How to Get the Best Car Loan

To secure the best car loan, compare rates from multiple lenders and negotiate terms. Ensure your credit score is high to receive favorable interest rates.

Securing the best car loan involves a blend of preparation and strategy. Prior to engaging with potential lenders, review your credit report and rectify any errors. A solid credit history translates to lower interest rates and better loan terms. Research is key; explore various financial institutions, including banks, credit unions, and online lenders to find competitive rates.

Don’t overlook the importance of a sizable down payment, as it can notably reduce your loan’s total cost. Timing also plays a role; aim for loan shopping when interest rates are low. Remember, the terms of the loan should be as important as the rate. A shorter loan term might mean higher monthly payments, but less interest paid overall. Always read the fine print; watch for prepayment penalties or additional fees. By adhering to these steps, you’re well on your way to finding a car loan that suits your financial needs.

Factors To Consider Before Applying

Securing the best car loan requires careful planning. Pay attention to several aspects before applying. These will influence loan approval and your financial health for years. Understand the factors that shape your loan’s viability.

Assessing Your Credit Score

A high credit score opens doors to low-interest loans. Check your credit report for errors before lenders do. Errors could hurt your score. A better score means more bargaining power.

Determining Your Budget

Knowing what you can pay monthly is critical. Calculate your income and expenses. Stick to a number that doesn’t strain your finances. Remember to include other car-related costs like insurance and maintenance.

Understanding Loan Terms

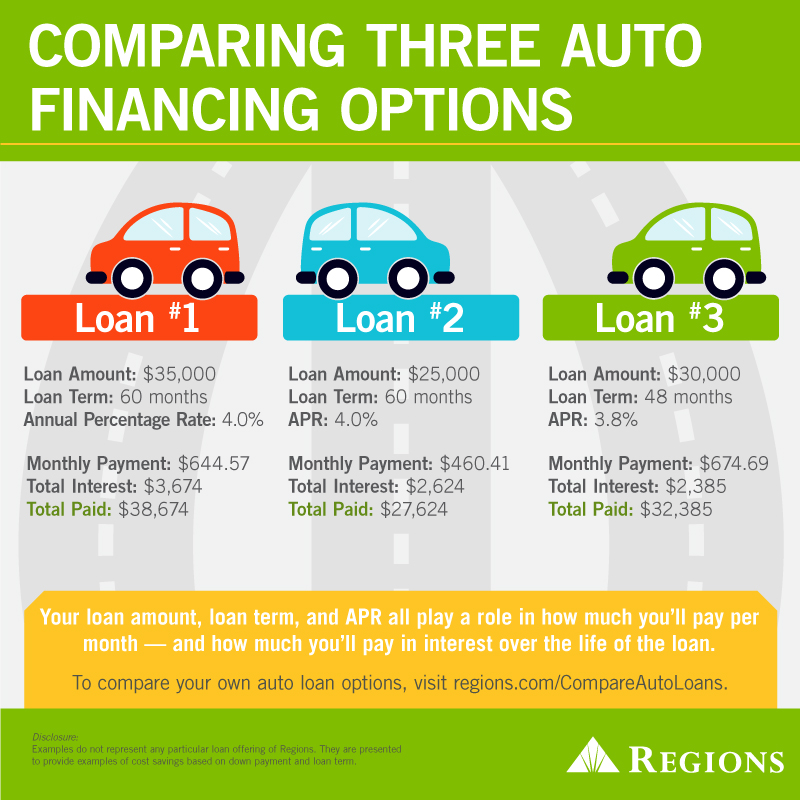

The term ‘APR’ means Annual Percentage Rate. A lower APR saves you money. Short-term loans have higher payments but lower interest over time. Long-term loans spread out payments but cost more in the end. Grasp these details.

Researching The Market

Don’t settle on the first loan offer. Explore different lenders. Compare bank, credit union, and dealership rates. Online loan calculators help. They compare loans based on your input.

| Lender Type | Pros | Cons |

|---|---|---|

| Banks | Potential discounts for customers | May require good credit |

| Credit Unions | Typically lower rates | Membership required |

| Dealerships | Convenience | May have higher rates |

- Tip: Always read the fine print.

- Be prepared to negotiate.

- Use pre-approval as leverage.

Credit: www.bankrate.com

Types Of Car Loans

Selecting the right car loan can make a significant difference in your finances. Understanding the various loan types is key. Each has its own set of benefits and terms. Let’s explore the options to find the best fit for your car-buying needs.

