How to Shop for a Car Loan

To shop for a car loan, start by checking your credit report and comparing rates from multiple lenders. Ensure you understand all terms and fees before committing to a loan.

Shopping for a car loan requires a strategic approach to ensure you get the best possible deal. Start by acquiring a copy of your credit report and score, as this information can significantly influence interest rates. Next, reach out to several types of lenders, including banks, credit unions, and online financial services, to compare the variety of rates available.

Prioritize your needs, considering both the loan’s total cost and the affordability of monthly payments. Always read the fine print to avoid hidden fees and ask about any potential penalties for early repayment. With diligent research and a clear understanding of your financial standing, you’ll be in a strong position to secure a car loan that fits your budget.

:max_bytes(150000):strip_icc()/what-credit-score-do-you-need-to-buy-a-car-5181034_final-70360ef3611a47d7af938b7d7a3525ab.png)

Credit: www.investopedia.com

Starting Your Journey For The Right Car Loan

Ready to buy a car? Getting the right car loan matters as much as choosing the car itself. Start this journey well-informed and prepared. Let’s explore how to create a solid plan for your car loan, step by step.

Assessing Your Financial Health

First, take a close look at your finances. This step is about more than just how much you can spend on a car. Understand your budget to determine a loan that won’t strain your wallet.

Here’s what to consider:

- Income: Gather your pay stubs and account for your monthly earnings.

- Expenses: List all monthly bills, from rent to groceries.

- Debt: Include all debts to have a clear picture.

- Savings: Factor in your savings. This will help you decide on a down payment.

Understanding Your Credit Score Influence

Your credit score is the key to unlocking better loan terms. A higher score can mean lower interest rates. Know where you stand by getting a free credit report from major bureaus.

| Credit Score Range | What It Means |

|---|---|

| Excellent (720 and above) | Access to best rates |

| Good (690-719) | Favorable rates |

| Fair (630-689) | Average rates |

| Poor (629 and below) | Higher rates |

Work on improving your credit score if it’s low. Pay bills on time and reduce debt where possible. Remember, a better score makes your car loan journey smoother.

Exploring Loan Options And Lenders

When buying a car, picking the right loan is crucial. It’s time to dive into the sea of lenders. With a range of options, the quest takes you through banks, credit unions, online lenders, and dealerships. Each offers unique benefits.

Comparing Banks, Credit Unions, And Online Lenders

Banks are traditional go-tos for loans. They offer security and often comprehensive services. Credit unions, on the other hand, may extend lower interest rates. Their eligibility criteria revolve around membership. Online lenders stand out for convenience. They boast quick applications and potential savings. It’s wise to compare:

- Interest Rates: Could vary significantly.

- Loan Terms: Flexible options matter.

- Fees: Look out for hidden charges.

- Customer Service: Access to support can be a deal-breaker.

Dealership Financing: Pros And Cons

Consider financing through a dealership. They often facilitate loans with their own terms. Research the advantages and pitfalls carefully.

| Pros | Cons |

|---|---|

| One-stop-shop convenience | Higher interest rates possible |

| Promotional financing rates | Limited to specific cars |

| Easier qualification for credit-challenged buyers | Longer loan terms, higher overall costs |

Evaluate both the terms and total loan costs. Look beyond the monthly payment. Total interest paid over the life of the loan speaks volumes.

Preparing To Apply For A Car Loan

Securing a car loan requires attention to detail and a clear understanding of your financial situation. Before starting your car-buying journey, it’s crucial to be well-prepared. This ensures a smooth application process and increases your chances of getting a favorable loan. Let’s dive into what you need to gather and consider before applying for a car loan.

Gathering Necessary DocumentationGathering Necessary Documentation

The right documents can make or break your loan application. Start by organizing the essential paperwork.

- Proof of Identity: Passport, driver’s license, or state ID.

- Proof of Income: Recent pay stubs, tax returns, or W-2 forms.

