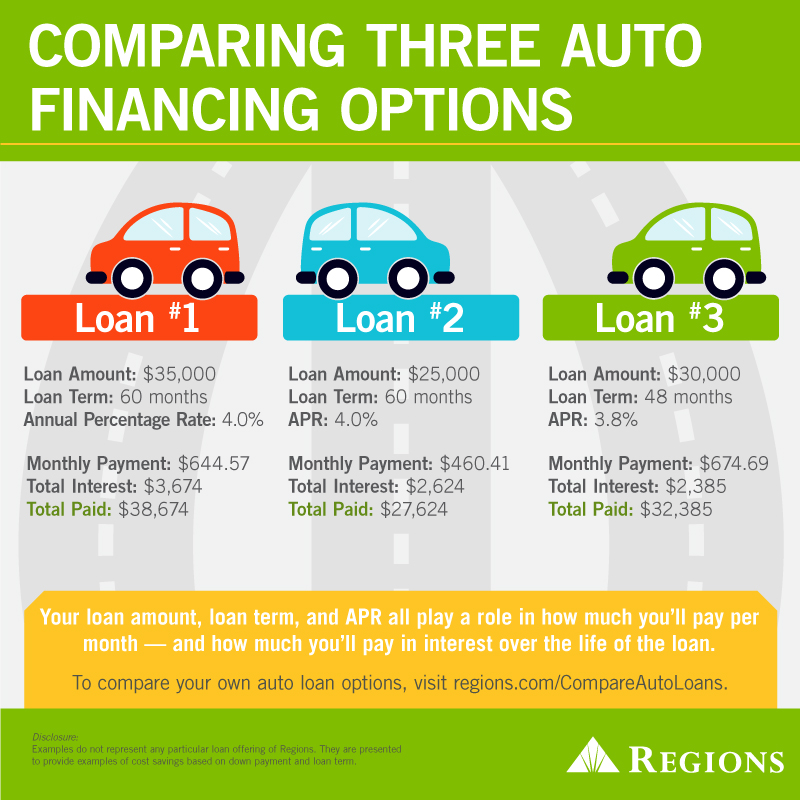

Dealing with car loans can be a stressful part of financial management, but paying off the principal faster can save money on interest and shorten the loan term. Extra payments reduce the principal balance, which in turn decreases the amount of interest accrued over the life of the loan.

To ensure your payments target the principal, you must communicate with your lender, as many auto loans apply extra payments to interest first by default. Don’t let unfamiliarity hold you back; understanding how to direct funds to your principal amount is a savvy financial move that can lead to significant savings and greater control over your debt. Start by reviewing your loan agreement to confirm there are no prepayment penalties, and then reach out to your lender to make the necessary arrangements. Keep track of your progress to stay motivated and watch your loan shrink faster than you thought possible.

Credit: www.bankrate.com

Grasping Car Loan Structure

Understanding your car loan’s structure is key to managing it wisely. It dictates how payments are split between principal and interest. By knowing the details, you can strategize on paying off your loan faster. Let’s break down the essentials.

Principal Vs. Interest

Your car loan has two main parts: principal and interest. The principal is the car’s cost minus your down payment. Interest is the lender’s fee for borrowing money. Payments initially cover more interest than principal. But over time, your principal payments increase.

- Principal: Money borrowed for the car.

- Interest: Lender’s fee for the loan.

Paying extra towards the principal reduces the total interest costs. It means less money for the lender and more savings for you.

Amortization: What It Means For You

Amortization is how loan payments break down over time. In car loans, payments are front-loaded with interest. This structure is designed to favor lenders, ensuring they get their fees first.

| Month | Payment | Interest | Principal | Balance |

|---|---|---|---|---|

| 1 | $300 | $220 | $80 | $19,920 |

| 2 | $300 | $218 | $82 | $19,838 |

As the loan matures, interest decreases, and principal payment goes up. Paying extra on principal early makes a big difference. It lessens your balance and cuts down on your interest.

Tip: Check for prepayment penalties before making extra payments.Benefits Of Paying Towards Principal

Benefits of Paying Towards Principal on your car loan can work wonders. Doing so may not only chip away at your debt faster, but it can also save you a bundle in interest. It’s a smart money move that can give you more financial freedom in the long run. Let’s take a closer look at how this can benefit your finances.

