How to Stop Wage Garnishment for Car Loan

To stop wage garnishment for a car loan, immediately contact your lender to negotiate a payment arrangement. Seek legal advice to understand your rights and explore debt resolution options.

Experiencing wage garnishment can cause significant financial strain, especially when it relates to an essential asset like your car. If you’re facing this situation, it’s critical to act swiftly. Communicating directly with your lender could lead to an alternate repayment plan, halting the wage garnishment process.

Getting professional legal counsel can provide clarity on your rights and facilitate a better understanding of available remedies, such as restructuring the debt or even filing for bankruptcy in extreme cases. Ignoring the garnishment is never advisable, as it can lead to further complications. Through prompt and informed actions, you can navigate the challenge of wage garnishment and work towards resolving your financial obligations.

Origins Of Wage Garnishment

The term ‘wage garnishment’ may sound quite medieval, but its origins are deeply rooted in modern law. Understanding how wage garnishment emerges can help individuals like you steer clear of the financial turmoil associated with it, particularly in the realm of car loans. Let’s delve into the legalities that allow such practices and the common reasons they happen in the auto loan sector.

Legal Basis For Wage Garnishment

Wage garnishment starts with a court order. It’s a legal mechanism creditors use to claim debts from a borrower’s income. If a borrower fails to make car payments, the lender may take legal action. Upon the court’s ruling, part of the borrower’s wages gets directed to the lender until the debt is paid.

Here’s a brief look at the legal framework:

- Lawsuit Filed: Lender sues borrower for unpaid debt.

- Judgment Granted: Court rules in favor of the lender.

- Order Issued: Court orders wage garnishment.

Common Causes For Garnishment In Auto Loans

Car loans can fall into garnishment for several reasons. Recognizing these reasons can help in avoiding such financial setbacks. Some common triggers include:

- Defaulting on Loan: Missing several car payments consecutively.

- Inadequate Insurance: Failing to maintain required insurance leads to lender covering the cost, added to the loan balance.

- Loan Rollover Balances: Unsettled balances from previous car loans can also lead to garnishment on the new vehicle.

Stay informed, and you can keep your wages intact and your car loan under control.

Early Indicators Of Potential Garnishment

Attending to the early signs of wage garnishment can save your financial health when struggling with a car loan. Recognizing these signals acts as a first defense against potential wage garnishment. Understanding the warnings and lender communications helps borrowers take timely action.

Missed Payment Warnings

Regular payment reminders become red flags if payments start slipping. Alerts from your lender indicate concern:

- Payment Due Date Notices: These are reminders of your upcoming dues.

- Late Payment Notifications: Alerts sent after a missed date suggest urgency.

- Recurring Call Attempts: When lenders repeatedly contact you, they signal distress.

Boldly addressing missed payments can prevent lenders from moving towards garnishment.

Lender’s Communications

Lenders often communicate their intentions. Look out for:

| Communication Type | Indication |

|---|---|

| Notice of Default: | This letter marks a serious phase of delinquency. |

| Repayment Plan Offers: | Proposals to adjust payment schedules are last chances. |

| Court Summons: | A court summons is a direct step towards garnishment. |

Engaging promptly with the lender after receiving such communications can avert garnishment actions.

Preventive Steps To Avoid Wage Garnishment

Facing wage garnishment can be daunting.

But taking proactive steps can keep your earnings safe.

Let’s dive into how to protect your paycheck before garnishment starts.

Budgeting To Stay On Track

Creating a budget is key.

It helps you manage money better.

Let’s look at how to make one that works:

- List your monthly income sources.

- Add up all monthly expenses.

- Subtract expenses from income.

- Set aside funds for your car loan.

- Review and adjust your budget as needed.

Tools like spreadsheets or apps can help you track.

Negotiating With Lenders

Good communication with lenders is crucial.

Be open about financial hardships.

They may work with you to avoid garnishment.

Consider the following negotiation points:

| Strategy | Benefit |

|---|---|

| Loan Modification | Changes terms to make payments more manageable. |

| Repayment Plan | Spreads past due amounts over future payments. |

| Settlement Offer | Possibly pay less than what’s owed. |

Get any agreement in writing.

Navigating The Garnishment Process

No one expects the shock of wage garnishment for a car loan. It can create a sense of panic. Understanding the process is the first step to regaining control. Here’s how to navigate through this challenging time:

Understanding Your Rights

Knowing your rights is crucial. Wage garnishment doesn’t happen without warning. You’ll receive a court notice first. Your state law sets the rules for how much can be taken from your paycheck. The Consumer Credit Protection Act limits the percentage. Check the details:

| Income Level | Maximum Garnishment |

|---|---|

| Disposable income below $217.50 weekly | None |

| Disposable income between $217.50 and $290 weekly | Amount above $217.50 |

| Disposable income above $290 weekly | 25% or less |

Employers can’t fire you for a single garnishment. But protection varies for multiple garnishments. Know your state’s stance on this to protect your job.

Seeking Legal Advice

A licensed attorney offers the best help. They can assist with paperwork and represent you in court. They help find alternatives, like loan restructuring or settlement. Check for resources:

- Local legal aid societies

- State bar associations for referrals

- Financial counseling centers

A lawyer might stop the garnishment before it starts. This can save you time and stress. They also guide you on debt management practices to avoid future issues.

Resolving The Garnishment

Feeling the weight of a wage garnishment on a car loan can be daunting. Yet, options for resolving the garnishment exist. Taking the right steps can put you back in the driver’s seat of your financial life.

Payment Options And Settlements

When it comes to lifting the burden of wage garnishment, exploring payment options is key. Prioritize communication with your lender to negotiate a reasonable settlement. Often, they may agree to a lump-sum payment that is less than what you owe. This is known as a “settlement”. Settlements can halt garnishments and save you money.

