How to Get Out of a Negative Equity Car Loan

To escape a negative equity car loan, consider selling the car or refinancing. Another option is to pay off the excess debt until you reach positive equity.

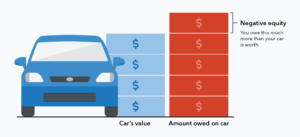

Escaping the financial burden of a negative equity car loan can be challenging. It occurs when your vehicle is worth less than the amount you owe on your car loan, often referred to as being “upside-down” in your car loan.

This scenario is a common occurrence due to cars’ rapid depreciation. Owners seeking relief from their upside-down situation have several strategies to consider, such as extra payments to principal, loan refinancing to lower monthly payments, or even selling the car to pay down the loan balance. Taking proactive steps to address negative equity is crucial as it can impact financial stability and your ability to transition to new vehicles in the future.

The Perils Of Negative Equity In Car Loans

The perils of negative equity in car loans can be a financial thorn in your side. Known as being “upside-down,” this situation means you owe more on your car loan than the car’s current value. It’s a risk consumers face, but with savvy management and strategic planning, escaping this financial pitfall is feasible.

What Is Negative Equity?

Negative equity in an auto loan happens when your vehicle’s worth drops faster than the repayment of the loan balance. It’s like an invisible financial weight that can limit your mobility, both metaphorically and literally. Boldly put, it’s an upside-down loan where you find yourself paying for an asset that’s worth less than what you owe.

How Does Negative Equity Happen?

Negative equity can sneak up on any car owner. It’s a convergence of factors, often outside your control. The rapid depreciation of new cars is a key culprit. Once you drive a new car off the lot, its value plummets. Pair that natural decline with long-term financing, minimal down payments, or rolling over previous auto debts, and you’ve set the stage for negative equity.

| Factor | Impact on Equity |

|---|---|

| Depreciation | Immediate drop in value post-purchase |

| Extended Loans | Smaller payments, slower balance reduction |

| Small Down Payments | Larger remaining balance, higher risk |

| Debt Rollover | Old car debt added to new loan |

Understanding these components can shed light on why and how negative equity arises and help you steer clear of it in the future. Remember, knowledge is power. With the right information, you can navigate away from the quicksand of negative equity and towards solid financial ground.

Assessing Your Financial Situation

Finding yourself upside down on a car loan can feel daunting. Your car is worth less than what you owe. It’s time to assess your financial standing meticulously. A solid action plan starts with understanding your loan and your car’s actual value.

Review Your Loan Terms

Dig into the details of your loan agreement. Check your balance, interest rate, and remaining payment period. Knowing these facts helps pinpoint options for managing the negative equity.

| Loan Detail | Information to Gather |

|---|---|

| Balance | Total amount owed |

| Interest Rate | Annual percentage rate (APR) |

| Payment Period | Months left to pay off |

Calculate Your Car’s Current Value

Next, determine your car’s present worth. Use online appraisal tools for an estimate. Compare this value with your loan balance to measure the negative equity.

- Visit reputable car valuation sites like Kelley Blue Book or NADA Guides.

- Input your car’s make, model, year, and condition for an estimate.

- List these numbers down and subtract from your current loan balance.

Strategies To Tackle Negative Equity

Being “underwater” on a car loan feels daunting. Negative equity occurs when a car’s value drops faster than the loan balance decreases. Simple steps can help balance this equation. This post outlines effective strategies to swim back to financial safety.

Making Additional Payments

Making Additional Payments

Speed up equity growth by paying more than the monthly due. Small, extra payments stack up over time. Consider these tactics:

- Allocate tax refunds, bonuses, or cash gifts to your loan.

- Round up payments to the nearest $50 for progressive impact.

- Switch to bi-weekly payments to pay off one extra payment a year.

Use a loan calculator to see how these extra payments shorten your loan term and rebuild equity.

