How to Get Your Car Back After Title Loan Repossession

To reclaim your car after a title loan repossession, promptly contact the lender to discuss redemption options. You may need to pay the outstanding loan amount plus any additional fees.

Navigating the stressful ordeal of car repossession requires a swift and informed response. Understanding the terms of your title loan agreement and the laws in your area governing repossession are crucial in determining your next steps. Lenders often prefer settlement over holding onto repossessed vehicles, presenting an opportunity for negotiation.

Time is of the essence, and acting quickly can improve your chances of getting your vehicle back without the added complexity of legal proceedings. Start by reaching out to your title loan lender to understand the specific redemption process, the total amount due, and any possible repayment plan options.

The Reality Of Title Loan Repossession

Dealing with a title loan repossession is a stressful situation. People often use their vehicle as collateral to borrow money. If they fail to meet the loan terms, the lender can take the car. Understanding how this process works is critical to prevent losing your vehicle or to retrieve it after repossession.

Basics Of Title Loan Contracts

A title loan contract is an agreement between a borrower and a lender. The borrower hands over their vehicle title in exchange for money. Here are key points to consider:

- Read the contract carefully before signing.

- Title loans usually have high interest rates and short repayment periods.

- Failure to repay the loan can result in car repossession.

Triggers And Process For Repossession

Understanding what can trigger a repossession is vital. Below are the common causes:

- Missed payments are the primary trigger.

- Lenders may require full coverage insurance, and lapses can lead to repossession.

- Defaulting on any term in the title loan contract can start the repossession process.

Once a loan default occurs, the lender may:

- Send a notice of default and repossession.

- Use a repossession company to take the vehicle.

- Sell the vehicle to recoup the loan balance.

While the prospect of repossession is daunting, knowledge and prompt action can make all the difference.

Assessing Your Options Post-repossession

After a title loan repossession, it can feel like you’ve hit a wall. But, you still have options to get your car back. Timely action is vital. The first step is to fully understand the situation and the choices available to you. This section breaks down the critical steps to assess your situation after your vehicle has been repossessed due to a title loan default.

Analyzing The Repossession Notice

Understanding the details of the repossession notice is your first priority. Typically, lenders must provide a written notice after repossessing your car. This notice should detail important aspects such as:

- The reasons for repossession

- Amount owed to recover the vehicle

- Deadline to act and avoid sale of your car

Check the notice carefully. Are there any inaccuracies or unexpected charges? Errors could provide leverage for negotiation or an appeal to recover your car.

Understanding Redemption Rights

Even after repossession, you may have the right to redeem your vehicle. This is known as your redemption period. During this time, you can reclaim your car by:

- Paying the full loan amount plus any additional fees

- Making arrangements for a revised payment plan, if possible

Keep in mind that redemption rights and periods vary by state. Know your state’s laws. You’ll discover the specific period available to you to act and reclaim your vehicle before it’s sold.

| Factor | Action |

|---|---|

| Loan Balance | Arrange funds to pay off |

| Repossession Fees | Validate and consider in budget |

| Timing | Act swiftly to meet deadlines |

Strategies To Get Your Car Back

Facing car repossession after a title loan can be stressful. The good news is that there are proactive steps you can take. These strategies aim to reunite you with your vehicle.

Negotiating With The Lender

Act quickly and speak to the lender. Explain your situation clearly. Use these tips to start on the right foot:

- Prepare: Know how much you owe.

- Communicate: Present a clear plan for repayment.

- Stay calm: Respect goes a long way in negotiations.

- Document everything: Keep records of all agreements.

Offer a realistic, lump-sum payment if possible. Sometimes, lenders prefer a smaller immediate payment over the hassle of selling the repossessed car. And they might be willing to negotiate the debt.

Finding The Money To Reclaim Your Car

If negotiating lowered the amount needed, consider these options:

- Borrow from family or friends who trust you to repay.

- Sell items you no longer need to raise cash quickly.

- Ask for an advance at your workplace.

- Explore short-term side gigs or freelance work.

- Check savings accounts for possible funds.

Seek out community programs or non-profits that provide aid for such emergencies. They can sometimes offer a grant or a loan without stringent conditions.

