How to Get Car Insurance Quotes Without Personal Information

To get car insurance quotes without personal information, use online tools that provide estimates based on generic factors. Many websites offer ballpark figures using just your car’s make, model, and year.

Seeking car insurance quotes can often feel like navigating a minefield of personal data requests. Companies usually ask for sensitive information like your social security number, but there’s growing demand for privacy-first solutions. This introduction to finding insurance quotes without compromising personal details empowers drivers to maintain their privacy while shopping for the best rates.

Understanding how to bypass the need for sensitive information can simplify the process, making it quicker and more secure. Car owners are increasingly seeking convenient, anonymous ways to compare insurance policies, ensuring they stay informed and protected without unnecessary exposure of their personal data.

Credit: www.caranddriver.com

The Privacy Concern: Getting Quotes Anonymously

In today’s digital age, privacy is a top priority for many. Especially when it comes to sensitive tasks like obtaining car insurance quotes. Understandably, providing personal information online can feel intrusive, and carries the risk of misuse. Let’s dive into how you can get car insurance quotes while keeping your personal data safe.

The Need For Data Protection In Insurance

Applying for insurance traditionally means sharing extensive personal data. But protecting this data is crucial. Insurers must balance collecting necessary information with safeguarding individuals’ privacy.

Why is data protection important?

- Minimizes identity theft risks

- Avoids misuse of personal data

- Preserves consumer trust

Common Personal Details Asked For By Insurers

Typically, insurers will ask for a handful of details to provide a quote. The basics include:

| Information | Reason for Requirement |

|---|---|

| Name | To identify you |

| Address | For determining regional risks |

| Birthdate | For calculating age-related risks |

| Vehicle Information | To assess vehicle-related risks |

However, the question remains: Can you get quotes without sharing these details? The answer is yes! Certain platforms offer anonymous quoting tools that require minimal information.

