How to Get a Personal Loan for a Car

To get a personal loan for a car, start by checking your credit score and then approach a lender. Compare loan terms and interest rates to find the best deal for your situation.

Securing a personal loan for a car purchase is a straightforward process that could offer more flexibility than traditional auto loans. Typically, it doesn’t require a down payment, and the vehicle itself isn’t used as collateral, meaning you might retain ownership even if you run into payment difficulties.

Begin by understanding your creditworthiness, as this affects the interest rates lenders will offer you. With a good credit score, you’re more likely to receive favorable terms. Choose a financial institution—banks, credit unions, or online lenders—and submit an application, providing necessary financial details. Interest rates can vary widely, so it’s important to shop around. Ensure that the repayment period aligns with your budget to manage the loan effectively without financial strain. Remember, a personal loan should enhance your financial position, not hinder it, so thorough research and responsible borrowing are key.

Assessing Your Financial Health

Before you start shopping for your dream car, it’s crucial to understand where you stand financially. Assessing your financial health helps you determine what you can afford. It prevents unexpected hiccups when securing a personal loan for a car. Let’s dive into the essentials: evaluating your credit score and analyzing your debt-to-income ratio.

Evaluating Credit Score

Your credit score is a vital factor in loan approval. A higher score means better loan terms and interest rates. Check your credit report for errors that might drag your score down. Aim for a score above 700 to increase your chances of getting favorable terms. You can obtain a free credit report annually from the three major bureaus.

Analyzing Debt-to-income Ratio

The debt-to-income ratio (DTI) is the percentage of your monthly income that goes towards paying debts. Lenders use this to gauge your ability to manage monthly payments. Calculate your DTI by adding all your monthly debt payments and dividing by your gross monthly income. Most lenders prefer a DTI under 36%. Use this simple formula:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

A lower DTI can significantly boost your chances of loan approval. Remember to keep your spending in check and pay down existing debts before applying for a new loan. This will improve your DTI ratio and put you in a stronger position for a car loan.

Credit: www.bankrate.com

Choosing The Right Loan

Buying a car is exciting, but finding the right loan can be challenging. It is crucial to choose a loan that fits your budget and financial goals. Below, explore the differences between secured and unsecured loans and how term length and interest rates affect your payment.

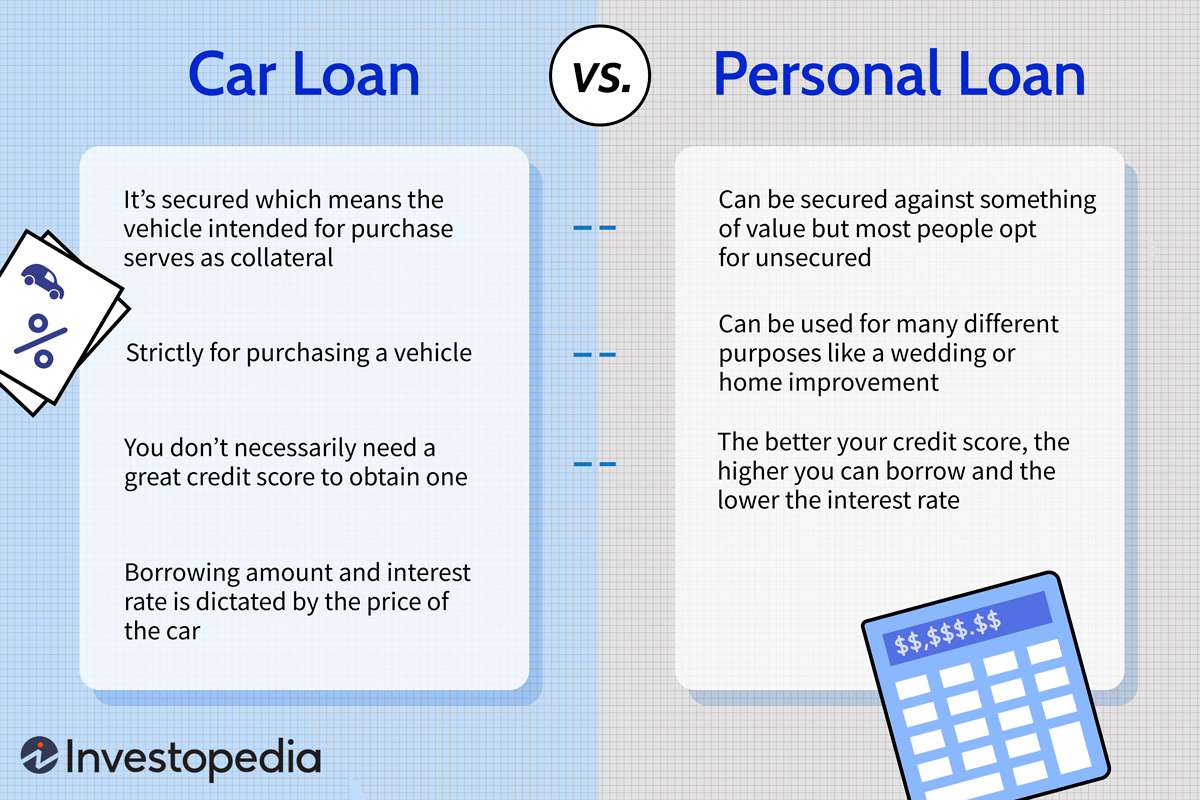

Secured Vs. Unsecured Loans

Understanding the difference between secured and unsecured loans is key. Secured loans require collateral, like the car you’re buying. If payments are missed, the lender may take the car. Unsecured loans don’t require collateral, but often have higher interest rates.

| Secured Loan | Unsecured Loan |

|---|---|

| Lower interest rates | Higher interest rates |

| Requires collateral | No collateral needed |

| Risk of losing asset | No asset risk |

Term Length And Interest Rates

The loan’s term length significantly impacts monthly payments and total interest. Longer terms mean smaller monthly payments but higher total interest. Shorter terms increase monthly payments but save on interest.

