How to Get a Cosigner off a Car Loan

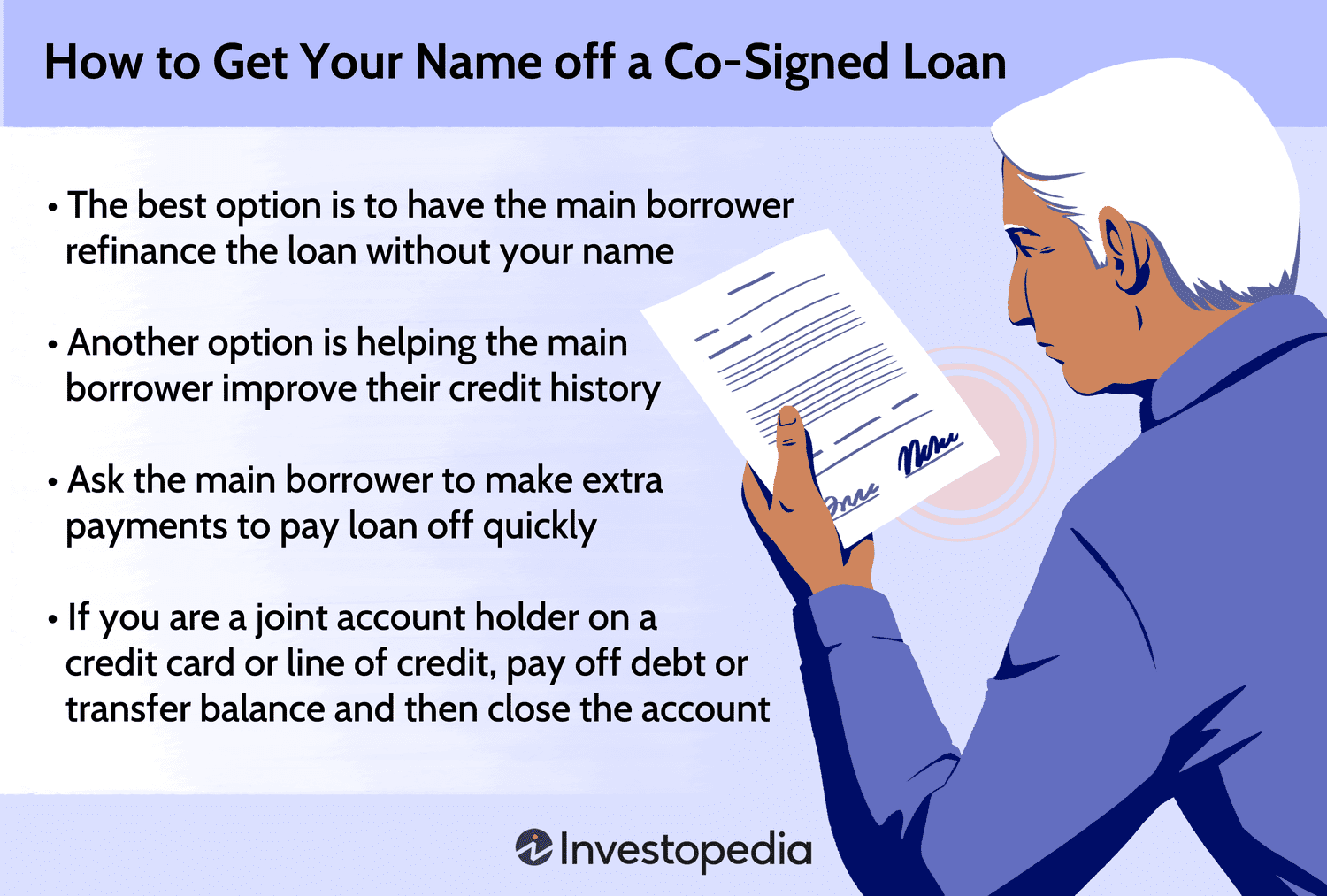

To release a cosigner from a car loan, you must refinance the loan or pay it off. Explore alternative loan options or discuss cosigner release policies with the lender.

Removing a cosigner from a car loan can provide financial independence and relieve the cosigner’s obligations. Typically, lenders require a good payment history and proof that the primary borrower can handle the loan independently before considering cosigner release. Refinancing the loan under the solo borrower’s name can be the most straightforward solution, albeit it requires the borrower to have improved credit since the loan’s inception.

