What Insurance Covers Car Repairs

Car insurance that includes collision and comprehensive coverage typically covers car repairs. These policies cover damages from accidents, natural disasters, theft, and vandalism.

Navigating the maze of car insurance options can be overwhelming. Not all car insurance plans are made equal, with varying degrees of protection based on the type of coverage you choose. To ensure your vehicle’s repairs are covered in case of mishaps, it’s crucial to understand the distinctions between collision and comprehensive insurance.

Collision insurance is your financial safeguard against costs incurred from your car’s run-ins with other vehicles or objects. Comprehensive coverage, on the other hand, is the ally that helps pay for damages caused by various non-collision incidents. Opting for both types of insurance provides a solid safety net for your automobile, keeping it secure from a wider range of threats. Hence, selecting the right insurance plan is pivotal in safeguarding not only your car but also your peace of mind on the road.

Types Of Car Insurance Policies

Understanding car insurance policies is vital for any car owner. Different policies cover various aspects of car-related incidences. Not all policies cover car repairs. Let’s dive into the types of insurance that help with your car repair needs.

Collision Insurance

Collision insurance helps when you crash with another vehicle. It also comes in handy if you hit an object like a pole.

- Covers car repair or replacement costs

- Works regardless of who caused the accident

- Essential if you own a newer vehicle

Think of it as a shield for your car in collisions.

Comprehensive Insurance

Comprehensive insurance offers coverage for non-collision-related incidents. These can be events out of your control.

- Protects against theft, vandalism, and natural disasters

- Covers repairs for damage from hail or falling objects

- Includes hitting an animal while driving

Comprehensive insurance is a safety net for the unexpected.

Credit: www.libertymutual.com

Coverage Specifics For Auto Repairs

Understanding your car insurance policy is crucial when facing auto repairs after an incident. Different coverages kick in based on the situation. Let’s dive into the specifics of what your insurance may cover when repairs are necessary.

When To Use Collision Coverage

Collision coverage steps in when your vehicle needs repairs after crashing into another vehicle or an object. It applies in scenarios such as:

- Hitting a pole: Your collision coverage can cover repairs.

- Rear-ending another car: Damage to your car falls under this coverage.

- Getting hit by another car: Your insurance can help if you’re not at fault.

Always check your deductible amount first. It’s the sum you pay before insurance aids.

Scenarios For Comprehensive Claims

Comprehensive coverage handles non-collision incidents. Here’s when it aids:

| Scenario | Your Comprehensive Coverage Kicks In |

|---|---|

| Storm Damage | Covers repairs from hail or fallen branches |

| Theft | Pays for damage due to break-in attempts. |

| Animal Collision | Repairs your car after hitting an animal. |

Remember, your policy details and deductible affect claim eligibility.

Policy Limits And Deductibles

After an unexpected fender bender, knowing which repairs your auto insurance covers makes a world of difference. Two vital components in this equation are policy limits and deductibles. These determine how much protection your insurance offers and what costs are yours to bear.

Choosing The Right Deductible

Think of your deductible as your financial commitment in the event of a car repair. It’s the sum you pay before your insurer chips in. A higher deductible usually means lower premiums, but it’s crucial to balance this with what you can afford out-of-pocket if an incident occurs.

- Lower Deductibles: Easier on your wallet now, but higher monthly payments.

- Higher Deductibles: Save on payments, but require more cash on hand for repairs.

Select a deductible that aligns with your savings and risk tolerance. This ensures you’re not stretched thin financially after an unforeseen event.

Understanding Policy Limits

Your policy limit is the maximum amount your insurance company will pay for a covered claim. These limits play a pivotal role in the extent of coverage you have in place. Knowing them inside-out can save you from unexpected expenses during challenging times.

| Coverage Type | Typical Policy Limit |

|---|---|

| Liability Coverage | Set by state requirements |

| Collision Coverage | Value of your car |

| Comprehensive Coverage | Value of your car |

Consider policy limits in harmony with your vehicle’s value and your comfort with potential out-of-pocket costs.

:max_bytes(150000):strip_icc()/car-repair-following-insurance-claim-accident-527113_color-e5cd60eaed274db5b5e65c860183cd64.png)

Credit: www.thebalancemoney.com

Insurance Exclusions And Limitations

Understanding what your car insurance covers is crucial for your peace of mind. Not all damages or incidents fall under the protection of standard policies. It’s important to know the exclusions and limitations beforehand. This knowledge saves time and avoids unexpected expenses when repairs are needed.

