What Type of Expense is Car Repairs

Car repairs are typically classified as a variable expense for individuals and maintenance or operating expenses for businesses. They fluctuate depending on usage and are not fixed costs.

Managing the costs of car repairs can be challenging for both personal budgets and company finances. Vehicle maintenance is essential to ensure safety and extend the vehicle’s lifespan but can vary dramatically from month to month. Individuals may encounter unexpected repair bills following breakdowns or accidents, making car repairs a unpredictable financial burden.

For businesses that rely on a fleet of vehicles, these expenses are part of the regular financial planning but can still present surprises. By categorizing them correctly in financial documentation and budgets, both individuals and businesses can better anticipate and control their financial health. Accurately accounting for these costs is crucial for effective financial management and planning.

Car Repairs As A Financial Outlay

Car repairs often take a toll on one’s finances. These costs, while sometimes unexpected, form an integral part of vehicle maintenance. They vary widely, based on several factors. Identifying these costs as variable or fixed expenses is crucial. It aids in planning and managing your budget.

Categories Of Car Expenses

When discussing car expenses, it’s important to recognize two main types:

- Fixed Expenses: These are predictable payments like insurance and loan installments.

- Variable Expenses: This category includes car repairs and maintenance costs which fluctuate.

Table 1:

| Expense Type | Description | Examples |

|---|---|---|

| Fixed | Regular, unchanged payments | Insurance, Loan Payments |

| Variable | Costs that can vary each month | Repairs, Fuel, Maintenance |

The Nature Of Repair Costs

Repair costs often catch car owners by surprise. These expenses can be minor or significant. A flat tire fix differs vastly from engine overhaul costs. Hence, a repair fund makes sense. It ensures that sudden financial pressures do not disrupt your budget.

- Minor Repairs: Small, more frequent expenses. Examples include brake pad replacement or oil changes.

- Major Repairs: Less frequent but costly. These include transmission fixes or engine repairs.

| Repair Type | Cost Range |

|---|---|

| Minor | Low to Moderate |

| Major | Moderate to High |

Preparing for these financial outlays requires foresight. A car repair can strain budgets if not anticipated. Regular maintenance reduces the likelihood of massive repair bills. Always consider the potential for repair expenses when budgeting for car ownership.

Is Car Repair An Operational Cost?

Understanding car repair expenses is crucial for managing finances. It begs the question — is car repair an operational cost?

Routine Repairs Vs. Unexpected Repairs

Routine repairs refer to regular maintenance needed to keep a car running. These include oil changes, brake pad replacements, and tire rotations. Such costs are predictable and can be budgeted for in advance.

Unexpected repairs arise from accidents or sudden failures. They are not planned for and can disrupt budgets.

Impact On Business And Personal Finance

For businesses, car repairs are part of operational costs. They are essential for the smooth running of company vehicles.

| Expense Type | Business | Personal |

|---|---|---|

| Routine Maintenance | Operational Cost | Personal Budget |

| Unexpected Repairs | Potential Downtime Costs | Out-of-Pocket Expense |

In personal finance, repairs impact savings. Routine maintenance prevents costly damage later. Unexpected repairs, however, can be a financial strain.

Effective planning and savings strategies can mitigate the financial impact of car repairs for both businesses and individuals.

Car Repairs For Individuals

Every vehicle owner knows that car repairs are a part of the driving experience. Expenses can clock up, from tire changes to brake repairs. Smart budgeting can tame this financial beast, helping keep your car on the road without breaking the bank.

Personal Budgeting For Vehicle Maintenance

Setting aside money each month ensures car repairs don’t throw your finances off track. A little foresight ensures peace of mind and a well-maintained vehicle. A good rule of thumb is saving a portion of your income solely for maintenance.

- Estimate yearly maintenance costs: Consider your car’s age, model, and condition for a tailored budget.

- Create a car repair fund: Dedicate a savings account to handle unexpected repairs.

- Regular check-ups: They prevent costly repairs in the future.

Depreciation And Maintenance

Depreciation affects your car’s value over time. Regular upkeep, however, can slow this process. Cars in great condition fetch a higher resale price. They sell quicker too. Below is an example of how costs can break down:

| Year | Depreciation (%) | Maintenance Costs |

|---|---|---|

| 1 | 20% | $500 |

| 2 | 15% | $600 |

| 3 | 10% | $700 |

Maintaining your car well extends its life and performance. This approach turns potential large expenses into manageable, planned costs. Remember to adjust your budget as your car ages and repair costs evolve.