Secured Vs Unsecured Loans

Secured loans are protected by an asset, your new car. If payments are missed, the lender may take the car. Typically, these loans have lower interest rates. Unsecured loans do not involve collateral. They might have higher interest rates due to the increased risk for the lender.

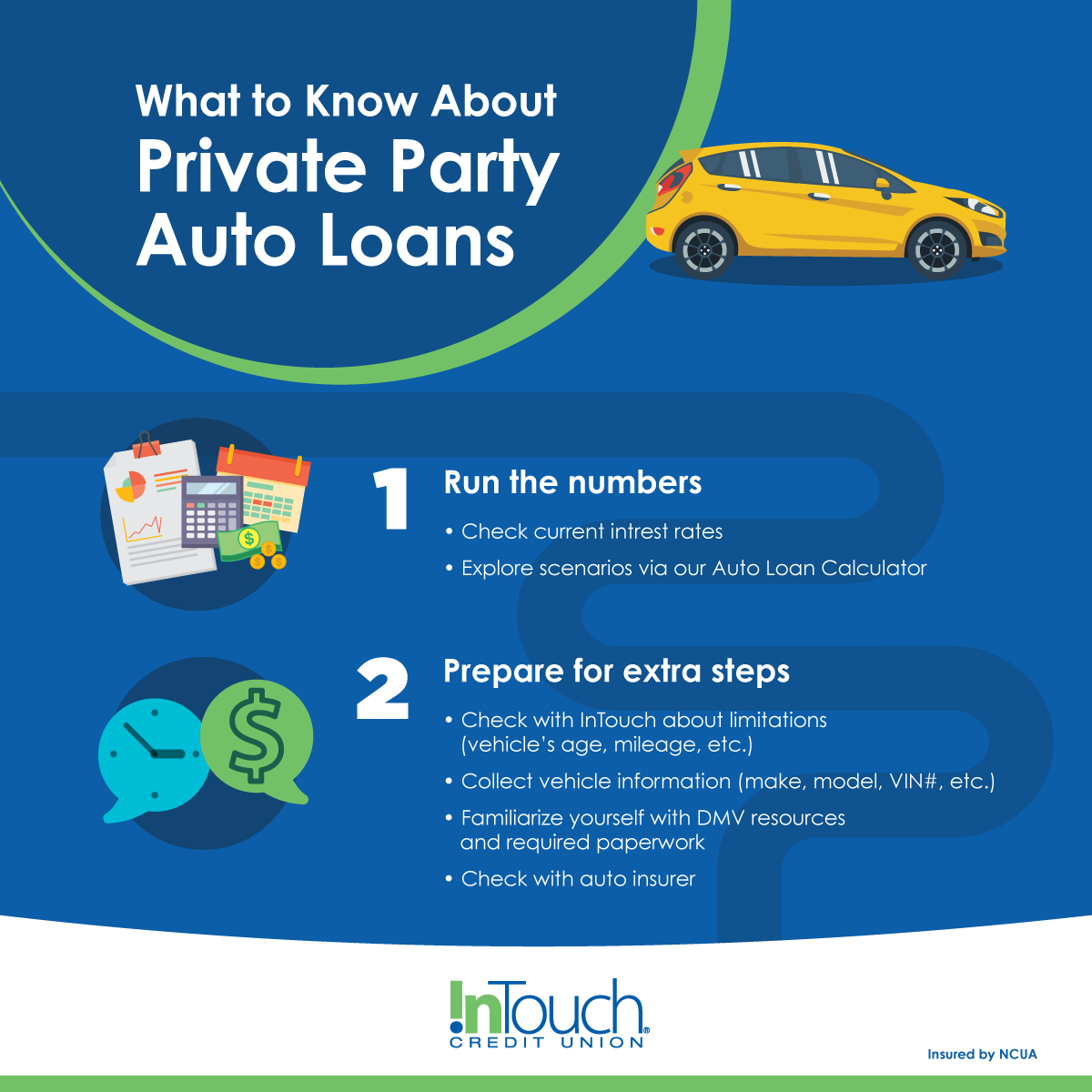

Direct Lending Vs Dealership Financing

Direct lending means you obtain a loan directly from a bank, credit union, or online lender. You know the terms upfront when you visit the dealership. Dealership financing involves getting your loan through the dealership. They often have special deals but can include higher rates.

New Car Loans Vs Used Car Loans

New car loans are specific to brand-new vehicles. They typically offer lower interest rates and longer terms. Used car loans apply to pre-owned vehicles. Rates might be higher, but they’re a great option for budget-conscious buyers.