Borrowers must assess their financial situation, explore various lending institutions, and ensure they meet all the eligibility criteria for a new loan. Successfully navigating this process not only streamlines financial responsibilities but can also strengthen the borrower’s creditworthiness. Understanding the terms and conditions set by lenders is crucial for a seamless transition from a joint to an individual loan agreement.

The Role Of A Cosigner In Car Financing

A cosigner plays a critical role in car financing. They act as a safety net for lenders. When you can’t meet credit requirements alone, a cosigner steps in. Their credit history backs your loan application. This increases chances for approval and often leads to better terms.

Who Qualifies As A Cosigner?

Not everyone can be a cosigner. Lenders expect certain qualifications. Ideal cosigners have good to excellent credit scores. They must show stable income to cover potential payments.

- Stable income: Proof of ongoing, reliable earnings

- Good credit history: A record of paying debts on time

- Debt-to-income ratio: Should be low

Financial Implications For A Cosigner

Becoming a cosigner is a big responsibility. It can affect one’s finances greatly. If the primary borrower fails to make payments, the cosigner must pay. Missed payments impact the cosigner’s credit score too.

| Responsibility | Credit Impact | Risk |

|---|---|---|

| Loan repayment | Credit score decrease if payments missed | High if primary borrower defaults |

| Debt liability | Increase in debt-to-income ratio | May affect future credit/loan approvals |

:max_bytes(150000):strip_icc()/How-to-remove-your-name-from-a-cosigned-loan-960968_Final3-5880ee67f82b43e7bd81edf9a3147be2.png)

Credit: www.thebalancemoney.com

Reasons For Removing A Cosigner

Signing a car loan with a cosigner can be a great way to get approval. Yet, situations change, and you might want to remove that cosigner from the loan. Understanding why and how to navigate this process is key to maintaining your financial health and relationships. Let’s dive into the reasons one might pursue this course of action.

Improved Credit Score

Your credit score may have been low when you first got your loan. With time and good financial habits, it can improve. A better score means you might qualify for a loan on your own. So, removing a cosigner can be a natural next step.

Relationship Changes

Relationships evolve; they might go south, or simply, circumstances change. If the relationship with your cosigner changes, it might be best to remove them from your loan. This action can prevent potential conflicts over financial obligations.

Financial Independence Goals

Gaining financial independence is a milestone. It often includes taking full responsibility for debts. Removing a cosigner signifies financial maturity and confidence in your ability to manage loans alone.

Preparation Before Removing A Cosigner

Need to remove a cosigner from your car loan? Preparation is key. Begin by gathering all the necessary information. This process can protect your credit and potentially strengthen your financial standing. Let’s walk through the steps to make this transition smooth and clear.

Reviewing The Loan Agreement

Know every detail of your current loan terms. Your original loan agreement holds vital information that will guide you. It outlines the conditions under which a cosigner release is possible. Skim through the document for any clauses pertaining to the cosigner’s obligations. Look out for an early release option.

Understanding The Lender’s Policies

Lenders have specific rules for removing cosigners. Contact your lender directly and inquire about their protocol. Take notes on their requirements. They may offer options like refinancing or loan reassignment. Ensure you understand their terms fully.

Evaluating Your Creditworthiness

Your credit score plays a crucial role in this process. A high credit score might mean easier removal of a cosigner. Check your credit report for accuracy. Improve where needed. Bear in mind, stable income and low debt can also positively impact your case.

These steps are just the beginning. They set the stage for a successful cosigner release. Stick to the details and be patient. The end result is a loan in just your name.

:max_bytes(150000):strip_icc()/get-your-name-off-cosigned-loan-v1-3da6bfc5abf444ceb53ed745d6dab2c9.png)

Credit: www.investopedia.com

Step-by-step Process Of Releasing A Cosigner

Welcome to our step-by-step guide on how to release a cosigner from a car loan. A cosigner can be critical when obtaining a car loan, especially if you have limited credit history. The time might come to remove them from the obligation, whether it’s due to imrpovements in your financial situation or changes in your relationship with the cosigner. Let’s dive into the process.

Communication With The Cosigner

Begin by informing your cosigner about your intention to remove them from the loan. Clear communication ensures mutual understanding and can prevent conflicts. Discuss the financial responsibility you’ve built and your capacity to manage the loan independently. Aim for their agreement before proceeding.

Approaching The Lender

Next, contact your lender to ask about the procedure. Each lender has specific requirements and processes for releasing a cosigner. Often, lenders will assess your creditworthiness to ensure you can maintain the loan on your own. Complete all necessary forms and provide the lender with the requested documentation. Patience is key as this process may take time.