Credit: www.800loanmart.com

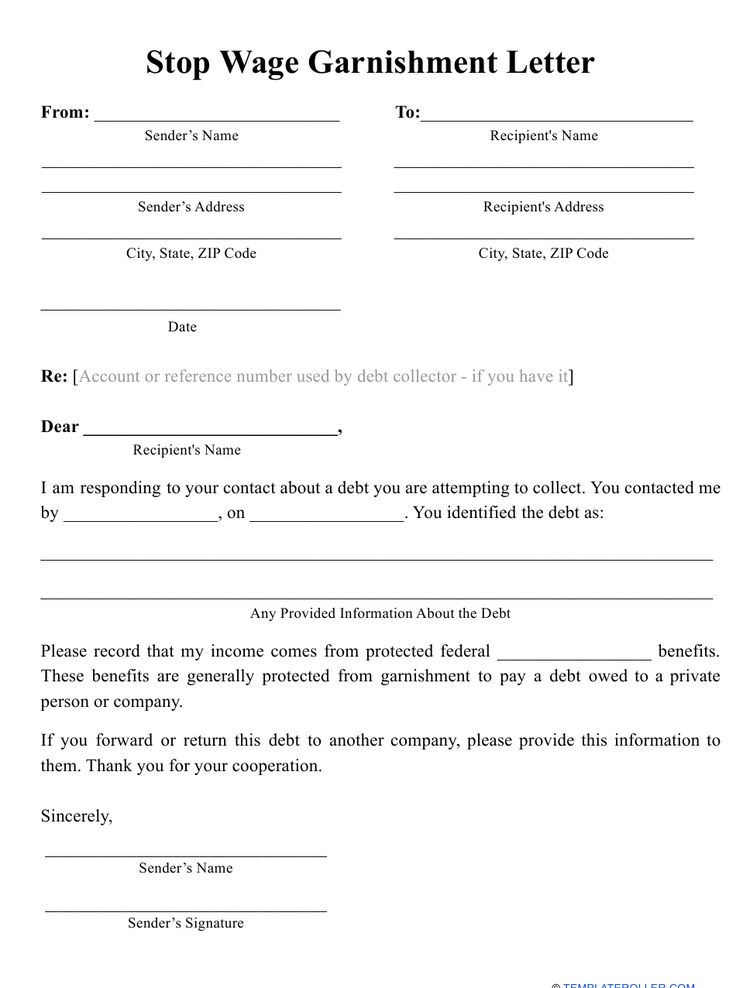

Legal Avenues For Recovery

Facing car repossession post-title loan can be distressing. The critical next step involves exploring your legal options to recover your vehicle. Knowledge of state laws and professional assistance play pivotal roles in this process. Let’s delve into these avenues:

Examining Reinstatement Laws

Reinstatement laws may offer a lifeline. These laws vary by state, allowing borrowers to reclaim repossessed vehicles. To understand your rights:

- Review your loan agreement for reinstatement clauses.

- Research state-specific reinstatement rights.

- Contact your lender to discuss options.

Borrowers typically need to pay overdue amounts and fees. Timeliness in initiating this process is crucial.

Consulting A Consumer Rights Attorney

Legal guidance can be invaluable. A consumer rights attorney will help navigate complex recovery paths. Important steps include:

- Scheduling a consultation quickly.

- Gathering all relevant loan documents.

- Understanding potential legal routes.

An attorney will assess your situation, aiming to protect your possessions and financial standing.

Preventing Future Repossession

Getting your car back after a title loan repossession is tough. It’s key to prevent this from happening again. Smart finance moves and looking at different loans can make a big difference. Let’s dive into how you can keep your car safe from repossession in the future.

Improving Financial Management

Keeping track of your cash is vital. It helps you avoid missing loan payments. Here’s how to get better at handling your money:

- Create a budget: Know what you earn and spend. Stick to your budget.

- Save: Put some money aside. It’s for emergencies.

- Track expenses: See where your money goes. Cut down on what’s not needed.

- Pay on time: Make loan payments early or on the due date. Never late.

Show lenders you’re reliable. You’ll face fewer risks of losing your car.