Leases Vs Traditional Loans

Leasing a car means you pay to use it for a set time. Monthly payments are usually lower. You return the car at the end. Traditional loans lead to ownership. Payments are higher, but in the end, you own the car completely.

Navigating The Loan Application Process

Navigating the loan application process is often the first step in getting behind the wheel of your new car. Understanding this journey is key to securing a loan that fits your budget and meets your needs. Let’s dive into the essential steps to ensure you are fully prepared to land the best car loan possible.

Gathering Necessary Documentation

Start by collecting the required paperwork. Lenders will need to verify both your identity and financial stability. Below is a checklist of what to gather:

- Proof of Identity: Typically, a driver’s license or passport.

- Proof of Income: Recent pay stubs or tax returns.

- Proof of Residence: A utility bill or lease agreement.

- Credit Information: Know your credit score beforehand.

- Vehicle Information: Details about the car you intend to buy.

Comparing Pre-approval Offers

With your documents in hand, shop around for pre-approval offers. Consider these factors:

| Interest Rates | Loan Terms | Lender Reputation |

|---|---|---|

| Look for the lowest available. | Longer terms can mean lower monthly payments but higher overall costs. | Read reviews and check ratings. |

Pre-approval does not equate to commitment. Feel empowered to explore multiple options.

Negotiating Terms With Lenders

Once you have pre-approvals, it’s time to negotiate. Do not accept the first offer; use competing offers as leverage to lower rates or improve terms. Remember these tips:

- Focus on the total loan cost, not just the monthly payment.

- Discuss lowering interest rates or removing fees.

- Clarify details about prepayment penalties.

Finalizing The Loan Agreement

After negotiating terms that suit your budget, it’s time to finalize the deal. Before signing, ensure all negotiated terms are clearly reflected in the agreement. Double-check the following:

- Interest rates match what was agreed upon.

- There are no hidden fees.

- The payment schedule is clear and manageable.

Sign the contract, congratulations! You’re one step closer to owning your new car.

Credit: www.buddyloan.com

Strategies For Obtaining The Best Rates

Securing a favorable car loan requires smart strategies. Understanding the best techniques ensures you save money while financing your new ride. In this guide, we delve deep into how you can obtain the best rates possible. Here are proven strategies:

Timing Your Loan Shopping

Choosing the right time can lead to major savings. Aim for the end of the month or financial quarter. Dealerships often have quotas and could offer better financing deals to meet targets.

Improving Credit Score Before Applying

A higher credit score unlocks lower interest rates. Prioritize credit repair by paying down debts and avoiding new credit inquiries before loan shopping.

Exploring Membership Discounts

Belong to a union, club, or organization? Check for partnership discounts. Exclusive loan deals can significantly lower your rates.

Utilizing Online Loan Calculators

Knowledge is power. Use online calculators to estimate monthly payments. Compare multiple loan offers to find the best deal.

Tips For Loan Management And Repayment

Managing your car loan effectively ensures you stay in control of your finances. Applying smart strategies to loan management and repayment can save you money. Let’s explore ways to navigate through your loan effectively.

Optimizing Your Repayment Schedule

Shorten loan terms to pay off debt faster. You’ll reduce the total interest paid over time. Consider bi-weekly payments. This little change can lead to one extra payment each year, reducing your loan balance faster.

Always pay on time to avoid late fees. Use automatic payments to help with this.

Refinancing For Better Rates

Check for lower interest rates if your credit score has improved. Refinancing can decrease monthly payments and the total amount paid. Always compare offers from multiple lenders to ensure the best deal.