Shortening Loan Term

- Feel the freedom sooner: Pay more towards your principal and say goodbye to your loan early.

- Less stress: Shorter loan terms mean fewer months worrying about payments.

Reducing Total Interest

Keep more cash: Paying down the principal quickly lowers the interest you pay overall.

| Regular Payments | With Extra Principal Payments |

|---|---|

| Total Interest Paid: $5,000 | Total Interest Paid: $4,000 |

| Loan Term: 5 years | Loan Term: 4 years |

Example above: The extra payments saved you $1,000 in interest. This shows the clear financial benefit of paying towards your principal.

Preparing To Make Principal Payments

Welcome to the world of smart car loan payments! Today, let’s explore how to effectively make payments towards your loan’s principal. This can help you save money on interest and pay off your loan faster. Preparing to make these extra payments is crucial. Here are some steps to get you started.

Assessing Your Finances

Determine your financial standing before making principal payments. This involves:

- Checking your current loan balance.

- Understanding your loan’s interest rate.

- Reviewing your monthly budget.

- Ensuring you have a healthy savings buffer.

Make sure you will not face penalties for early payment. Some loans have early payoff penalties. It’s important to check this with your lender.

Setting A Budget For Extra Payments

Extra payments reduce your loan balance. To set a budget for these payments:

- Pinpoint areas where you can reduce expenses.

- Decide on a fixed amount for extra payments.

- Update your monthly budget to include this amount.

| Expense Category | Current Spending | Potential Savings | Amount for Extra Payment |

|---|---|---|---|

| Entertainment | $200 | $50 | $150 |

| Dining Out | $150 | $75 | |

| Subscriptions | $100 | $25 |

This table is a simple example. Customize it to fit your spending habits. Automate your extra payments when possible. This ensures you never miss a payment toward your principal.

Strategies For Principal Reduction

Reducing the principal on a car loan can save money. You pay less interest. Let’s explore effective ways to lower the main balance. These strategies can fast-track loan payoff and lead to savings.

Lump-sum Payments

Making extra payments helps. It lowers the balance. This reduces interest costs. Use money from tax refunds or bonuses. Always confirm with the lender. Make sure extra payments go towards the principal.

Bi-weekly Payment Plans

Split monthly payments in two. Pay half every two weeks. This leads to one extra payment a year. This method chips away at the principal faster. Over time, you’ll pay off the loan sooner and save on interest.

Remember, reducing your loan balance doesn’t have to be complex. Consider these strategies:

- Extra payments: Any time you have extra cash. Send it to your lender.

- Round up payments: Increase your regular payment, even by a small amount.

- Refinance: If interest rates drop, refinancing could mean lower payments.

Navigating Lender Policies

When working to pay off your car loan, it’s important to understand your lender’s policies. Every lender has specific rules concerning loan repayment. Some allow you to pay towards principal directly; others do not. A clear grasp of these policies empowers you to strategize effectively and reduce your loan’s principal faster. Let’s delve into what you need to know to navigate these policies and accelerate your journey to financial freedom.

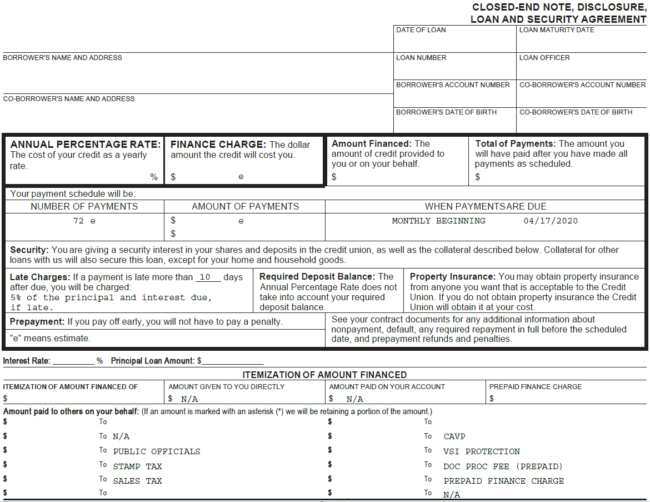

Understanding Prepayment Penalties

Lenders may charge penalties for paying off a loan early. This discourages borrowers from paying beyond their scheduled monthly payments. Check your loan agreement. Look for a ‘prepayment penalty’ clause. No penalty means more savings when you pay your principal down.