Refinancing Your Loan

Refinancing Your Loan

Interest rates and loan terms dictate your monthly payments. Refinancing might offer relief if market conditions are favorable. Check these points before refinancing:

| Criteria | Action |

|---|---|

| Credit Score | Ensure it’s improved since the car purchase. |

| Interest Rates | Seek rates lower than your current one. |

| Loan Terms | Avoid extending them too far into the future. |

| Additional Fees | Calculate all costs tied to refinancing. |

Compare offers from different lenders to secure the best deal and consider a shorter loan term for faster equity build-up.

Exploring The Option Of Selling

Stuck with a car loan that’s more than your car’s worth? It’s a common issue. Selling your vehicle could be a way out. But who do you sell to, and how? Let’s dig into whether a private sale or a dealer trade-in works best for your situation.

Private Sale Vs. Dealer Trade-in

Choosing between a private sale and dealer trade-in depends on your priority. Do you want more control over the price? A private sale might be better. If convenience is key, consider a dealer trade-in.

- Private Sale:

- Set your price

- More effort needed

- Potential for higher return

- Dealer Trade-In:

- Quick and easy

- Lower offers

- Leverage for a new car deal

Handling The Sale With Negative Equity

When your car’s value is less than what you owe, that’s negative equity. Selling can still happen! Here’s how to tackle it:

- Find out the payoff amount for your loan.

- Get your car valued by multiple sources.

- If selling privately, list your car at a competitive price.

- Look for the best offer to minimize loss.

Sometimes, you may need to pay the difference between the sale price and loan balance. Consider a short-term loan or payment plan if needed. With careful planning, selling with negative equity can be a smooth process.

Prevention Better Than Cure

Falling into a negative equity trap with your car loan can be a financial nightmare.

Stopping this trouble before it starts saves headaches and money.

Explore smart moves to avoid landing in this sticky situation.

Choosing Loans Wisely

Selecting the right loan sets you on a path to financial stability.

A loan’s terms play a huge role in whether you’ll end up owing more than your car’s worth.

- Shorter loan terms can mean higher monthly payments, but they also lead to rapid equity building.

- Avoiding loans with hefty fees and high interest rates keeps costs in check.

- Choosing a car that holds its value well matters too. Research vehicles for a smart pick.

Regular Maintenance To Retain Value

A well-maintained car stays valuable for longer.

Protecting your car’s resale value involves effort and planning.

| Maintenance Task | Frequency | Benefits |

|---|---|---|

| Oil Change | 5,000 miles | Engine Health |

| Tire Rotation | 6,000 miles | Tire Longevity |

| Brake Check | Yearly | Safe Driving |

Keeping a log of each service shows a history of care.

This log can boost the car’s value at resale or trade-in time.

Credit: canadianautobrokers.ca

Frequently Asked Questions For How To Get Out Of A Negative Equity Car Loan

What Is Negative Equity On A Car Loan?

Negative equity on a car loan means you owe more than the vehicle’s current worth. It’s often called being “upside down” in your car loan. It can happen when a car depreciates faster than you pay down the loan balance.

Can You Trade In A Car With Negative Equity?

Yes, you can trade in a car with negative equity. However, the negative equity doesn’t disappear. It’s typically rolled into the new loan, increasing the loan amount and potentially the payments or the loan term.

How Do I Escape Negative Equity?

To escape negative equity, consider paying extra on your car loan principal, selling the car privately to get a higher price, or refinancing your loan if you can secure a lower interest rate.

What Happens When You Pay Off A Negative Equity Car Loan?

When you pay off a negative equity car loan, you eliminate the debt you owe. However, until the loan is paid off, you might not have any equity to show for paying the loan down unless the car’s value increases.

Conclusion

Escaping a negative equity car loan is challenging, yet achievable with the right strategy. Explore options like refinancing, extra payments, or even selling privately. Remember, patience and informed decisions will guide you toward financial stability. Act now to steer your finances back on the road to success.