- Proof of Residence: Utility bills or lease agreement.

- Credit and Banking History: Credit report and bank statements.

- Vehicle Information: If you have a car in mind, include the make, model, and VIN.

- Trade-in Documentation: If applicable, your current car’s title and registration.

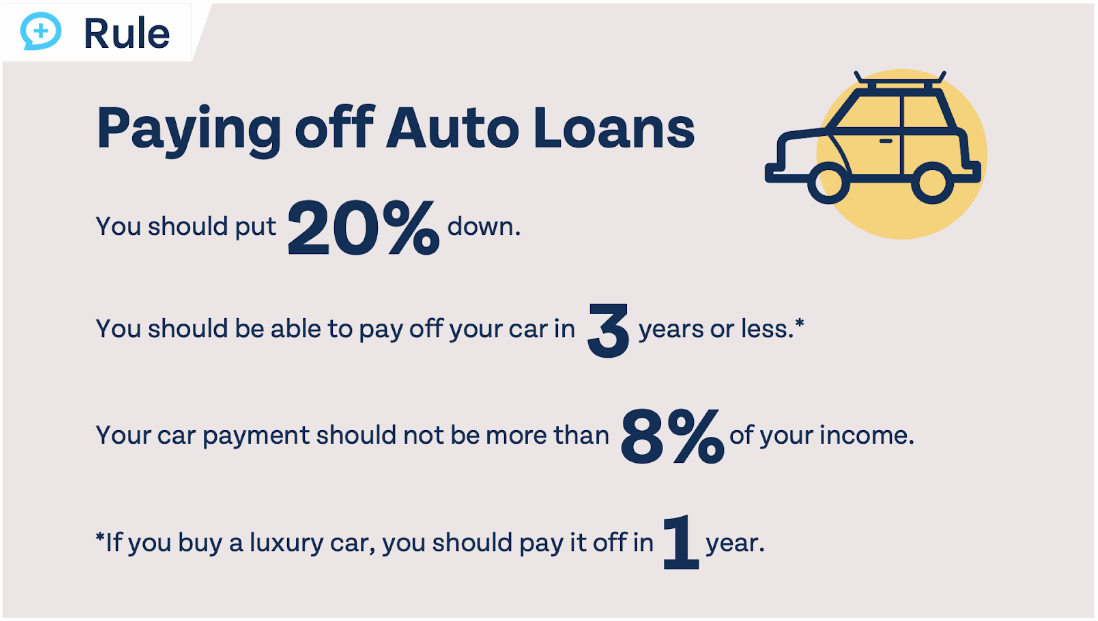

Determining How Much You Can Afford

Recognizing your budget’s limits is crucial for a financially wise decision. Assess your finances to find a comfortable monthly payment.

| Expense Category | Monthly Cost |

|---|---|

| Income | Your monthly take-home pay |

| Debts | Monthly debt obligations |

| Lifestyle Expenses | Regular monthly spending |

| Savings | Amount set aside each month |

| Car Loan Payment | Target monthly payment |

Factor in insurance costs, maintenance, and fuel when calculating. Use online calculators to estimate loan terms based on interest rates and down payment. Remember, a shorter loan term means higher monthly payments but lower overall interest costs.

:max_bytes(150000):strip_icc()/Heres-how-get-car-no-down-payment_final-1c94e62ad4644532a18289cf826f6cce.png)

Credit: www.investopedia.com

Negotiating The Best Loan Terms

Scoring a great car loan is all about understanding and negotiating the terms. A good deal means paying less over time. Here’s what to focus on:

Interest Rates And Their Impact On Loan Cost

The interest rate on your car loan decides how much extra you pay back. Lower rates mean you pay less over the loan’s life. Let’s break down how to get a lower interest rate:

- Check your credit score: A high score can help you snag a lower rate.

- Shop around: Compare rates from different lenders to find the best deal.

- Negotiate: Don’t accept the first offer. Use competition among lenders to your advantage.

