How to Qualify for a Car Loan With Low Income

To qualify for a car loan with low income, show lenders a stable job and a low debt-to-income ratio. Improve your credit score to enhance your approval chances.

Securing a car loan when you have a low income might seem daunting. Still, with the right strategy, it’s entirely possible. Your focus should be on demonstrating to potential lenders that you’re a reliable borrower. This requires a solid history of employment, indicating the ability to make consistent payments.

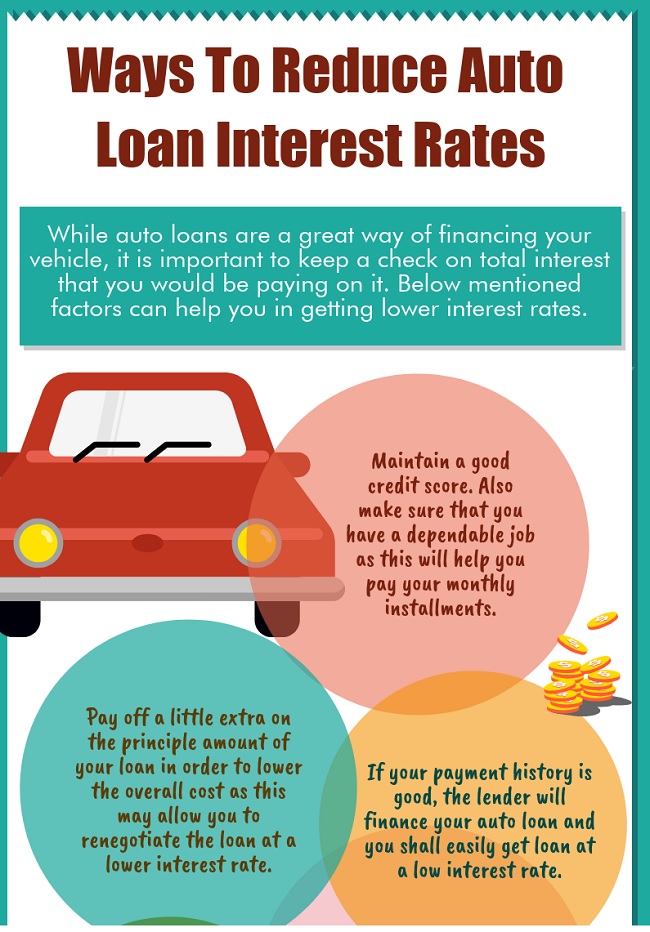

Keeping your debts minimal also plays a crucial role, as this lowers your debt-to-income ratio, a key factor lenders evaluate. Moreover, a better credit score can significantly sway the decision in your favor. Aim to maintain a spotless credit history or take steps to repair your credit if necessary. By presenting a financially responsible image and planning your application carefully, you can improve your eligibility for a car loan even with a lower income.

Assessing Your Financial Position

Qualifying for a car loan with a low income may sound daunting, but it’s possible by assessing your financial position. Understanding your financial health helps lenders see your potential as a borrower. Let’s dive into key factors like credit scores and debt-to-income ratios to enhance your loan approval odds.

Evaluating Your Credit Score

Your credit score is a vital indicator of your financial reliability. It’s the first detail lenders check. A high score can significantly improve loan terms. Know your score by requesting a free report from credit bureaus annually.

- Check for errors that might lower your score.

- Pay bills on time to show fiscal responsibility.

- Maintain a healthy credit mix and history to impress lenders.

Understanding Debt-to-income Ratio

A low debt-to-income (DTI) ratio shows financial control, improving loan eligibility. Calculate DTI by dividing total monthly debts by gross monthly income. Keep this ratio below 43% for better loan chances.

| Total Monthly Debts | Gross Monthly Income | DTI Ratio |

|---|---|---|

| $ | $ | % |

To lower your DTI:

- Reduce debt by paying off loans and credit cards.

- Avoid taking on additional large debts.

- Consider ways to increase your monthly income.

Maintain a ledger of earnings and expenses for better debt management.

Maximizing Creditworthiness

Qualifying for a car loan with low income means showing lenders you’re a safe bet. Creditworthiness plays a huge role. Lenders squint at your credit past to predict your payment future. Think of your credit score like a financial report card. A strong score can swing open the doors to that shiny new ride. Let’s explore how to buff up your credit shine!