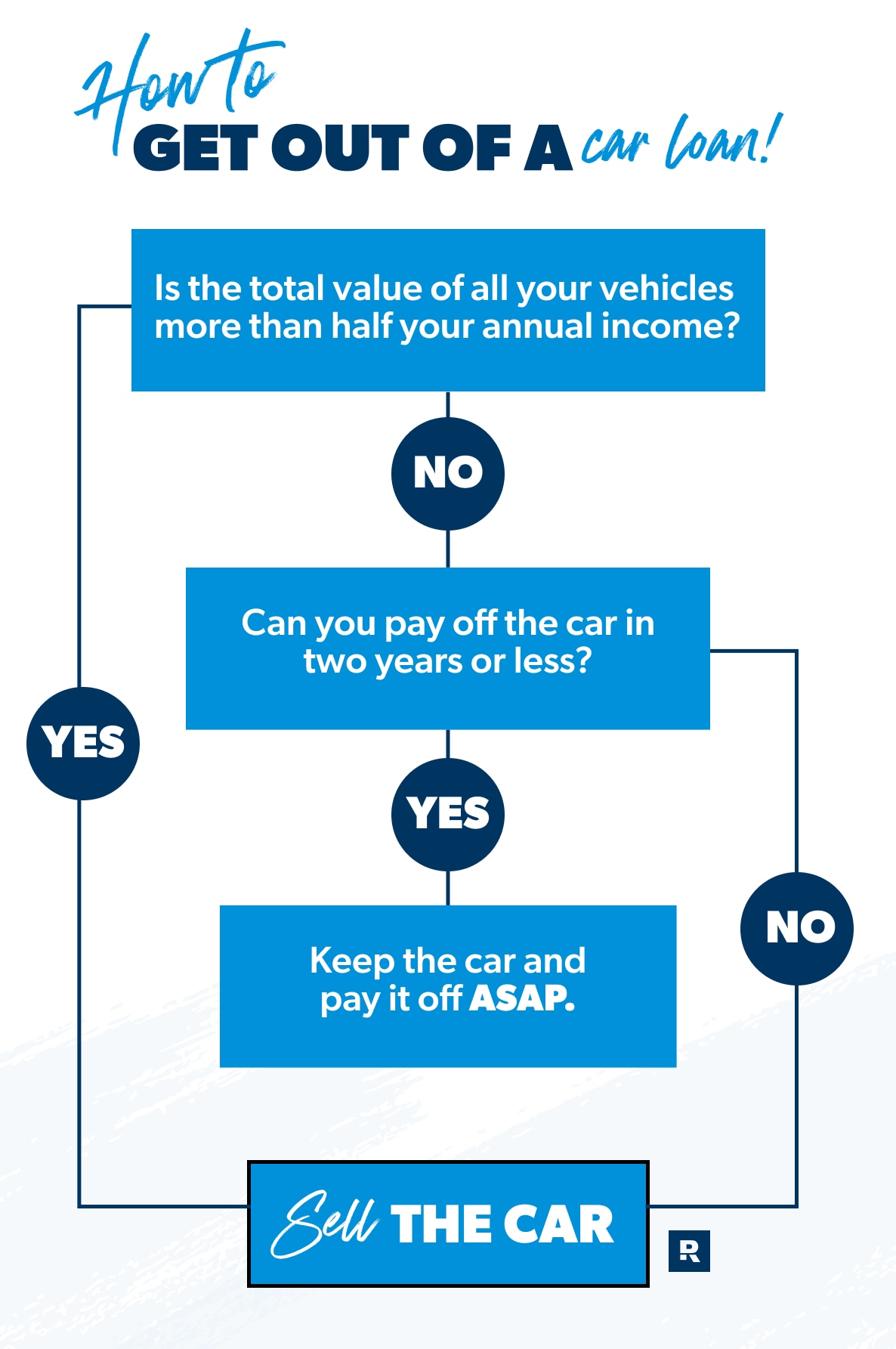

Options: Refinancing Or Loan Modification

Two primary options exist: refinancing and loan modification. Refinancing entails taking out a new loan to pay off the existing one, effectively releasing the cosigner. Loan modification adjusts the terms of your current loan but may not always release the cosigner. Explore both options to determine the best fit for your situation.

- Refinancing: Consider the following:

- Check your credit score; a higher score can secure better rates.

- Shop around for competitive rates and terms.

- Calculate closing costs and ensure the new loan is cost-effective.