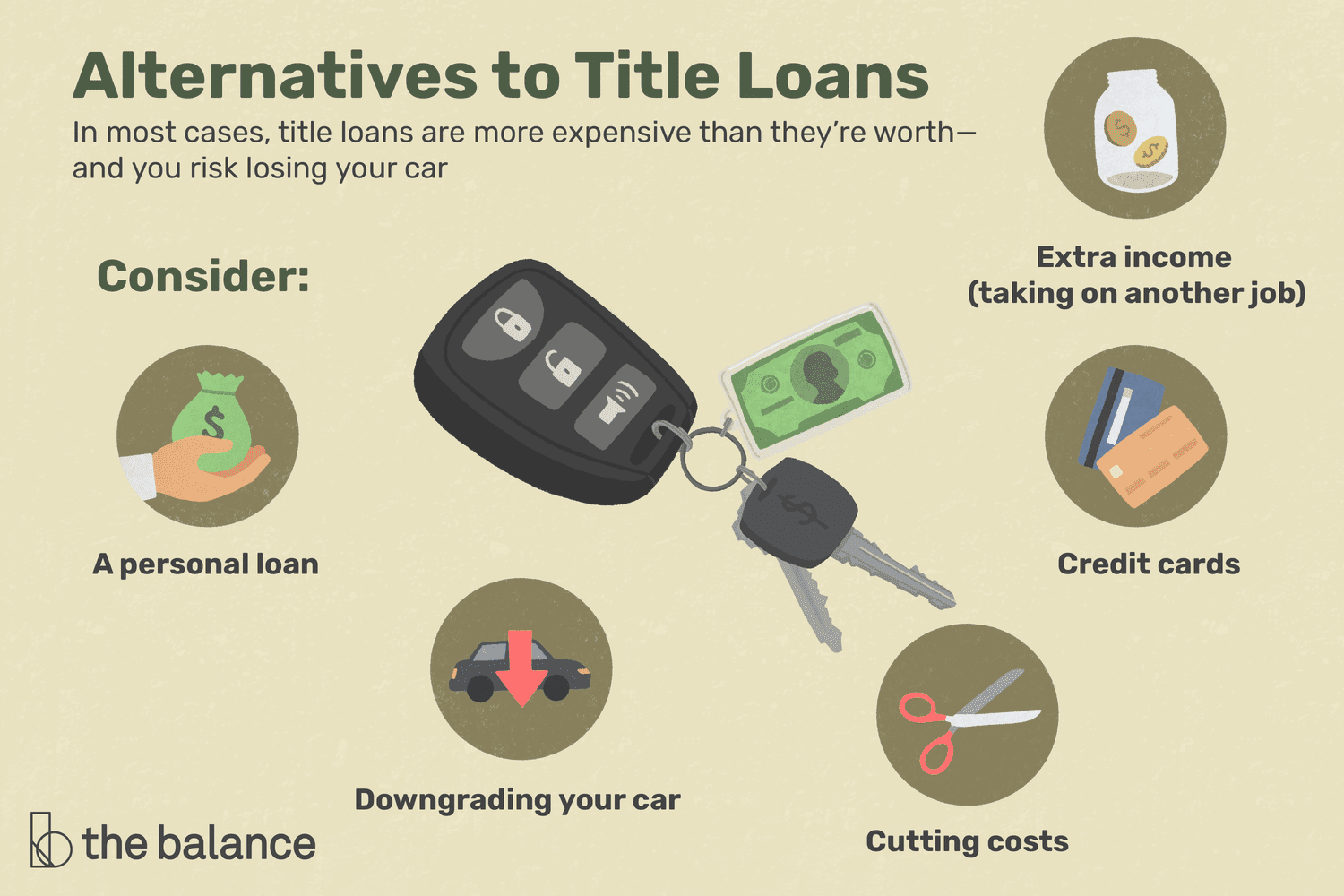

Avoiding Common Loan Pitfalls

Read all terms before signing a loan agreement. Beware of prepayment penalties which can cost you for paying off early. Steer clear of long-term loans which may seem cheaper monthly but cost more overall.

Monitoring Your Credit During Repayment

Maintain a good credit score during loan repayment. A solid score unlocks future financial opportunities. Check your credit report regularly for any errors and address issues swiftly to prevent damage to your score.

By using these tips, you will not only manage and repay your car loan efficiently but also protect and improve your credit, ensuring a healthier financial future.

Frequently Asked Questions Of How To Get The Best Car Loan

What Is The Best Car Financing Option?

The best car financing option varies by individual needs but generally, credit union loans often offer lower interest rates. Always compare offers to secure the best deal.

How Can I Get A Better Interest Rate On A Car Loan?

Improve your credit score before applying for a car loan. Shop around for the best rates from various lenders. Consider a larger down payment to reduce the borrowed amount. Opt for a shorter loan term if possible. Negotiate the interest rate with the lender.

Which One Is Best For Car Loan?

The best car loan depends on individual needs, including interest rates, loan terms, and lender reliability. Compare offers from banks, credit unions, and online lenders to find the right fit.

What Interest Rate Can I Get With A 800 Credit Score Car Loan?

With a 800 credit score, you can typically secure a car loan interest rate as low as 3% to 5%. Your actual rate may vary based on lender terms and market conditions.

Conclusion

Securing the best car loan demands attention to detail and smart shopping. Arm yourself with know-how and never rush your decision. Credits and loans can differ widely; choose wisely for financial peace. Remember, the right loan propels you toward your dream car without financial strain.

Drive away with confidence, backed by your best-loan triumph.