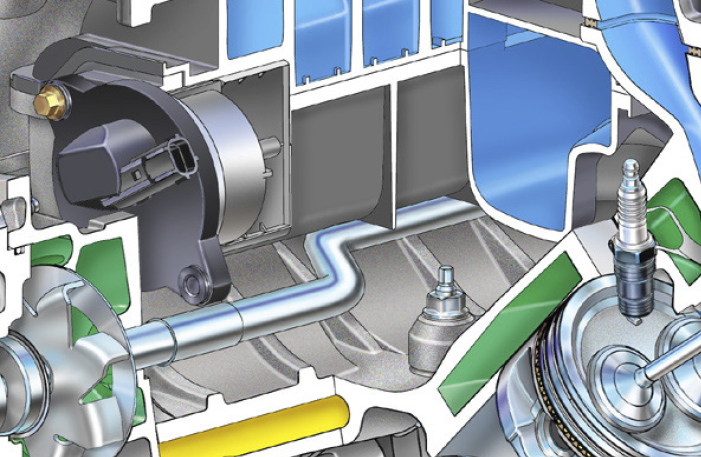

Credit: www.amazon.com

Recording Car Repairs For Businesses

Welcome to the insightful world of business accounting, specifically in the realm of car repairs. For businesses, keeping a meticulous record of car repairs is crucial. It helps in managing finances and understanding the health of the company’s assets. Let’s explore how to effectively record these expenses.

Accentuating Expenses In Financial Statements

To maintain clarity in financial reports, businesses must highlight car repair costs. Here are the steps to do so:

- List each repair as a line item under expenses.

- Categorize repairs separately from maintenance for clarity.

- Update the asset’s value if the repair extends its life.

These steps ensure both accuracy and transparency in financial statements.

Tax Implications Of Repair Costs

For businesses, car repair costs can have significant tax implications. Understanding these can lead to smart financial decisions.

| Type of Expense | Tax Deductible | Notes |

|---|---|---|

| Immediate Repairs | Yes | Repairs that are necessary and reasonable. |

| Improvements | Depends | May need to be capitalized and depreciated. |

Correctly recording and understanding the tax implications can lead to potential savings during tax time.

Strategies To Manage Repair Expenses

Every car owner knows repairs can take a big bite out of your wallet. The right strategies can ease the financial sting. Let’s discuss ways to manage those expenses.

Preventative Maintenance To Reduce Costs

Regular check-ups keep your car healthy and your wallet happy. By catching issues early, you avoid big repair bills later.

- Oil Changes: Get them on schedule.

- Tire Rotations: This extends tire life.

- Brake Inspections: Replace pads before more damage occurs.

Refer to your owner’s manual for a maintenance schedule. Stick to it.

Choosing Vehicle Repair Insurance

Another smart move is repair insurance. It can cover costs when your car breaks down.

| Type of Insurance | Benefits |

|---|---|

| Extended Warranty | Covers many parts and systems. |

| Collision Insurance | Helps with repairs after a crash. |

| Comprehensive Insurance | Good for non-crash related issues. |

Compare plans. Read the fine print. Know what you get.