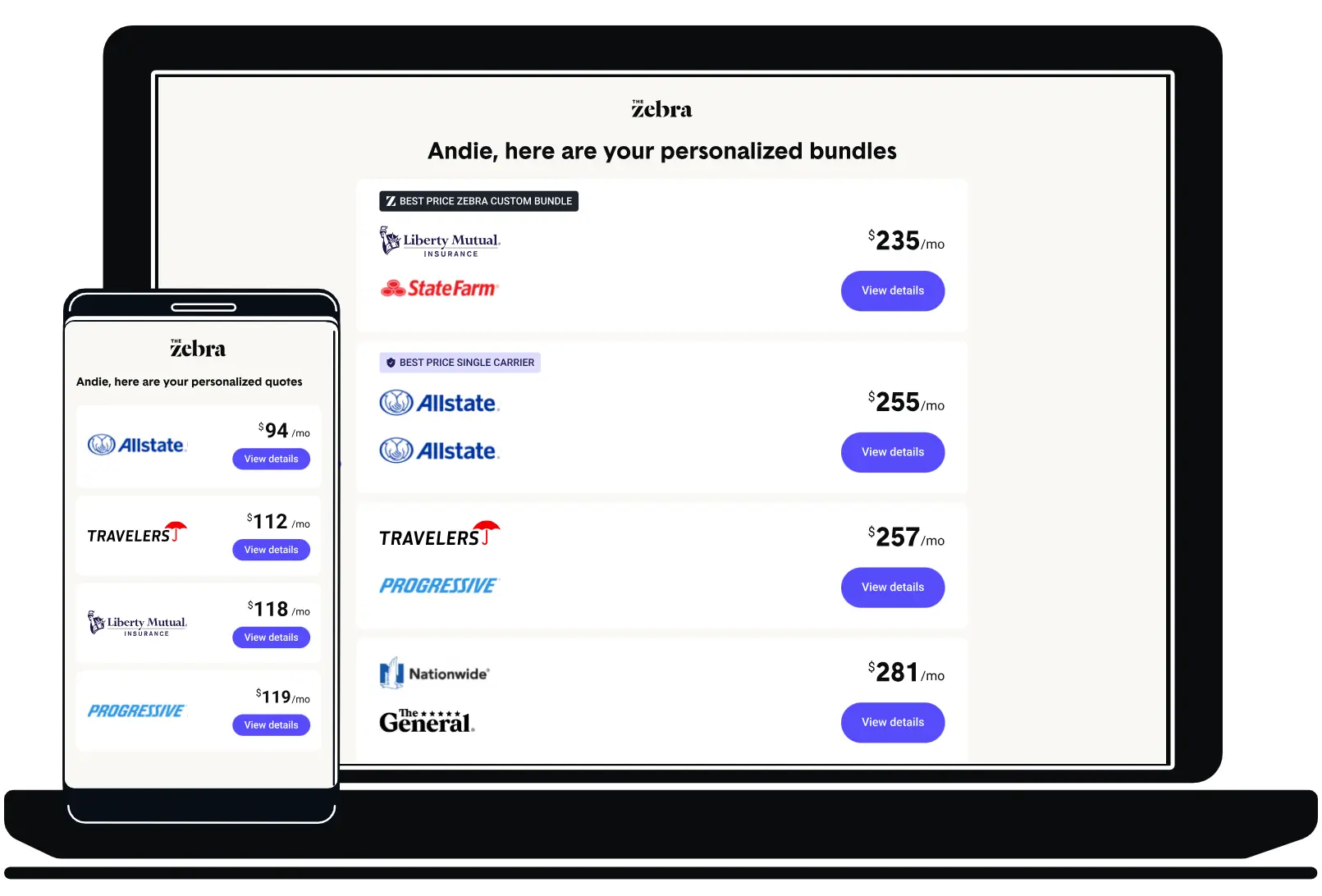

Credit: www.thezebra.com

Initial Steps: What You Can Share

Before diving into car insurance quotes, know what info you can give without oversharing. It’s crucial to protect your personal details. Still, enough non-sensitive data can help get an insurance estimate.

Basic Vehicle Information Required

To kick-start the quote process, insurers need some details about your vehicle. This data helps them gauge what kind of coverage fits best. Prepare to share:

- Make, model, and year: The car’s brand, its specific style, and the year it came out

- Vehicle Identification Number (VIN): A unique code for your car. It’s okay to share; it’s not personal info

- Mileage: How many miles are on your car shows how much you use it

- Ownership status: Are you the owner, leaser, or still financing the vehicle?

Non-personal Data Influencing Insurance Rates

Insurers look at more than just your vehicle info. They observe patterns and statistics. Don’t worry; these factors don’t need your personal details:

- Location Factor: Where you live can affect rates due to crime, weather, and traffic patterns

- Usage: How often, and for what purpose you drive, plays a role

- Credit Score Range: In some states, this is a factor. You can give a range, not the exact number

- Driving History: A clean record typically results in lower rates

Exploring Anonymous Quote Options

Shopping for car insurance can feel tricky. You might want to compare quotes without giving out too much personal information. Is that even possible? Yes, with anonymous quote options, you can get a sense of car insurance costs. Let’s explore how you can use these tools wisely.

Insurance Comparison Websites

Insurance comparison websites are a starting point for anonymous quotes. They let you see different rates from various insurers. You only need to provide basic details about your car, the coverage you need, and your driving history. Remember, these sites typically don’t require your social security number or other sensitive information.

- Enter generic details about your car, like make and model.

- Specify the type of insurance coverage you’re seeking.

- Compare the quotes from multiple insurers easily.