Improving Your Credit Score

Boosting your credit score unlocks better loan terms. Start by checking your credit report. Look for errors. Dispute them if you find any. Next, pay bills on time, every time. Late payments tarnish your score. If you can, pay more than the minimum due. Lastly, keep old accounts open to show a long credit history.

- Check credit reports: AnnualCreditReport.com offers free checks.

- Set payment reminders: Never miss a deadline.

- Avoid maxing out credit cards: High balances hurt scores.

Reducing Existing Debt

Less debt means a stronger loan application. Begin by listing all you owe. Start paying more on the smallest balances. This is called the snowball method. Another way is focusing on high-interest debts first. This is known as the avalanche method. Reducing debt boosts your debt-to-income ratio. A lower ratio impresses lenders.

- Make a debt list with amounts and interest rates.

- Pick the snowball or avalanche method.

- Stick to a budget to prevent new debt.

Strategies For Low-income Borrowers

Qualifying for a car loan with a low income can be challenging. Yet, it’s not impossible. Various strategies can help boost your chances of approval. From seeking pre-approval to finding a co-signer, these tips have one goal: making car ownership accessible. Let’s explore vital steps that low-income borrowers can take to secure a car loan.

Seeking Pre-approval

Pre-approval is a great first step. This process gives you a clear picture of what you can afford. It also shows sellers that you’re serious. Follow these steps for pre-approval:

- Collect recent pay stubs and your tax return.

- Know your credit score.

- Compare rates from multiple lenders.

Opting For A Co-signer

A trusted co-signer can tilt the scales in your favor. Lenders see this as a reduced risk. A co-signer promises to pay if you cannot. Here’s what you need:

- Find someone with a strong financial background.

- Ensure they understand the responsibility involved.

Considering A Larger Down Payment

More money down means less risk for the lender—and a smaller loan for you. Aim for at least 20% of the car’s price as a down payment. This approach could improve loan terms. Save diligently and consider these sources:

| Source | Tips |

|---|---|

| Savings Account | Set up automatic transfers to save consistently. |

| Extra Income | Use bonuses or tax refunds as additional savings. |

:max_bytes(150000):strip_icc()/Heres-how-get-car-no-down-payment_final-1c94e62ad4644532a18289cf826f6cce.png)

Credit: www.investopedia.com

Choosing The Right Vehicle

When it comes to getting a car loan with a low income, selecting the right vehicle is crucial. It’s not just about finding a car you love; it’s about finding one that fits your budget. Here’s how you can choose an affordable, economical vehicle that won’t break the bank.

Selecting An Affordable Model

Finding a car that aligns with your financial situation requires research and planning. Start by:

- Setting a realistic budget based on your income and expenses.

- Exploring various models within your price range.

- Considering pre-owned vehicles for more savings.

- Researching incentives and rebates on certain car models.

Remember, your goal is a manageable loan, not a financial burden.

The Importance Of Fuel Efficiency And Maintenance Costs

Choosing a car with good fuel efficiency will save you money long-term. Look for cars with:

- High miles-per-gallon (MPG) ratings

- Low-cost maintenance records

- Ratings for affordable repair costs

Vehicles that demand less fuel and cheaper upkeep ease your financial load.

| Model | MPG | Maintenance Cost |

|---|---|---|

| Model A | 30 City / 40 Hwy | $200/year |

| Model B | 28 City / 36 Hwy | $220/year |

| Model C | 25 City / 33 Hwy | $250/year |

Refer to the table above to compare some popular fuel-efficient cars and their typical yearly maintenance costs.

Understanding Loan Terms

Understanding Loan Terms is crucial when trying to secure a car loan on a low income. Knowing the ins and outs of loan agreements can significantly impact monthly payments and the total cost over time. Before signing on the dotted line, it’s essential to grasp the implications of the loan duration and interest rates. Let’s delve into how these terms affect loan affordability.

Importance Of Shorter Loan Duration

Opting for a shorter loan duration can lead to several advantages. A shorter-term means you pay off the loan faster. While monthly payments might be higher, the overall interest paid is less. It’s easier to stay ahead of depreciation, potentially allowing you to trade in or sell the vehicle without owing more than it’s worth.