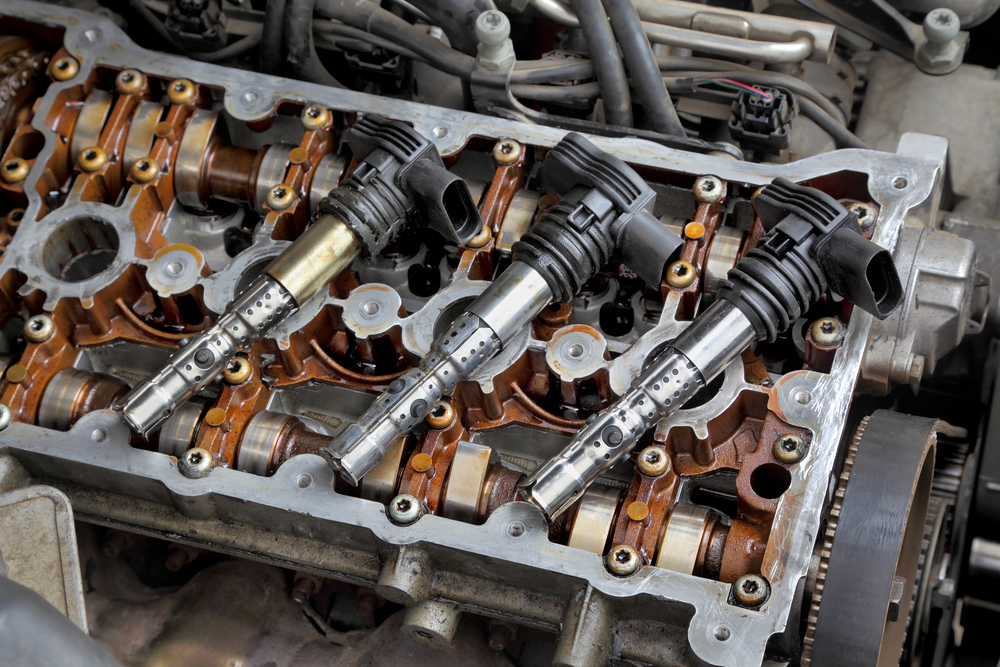

Credit: www.experian.com

The Future Of Car Repair Expenses

As the automotive industry evolves, so does the landscape of car repair costs. The move towards more advanced technologies promises to significantly transform how we budget for and approach vehicle maintenance. In the realm of car repairs, two pivotal factors could play crucial roles in shaping future expenses: the rise of electric vehicles (EVs) and the surge in automotive innovations aimed at reducing long-term expenses.

Electric Vehicles And Repair Costs

Electric vehicles are changing the game for car repair expenses. With fewer moving parts than traditional combustion engines, EVs often require less frequent maintenance. Here’s how EVs could potentially ease future repair costs:

- Less Wear and Tear: EVs have simpler drivetrains, meaning fewer parts to fix.

- Regenerative Braking: This feature reduces brake wear, prolonging brake life.

- Battery Prices Dropping: As technology advances, replacement costs for EV batteries are expected to decline.

| Component | Traditional Vehicle | Electric Vehicle |

|---|---|---|

| Engine/Drivetrain | Complex Maintenance | Simpler, Less Frequent Care |

| Braking System | Regular Replacement | Extended Life |

| Battery | N/A | Declining Replacement Costs |

Overall, electric vehicles offer a promising future with potentially lower repair costs, benefiting owners long-term.

Innovations Reducing Long-term Expenses

Car repair costs may decrease due to innovative automotive technologies. Here are some evolutions contributing to cost efficiency:

- Predictive Maintenance: Smart technologies can predict issues before they worsen, saving big on repairs.

- 3D Printing: This can lower part replacement costs by allowing for on-demand manufacturing.

- Durable Materials: New materials extend the life of car parts, meaning less frequent replacements.

Investments in tech-driven solutions not only enhance vehicle performance but also aim to cut down on maintenance expenses. With each advancement, the promise of reduced repair costs becomes more tangible. Vehicle owners stand to benefit from these cost-saving measures in years to come.

Credit: us.cnn.com

Frequently Asked Questions For What Type Of Expense Is Car Repairs

Can You Deduct Car Repairs As A Business Expense?

Yes, you can deduct car repairs as a business expense if the vehicle is used for business purposes. Keep records to justify the expense.

Are Repairs Considered Expenses?

Yes, repairs are typically classified as expenses in financial accounting and can be deducted for tax purposes. They are considered maintenance costs for business operations.

What Expense Is A Car?

A car is typically categorized as a personal or business asset, leading to various expenses such as maintenance, fuel, insurance, and depreciation.

How To Expense A Car For Business?

To expense a car for business, select the actual expense method or the standard mileage rate. Document business-related mileage and car expenses. Keep meticulous records and receipts. Ensure personal use is accurately tracked and separated. Consult a tax professional for optimal deductions.

Conclusion

Car repair costs can strain any budget, demanding smart management. Classifying these expenses properly aids in financial tracking and planning. Regular maintenance or the occasional fix? Remember to reflect on how they fit into your finances. Tackle car repairs knowledgeably, keeping your vehicle and wallet in good shape.