The impact of interest rates is huge. Even a small difference can mean big savings.

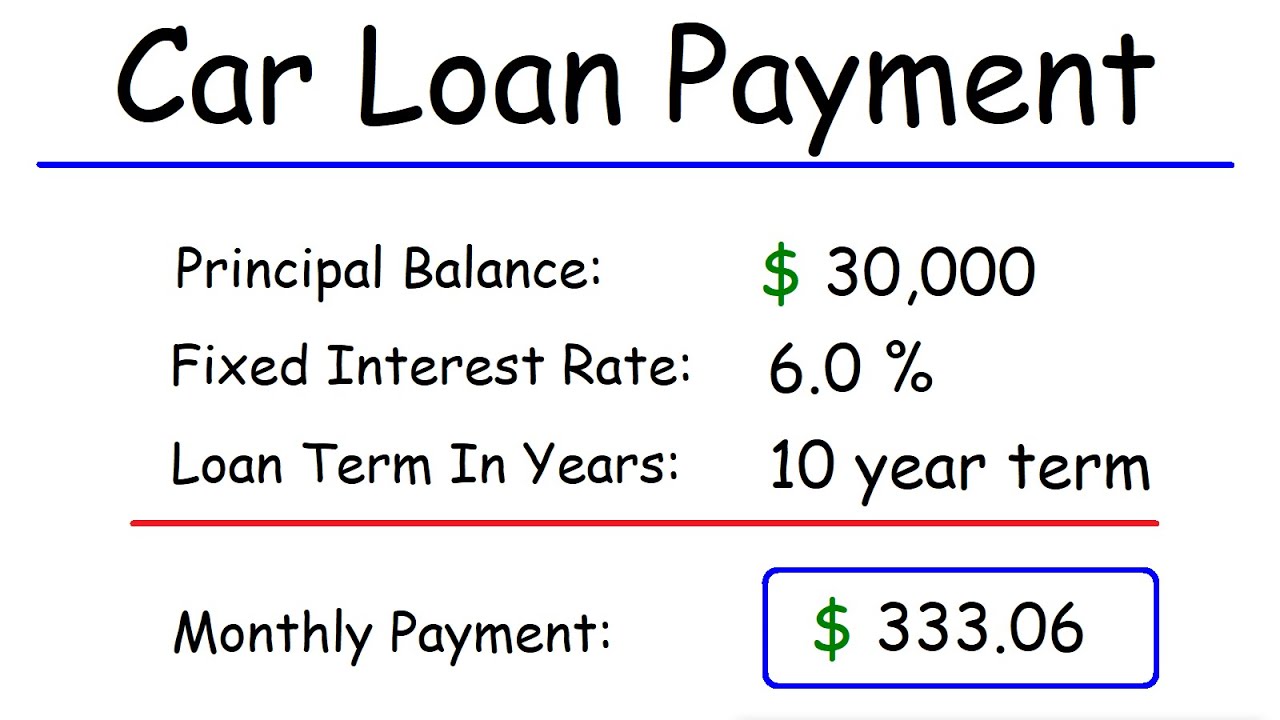

Loan Duration And Monthly Payment Calculations

Choosing the loan term affects your monthly payments and total cost. Shorter loans mean higher monthly payments but less interest overall. Let’s explore:

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 3 years | Higher | Lower |

| 5 years | Lower | Higher |

To find your ideal balance:

- Use online calculators for loan costs over different terms.

- Consider your monthly budget to ensure payments are manageable.

- Remember, a longer loan term might feel easier each month, but it costs more in the long run.

Finalizing The Loan And Making The Purchase

Once you have chosen the right car loan, the next steps are crucial. Understanding each aspect of the loan agreement is key to a successful purchase. Follow the steps to properly finalize your car loan and make your car purchase with confidence.

Understanding The Fine Print

Reviewing the loan agreement in detail is essential before signing. Pay attention to the following elements:

- Interest Rate: Verify the annual percentage rate (APR).