- Less interest accumulation over time

- Lower risk of negative equity

- Quicker path to ownership

Benefits Of Lower Interest Rates

Lower interest rates are a game-changer for low-income borrowers. A reduced rate decreases the overall cost of buying a car. It ensures more of your payment goes towards the principal balance rather than interest charges. This can save you money, making car ownership more accessible.

| Interest Rate | Monthly Payment | Total Paid Over Loan Term |

|---|---|---|

| Higher Rate | Higher Payment | More Expensive |

| Lower Rate | Lower Payment | Less Expensive |

Negotiating With Lenders

Embarking on the journey for a car loan with a limited income might feel daunting. Yet, the real game-changer lies in ‘Negotiating With Lenders’. This crucial step can turn the tides in your favor, even with lower income. It requires preparation, knowledge, and the right approach to tap into favorable loan terms.

Preparing For Negotiation

Before sitting down with lenders, get your ducks in a row. A critical part of the preparation is understanding your credit report. Know your credit score and be ready to explain any potential red flags. Compile all necessary documents such as proof of income, expenses, and any other assets. A solid financial snapshot can strengthen your position. Practice your negotiation points and remain confident yet flexible throughout the discussions. Remember, the goal is to reach a mutual agreement where you can manage your payments, and the lender feels secure in your ability to repay.

Exploring Different Financing Options

Exploring various financing avenues can provide leverage during negotiations. Consider credit unions, local banks, and online lenders. Each might offer different advantages. Make a comparison table to weigh the pros and cons of each.

| Lender Type | Pros | Cons |

|---|---|---|

| Credit Union | Lower Interest Rates | Membership Required |

| Local Bank | Personal Service | Higher Rates Possible |

| Online Lender | Convenience | Less Personal Interaction |

Be aware of all available lending solutions, like longer-term loans which can reduce monthly payments. Know what you qualify for and present it during your talks. Show lenders you have done your homework and watch them consider your propositions more seriously.

Additional Financial Considerations

Welcome to the ‘Additional Financial Considerations’ section of our guide on securing a car loan with a low income. Beyond just the loan amount and monthly payments, other financial factors play critical roles in the affordability of your new car. Understanding these can help you avoid future financial strain. Let’s dive into some vital aspects that you need to consider.

Insurance Costs

Insurance is a must when you own a car, but it can be pricey. Look for ways to get the coverage you need without breaking the bank:

- Compare insurance rates from different providers.

- Opt for higher deductibles to lower your premiums.

- Check for discounts you might be eligible for.

- Bundle insurance policies if possible for more savings.

Budgeting For Unexpected Expenses

After the car loan and insurance, you’ll still need a financial cushion. Unpredictable costs can arise, such as:

| Expense Type | Description | Tips |

|---|---|---|

| Maintenance Costs | Regular upkeep of your vehicle. | Set aside a small amount monthly. |

| Emergency Repairs | Unexpected issues that need fixing. | Build an emergency car repair fund. |

| Registration Fees | Annual cost to keep your car legal. | Remember registration renewal dates. |

Plan your budget so these expenses don’t surprise you. Missing them can lead to financial hiccups down the road.

Frequently Asked Questions On How To Qualify For A Car Loan With Low Income

How Much Can I Borrow For A Car Based On My Income?

Lenders typically suggest that your car payment should not exceed 15-20% of your pretax monthly income. The amount you can borrow depends on your income level, credit score, and debt-to-income ratio. Always consult with a financial advisor for personalized advice.

What Percentage Of Income Do You Need For A Car Loan?

Lenders typically recommend spending no more than 15-20% of your monthly income on a car loan payment.

How Much Do You Need To Earn To Buy A 50k Car?

To afford a $50k car, aim to earn at least $75k per year. Allocate no more than 20% of your income towards car payments for financial health.

What Credit Score Do You Need To Get A Low Car Payment?

Generally, a credit score of 700 or above can secure a low car payment. Scores in this range typically qualify for better interest rates on car loans.

Conclusion

Securing a car loan on a low income is possible with the right approach. Start by reviewing your credit history and improving your score where you can. Embrace budget-friendly choices, consider a co-signer, and explore various lenders. By applying these strategies, you’re stepping closer to a favorable car loan.

Let your financial savvy lead the way to a new set of wheels!