- A 3-year loan has higher monthly payments but less interest.

- A 5-year loan has lower monthly payments but more interest.

Next, study interest rates. A lower rate means saving money over the loan’s life. Always seek the lowest rate that your credit score allows. Notice advertised rates may not be the final rate, which depends on your credit profile.

Understanding Lender Options

When searching for a personal loan to buy a car, knowing where to look is key. There are diverse lenders with different benefits. This guide will explore your options. Browse with confidence to find a perfect fit for your car finance needs.

Banks And Credit Unions

Traditional options like banks and credit unions are a good starting point. They offer personal loans with various terms. Look for a loan at your bank first, especially if you have a good relationship or an account there. Banks may offer better rates for current customers. Credit unions could provide lower interest rates than banks.

- Banks: Might offer rewards for existing customers.

- Credit Unions: Requires membership but typically offers lower rates.

Online Lenders And P2p Platforms

If you prefer faster service or don’t have a bank nearby, check online lenders. They process loans quickly, and you can do it all from your home. Peer-to-peer (P2P) lending sites connect borrowers with investors. These platforms can offer competitive rates.

| Lender Type | Features |

|---|---|

| Online Lenders | Quick processing, convenient application, competitive rates. |

| P2P Platforms | Connect directly with investors, personalized rates. |

Credit: www.sofi.com

Loan Application Essentials

Understanding Loan Application Essentials is key when aiming for a smooth car loan process. These essentials serve as your roadmap. They guide you from start to finish, ensuring you don’t miss a beat. Let’s focus on some pivotal steps: Documentation and Preapproval.

Documentation Needed

Gathering the right documentation is crucial. Here’s what you need:

- Proof of Identity: Typically a driver’s license or passport.

- Proof of Income: Recent pay stubs or tax returns.

- Proof of Residence: A utility bill or lease agreement works well.

- Credit and Bank Statements: To show your financial history.

- Vehicle Information: Make, model, and VIN for your new car.

- Insurance Proof: A policy or a quote from an insurance provider.

The Importance Of Preapproval

Securing a preapproval offers big advantages:

- You know your budget up front.

- It gives you negotiating power with the seller.

- You’ll face less pressure at the dealership.

Reach out to banks, credit unions, and online lenders. Provide them with the necessary documents. They will respond with an offer. This tells you how much they will lend and at what interest rate.

Navigating Loan Approval

Getting a personal loan for a car is a smart move to fund your dream vehicle. Before you ink the deal, several steps ensure a smooth loan approval process.

Negotiating Terms

The right loan terms can save you money. Sit down with lenders and discuss:

- Interest rates: lower rates mean lower monthly payments.

- Repayment period: a longer term reduces payments but increases interest.

- Down payment: a larger upfront payment often secures better rates.

Understanding The Fine Print

Loan contracts have tiny details that make big differences. Always check:

- Prepayment penalties: know the cost of paying off your loan early.

- Late payment fees: understand the consequences of missed payments.

- Variable-rate terms: ensure rates won’t skyrocket unexpectedly.

Don’t hesitate to ask questions about anything unclear. A clear understanding of these terms is essential. Your wallet will thank you!

Credit: www.experian.com

Managing Loan Repayment

Once you secure a personal loan for a car, managing repayments becomes key. It’s crucial to stay organized and proactive to ensure the loan doesn’t become a burden. A well-laid-out plan keeps you on track, saves money, and even builds credit.

Setting Up A Repayment Schedule

Staying on top of loan repayment starts with a clear schedule. Create a timeline that aligns with your income. This will prevent missed payments. Consider these tips:

- Choose the right payment date: Align it with your paycheck for consistent funds.

- Use automatic transfers: Automate payments to avoid late fees.

- Review loan terms: Understand your installments and end date.

Keep a calendar alert a few days before the due date. This helps you ensure enough balance in your account.

Strategies For Early Payoff

Paying off your loan early can save you interest and stress. Here are strategies to consider:

- Make bi-weekly payments: Half-payments every two weeks can lead to an extra installment annually.

- Round up payments: Increase your payment slightly to chip away the principal faster.

- Allocate bonuses/tax returns: Apply extra cash to your loan balance.

Check for prepayment penalties. Some lenders charge fees for early payoff. Avoid surprises by knowing your terms.

Frequently Asked Questions On How To Get A Personal Loan For A Car

Is It A Good Idea To Get A Personal Loan For A Car?

Opting for a personal loan for a car can be beneficial if you find low-interest rates and desire flexibility in spending, but secured auto loans typically offer better rates. Always compare loan terms and consider your financial stability before proceeding.

Can A Personal Loan Be Used For A Vehicle?

Yes, you can use a personal loan to purchase a vehicle. Personal loans offer flexibility and can cover various expenses, including buying a car.

Can You Get A Personal Loan To Pay Off A Car?

Yes, you can obtain a personal loan to pay off your car. Lenders typically allow the use of personal loan funds for this purpose.

Is It Smart To Take Out A Loan For A Car?

Taking out a loan for a car can be wise if it fits your budget and financial goals. Consider interest rates, loan terms, and your ability to repay without strain. Assess your needs and explore financing options to ensure smart financial planning.

Conclusion

Securing a personal loan for your car purchase is straightforward with the right approach. Ensure your credit is solid, do your research on lenders, and be clear about repayment terms. Remember, a well-informed decision coupled with responsible financial planning puts you in the driver’s seat towards owning your dream car.

Drive away confidently, knowing you’ve navigated the personal loan process like a pro.