Anonymous Quote Tools And Their Limitations

Anonymous quote tools are handy, but they come with limitations. Since they use less personal info, the quotes can be less accurate. The final price might change once you provide your full details. It’s best to use these tools for an initial estimate.

| Tool Feature | Benefit | Limitation |

|---|---|---|

| Less personal info needed | Privacy protection | Generic estimates |

| Multiple insurer quotes | Easy comparison | May not include all discounts |

| Quick process | Instant results | Potential accuracy issues |

When Personal Information Becomes Necessary

Exploring car insurance quotes can start without sharing personal details. Yet, at some point, sharing information is key. This stage marks a pivot in the insurance search. Let’s dive into understanding when and how information sharing becomes essential.

The Transition From Anonymous Quotes To Applications

Initial car insurance quotes often require minimal data. No need to divulge sensitive info upfront. The focus is on general rate estimates. But, things shift as commitment nears. Here’s why:

- Verification: Insurance firms must confirm identity and driving history.

- Accuracy: Precise quotes rely on specific personal and vehicle information.

- Agreements: To finalize, insurers need details to prepare legal documents.

Once the decision to proceed is made, expect to provide:

| Type of Information | Reason for Requirement |

|---|---|

| Full Name | To customize policy documents |

| License Number | For driving record checks |

| Address | To assess location-based risks |

Protecting Your Data During The Process

While personal details are necessary, protection is paramount. Here are tips to safeguard your data:

- Secure Websites: Look for HTTPS in web addresses.

- Privacy Policies: Read and understand how your data is used.

- Trusted Providers: Choose insurers with strong reputations.

Encrypt Personal Documents: Before sending, ensure files are secure. Ask for confirmation of receipt. Keep records of all data shared. Vigilance is your ally in data security during the insurance application process.

Tips For Safe Information Sharing

Sharing personal information for car insurance quotes can be daunting. To maintain privacy and security, it is crucial to know how to share data safely. The following guide provides practical tips to help you interact with insurers without risking your personal details. Always stay vigilant and take proactive steps to keep your information secure.

Red Flags To Watch Out For With Insurers

- Unsolicited requests: Be wary if you receive unexpected contact asking for your data.

- No privacy policy: Avoid companies that do not publicly share their data handling practices.

- Pressure tactics: Watch out for insurers rushing you to provide information quickly.

- Vague explanations: Question vague reasons provided for needing your personal details.

Trust your instincts. If something feels off, it probably is. Choose only reputable companies that you have researched well.

How To Monitor Your Personal Information

- Check credit reports regularly: Look for unfamiliar activities that hint at fraud.

- Set up alerts: Use services that notify you when your information is used.

- Review your statements: Regularly check insurance and financial statements for accuracy.

- Use identity protection services: Consider subscriptions that monitor and protect your data.

By staying informed and attentive, you minimize the risk of your personal information being misused. Remember these tips to keep your privacy intact.

Frequently Asked Questions Of How To Get Car Insurance Quotes Without Personal Information

Can You Get Car Insurance Online Without Talking To Someone?

Yes, you can purchase car insurance online directly from insurers without speaking to an agent. This process is quick, efficient, and user-friendly, allowing for instant coverage.

Why Is It So Hard To Get Car Insurance Quotes?

Getting car insurance quotes can be tough due to varying factors like personal driving history, location, vehicle specifics, and coverage options which affect the cost and require detailed information.

Is It Safe To Get Insurance Quotes Online?

Yes, obtaining insurance quotes online is generally safe when using reputable websites. Ensure the site is secure and your personal information is protected. Always verify the provider’s legitimacy before sharing sensitive details.

Is The Zebra Legit?

Yes, The Zebra is a legitimate insurance comparison website. It provides real-time quotes from numerous insurers, ensuring users can find competitive rates for car insurance.

Conclusion

Navigating the process of acquiring car insurance quotes without divulging personal details can be a breeze. By using anonymous online tools, seeking broker assistance, and leveraging direct insurer inquiries, securing an estimate is straightforward. Remember to cross-check these anonymous quotes for the best fit.

Safeguard your privacy and stay informed on the journey to apt coverage.