- Loan Modification: Take these steps:

- Speak with your lender about modifying your current loan.

- Present a solid case for why you no longer need a cosigner.

- Understand the impact on your interest rates and payment schedule.

Throughout the process, stay proactive and monitor progress. Removing a cosigner is a significant financial move, requiring diligence and good decision-making.

Potential Challenges And Solutions

Finding your way through the complexities of releasing a cosigner from a car loan presents unique challenges. Yet, with the right strategies, it’s a hurdle you can overcome. It’s important to be prepared for the potential obstacles that might arise. A plan in place sets you up for a smooth transition. Let’s explore the potential stumbling blocks and the effective solutions for each scenario.

Lender’s Reluctance

Lenders often hesitate to remove cosigners from loans. Why? Cosigners provide security for the loan. Let’s glance at why lenders might be reluctant:

- Risk management: A cosigner ensures the loan is repaid.

- Policy adherence: Some have strict rules on cosigner release.

Solutions include:

- Review your loan agreement for release options.

- Build a strong payment history to prove creditworthiness.

- Connect with your lender to discuss eligibility for cosigner release.

High Refinancing Costs

Refinancing could come with hefty fees. Anticipate these expenses:

| Type of Cost | Details |

|---|---|

| Application fees | Charges for processing a new loan |

| Origination fees | Costs for creating the new agreement |

| Prepayment penalties | Fees for early loan closure |

Here’s how to soften the blow:

- Shop around for lenders with competitive rates.

- Negotiate to waive or reduce certain fees.

- Calculate savings to ensure refinancing is cost-effective.

Maintaining A Good Relationship With The Cosigner

Removing a cosigner can strain relationships. Their credit was at stake. To ease tensions:

- Communicate openly about the process and intentions.

- Reassure them with proof of financial stability.

- Express gratitude for their initial support.

Ensuring the cosigner feels respected and informed keeps relations amicable.

Protecting Your Financial Interests After Cosigner Release

Removing a cosigner from a car loan marks a significant step in your financial journey. Let’s talk about how to safeguard your future financial health once your cosigner is removed.

Monitoring Your Credit Score

Your credit score is key. It’s like a financial fingerprint. When a cosigner steps back, this score might shift. Keep an eye out! Here’s how:

- Check your credit report often. Look for errors or unexpected changes.

- Use free online services to track your score monthly.

- Report any errors you find to the credit bureaus.

Adapting To New Loan Terms

Loan terms can change. It’s a truth often overlooked. After a cosigner release, review your loan agreement. It might have new terms. Do this:

- Read your new loan terms carefully.

- Contact your lender with any questions.

- Consider refinancing if the new terms aren’t in your favor.

Continuous Financial Planning

Financial health is a journey. Taking off a cosigner is one pit stop. Prepare for the road ahead by:

- Setting up a monthly budget.

- Saving for emergencies.

- Planning for future loan payments.

Stay financially fit by keeping these tips at the forefront of your planning strategy.

Credit: www.rategenius.com

Frequently Asked Questions On How To Get A Cosigner Off A Car Loan

Can A Cosigner Be Released From A Car Loan?

Cosigners may be released from a car loan if the primary borrower refinances the loan in their own name. This requires the primary borrower to have sufficient credit and income to qualify independently. The lender must approve the refinance application, effectively removing the cosigner’s obligation.

What Steps Are Necessary To Remove A Cosigner?

To remove a cosigner from a car loan, the primary borrower usually needs to refinance the loan. This involves applying for a new loan solely in their name and using it to pay off the existing one. Approval is based on the borrower’s creditworthiness and the lender’s criteria.

When Can A Cosigner Withdraw From A Car Loan?

A cosigner can withdraw from a car loan once the primary borrower successfully refinances the loan without the cosigner’s involvement. This often depends on the primary borrower’s credit score improvement and a stable income, which can take several years from the loan’s initiation.

Does Removing A Cosigner Affect Credit Scores?

Removing a cosigner can affect both parties’ credit scores. If refinancing is smooth and payments are made on time, it should not negatively impact credit scores. However, any missed payments during the process could negatively affect both the primary borrower’s and cosigner’s credit.

Conclusion

Securing a cosigner release from a car loan can be a smooth process with the right strategy. By assessing eligibility, communicating with lenders, and potentially refinancing, you can navigate this situation effectively. Remember, it’s about taking the steps that protect both your financial health and that of your cosigner.

Stay informed, be proactive, and drive towards a solution that works for everyone involved.