- Offer a Lump-Sum Payment: Engage with your lender about paying a portion of the debt in one go.

- Installment Plan: Discuss setting up a new payment plan that fits your budget.

Restructuring The Debt

Reworking the terms of your car loan is another potential solution. This option, called debt restructuring, can lower monthly payments and stop garnishments. Start by requesting a loan modification from your lender. Make sure to clearly present your financial situation.

| Loan Modification Options | Benefits |

|---|---|

| Extended Loan Term | Lower monthly payments |

| Reduced Interest Rate | Less paid in interest over time |

| Principal Reduction | Immediate decrease in debt owed |

Contact your lender and ask about these options. A restructured loan could be the ticket to regaining your financial stability and stopping wage garnishment.

Credit: lanterncredit.com

Long-term Financial Strategies

Long-Term Financial Strategies play a crucial role when you’re dealing with wage garnishment for a car loan. Overcoming such a financial obstacle doesn’t end with the immediate resolution of your debt. It’s about preparing ahead, ensuring stability, and preventing future financial disruptions. Let’s navigate through the ways you can achieve a firm financial footing.

Building A Safety Net

A safety net is your financial buffer that keeps you afloat during hard times. Here’s how to build one:

- Start small, saving whatever you can each month.

- Open a dedicated savings account for your emergency fund.

- Set a goal, say three to six months of living expenses.

- Cut unnecessary costs to boost your savings rate.

Rebuilding Your Credit After Garnishment

Your credit score may take a hit after garnishment. Rebuilding your credit is essential. Follow these steps:

- Check your credit report for errors and dispute them.

- Pay all bills on time; this cannot be overstressed.

- Keep credit card balances low relative to limits.

- Consider a secured credit card to rebuild your score.

- Be patient; credit recovery takes time and consistency.

Frequently Asked Questions For How To Stop Wage Garnishment For Car Loan

Is There A Way Around Wage Garnishment?

Yes, ways to circumvent wage garnishment include negotiating payment arrangements, challenging the garnishment’s validity, or filing for bankruptcy protection. Legal advice may assist in exploring options.

How Can I Stop Wage Garnishment Once It Starts?

To stop wage garnishment, you can challenge it in court, repay the debt, or negotiate with the creditor. Consider filing for bankruptcy or seeking legal counsel to explore your options.

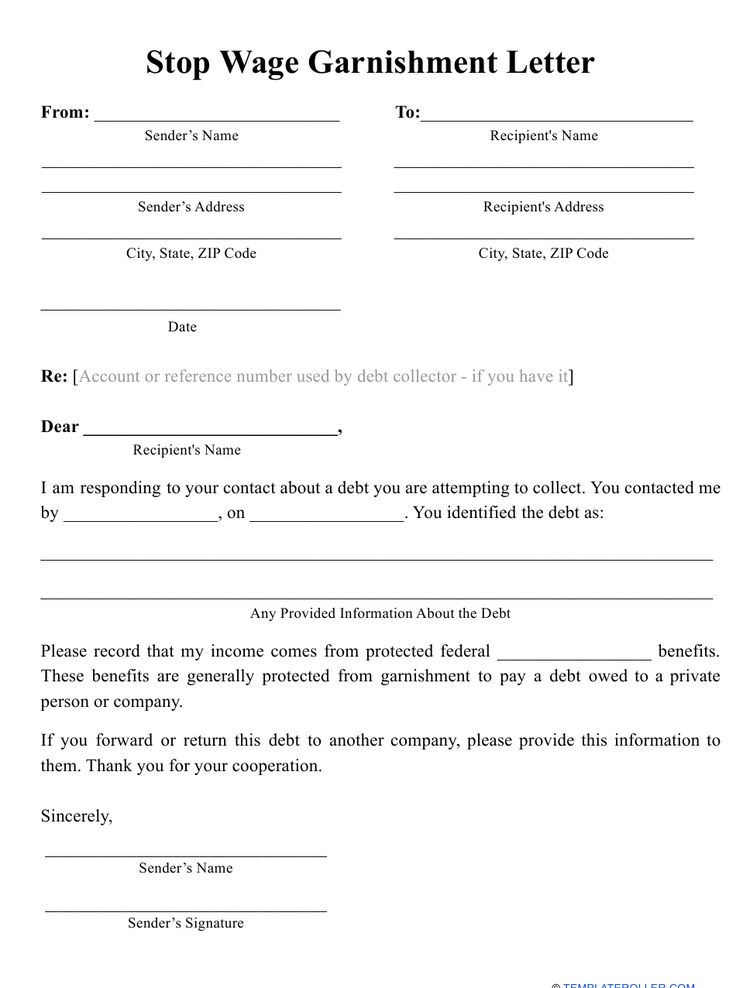

How Do I Write A Letter To Stop Wage Garnishment?

To write a letter stopping wage garnishment, clearly state your request, provide your employment and garnishment details, and attach any supporting legal documents. Send this directly to the creditor or court, and retain a copy for your records. Consult legal advice for specific requirements.

What States Prohibit Garnishment?

Four states—Pennsylvania, North Carolina, South Carolina, and Texas—generally prohibit wage garnishment resulting from consumer debt. Exceptions exist for debts related to taxes, child support, federal student loans, and court-ordered fines or restitution.

Conclusion

Navigating the distress of wage garnishment can feel overwhelming, but options exist to regain control. Explore every legal avenue, communicate with lenders, and consider professional assistance. It’s possible to halt garnishments and work towards a stable financial future. Remember, you have rights and solutions are within reach.

Take action to protect your earnings now.