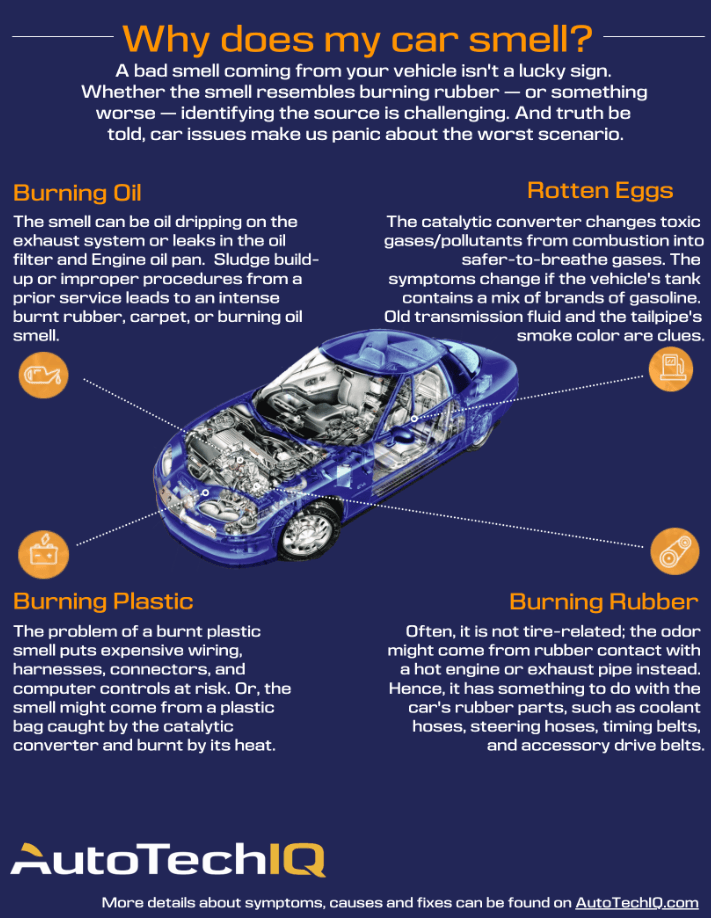

Wear And Tear Policy Exclusions

Regular wear and tear on a car is not covered by insurance. These are exclusions you need to be aware of:

- Engine failure from regular use

- Tire wear

- Interior upholstery damage

- Paint fading over time

- Aging parts needing replacement

Insurance expects owners to maintain their vehicles regularly. Neglect can lead to denial of coverage. Always check your policy’s fine print for a detailed list of exclusions.

Aftermarket Parts And Modifications

Auto enthusiasts love customizing their vehicles, but insurance may not cover these changes. Here are common issues with aftermarket parts and modifications:

| Modification Type | Coverage Status |

|---|---|

| Engine Mods | Usually Not Covered |

| Suspension Alterations | May Void Warranty |

| Custom Paint Jobs | Rarely Included |

| Body Kits | Not Typically Covered |

| Performance Upgrades | Check with Insurer |

Modifications can affect the vehicle’s safety and resale value. Inform your insurer about any modifications to understand your coverage. This action avoids disputes during claims.

Additional Coverage Options

Car repairs can be costly. Insurance might cover some costs. Let’s explore extra coverages you can get. These include mechanical breakdown insurance and emergency roadside assistance. These offer help beyond classic insurance.

Mechanical Breakdown Insurance

Mechanical Breakdown Insurance (MBI) pays for car repairs not caused by accidents. It’s like a warranty from an insurer. It covers big fixes like engine or transmission work. Vehicles under a certain age or mileage are eligible. MBI often has a deductible, like health insurance.

Compare MBI with the dealer’s warranty:

| MBI | Dealer Warranty |

|---|---|

| Choose any licensed repair shop. | Limited to where you bought the car. |

| Possible lower costs over time. | Often included in the car’s price. |

Emergency Roadside Assistance

Emergency Roadside Assistance is for urgent help on the road. Flat tires, dead batteries, and towing included. Some insurers offer this as a membership. Others may require you to pay upfront and get reimbursed later.

- Towing: Takes your car to a repair shop.

- Jump-starts: Helps when the battery is dead.

- Tire changes: Replaces flat tires with your spare.

- Lockout service: Helps if you are locked out of your car.

Filing A Claim For Repairs

Have you ever wondered about the steps to take when your car needs repairs after an accident? Understanding how to file a claim with your insurance is crucial. It can be the difference between a seamless repair process and a drawn-out, frustrating experience. Let’s dive into the world of insurance claims to get your car back in shape swiftly.

The Claims Process

Initiating an insurance claim can be a daunting task, but it doesn’t have to be. The key lies in understanding the flow of events. Here’s a snapshot of this process:

- Contact your insurance provider immediately after the incident.

- Document the damage with photos and gather any witness statements.

- Claim Review involves an assessor determining the extent of repairs.

- Approval follows once the insurance company reviews the claim.

- Repair and Reclaim where your vehicle is fixed and expenses sorted.

Tips For A Smooth Claims Experience

Everyone desires a hassle-free claims process. Here’s how to aim for one:

- Keep all the necessary information and paperwork organized.

- Be aware of your policy details, including coverages and deductibles.

- Maintain good communication with your insurance representative.

- Follow up regularly to stay updated on your claim status.

By adhering to these steps, you’re not just fixing your vehicle — you’re steering towards peace of mind.

Frequently Asked Questions For What Insurance Covers Car Repairs

What Does Carshield Cover?

CarShield offers extended auto warranties covering major vehicle systems, electrical issues, and roadside assistance. Plans can vary, but often include engine, transmission, and AC system repairs. Select packages may also cover hi-tech electronics.

Which Type Of Insurance Will Pay For The Repair Of Your Vehicle?

Collision and comprehensive insurance cover vehicle repairs. Collision insurance pays for damage from accidents, while comprehensive insurance covers non-collision events like theft or natural disasters.

Which Of The Following May Be Covered Under A Mechanical Breakdown Insurance Policy?

Mechanical breakdown insurance typically covers engine, transmission, and electrical system repairs not due to accidents or normal wear and tear.

Is Carshield Worth It?

CarShield may be valuable for managing expensive car repairs, offering varied coverage plans tailored to different needs and budgets. Customer experience varies, so research and compare with alternatives for the best decision.

Conclusion

Navigating car repair costs can be daunting without the right insurance. From collision coverage to comprehensive plans, understanding your policy is key. Ensure peace of mind by selecting insurance that aligns with your needs. Safe driving and the proper insurance will keep your car—and your finances—in top shape.