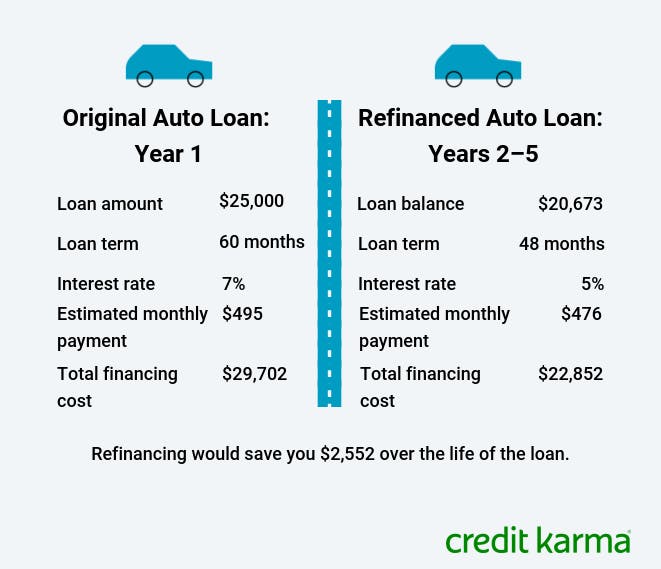

Exploring Alternative Loan Solutions

Other loans might fit better than title loans. They can come with less risk of losing your car. Consider these options:

| Loan Type | Pros | Cons |

|---|---|---|

| Personal Loans | Lower interest rates, longer payback period. | Need good credit score. |

| Payday Alternative Loans | Accessible from credit unions, affordable rates. | Lower borrowing limits. |

| Peer-to-Peer Lending | No traditional bank involvement, flexible terms. | May have higher interest rates. |

Check these options out. Pick the one that matches your needs best. This way, your car stays yours and your finances stay healthy.

Credit: podcasters.spotify.com

Resources And Assistance

Facing car repossession after a title loan can be stressful. You may feel overwhelmed, but resources and assistance are available to help you. By exploring non-profit credit counseling services and community support programs, you can find valuable guidance. These resources can help you understand your options and take the necessary steps to get your car back.

Non-profit Credit Counseling Services

Non-profit credit counseling organizations offer free or low-cost services to those struggling with debt. They can provide you with advice on managing your finances, creating a budget, and understanding loan agreements.

- Debt management plans: These can restructure your title loan debt and provide a strategy to regain control.

- Financial education: Learn about money management, credit scores, and how to avoid future debt.

- Free consultations: Get professional advice tailored to your situation without extra financial burden.

Community Support Programs

Your local community may have programs designed to assist residents facing financial difficulties. Community support can come in many forms.

| Type of Support | How It Helps |

|---|---|

| Emergency funds | Monetary assistance for urgent needs |

| Legal aid | Free or low-cost legal advice |

| Food assistance | Help with groceries to free up funds |

Contact local organizations, charities, and religious groups to discover what aid they may offer. They can sometimes provide direct help or refer you to other services that could assist with vehicle repossession cases.

:max_bytes(150000):strip_icc()/car-title-loan-requirements.asp-final-733928ccd9004905b36ed58e2d029ecc.png)

Credit: www.investopedia.com

Frequently Asked Questions For How To Get Your Car Back After Title Loan Repossession

Can You Reclaim A Car After Repossession?

Reclaiming a vehicle post-repossession is possible by settling the outstanding loan balance. This usually includes paying off the loan amount, any additional fees, and costs associated with the repossession. Contact your lender immediately to discuss your options.

What To Do If Your Car Is Repossessed?

Act quickly if your car has been repossessed. Reach out to your lender to understand the balance owed and any associated recovery costs. Consider if you can repay or negotiate a payment plan. Ensure you’re aware of the time frame you have to act before the car is sold.

How Long To Get A Car Back After Repossession?

The time frame to reclaim a car after repossession varies depending on state laws. Typically, lenders may offer a redemption period during which you can settle your debts and reclaim the vehicle. Contact your lender promptly to prevent your car from being auctioned.

Are Title Loan Repossessions Negotiable?

Yes, title loan repossessions are often negotiable. Lenders may work with borrowers to arrange payment plans or settlements. Negotiate terms with your lender directly, but act fast as time is crucial for avoiding permanent loss of your vehicle.

Conclusion

Regaining possession of your car following a title loan repossession is possible with the right approach. Start by communicating with your lender to explore available options. Don’t hesitate to seek legal advice if needed. Taking prompt action can make a big difference.

Stay informed and proactive for the best chance at retrieval.