- Loan Term: Note the duration and number of payments.

- Extra Fees: Look for processing or administrative costs.

- Prepayment Penalties: Check if paying off early incurs charges.

Ask questions if something is unclear. Your lender should clarify all details.

Steps After Securing The Loan

- Insurance Requirement: Obtain the necessary car insurance coverage.

- Payment Schedule: Mark payment dates on your calendar.

- Documentation: Gather all required paperwork for the dealership.

- Vehicle Inspection: Have a professional inspect the car.

After completing these steps, you are ready to drive off in your new car!

Staying On Top Of Your Car Loan

Once you secure a car loan, the journey doesn’t end there. Staying on top of your car loan ensures smooth financial sailing. Learn effective payment management and consider refinancing for better terms.

Managing Your Loan Payments Effectively

To keep your finances in check, manage car loan payments with care. Regular, timely payments protect your credit score.

- Set up automatic payments from your bank account.

- Use mobile banking apps to track payment dates.

- Check for prepayment penalties before paying extra.

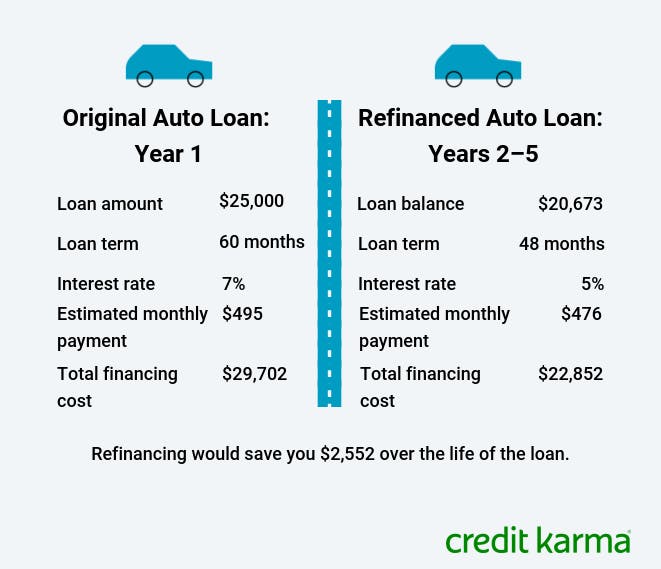

Considering Refinancing Options

Refinancing your car loan could lower interest rates or reduce monthly payments. It’s an option to explore when circumstances change.

- Evaluate current loan terms against potential new offers.

- Look for lower interest rates to decrease costs over time.

- Assess your credit score; a higher score can secure better terms.

By managing payments and considering refinancing, you stay in control. Keep your loan manageable and budget-friendly with these strategies.

Credit: moneyguy.com

Frequently Asked Questions For How To Shop For A Car Loan

What Should You Look For In An Auto Loan?

Consider the interest rate, loan term, total cost, fees, and prepayment penalties when seeking an auto loan. Research lenders for the best deal and read the fine print before signing.

Can I Shop Around For Auto Loans?

Yes, you can shop around for auto loans before buying a vehicle. It’s wise to compare rates and terms from multiple lenders to secure the best deal.

What Is A Good Apr For A Car?

A good APR for a car loan typically ranges between 3% to 10%. Factors like credit score and loan term influence the rate you receive. Aim for the lowest APR possible to save on interest.

How To Shop Car Loan Rates Without Hurting Credit?

Focus on obtaining pre-approvals from lenders who perform soft credit inquiries, which don’t affect your score. Limit your loan shopping to a 14-day period to minimize the impact, as multiple inquiries within this timeframe are typically counted as one.

Conclusion

Securing the best car loan requires diligence and information. Remember these steps: compare rates, check terms, and negotiate. Empower yourself with knowledge, and your ideal loan may be just a dealership away. Drive off confident, knowing you’ve made a financially savvy choice for your new vehicle.