Can You Claim Car Repairs on Taxes

You can claim car repairs on taxes if they are business expenses. Personal car repair costs are not deductible.

Car repairs can become a pivotal detail during tax season for individuals using their vehicles for business purposes. Under the IRS tax code, these repairs are accounted as necessary expenses vital for business operations and are therefore tax-deductible. This means that when you use your vehicle for work outside of commuting—like making deliveries or visiting clients—you might be able to write off repair costs.

Regular maintenance or unexpected repairs can add up, and smartly documenting these expenses can lead to significant tax savings. Just remember to keep detailed records of each repair to substantiate your claims. This introduction sets the stage for drivers and entrepreneurs alike who seek to understand how to navigate car repair deductions on their tax returns.

Eligibility For Deducting Car Repairs

Tax season is here, and you might wonder about car repair deductions. Understanding when you can claim these expenses is crucial. Let’s dive into the details of who qualifies for these tax deductions.

Qualifying For Tax Deductions

Not all car repairs are tax-deductible. To qualify:

- The car must be for business purposes.

- Repairs should be necessary and ordinary.

- You must itemize deductions on your tax return.

Keep detailed records and receipts. These prove your expenses to the IRS.

Personal Vs. Business Expenses

| Personal Use | Business Use |

|---|---|

| Generally, not deductible. | May qualify for deductions. |

| Includes commuting. | Includes business trips, client visits. |

| No tax benefits. | Possible write-offs. |

For mixed-use vehicles, calculate the percentage of business vs. personal use. Apply this percentage to your total car repair expenses.

Types Of Deductible Car Expenses

When tax season rolls around, knowing what car expenses you can claim makes a big difference. There are a few types you might deduct. Let’s delve into these categories to save you money.

Direct Repairs and Maintenance

Direct Repairs And Maintenance

Keeping your car running can add up over the year. You might be able to deduct these costs:

- Oil changes: Regular engine care is crucial.

- New brakes: Safety comes first.

- Tire replacement: Keeps your ride smooth.

- Other routine services: Checkups keep cars healthy.

Note, this only applies if you use your car for business purposes. Personal driving costs won’t count here.

Improvement and Depreciation

Improvement And Depreciation

Some car updates increase its value. They can also be deducted over time. This is called depreciation. Examples include:

| Improvement Type | Depreciation Allowed |

|---|---|

| New engine | Yes, if it ups car value |

| Major body work | Spread out over car life |

| Advanced tech add-ons | Often over 5 years |

Only claim what’s called the “business portion”. This is based on how much you use your car for work.

Understanding Business Use Of Vehicle

Vehicles used for business can create tax-saving opportunities. Claiming car repairs on taxes is not straightforward. Deductions depend on business structure and vehicle use. Keep accurate records. This ensures legitimate deductions during tax time.

Sole Proprietorships And Partnerships

Determining deductions for sole proprietors and partners is key. Use the following steps:

- Determine the percentage of vehicle use for business

- Keep mileage logs, repair receipts, and other records

- Use the standard mileage rate or actual expense method

- File these expenses on Schedule C or Form 1065

Maximize deductions by using accurate tracking. This minimizes taxes owed.

Corporations And Employees

Corporations and employee situations differ. Here’s what to remember:

- Corporations can deduct vehicle expenses directly

- Employees with unreimbursed business use must itemize

| Type | Document Required | Deduction Method |

|---|---|---|

| Corporation | Maintenance receipts, mileage logs | Actual expenses |

| Employee | Unreimbursed business expense records | Itemized deductions |

Note that the Tax Cuts and Jobs Act limits the deductions for employees. Consult a tax professional.

Credit: www.hrblock.com

Calculating Your Deduction

Understanding how to calculate your tax deductions for car repairs can lead to significant savings. Whether you use your vehicle for business, medical, or charitable reasons, different methods determine your deductible expenses. Dive into these methods for accurate calculation.

Actual Expense Method

This method requires meticulous tracking of all car expenses throughout the year. To get started, compile all receipts and records for:

- Gasoline

- Maintenance and repairs

- Insurance

- Depreciation

- Registration fees

- Tires

Add these expenses and apply the percentage of vehicle usage that is business-related. Only this portion is deductible.

| Total Expenses | Business Use % | Deductible Amount |

|---|---|---|

| $5,000 | 50% | $2,500 |

Standard Mileage Rate Method

The Standard Mileage Rate Method simplifies the process. Each year, the IRS sets a standard rate per mile. Keep a log of your business miles throughout the year. Then, multiply your total business miles by the IRS rate.

- Record your total business miles.

- Find the current year’s IRS mileage rate.

- Multiply miles by the rate.

For example:

- Total Business Miles: 10,000 miles

- IRS Mileage Rate: $0.56/mile

- Deduction: 10,000 miles x $0.56/mile = $5,600

Record Keeping For Car Repair Deductions

Understanding the importance of record keeping for car repair deductions is crucial. Proper documentation supports your claims on taxes. Without records, you might miss out on valuable deductions or face challenges with the IRS. Let’s dive into how to stay organized and prepared.