- Read through your contract to identify any mentioned penalties.

- Find out how the penalty is calculated if applicable.

- Contact customer service if unsure about the terms.

How To Specify Payments For Principal

Clear communication with your lender is crucial for principal payments. Online payments often go towards the interest first. To allocate funds to principal, you might need to take extra steps.

- Access your online account or payment portal.

- Look for an option titled “Apply to Principal” or similar.

- If unavailable, send a check with a clear memo stating “Apply to Principal”.

- After making a principal payment, confirm with the lender that they processed it correctly.

Remember, regular communication with your lender ensures your payments are applied as intended.

Staying On Track With Principal Payments

Paying off a car loan faster means focusing on the principal balance. Extra payments towards the principal bring you closer to being debt-free. An easy-to-follow strategy ensures consistent principal reduction. Let’s dive in and keep that car loan shrinking!

Monitoring Loan Balance And Statements

Regularly check your loan details. This habit helps you understand your balance and interest. Online accounts and monthly statements are key tools. Use them to track your progress.

- Check online: Most lenders offer online access. Log in regularly.

- Monthly statements: Look for principal versus interest breakdown.

- Track payments: Record every extra payment made towards the principal.

React to any discrepancies immediately. Contact your lender with concerns or questions.

Re-evaluating Payment Plan Periodically

A change in financial status may alter your payment capability. Recognize these changes. Adjust your payment plan as needed. This will help you stick to your goal.

| Time | Action |

|---|---|

| 6-Month Check: | Is the current payment suitable? |

| Annual Review: | Consider increasing payments. |

| Change in Income: | Can you pay more towards principal? |

Remain flexible and proactive. These steps keep you on track for paying off your car loan early!

Long-term Financial Impact

Paying more toward your car loan principal does more than reduce the loan balance. It shapes your financial health in the long run. You might ask, “How does it affect my finances?” Let’s explore the significant impacts.

Credit Score Implications

Paying your loan principal early can boost your credit score. It shows lenders you’re responsible with credit. A higher score may secure lower interest rates on future loans. It could save you money on mortgages and student loans.

- Decreases debt-to-income ratio

- Improves payment history

- Reduces credit utilization

Equity Building And Car Resale Value

Paying extra on your loan builds equity faster. Equity is the car’s value minus what you owe. More equity means you can sell your car for more than the loan balance. This puts money in your pocket.

| Loan Balance | Car Value | Equity |

|---|---|---|

| $5,000 | $10,000 | $5,000 |

| After Extra Payments | $10,000 | $7,000 |

Extra payments keep the car value above the loan balance. This is vital if you plan to upgrade your vehicle. You’ll have a better start for your next purchase.

Credit: mytresl.com

Credit: www.rategenius.com

Frequently Asked Questions On How To Pay Towards Principal On Car Loan

Can I Make Principal-only Payments On A Car Loan?

Yes, you can make principal-only payments on a car loan. Inform your lender that your extra payments should apply to the principal balance. Doing this can reduce the loan balance faster and decrease the total interest paid over the loan’s life.

How Does Paying The Principal Save Money?

Paying extra towards the car loan principal lowers the remaining balance, which reduces the interest amount charged over time. Consequently, you’ll pay less interest overall, leading to savings and potentially shortening the loan term.

What’s The Process For Paying Extra On Principal?

To pay extra on the principal, simply make a payment higher than your monthly installment and indicate that it’s meant for the principal. Always check with your lender on how to correctly process principal-only payments to ensure they are applied properly.

When Should I Pay Extra Towards My Car Loan Principal?

Consider paying extra toward your car loan principal after covering necessary expenses and high-interest debt. It’s best done when you have extra funds and want to minimize interest costs and pay off the loan faster.

Conclusion

Concluding your journey to trim down your car loan principal can be empowering. Adopt the strategies discussed; they’re effective and practical. Remember, extra payments lead directly to interest savings and a quicker loan payoff. Stay disciplined with your budget, consult your lender for specifics, and watch your loan balance decrease.

Your financial freedom awaits.