Receipts And Logbooks

Keeping every receipt for car repairs is a must. Whether it’s a small fix or major overhaul, these receipts serve as your financial diary. Make digital copies to ensure they don’t fade over time.

Create a logbook for each trip that relates to your business or eligible work activities. Note down:

- Date of travel

- Destination

- Purpose

- Odometer readings

- Repair details and costs

Organize these records by date or vehicle, whichever suits your needs better.

Limitations And Audits

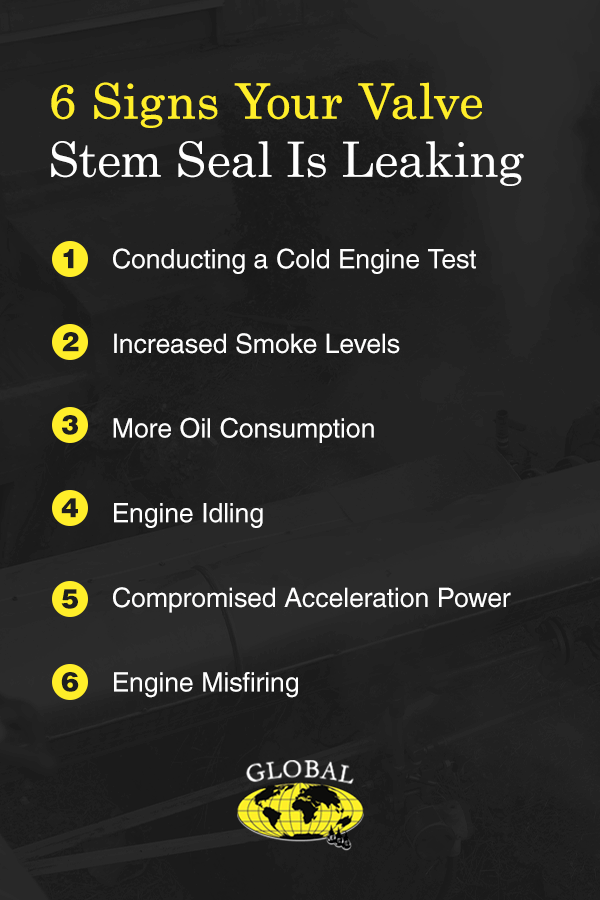

Be aware of the limitations on car repair deductions. Personal travel expenses are non-deductible. Mixed-use vehicles require clear separation of business and personal usage. Know the percentages that are applicable to your situation.

Audits require solid proof. In case the IRS scrutinizes your claims:

- Ensure records are precise and accessible.

- Back up digital files.

- Stay updated on tax laws for vehicular expenses.

Adherence to these practices shields you from unnecessary stress during tax season.

Filing The Claim

Filing the claim for car repairs on taxes can be a smart move if you’re eligible. Understanding the IRS rules is key to getting the deductions right. Now let’s dive into the details of choosing the correct tax forms and sidestepping common errors.

Choosing The Right Tax Forms

Selecting the right forms is crucial to a successful tax deduction for car repairs. Business owners and self-employed individuals often use Form 1040, Schedule C. This form allows you to list expenses and report income from a business. Individuals who are employed and have unreimbursed expenses related to their job might qualify under Itemized Deductions on Schedule A, but remember, this is rare after tax law changes in 2018.

Common Pitfalls To Avoid

- Not tracking expenses: Keep all receipts and records of car repairs.

- Misclassifying repairs: Understand what qualifies. Regular maintenance isn’t typically deductible.

- Overlooking usage details: Only the business portion of car expenses are deductible, not personal use.

Ensure accuracy in your calculations and maintain detailed logs of business usage versus personal use. This precision will safeguard against errors when claiming your deductions. Remember, claiming a deduction for car repairs requires meticulous documentation and adherence to tax laws.

:max_bytes(150000):strip_icc()/6-ways-to-write-off-your-car-expenses.aspx-Final-97003f07090546d99b4e2cf41c552cbd.jpg)

Credit: www.investopedia.com

Frequently Asked Questions On Can You Claim Car Repairs On Taxes

Can Car Repairs Be Tax Deductible?

Yes, car repairs can be tax deductible if the car is used for business. You must itemize deductions and the expenses must exceed 2% of your adjusted gross income.

Are Personal Car Repairs Tax Deductible?

No, personal car repairs are not typically tax deductible. Only repairs for a car used for business purposes may qualify, and the costs must be ordinary and necessary.

How To Claim Car Repair Tax Deductions?

To claim car repair tax deductions, use Schedule C or Form 1040 if self-employed. Itemize the expenses related to business use of your car. Keep detailed records and receipts.

What Car Expenses Are Deductible On Taxes?

Deductible car expenses include gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation or lease payments for business use of your car.

Conclusion

Navigating the complexities of tax deductions can feel overwhelming. Yet, understanding the specifics of car repair claims can yield significant savings. Check with a tax professional to ensure you maximize these potential deductions. Remember, keeping meticulous records is crucial. Embrace the possibilities and optimize your tax returns, potentially easing your financial burden.